Federal Student Loan Refinancing: A Comprehensive Guide

Table of Contents

The weight of student loan debt is a significant burden for millions of Americans. Anecdotes abound of recent graduates struggling to balance repayments with the cost of living. This is where understanding Federal Student Loan Refinancing becomes crucial. Federal student loan refinancing is the process of replacing your existing federal student loans with a new private loan, potentially offering lower interest rates and simplified repayment terms. This comprehensive guide will equip you with the knowledge to navigate the process effectively.

H2: Understanding Federal Student Loans and Refinancing Eligibility

H3: Types of Federal Student Loans: Before considering refinancing, it's essential to understand the different types of federal student loans you might have. These include:

- Direct Subsidized Loans: The government pays the interest while you're in school (under certain conditions).

- Direct Unsubsidized Loans: Interest accrues from the time the loan is disbursed, even while you're still in school.

- Direct PLUS Loans: Loans available to graduate students and parents of undergraduate students.

Knowing the type of federal student loans you hold is crucial as it impacts your refinancing eligibility and potential benefits.

H3: Who Qualifies for Refinancing?: Not everyone qualifies for refinancing. Lenders typically assess your creditworthiness based on several factors:

- Credit Score: A higher credit score significantly improves your chances of securing favorable refinancing terms. Many lenders require a minimum credit score of 660 or higher.

- Income: Lenders assess your ability to repay the loan based on your income and debt-to-income ratio. A stable income stream is essential.

- Debt-to-Income Ratio (DTI): A lower DTI ratio (the percentage of your monthly income dedicated to debt payments) enhances your eligibility.

- Co-signers: If you have a lower credit score or income, a co-signer with good credit can significantly improve your chances of approval.

Bullet Points:

- Minimum credit score requirements vary between lenders, ranging from 660 to 700 or higher.

- Income verification typically involves providing pay stubs, tax returns, or bank statements.

- Federal student loan types influence eligibility, with some being more easily refinanced than others.

- Building a strong credit history before applying is crucial for better interest rates and terms.

H2: The Advantages and Disadvantages of Refinancing Federal Student Loans

H3: Potential Benefits: Refinancing federal student loans can offer several compelling advantages:

- Lower Monthly Payments: A lower interest rate can dramatically reduce your monthly payment, freeing up cash for other financial goals.

- Lower Interest Rates: Private lenders often offer lower interest rates than the standard federal loan rates, leading to significant long-term savings.

- Potential Savings Over the Life of the Loan: The cumulative savings from lower interest rates can be substantial over the repayment period. A simple online calculator can help illustrate these potential savings.

H3: Potential Drawbacks: It's vital to weigh the potential drawbacks:

- Loss of Federal Protections: Refinancing your federal student loans means losing access to federal protections like income-driven repayment plans, forbearance, and potential loan forgiveness programs.

- Risk of Increased Interest Rates: If market interest rates rise after refinancing, you might end up paying a higher interest rate than your original federal loan.

- Private Lender Risks: Private lenders may have less flexible repayment options compared to federal loan programs.

Bullet Points:

- Example: Refinancing a $50,000 loan from 6% to 4% could save thousands over the loan term.

- Savings calculations should consider the loan amount, interest rate difference, and loan term.

- Lost federal benefits represent a considerable risk and should be carefully considered.

- Private lenders may have less consumer protection than federal loan programs.

H2: Choosing the Right Federal Student Loan Refinancing Lender

H3: Comparing Lenders: Don't settle for the first offer. Compare interest rates, fees, and repayment terms from multiple lenders. Consider different lender types:

- Banks: Large, established banks offer refinancing options but may have stricter requirements.

- Credit Unions: Often offer competitive rates and personalized service, but may have limited loan amounts.

- Online Lenders: Many online lenders specialize in student loan refinancing and offer streamlined applications.

H3: Factors to Consider When Choosing a Lender: Look beyond interest rates:

- Customer Reviews: Check online reviews and ratings to gauge the lender's reputation for customer service.

- Lender Reputation: Choose a reputable and established lender with a proven track record.

- Transparency of Fees and Terms: Avoid lenders with hidden fees or unclear terms and conditions.

Bullet Points:

- Reputable lenders include (but are not limited to): [List reputable lenders with appropriate disclaimers and links, if applicable]

- Create a comparison chart using categories like interest rate, fees, repayment terms, and customer reviews.

- Hidden fees can include prepayment penalties, origination fees, and late payment fees.

- Carefully read the fine print before signing any loan documents.

H2: The Refinancing Application Process: A Step-by-Step Guide

H3: Gathering Necessary Documents: Before applying, gather these essential documents:

- Credit Reports: Obtain copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion).

- Income Statements: Provide proof of income, such as pay stubs or tax returns.

- Loan Details: Gather information about your existing federal student loans, including loan amounts, interest rates, and account numbers.

H3: Completing the Application: The application process is typically online and involves providing personal information, employment details, and loan information.

H3: Understanding the Approval Process: After submitting your application, the lender will review your information and assess your creditworthiness. The approval process usually takes several weeks.

Bullet Points:

- Checklist: Credit reports, income statements, loan details, identification documents.

- Step-by-step application instructions vary by lender but generally involve filling out an online form and uploading documents.

- Typical approval timelines range from a few days to several weeks.

- If your application is rejected, inquire about reasons for denial and consider improving your credit score or providing additional information.

3. Conclusion:

Federal student loan refinancing can offer substantial financial benefits, including lower monthly payments and significant long-term savings. However, it's crucial to carefully weigh the advantages and disadvantages, especially the loss of federal protections. Thorough research and comparison shopping are essential to securing the best refinancing terms. Don't rush the decision; carefully review all offers before choosing a lender. Start your journey towards lower monthly payments with federal student loan refinancing today! Don't delay your financial freedom – explore federal student loan refinancing options now!

Featured Posts

-

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025 -

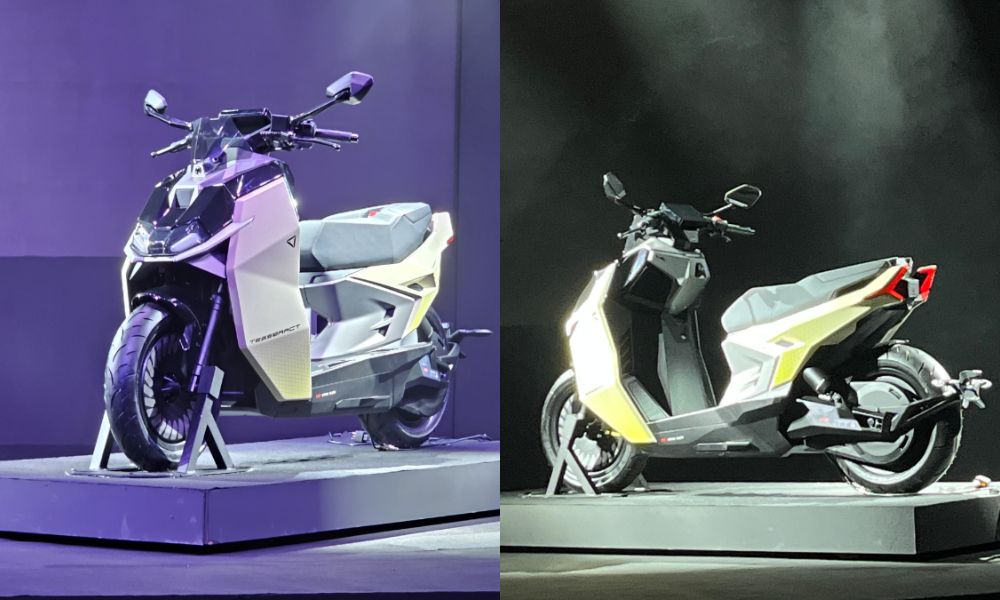

Ultraviolette Tesseract R1 45 Lakh Electric Scooter Launched In India

May 17, 2025

Ultraviolette Tesseract R1 45 Lakh Electric Scooter Launched In India

May 17, 2025 -

Worldwide Reddit Outage Thousands Affected

May 17, 2025

Worldwide Reddit Outage Thousands Affected

May 17, 2025 -

Best No Id Verification Casinos Online Top Rated Sites For 2025

May 17, 2025

Best No Id Verification Casinos Online Top Rated Sites For 2025

May 17, 2025 -

Nba Playoffs Knicks Vs Pistons Betting Odds Picks And Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Betting Odds Picks And Bet365 Bonus Code Nypbet

May 17, 2025