Fed's Cautious Approach: Why No Rate Cuts Yet?

Table of Contents

The whispers of a recession are growing louder, and many are clamoring for the Federal Reserve to cut interest rates. Yet, the Fed maintains a surprisingly cautious stance. Why the hesitation? The anticipation surrounding potential Fed rate cuts is palpable, but the central bank's continued reluctance raises important questions. This article will delve into the key reasons behind the Fed's decision to hold off on rate cuts, despite economic headwinds.

Persistent Inflation as a Key Factor

The current inflation rate remains stubbornly above the Federal Reserve's target of 2%. While inflation has cooled somewhat from its peak, it's still significantly higher than the central bank desires. This persistent inflation is a primary reason why the Fed is hesitant to implement rate cuts.

- Impact on Spending and Investment: High inflation erodes purchasing power, dampening consumer spending and impacting business investment decisions. Businesses become hesitant to expand or invest when facing uncertain future costs.

- Commitment to Price Stability: The Fed's mandate includes maintaining price stability. Premature rate cuts risk reigniting inflationary pressures, potentially leading to a more painful and protracted fight against inflation later.

- Exacerbating Inflationary Pressures: Lowering interest rates now could stimulate demand and further fuel inflation, making it more difficult to achieve the Fed's target. This could lead to a vicious cycle of inflation and necessitate even more aggressive rate hikes down the line.

The Consumer Price Index (CPI) and Producer Price Index (PPI) remain key indicators the Fed is monitoring closely. Until these show sustained and significant declines, rate cuts remain unlikely.

Strong Labor Market and Employment Data

The US labor market continues to exhibit remarkable strength. The unemployment rate remains low, indicating a robust economy. While positive for overall economic health, this strong labor market presents a challenge for the Fed's efforts to curb inflation.

- Wage Growth and Inflation: A tight labor market can lead to increased wage demands, which in turn can feed into higher prices and sustained inflation. The Fed carefully scrutinizes wage growth data to assess its impact on inflation.

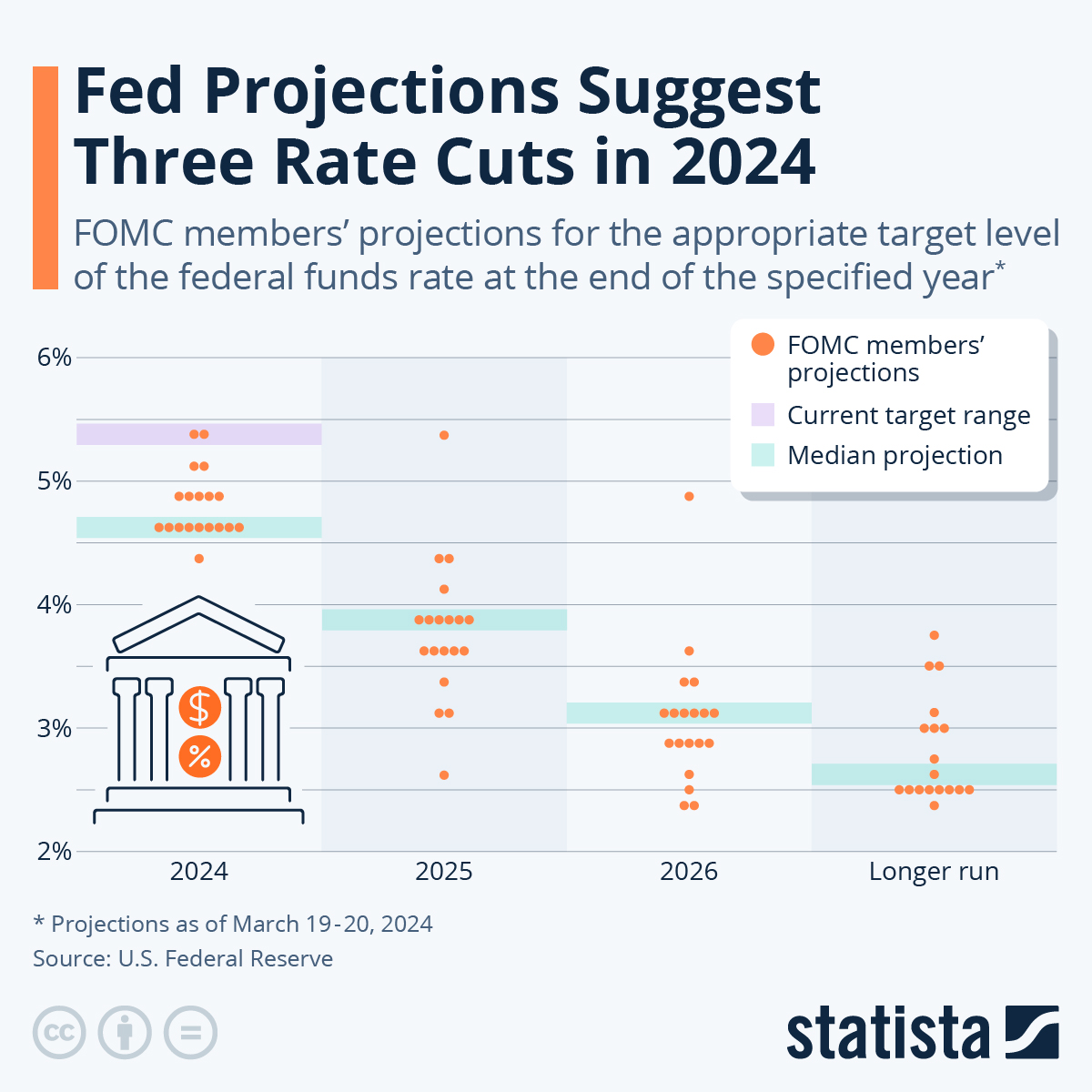

- Employment Data in Fed Decision-Making: The Fed’s Open Market Committee (FOMC) analyzes a range of employment indicators, including the unemployment rate, job creation numbers, and wage growth, to gauge the overall health of the labor market and its implications for inflation.

- Risks of Loosening Monetary Policy: Implementing rate cuts in a robust labor market could further exacerbate wage pressures and potentially accelerate inflation. The Fed wants to avoid creating a scenario where wage increases outpace productivity gains.

The strength of the labor market is a double-edged sword. While it signals a healthy economy, it complicates the Fed’s efforts to manage inflation effectively, making rate cuts a less appealing option.

Uncertainty Surrounding the Economic Outlook

Several significant uncertainties cloud the economic outlook, further contributing to the Fed's cautious approach. Geopolitical risks, persistent supply chain disruptions, and lingering concerns about a potential recession all contribute to the complexity of the current situation.

- Predicting the Economic Trajectory: These uncertainties make it significantly more challenging for the Fed to accurately predict the future economic trajectory and the impact of its monetary policy decisions. More data is needed to confidently assess the economic landscape.

- Gauging the Impact of Previous Rate Hikes: The full impact of the Fed's previous interest rate hikes has yet to be fully realized. The lagged effects of monetary policy require careful observation before making further adjustments.

- Downsides of Premature Action: Acting prematurely in an uncertain environment could lead to unintended consequences, potentially worsening the situation. A wait-and-see approach minimizes the risk of making costly policy mistakes.

The economic landscape is dynamic, and the Fed prefers to gather more data and gain a clearer understanding before altering its monetary policy stance.

The Fed's Data-Dependent Approach

The Federal Reserve has repeatedly emphasized its commitment to a data-dependent approach to monetary policy. This means that decisions regarding interest rates are made based on careful analysis of incoming economic data.

- Key Economic Indicators: The Fed closely monitors a wide range of economic indicators, including the Consumer Price Index (CPI), Producer Price Index (PPI), Gross Domestic Product (GDP), employment data, and consumer confidence indexes.

- Observing Trends, Not Short-Term Fluctuations: The Fed focuses on observing broader trends and patterns in the data rather than reacting to short-term fluctuations or noise in the numbers. Consistency is key.

- Transparency and Communication: The Fed maintains open and transparent communication with the public to explain its decision-making process and manage expectations regarding future interest rate movements.

Future FOMC meetings will be critical in determining the next steps. The release of key economic data will heavily influence the Fed's approach and the potential for future rate cuts.

Conclusion

The Fed's cautious approach to rate cuts stems from a combination of factors: persistent inflation, a strong labor market, considerable economic uncertainty, and a commitment to a data-driven strategy. Until inflation shows a consistent decline towards the target rate, the labor market exhibits signs of cooling, and the economic outlook becomes clearer, the probability of Fed rate cuts remains relatively low. Stay updated on the Fed's decisions and the potential for future rate cuts by following the release of key economic indicators and statements from the FOMC. The Fed's cautious approach needs to be followed closely, paying attention to upcoming economic data releases to better understand future interest rate decisions and the potential for Fed rate cuts.

Featured Posts

-

Analyzing Palantirs 30 Decline Investment Opportunity

May 10, 2025

Analyzing Palantirs 30 Decline Investment Opportunity

May 10, 2025 -

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 10, 2025

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 10, 2025 -

Nhl 2024 25 Season Key Storylines To Follow

May 10, 2025

Nhl 2024 25 Season Key Storylines To Follow

May 10, 2025 -

The Lasting Power Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 10, 2025

The Lasting Power Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 10, 2025 -

4 5

May 10, 2025

4 5

May 10, 2025