Federal Debt And Its Impact On Mortgage Rates: A Growing Concern

Table of Contents

The Mechanism: How Federal Debt Influences Mortgage Rates

The relationship between the federal debt and mortgage rates is intricate but ultimately boils down to the principles of supply and demand in the bond market. When the government needs to finance its ever-growing national debt, it issues treasury bonds. This increased borrowing leads to a higher demand for these bonds. As demand rises, so do bond yields – the return an investor receives from holding the bond.

This increase in bond yields doesn't exist in a vacuum. Mortgage rates are often benchmarked against treasury yields. Banks and mortgage lenders use these yields as a basis for setting their own lending rates. Consequently, when treasury yields climb due to increased government borrowing, borrowing costs for banks increase, and they pass these higher costs on to consumers in the form of higher mortgage interest rates.

- Increased government borrowing to finance the national debt.

- Increased demand for treasury bonds.

- Rising bond yields.

- Higher borrowing costs for banks and mortgage lenders.

- Subsequent increase in mortgage interest rates.

Different types of bonds play varying roles in this dynamic. Treasury bonds, being considered low-risk, significantly influence mortgage rates. Mortgage-backed securities, bundled mortgages sold as investments, also factor into the equation. The Federal Reserve, the central bank of the US, plays a crucial role in managing interest rates through monetary policy, influencing but not directly controlling this complex interplay.

The Current State of Federal Debt and its Projections

The US federal debt is currently at an astronomical level, representing a significant portion of the nation's Gross Domestic Product (GDP). The debt-to-GDP ratio, a key indicator of a nation's fiscal health, has been steadily rising for years. Projections from reputable sources like the Congressional Budget Office paint a picture of continued growth in the national debt over the coming decades.

- Current national debt figures: (Insert current data from a reliable source like the US Treasury Department)

- Debt-to-GDP ratio: (Insert current data and trend analysis)

- Projected future debt levels: (Insert projections from the CBO or similar source)

- Factors contributing to the rising debt: These include rising healthcare costs, increasing social security payouts due to an aging population, and ongoing government spending.

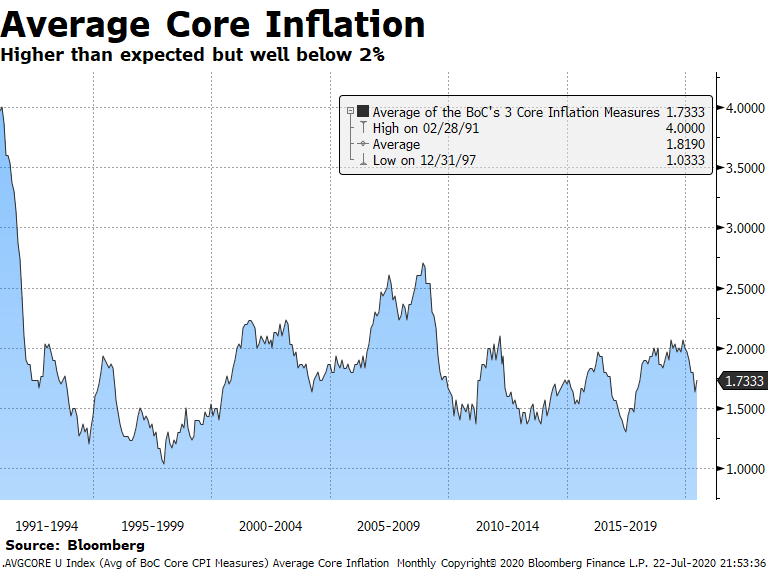

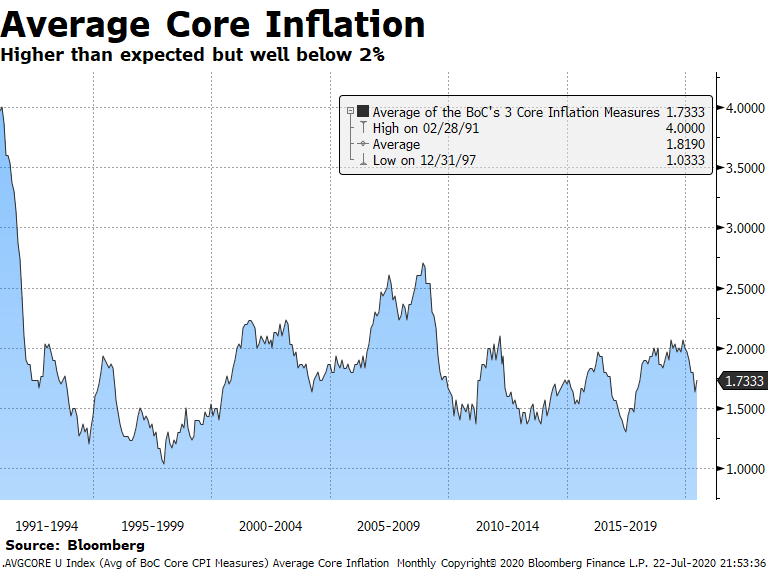

[Insert a visually appealing chart or graph showing the growth of the US national debt over time and projected future levels. Clearly cite the source of your data.]

Impact on Home Affordability and the Housing Market

The impact of rising mortgage rates, driven in part by the increasing federal debt, is significant for home affordability and the broader housing market. Higher interest rates directly reduce the purchasing power of prospective homebuyers. A larger portion of their income is allocated to mortgage payments, leaving less for other expenses. This decrease in affordability can lead to several consequences:

- Reduced purchasing power for homebuyers.

- Decreased demand for homes.

- Potential slowdown in housing market activity.

- Impact on homebuilders and the construction industry.

Even a seemingly small increase in mortgage rates can substantially affect monthly payments. For example, a 0.5% increase on a $300,000 mortgage could add hundreds of dollars to monthly payments, making homeownership unattainable for many. This decreased demand can lead to a slowdown in the housing market, affecting not only homebuyers but also the construction industry and related sectors.

Strategies for Navigating Higher Mortgage Rates

Despite the challenges presented by rising mortgage rates, there are strategies homebuyers can employ to navigate the market:

- Shop around for the best mortgage rates: Compare offers from multiple lenders to secure the most favorable terms.

- Improve your credit score: A higher credit score often qualifies you for lower interest rates.

- Increase your down payment: A larger down payment can reduce the loan amount and potentially secure better rates.

- Consider adjustable-rate mortgages (ARMs) cautiously: ARMs offer initially lower rates but carry the risk of higher rates later.

- Explore government-backed loan programs: Programs like FHA and VA loans may offer more favorable terms to eligible borrowers.

Conclusion

The connection between Federal Debt and its Impact on Mortgage Rates is undeniable. The rising national debt is influencing bond yields, which in turn is driving up mortgage rates and impacting home affordability. The current state of the US national debt and its projected trajectory pose a significant challenge to the housing market. Understanding this dynamic is crucial for making informed decisions about your financial future.

Understanding the connection between Federal Debt and its Impact on Mortgage Rates is crucial for making informed decisions about your future home purchase. Stay updated on the latest economic news and consult with a financial advisor to plan effectively.

Featured Posts

-

Wrench Attacks And Finger Severings A New Threat To Cryptocurrency Leaders

May 19, 2025

Wrench Attacks And Finger Severings A New Threat To Cryptocurrency Leaders

May 19, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Company To Shutter

May 19, 2025

127 Years Of Brewing History Ends Anchor Brewing Company To Shutter

May 19, 2025 -

Coupes Budgetaires Une Region Retire 19 Millions D Euros A Une Universite Islamique

May 19, 2025

Coupes Budgetaires Une Region Retire 19 Millions D Euros A Une Universite Islamique

May 19, 2025 -

Cellcom Outage Extended Recovery Expected For Calls And Texts

May 19, 2025

Cellcom Outage Extended Recovery Expected For Calls And Texts

May 19, 2025 -

I Istoria Kai I Symvoli Tis Teletis Toy Ieroy Niptiros Sta Ierosolyma

May 19, 2025

I Istoria Kai I Symvoli Tis Teletis Toy Ieroy Niptiros Sta Ierosolyma

May 19, 2025