Federal Debt Crisis: Implications For The Housing Market And Mortgage Rates

Table of Contents

Rising Interest Rates: The Direct Impact of the Federal Debt Crisis

The Federal Debt Crisis exerts a direct influence on interest rates. As the government borrows heavily to finance its debt, it increases the overall demand for loanable funds. This heightened demand pushes up interest rates across the board, including mortgage rates. This mechanism works as follows:

- Increased Treasury bond yields: When the government issues more Treasury bonds to finance the debt, it increases the supply of bonds in the market. However, the increased demand from investors seeking a return on their investment pushes up the yields on these bonds.

- Higher borrowing costs for banks: Banks use Treasury bonds as a benchmark for setting their own lending rates. Higher Treasury yields translate directly into increased borrowing costs for banks.

- Banks pass increased costs onto consumers: To maintain profitability, banks pass these increased borrowing costs onto consumers in the form of higher mortgage rates. This affects various mortgage types, including fixed-rate mortgages and adjustable-rate mortgages (ARMs).

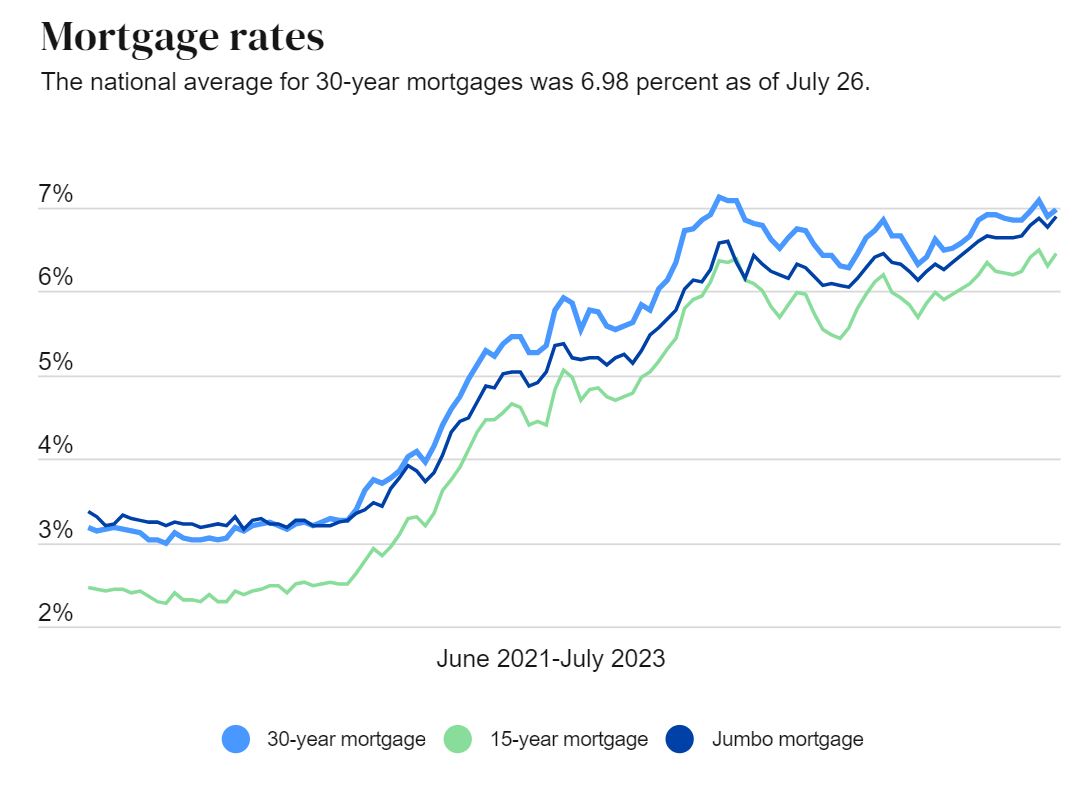

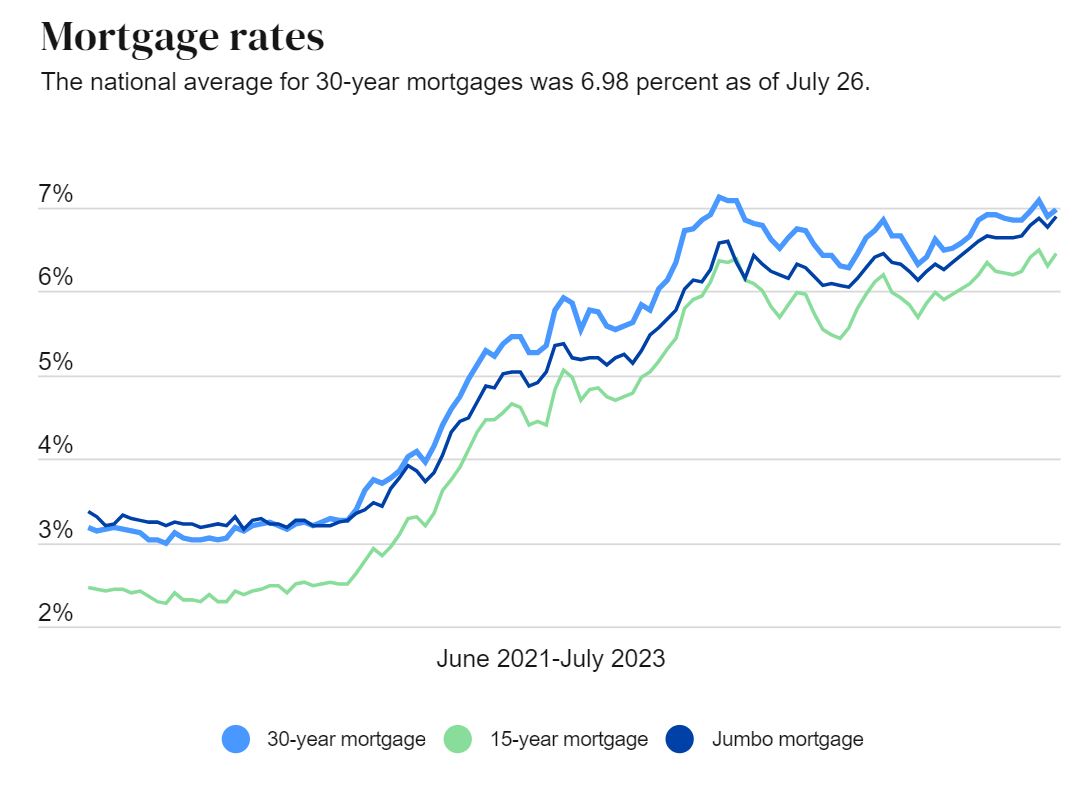

Current interest rate trends reflect this dynamic. [Insert relevant data and statistics here, citing credible sources like the Federal Reserve or reputable financial news outlets]. The Federal Reserve plays a crucial role in managing interest rates, and its response to the Federal Debt Crisis will significantly influence the trajectory of mortgage rates. The Fed may increase interest rates to combat inflation, potentially exacerbating the impact on the housing market.

Housing Market Instability: A Consequence of the Federal Debt Crisis

Higher mortgage rates directly reduce affordability, leading to decreased demand in the housing market. This decreased demand can result in a slowdown or even a correction in housing prices. The consequences can be significant:

- Reduced buyer purchasing power: Higher interest rates mean higher monthly mortgage payments, reducing the amount of house a buyer can afford.

- Increased risk of foreclosures and defaults: Higher payments can strain borrowers' budgets, leading to an increased risk of defaults and subsequent foreclosures.

- Impact on both new construction and existing home sales: A slowdown in demand affects both new construction projects and the sales of existing homes, potentially leading to a decline in housing prices.

History provides ample examples of housing market volatility linked to economic crises. [Include examples here, such as the 2008 financial crisis]. The impact of the Federal Debt Crisis is likely to vary across different segments of the housing market, with the affordable housing sector potentially experiencing the most significant challenges.

Government Intervention and Policy Responses: Navigating the Federal Debt Crisis

The government may implement various interventions to mitigate the Federal Debt Crisis's impact on the housing market. These potential policy responses could include:

- Government intervention in the mortgage market: This could involve programs that guarantee mortgages or provide direct financial assistance to borrowers.

- Tax incentives to stimulate the housing market: Tax breaks for homebuyers or builders could incentivize demand and increase construction activity.

- Regulatory changes impacting lending practices: Modifications to lending regulations could make mortgages more accessible and reduce the risk of defaults.

However, the effectiveness and potential drawbacks of such interventions are subject to considerable debate. The political complexities surrounding debt management and policy implementation make swift and decisive action challenging.

Long-Term Implications and Future Outlook: The Evolving Federal Debt Crisis

The long-term effects of the Federal Debt Crisis on the housing market and mortgage rates remain uncertain. Several potential scenarios exist:

- Potential for sustained higher interest rates: If the debt crisis persists, interest rates may remain elevated for an extended period.

- Long-term impact on homeownership rates: Sustained higher interest rates could lead to a decline in homeownership rates, particularly among first-time homebuyers.

- Shifting dynamics in the housing market: The housing market may experience a period of consolidation and restructuring, with potential shifts in demand and pricing.

The likelihood of these scenarios depends on various factors, including the government's response to the debt crisis, the overall economic climate, and global market conditions. The potential for a sustained recovery or further challenges necessitates careful monitoring and informed decision-making.

Conclusion: Understanding the Federal Debt Crisis's Impact on Your Housing Decisions

The Federal Debt Crisis presents a significant challenge to the housing market, influencing mortgage rates and overall affordability. Understanding this relationship is crucial for individuals making housing decisions. Higher interest rates directly impact borrowing costs, potentially leading to decreased demand and price adjustments within the housing market. The government's response to the Federal Debt Crisis will play a critical role in shaping the long-term outlook. We must all remain informed about economic developments and the evolving impact of the Federal Debt Crisis on the housing market. Consult with financial advisors, stay abreast of economic news, and proactively manage your financial situation to navigate this complex economic landscape effectively. Understanding the Federal Debt Crisis and its implications is paramount for making informed housing decisions.

Featured Posts

-

Policia Nacional Blinda El Cne Medidas De Seguridad En La Capital

May 19, 2025

Policia Nacional Blinda El Cne Medidas De Seguridad En La Capital

May 19, 2025 -

Samoy Eysevios Kalesma Stin Ekklisia Kai Tin Xristianiki Zoi

May 19, 2025

Samoy Eysevios Kalesma Stin Ekklisia Kai Tin Xristianiki Zoi

May 19, 2025 -

Ufc Vegas 106 Pros React To Morales Devastating Knockout

May 19, 2025

Ufc Vegas 106 Pros React To Morales Devastating Knockout

May 19, 2025 -

U Conn Legend Paige Bueckers Inducted Into Huskies Of Honor

May 19, 2025

U Conn Legend Paige Bueckers Inducted Into Huskies Of Honor

May 19, 2025 -

Paige Bueckers Hometown Mystery A Temporary Deletion Explained

May 19, 2025

Paige Bueckers Hometown Mystery A Temporary Deletion Explained

May 19, 2025