Fed's Rate Hike Pause: Why A Cut Isn't On The Horizon

Table of Contents

Persistent Inflation Remains a Key Concern

Persistent inflation continues to be a major roadblock to any immediate consideration of interest rate cuts. While headline inflation may show some signs of easing, core inflation—a more reliable indicator that excludes volatile food and energy prices—remains stubbornly elevated.

Core Inflation Remains Elevated

The persistence of core inflation is a significant worry for the Federal Reserve. Both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index, key measures of inflation, continue to show core inflation above the Fed's target.

- Bullet Point: Recent CPI data shows core inflation remaining at X%, significantly above the Fed's 2% target. (Insert actual data here when available).

- Bullet Point: Sticky inflation, meaning inflation that is slow to respond to changes in monetary policy, indicates that further action may be needed to bring inflation down to the desired level.

- Bullet Point: The gap between current inflation and the Fed's target remains considerable, highlighting the need for continued vigilance and potentially further monetary tightening.

Wage Growth and its Impact on Inflation

Strong wage growth, while positive for workers, also fuels inflationary pressures. The relationship between robust wage increases and rising prices creates a challenging environment for policymakers.

- Bullet Point: The potential for a wage-price spiral, where rising wages lead to higher prices, which in turn lead to further wage demands, is a real concern for the Fed.

- Bullet Point: The Fed carefully monitors wage growth data, particularly the Employment Cost Index (ECI), to assess its impact on inflation.

- Bullet Point: Sectors like technology and healthcare are exhibiting particularly strong wage growth, contributing to overall inflationary pressure.

A Robust Labor Market Complicates Rate Cuts

The current strength of the labor market, while generally positive, adds another layer of complexity to the decision of whether to cut interest rates. Low unemployment and a tight labor market contribute to upward pressure on wages and, consequently, inflation.

Low Unemployment and Tight Labor Market

The unemployment rate remains remarkably low, indicating a very tight labor market. This situation puts upward pressure on wages as employers compete for a limited pool of workers.

- Bullet Point: The current unemployment rate is at X% (insert actual data here). This is significantly below the historical levels considered to be full employment.

- Bullet Point: A tight labor market empowers workers to negotiate for higher wages, adding to inflationary pressures.

- Bullet Point: The Fed considers labor market conditions a crucial factor in its monetary policy decisions.

Potential for Further Wage Growth

Forecasts for wage growth in the coming quarters suggest that the current upward trend may persist. This prospect further complicates the possibility of near-term rate cuts.

- Bullet Point: Experts predict wage growth of around Y% in the next few quarters (insert predictions here, citing sources).

- Bullet Point: Expectations of continued strong wage growth can contribute to inflation by creating a self-fulfilling prophecy.

- Bullet Point: To control inflation, the Fed may need to continue raising interest rates, even if it risks slowing economic growth.

The Fed's Commitment to Price Stability

The Federal Reserve's dual mandate—to promote maximum employment and price stability—currently prioritizes the latter. The Fed's unwavering commitment to controlling inflation overshadows immediate concerns about employment in the short term.

The Fed's Dual Mandate

While the Fed aims for both maximum employment and price stability, the current inflationary environment necessitates a focus on controlling prices.

- Bullet Point: The Fed's communication consistently emphasizes its commitment to bringing inflation back to its 2% target.

- Bullet Point: In the short term, curbing inflation is deemed more crucial than maximizing employment to prevent long-term economic damage.

- Bullet Point: Recent statements by Federal Reserve officials reiterate their resolve to maintain price stability.

Data Dependency and Future Rate Decisions

The Fed's decisions are data-dependent, meaning that future rate hikes or cuts will depend on incoming economic data. Significant improvements in inflation and a clear easing of labor market tightness would be prerequisites for rate cuts.

- Bullet Point: The Fed will closely monitor key economic indicators, such as CPI, PCE, unemployment rate, and wage growth data.

- Bullet Point: Before considering rate cuts, the Fed will require substantial evidence that inflation is sustainably declining toward its target.

- Bullet Point: If inflation remains stubbornly high, further rate hikes remain a possibility.

Conclusion:

The Fed's rate hike pause is not a sign that rate cuts are imminent. Persistent inflation, a robust labor market, and the Fed's strong commitment to price stability all point toward a continued focus on controlling inflation. While the pause allows the Fed to assess the effects of prior rate hikes, further action might be necessary to curb inflation. Therefore, keeping a close eye on key economic indicators and the Fed's ongoing communication regarding monetary policy is vital for understanding future interest rate movements. Staying informed about the Fed's rate hike pause and its implications is crucial for navigating the economic landscape.

Featured Posts

-

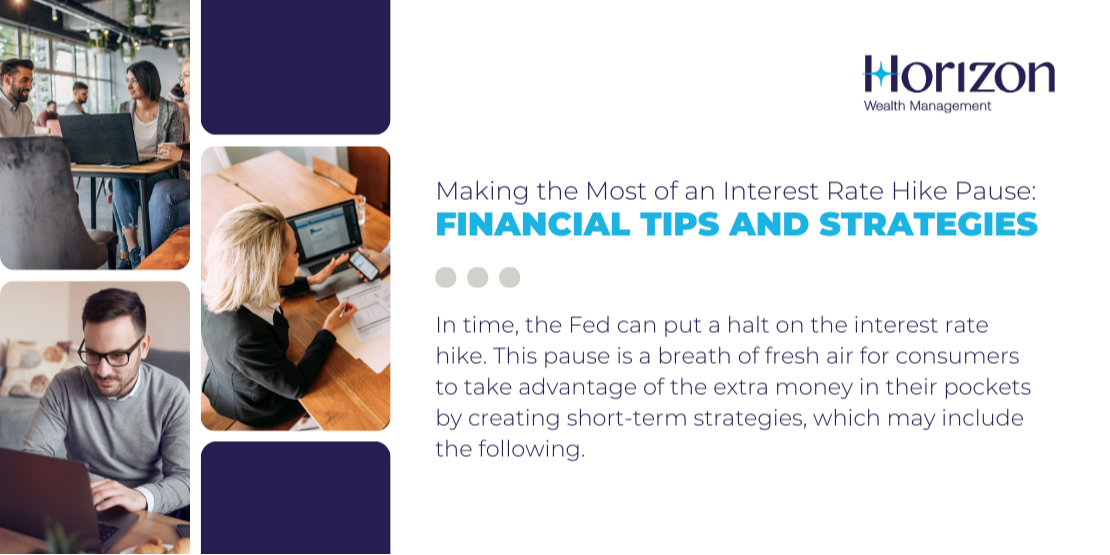

China Diversifies Canola Imports Following Canada Dispute

May 09, 2025

China Diversifies Canola Imports Following Canada Dispute

May 09, 2025 -

Formula 1s Next Generation Colapinto Emerges As A Threat To Lawson

May 09, 2025

Formula 1s Next Generation Colapinto Emerges As A Threat To Lawson

May 09, 2025 -

V Germanii Opasayutsya Novogo Pritoka Ukrainskikh Bezhentsev Iz Za S Sh A

May 09, 2025

V Germanii Opasayutsya Novogo Pritoka Ukrainskikh Bezhentsev Iz Za S Sh A

May 09, 2025 -

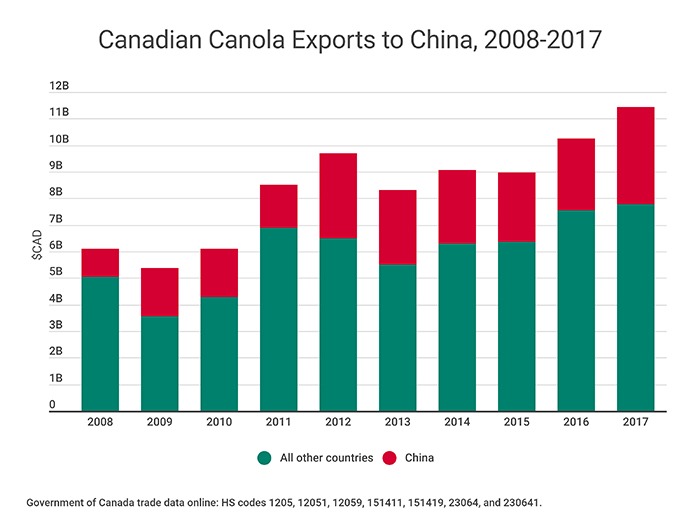

Police Make Arrest Following Weekend Shooting In Elizabeth City

May 09, 2025

Police Make Arrest Following Weekend Shooting In Elizabeth City

May 09, 2025 -

Indonesias Falling Reserves Analysis Of The Rupiahs Recent Weakness

May 09, 2025

Indonesias Falling Reserves Analysis Of The Rupiahs Recent Weakness

May 09, 2025