Finance Loans 101: Understanding Interest Rates, EMIs, And Tenure

Table of Contents

Decoding Interest Rates in Finance Loans

Interest rates represent the cost of borrowing money. They are essentially the price you pay to the lender for using their funds. Understanding interest rates is fundamental to making smart decisions about your finance loans.

Types of Interest Rates:

-

Fixed Interest Rates: These remain constant throughout the loan tenure. This offers predictability and allows for easier budgeting. For example, a fixed interest rate of 7% will mean your monthly payments remain consistent for the life of your loan.

-

Variable Interest Rates: These fluctuate based on market conditions. While they might start lower than fixed rates, they can increase or decrease, leading to unpredictable monthly payments. A variable rate loan might start at 6% but could rise to 8% or fall to 5% depending on market fluctuations.

Factors Influencing Interest Rates:

Several factors influence the interest rate you'll receive on a finance loan:

-

Credit Score: A higher credit score demonstrates creditworthiness and often results in lower interest rates. Lenders perceive you as a lower risk.

-

Loan Amount: Larger loan amounts might attract slightly higher interest rates due to increased risk for the lender.

-

Loan Type: Different types of finance loans (e.g., personal loans, auto loans, home loans) carry varying interest rates based on their perceived risk.

-

Market Conditions: Economic factors, such as inflation and central bank policies, significantly impact prevailing interest rates.

Understanding EMIs (Equated Monthly Installments) in Your Finance Loans

Your EMI is a fixed monthly payment you make towards your loan. It covers both the principal amount (the original loan amount) and the interest charged.

Components of an EMI:

-

Principal: The portion of your EMI that goes towards repaying the actual loan amount.

-

Interest: The portion of your EMI that covers the cost of borrowing the money. Initially, a larger part of your EMI goes towards interest, with the principal repayment increasing over time.

How EMIs are Calculated:

While the precise calculation involves a formula, the basic principle is that your loan amount, interest rate, and tenure all determine your EMI. Higher loan amounts, higher interest rates, and longer tenures lead to higher EMIs.

Factors Affecting EMI Amounts:

-

Loan Amount: A higher loan amount directly translates into a higher EMI.

-

Interest Rate: A higher interest rate increases your EMI.

-

Tenure: The loan's repayment period (tenure). A longer tenure results in lower EMIs but higher overall interest paid over the loan's lifespan. A shorter tenure means higher EMIs but less total interest paid.

The Impact of Loan Tenure on Your Finance Loans

Loan tenure refers to the repayment period – the length of time you have to repay the loan. This decision significantly impacts your EMIs and the total interest you pay.

Tenure, EMIs, and Total Interest:

-

Shorter Tenure: Results in higher EMIs but lower overall interest paid.

-

Longer Tenure: Results in lower EMIs but higher overall interest paid.

Choosing the Right Tenure:

Selecting the appropriate tenure depends on your financial capabilities and long-term goals. Consider your budget and ability to comfortably manage higher EMIs for a shorter period versus lower EMIs over a longer period. Remember that a longer tenure increases your total interest cost.

Finding the Best Finance Loans for Your Needs

Securing the best finance loans involves careful comparison and planning. Don't settle for the first offer you receive.

Beyond Interest Rates, EMIs, and Tenure:

-

Fees and Charges: Be aware of processing fees, prepayment penalties, and other associated costs that can add to the total loan cost.

-

Lender Reputation: Research the lender's reputation and read customer reviews to ensure you choose a trustworthy financial institution.

Tips for Securing Favorable Loan Terms:

-

Compare Offers: Obtain quotes from multiple lenders to compare interest rates, fees, and terms.

-

Negotiate: Don't hesitate to negotiate with lenders for better terms if possible.

-

Read the Fine Print: Carefully read the loan agreement to understand all terms and conditions before signing.

Conclusion

Successfully navigating the world of finance loans requires a solid understanding of interest rates, EMIs, and tenure. By carefully analyzing these key components and comparing offers from different lenders, you can secure the best possible loan terms for your financial needs. Remember to always compare finance loans thoroughly before making a decision. Don't hesitate to seek professional financial advice if needed. Start your search for the perfect finance loan today!

Featured Posts

-

Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali

May 28, 2025

Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali

May 28, 2025 -

Knicks Vs Pacers Game 3 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025

Knicks Vs Pacers Game 3 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025 -

Pacers Vs Knicks Game 1 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025

Pacers Vs Knicks Game 1 Tyrese Haliburton Prop Bets And Predictions

May 28, 2025 -

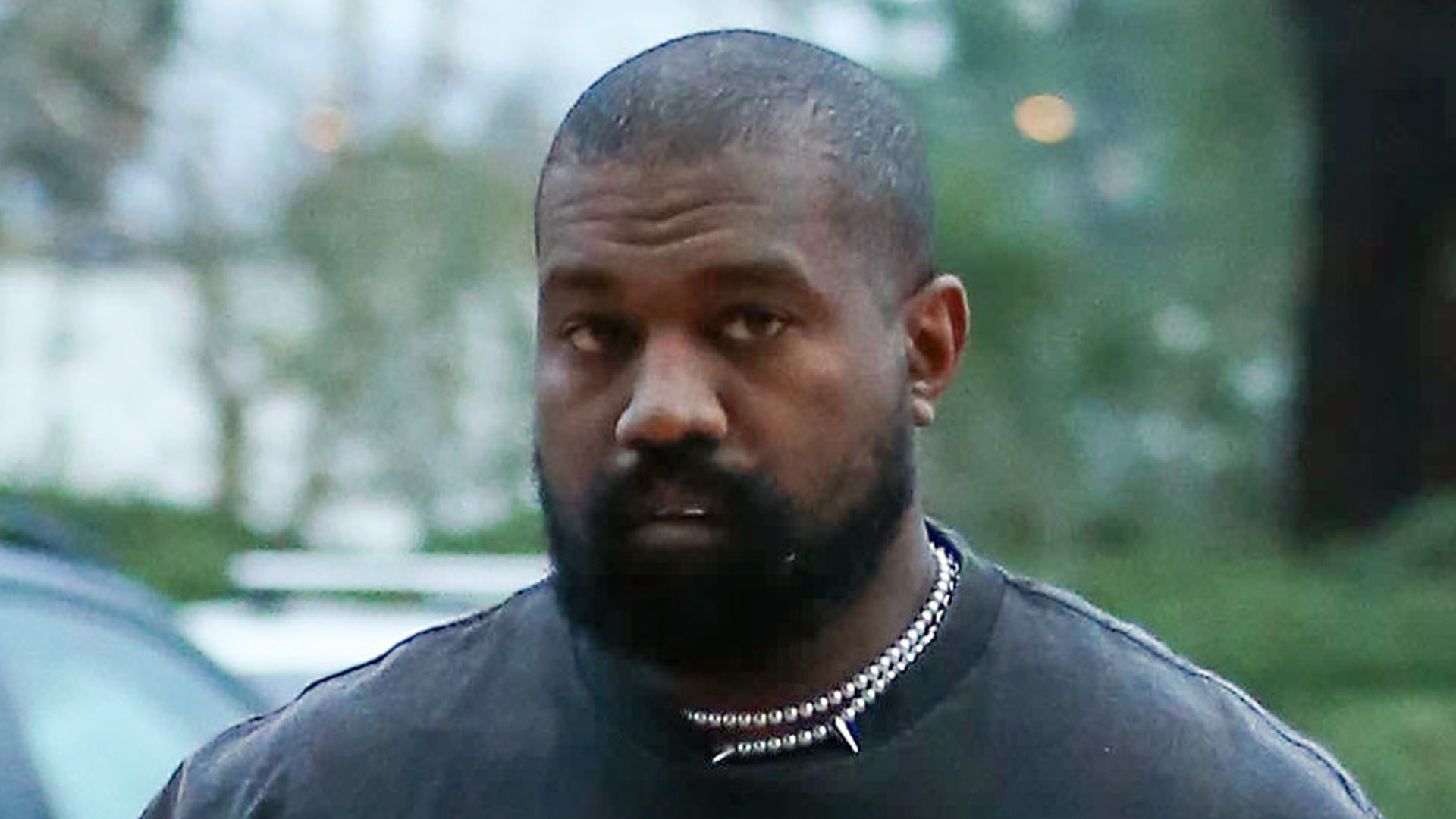

Kanye Wests Wife Bianca Censoris Latest Appearance Sparks Fan Reaction

May 28, 2025

Kanye Wests Wife Bianca Censoris Latest Appearance Sparks Fan Reaction

May 28, 2025 -

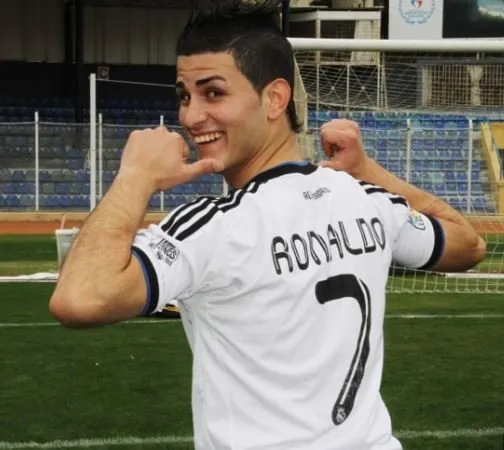

Cok Cirkinsin Diyen Ronaldoya Adanali Ronaldodan Net Bir Yanit

May 28, 2025

Cok Cirkinsin Diyen Ronaldoya Adanali Ronaldodan Net Bir Yanit

May 28, 2025

Latest Posts

-

El Chino Rios Un Dios Del Tenis Segun Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Tenista Argentino

May 30, 2025 -

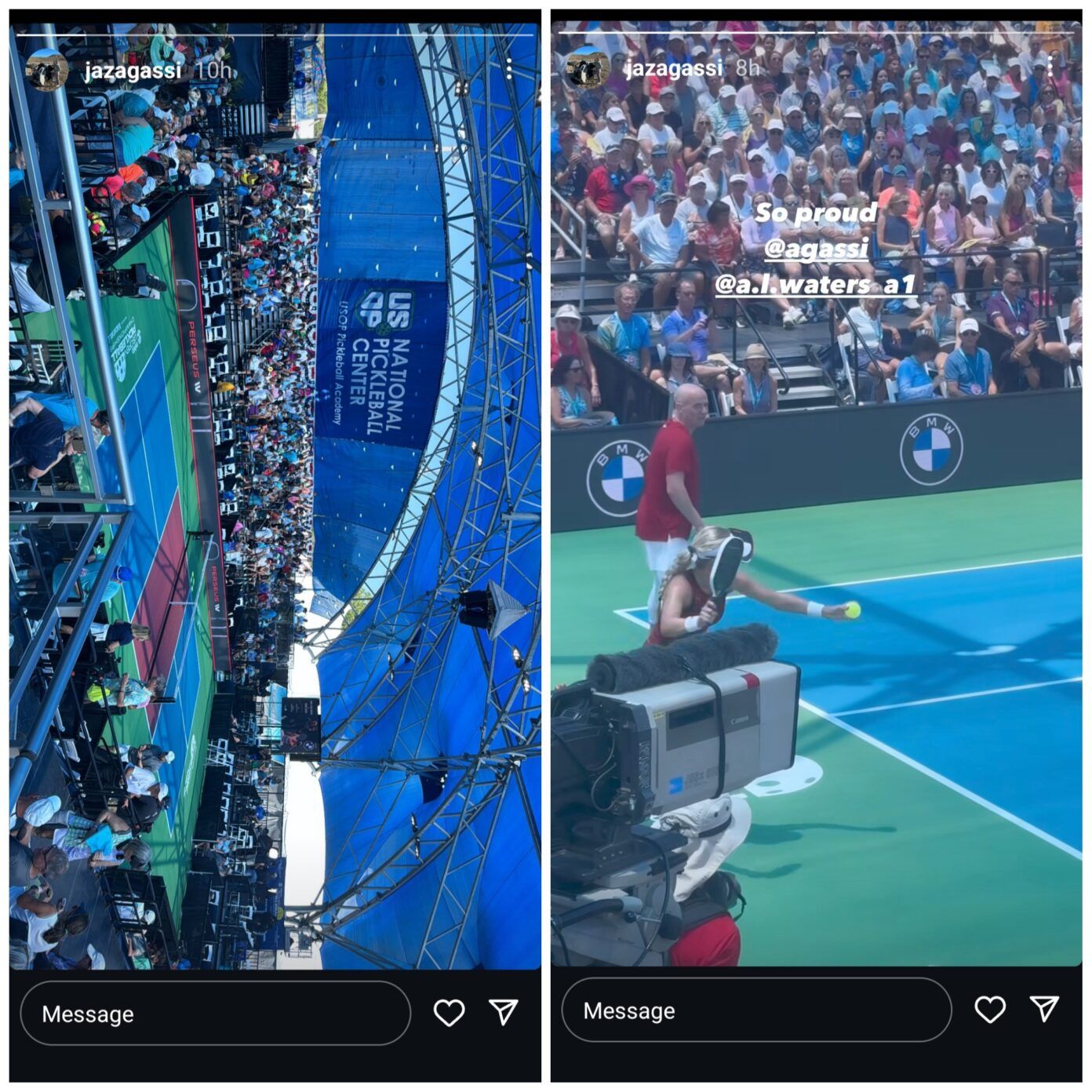

Das Erfolgsgeheimnis Von Steffi Graf Und Andre Agassi Im Pickleball

May 30, 2025

Das Erfolgsgeheimnis Von Steffi Graf Und Andre Agassi Im Pickleball

May 30, 2025 -

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025