Finance Loans 101: A Step-by-Step Guide To Loan Applications

Table of Contents

Understanding Your Financial Needs and Loan Options

Before diving into the application process, it's crucial to understand your financial needs and explore the various finance loan options available. This involves assessing your creditworthiness, researching different loan types, and comparing loan offers to find the best fit for your situation.

Assessing Your Creditworthiness

Your credit score plays a significant role in loan approval. A good credit score indicates your ability to manage debt responsibly, making you a less risky borrower. Lenders use this score to determine your eligibility and the interest rate they'll offer.

- Checking your credit report: Obtain your credit report from the three major credit bureaus (Equifax, Experian, and TransUnion) to identify any errors and understand your credit history.

- Understanding credit scores (e.g., FICO): Familiarize yourself with the FICO scoring system and understand what factors influence your score. Aim for a score above 700 for the best loan terms.

- Improving your credit score before applying: If your credit score needs improvement, take steps to pay down debt, avoid late payments, and maintain a good credit utilization ratio. This will significantly improve your chances of securing favorable finance loans. Addressing your financial health proactively is key.

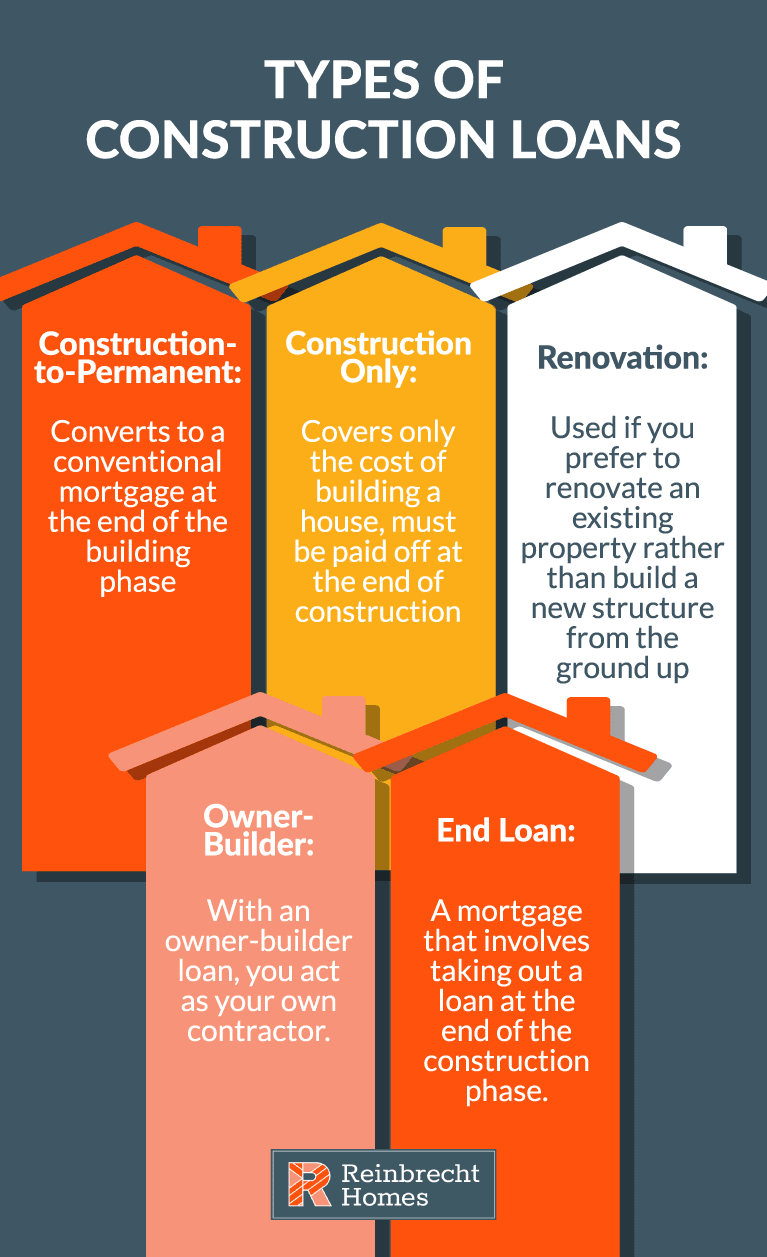

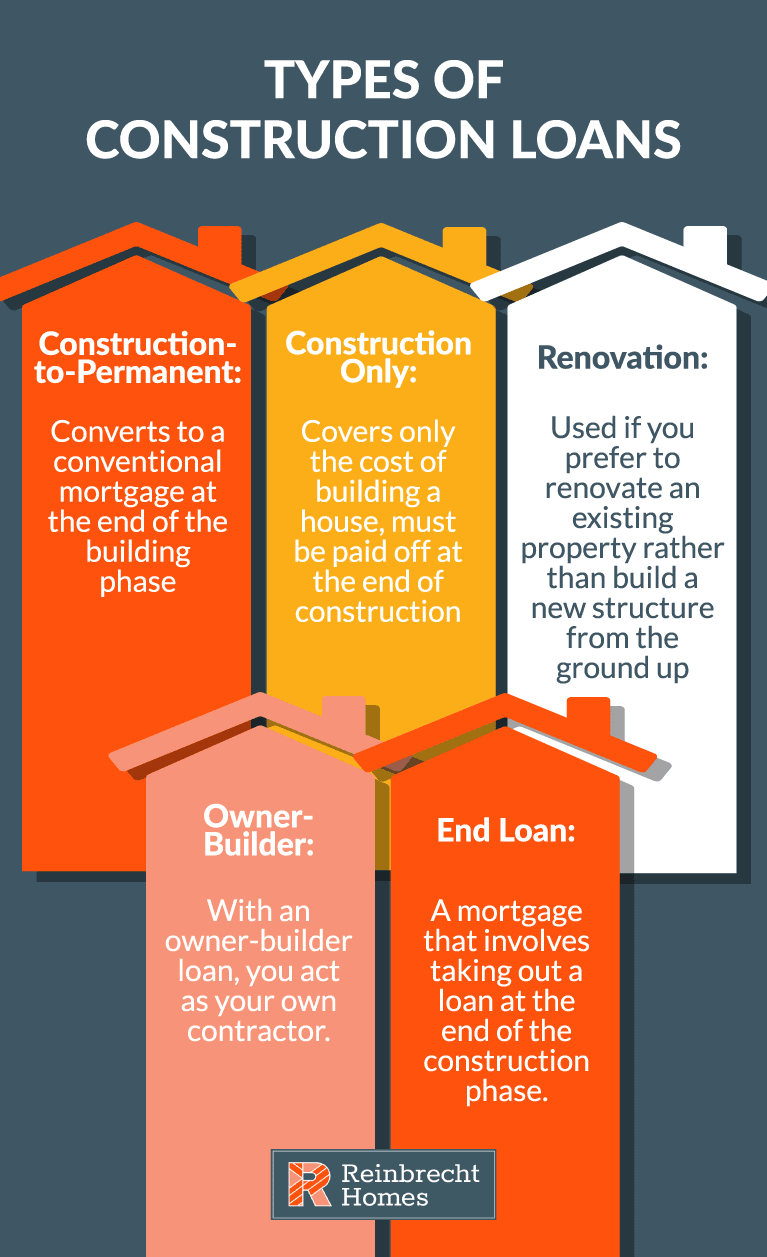

Exploring Different Loan Types

Numerous finance loan options cater to various needs. Understanding the nuances of each type is vital for making an informed decision.

- Personal loans: Unsecured loans used for various purposes, offering flexible repayment terms but often higher interest rates.

- Auto loans: Loans specifically for purchasing vehicles, typically secured by the vehicle itself.

- Mortgage loans: Loans used to purchase real estate, typically long-term with lower interest rates but larger upfront costs.

- Student loans: Loans designed to finance higher education, with government-backed options offering lower interest rates.

- Business loans: Loans designed to fund business operations or expansions, often requiring a detailed business plan.

Each loan type has its own interest rates, repayment terms, and eligibility criteria. Carefully consider your specific financial needs and circumstances when choosing a loan type. Understanding loan interest rates and loan repayment schedules is crucial for managing your finances effectively.

Comparing Loan Offers

Don't settle for the first loan offer you receive. Comparing offers from multiple lenders is crucial to securing the best possible terms.

- Using online loan comparison tools: Utilize online tools to compare interest rates, fees, and repayment terms from various lenders.

- Understanding APR (Annual Percentage Rate): APR represents the total cost of borrowing, including interest and fees, providing a comprehensive comparison metric.

- Hidden fees: Be wary of hidden fees such as origination fees, prepayment penalties, and late payment fees. Scrutinize the loan agreement carefully before signing. Careful comparison of loan fees is essential to avoid unexpected costs.

Gathering Required Documents and Completing the Application

Once you've chosen a loan type and lender, gather the necessary documents and meticulously complete the application form.

Essential Documents for Loan Applications

Lenders require various documents to verify your identity, income, and creditworthiness. These may vary depending on the loan type.

- Proof of income: Pay stubs, W-2 forms, tax returns, or bank statements demonstrating your income.

- Identification: Driver's license, passport, or other government-issued ID.

- Bank statements: Recent bank statements showing your financial activity.

- Other documents: Depending on the loan type, you might need additional documents such as proof of address, employment verification, or a business plan (for business loans). Having all required loan application documents ready will streamline the process.

Completing the Loan Application Form Accurately

Accuracy and completeness are paramount when filling out the loan application form. Errors or omissions can lead to delays or rejection.

- Double-checking information: Carefully review all information before submitting the application.

- Addressing any discrepancies promptly: If you notice any discrepancies, contact the lender immediately to clarify.

- Seeking help if needed: Don't hesitate to seek assistance if you are unsure about any part of the application process. Ensuring accurate information is vital for a smooth application process.

Submitting Your Application and Following Up

After completing your application, submit it using the chosen method and diligently follow up on its status.

Choosing the Right Application Method

Several methods exist for submitting loan applications. Each offers advantages and disadvantages.

- Online loan application: Convenient and often faster, but requires reliable internet access and attention to security.

- In-person application: Allows for direct interaction with a lender but may be less convenient.

- Mail-in application: A traditional method, but can be slower and requires careful attention to detail.

Consider your comfort level and circumstances when choosing the application method.

Tracking Your Application and Following Up

Tracking the status of your application and following up when necessary is crucial.

- Contacting the lender: Contact the lender if you haven't received an update within the expected timeframe.

- Understanding the timeline: Understand the typical processing time for the type of loan you've applied for.

- Handling potential rejections: If your application is rejected, understand the reasons and explore alternative options. Understanding loan processing time and handling potential rejections are vital aspects of the process.

Conclusion

This guide has provided a step-by-step overview of the finance loan application process, helping you understand your options and navigate the complexities of securing a loan. Remember to thoroughly research different loan types, compare offers, and accurately complete your application. By following these steps, you can significantly increase your chances of successfully obtaining the finance loans you need. Start your journey to financial freedom today – begin exploring your finance loan options now!

Featured Posts

-

Blue Jays Padres Trade Could It Save Vladdy Jr S Season

May 28, 2025

Blue Jays Padres Trade Could It Save Vladdy Jr S Season

May 28, 2025 -

The Sinner Doping Case Serena Williams Perspective And Potential Implications

May 28, 2025

The Sinner Doping Case Serena Williams Perspective And Potential Implications

May 28, 2025 -

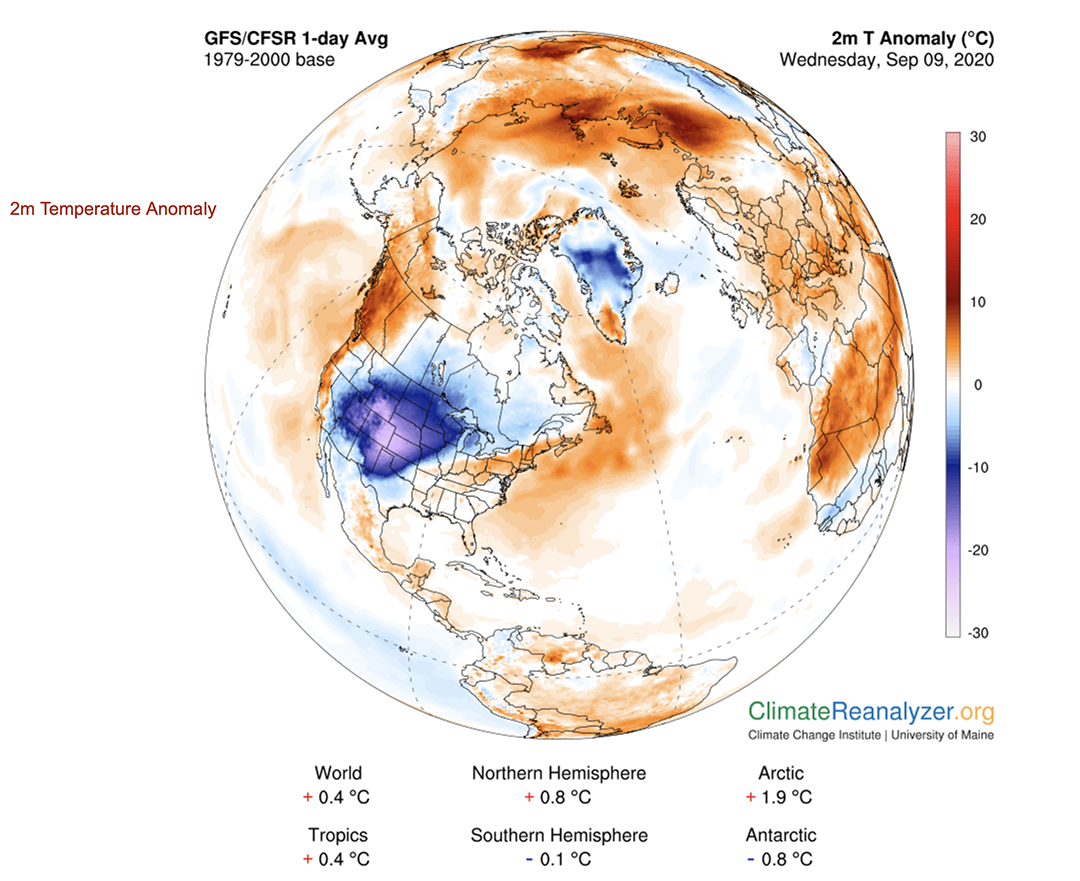

Understanding Dangerous Climate Whiplash And Its Impact On Global Cities

May 28, 2025

Understanding Dangerous Climate Whiplash And Its Impact On Global Cities

May 28, 2025 -

French Open Draw Sinner Lands In Favorable Top Half

May 28, 2025

French Open Draw Sinner Lands In Favorable Top Half

May 28, 2025 -

Toronto Blue Jays Trade A New Beginning For Vladimir Guerrero Jr

May 28, 2025

Toronto Blue Jays Trade A New Beginning For Vladimir Guerrero Jr

May 28, 2025

Latest Posts

-

Was Geschah Am 10 April Historische Ereignisse Und Mehr

May 30, 2025

Was Geschah Am 10 April Historische Ereignisse Und Mehr

May 30, 2025 -

Agassis Pickleball Debut What We Learned

May 30, 2025

Agassis Pickleball Debut What We Learned

May 30, 2025 -

El Impacto De Una Frase El Ex Numero 3 Del Mundo Y Su Consejo A Marcelo Rios

May 30, 2025

El Impacto De Una Frase El Ex Numero 3 Del Mundo Y Su Consejo A Marcelo Rios

May 30, 2025 -

Reviewing Andre Agassis Entry Into Professional Pickleball

May 30, 2025

Reviewing Andre Agassis Entry Into Professional Pickleball

May 30, 2025 -

La Motivacion Detras De La Frase El Legado Del Ex Numero 3 Del Mundo A Marcelo Rios

May 30, 2025

La Motivacion Detras De La Frase El Legado Del Ex Numero 3 Del Mundo A Marcelo Rios

May 30, 2025