Factors Contributing To D-Wave Quantum's (QBTS) Stock Increase On Monday

Table of Contents

Positive News and Announcements

Positive news and announcements are often major drivers of stock price increases. In the case of D-Wave Quantum's stock surge on Monday, several factors likely played a significant role.

New Partnerships and Collaborations

Strategic partnerships can significantly boost a company's prospects and investor confidence. For D-Wave, new collaborations could unlock access to new markets and resources, directly impacting their bottom line. For example:

- Partnership with a major pharmaceutical company: A collaboration focused on drug discovery using quantum annealing could lead to substantial revenue streams and position D-Wave as a leader in this burgeoning field. This would represent a significant expansion into the lucrative pharmaceutical research market.

- Government grant for quantum computing research: Securing funding from government agencies demonstrates confidence in D-Wave's technology and its potential for national advancement in quantum computing. This could signal future growth and potentially attract further investment.

- Collaboration with a financial institution: Utilizing D-Wave's quantum computers for advanced financial modeling and risk management could attract significant clients within the finance sector.

These partnerships aren't just about immediate revenue; they signal a growing acceptance of D-Wave's technology and its potential to disrupt multiple industries. The potential for increased revenue and market share is a major factor in understanding the D-Wave Quantum (QBTS) stock increase.

Successful Product Launches or Milestones

The successful launch of new products or achieving significant technological milestones is another key driver for stock price appreciation. For D-Wave, this could include:

- Release of an enhanced quantum computing system: Improvements in processing speed (e.g., "increased processing speed by 20%") or qubit connectivity would significantly enhance the capabilities of D-Wave's offerings, attracting more customers and justifying a higher stock valuation.

- Successful completion of beta testing: Positive feedback from beta testers validating the performance and usability of a new product can generate excitement and bolster investor confidence.

- Significant advancement in quantum annealing algorithms: Development of more efficient algorithms could improve the speed and accuracy of D-Wave's quantum computers, leading to increased demand and a positive impact on the D-Wave Quantum (QBTS) stock.

These achievements demonstrate tangible progress and solidify D-Wave's position as a leader in the field, attracting investors seeking exposure to the growing quantum computing market.

Positive Earnings Reports or Forecasts

Strong financial performance always boosts investor confidence. Positive earnings reports or upbeat forecasts can dramatically influence stock prices. For D-Wave, this might have involved:

- Revenue growth exceeding expectations: A higher-than-anticipated increase in revenue indicates strong market demand for their products and services.

- Reduced net losses: A shrinking deficit suggests improving financial health and increased efficiency, enhancing investor confidence in D-Wave's long-term viability.

- Improved profit margins: Higher profit margins demonstrate D-Wave's ability to effectively manage costs and maximize profitability.

These positive financial indicators would greatly influence investor perception and contribute to a positive D-Wave Quantum (QBTS) stock increase.

Market Sentiment and Investor Confidence

Beyond company-specific news, the overall market sentiment and investor confidence play a critical role in stock price fluctuations.

Overall Positive Sentiment in the Quantum Computing Sector

A positive outlook for the entire quantum computing industry can indirectly benefit D-Wave. Successes by competitors, positive industry reports, or increased media attention to quantum computing's potential can create a favorable environment for all players in the sector, including D-Wave. This positive sentiment can lead to increased investment across the board.

Speculation and Short Covering

Speculation and short covering can significantly impact stock prices, particularly in the volatile technology sector. Short selling involves borrowing shares, selling them, and hoping to buy them back later at a lower price. If the price rises instead (a "short squeeze"), short sellers are forced to buy back shares to limit their losses, driving the price even higher. Analyst upgrades or positive media coverage can trigger short covering, contributing to a rapid D-Wave Quantum (QBTS) stock increase.

Increased Institutional Investment

Large institutional investors, such as mutual funds and hedge funds, can significantly influence stock prices through their investment decisions. Their involvement often signals confidence in a company's long-term prospects, attracting further investment and pushing the price higher. Increased institutional investment in D-Wave would directly contribute to a D-Wave Quantum (QBTS) stock increase.

External Factors Influencing QBTS Stock

External factors unrelated to D-Wave's direct performance can still influence its stock price.

Broader Market Trends

The overall market's performance on a given day can impact individual stocks, even high-growth companies like D-Wave. A positive day for the broader market (e.g., the S&P 500 or Nasdaq showing gains) could lead to a general increase in investor enthusiasm, benefiting D-Wave's stock price as well. Conversely, a negative market trend could dampen enthusiasm, regardless of company-specific news.

Geopolitical Events or Economic News

Significant geopolitical events or major economic news releases can create market volatility. For instance, positive economic data or easing geopolitical tensions could improve investor sentiment, potentially benefiting D-Wave's stock price. Conversely, negative news can create uncertainty and lead to sell-offs.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Rise – Key Takeaways and Future Outlook

The D-Wave Quantum (QBTS) stock increase on Monday was likely a result of a confluence of factors. Positive news and announcements, including potential new partnerships and product launches, combined with positive market sentiment and potentially short covering, created a perfect storm for a price surge. External factors, such as broader market trends and overall economic climate, also played a role.

The future trajectory of D-Wave Quantum (QBTS) stock will depend on continued positive developments, successful execution of its business strategy, and the broader market conditions. Staying informed about D-Wave Quantum (QBTS) and the quantum computing sector is crucial for investors. To stay updated on all things D-Wave Quantum (QBTS) stock and related news, subscribe to our newsletter, follow us on social media, and regularly check back for updates. Understanding the factors influencing the D-Wave Quantum (QBTS) stock is vital for making informed investment decisions.

Featured Posts

-

Premijera Jutarnji List Otkriva Sve Uzvanike

May 20, 2025

Premijera Jutarnji List Otkriva Sve Uzvanike

May 20, 2025 -

Tonci Tadic O Putinovim Strategijama U Pregovorima

May 20, 2025

Tonci Tadic O Putinovim Strategijama U Pregovorima

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop On Thursday Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Thursday Explained

May 20, 2025 -

Sabalenka Defeats Mertens In Madrid Open Top Ranked Showdown

May 20, 2025

Sabalenka Defeats Mertens In Madrid Open Top Ranked Showdown

May 20, 2025 -

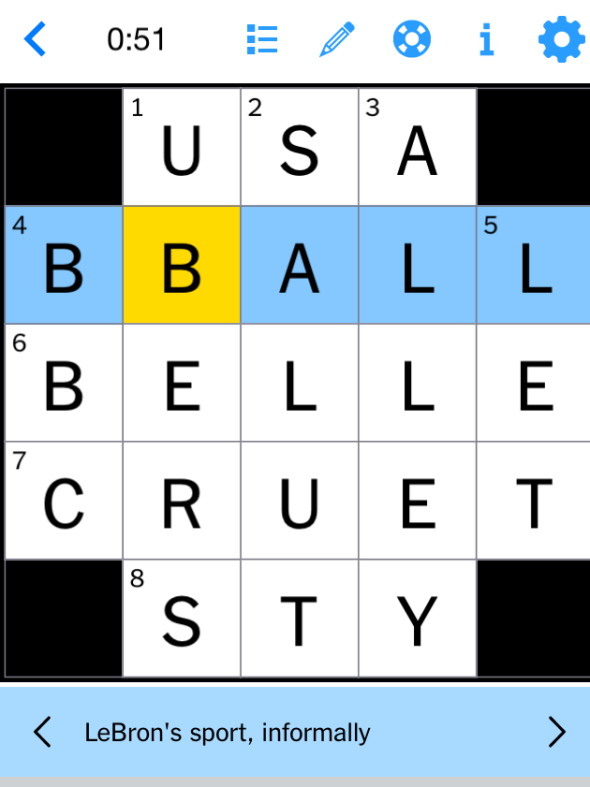

Nyt Mini Crossword April 18 2025 Solutions And Clue Explanations

May 20, 2025

Nyt Mini Crossword April 18 2025 Solutions And Clue Explanations

May 20, 2025

Latest Posts

-

O Baggelis Giakoymakis Kai I Friki Toy Sxolikoy Ekfovismoy

May 20, 2025

O Baggelis Giakoymakis Kai I Friki Toy Sxolikoy Ekfovismoy

May 20, 2025 -

Giakoymakis Mls Ena Oneiro Poy Mporei Na Ginei Pragmatikotita

May 20, 2025

Giakoymakis Mls Ena Oneiro Poy Mporei Na Ginei Pragmatikotita

May 20, 2025 -

Baggelis Giakoymakis To Bullying Oi Vasanismoi Kai To Tragiko Telos

May 20, 2025

Baggelis Giakoymakis To Bullying Oi Vasanismoi Kai To Tragiko Telos

May 20, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls Analyontas Tis Pithanotites

May 20, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls Analyontas Tis Pithanotites

May 20, 2025 -

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025