Finance Loans 101: Your Complete Guide To Applying For Loans

Table of Contents

Understanding Your Credit Score and its Impact on Loan Approval

What is a credit score?

Your credit score is a three-digit number that represents your creditworthiness. Lenders use it to assess your risk as a borrower. A higher credit score indicates a lower risk, making you a more attractive borrower and potentially leading to better loan terms. Your credit score is calculated based on several factors, including your payment history, amounts owed, length of credit history, credit mix, and new credit.

How to check your credit report?

You're entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – annually. You can access your reports through AnnualCreditReport.com. This is the only official source; be wary of websites that claim to offer free credit reports but require payment.

- Importance of a good credit score for favorable loan terms: A high credit score (typically 700 or above) can significantly improve your chances of loan approval and secure you lower interest rates, saving you thousands of dollars over the loan's lifetime.

- Steps to improve your credit score if needed: Paying bills on time, consistently, is the single most important factor. Reducing your debt-to-credit ratio (the amount you owe compared to your available credit) is also crucial.

- The impact of a poor credit score on loan approval and interest rates: A low credit score can lead to loan application rejections or significantly higher interest rates, increasing the overall cost of borrowing.

- Understanding different credit scoring models (FICO, VantageScore): While FICO is the most widely used scoring model, VantageScore is another common model. Understanding the nuances of these models can provide a more comprehensive picture of your creditworthiness.

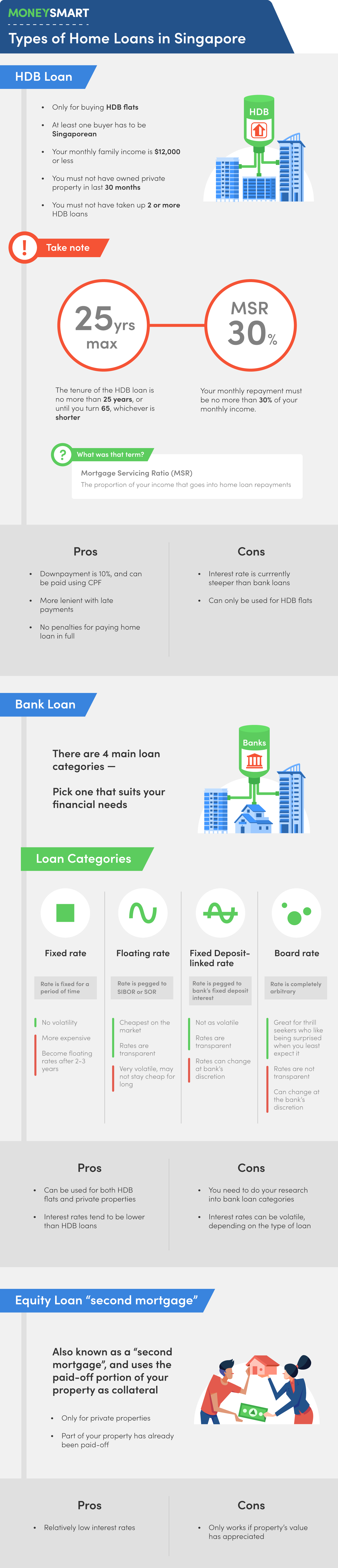

Types of Finance Loans Available

Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation, home improvements, or medical expenses. Interest rates typically vary depending on your credit score and the loan amount.

Business Loans

Business loans provide funding for various business needs, including equipment purchases, expansion, or working capital. Different types include:

- Term loans: Fixed repayment schedules over a set period.

- Lines of credit: Flexible access to funds up to a pre-approved limit.

- SBA loans: Government-backed loans offering favorable terms for small businesses.

Mortgages

Mortgages are loans used to finance the purchase of a home. Common types include:

- Fixed-rate mortgages: Consistent interest rate throughout the loan term.

- Adjustable-rate mortgages (ARMs): Interest rates fluctuate based on market conditions.

- FHA loans: Government-insured loans requiring lower down payments.

- VA loans: Loans specifically for eligible veterans and military personnel.

Auto Loans

Auto loans finance the purchase of a vehicle. Interest rates depend on your credit score, the vehicle's value, and the loan term.

Student Loans

Student loans help finance higher education. Types include:

-

Federal student loans: Offered by the government with various repayment plans.

-

Private student loans: Offered by private lenders with varying terms and conditions.

-

Comparison of loan terms and interest rates across different loan types: Interest rates and repayment terms will vary widely based on factors like the type of loan, your credit score, and the lender. Carefully compare offers before making a decision.

-

Suitable scenarios for each loan type: Each loan type serves different purposes; choosing the right one depends on your specific financial needs.

-

Advantages and disadvantages of each loan type: Understand the pros and cons of each loan type before making a choice.

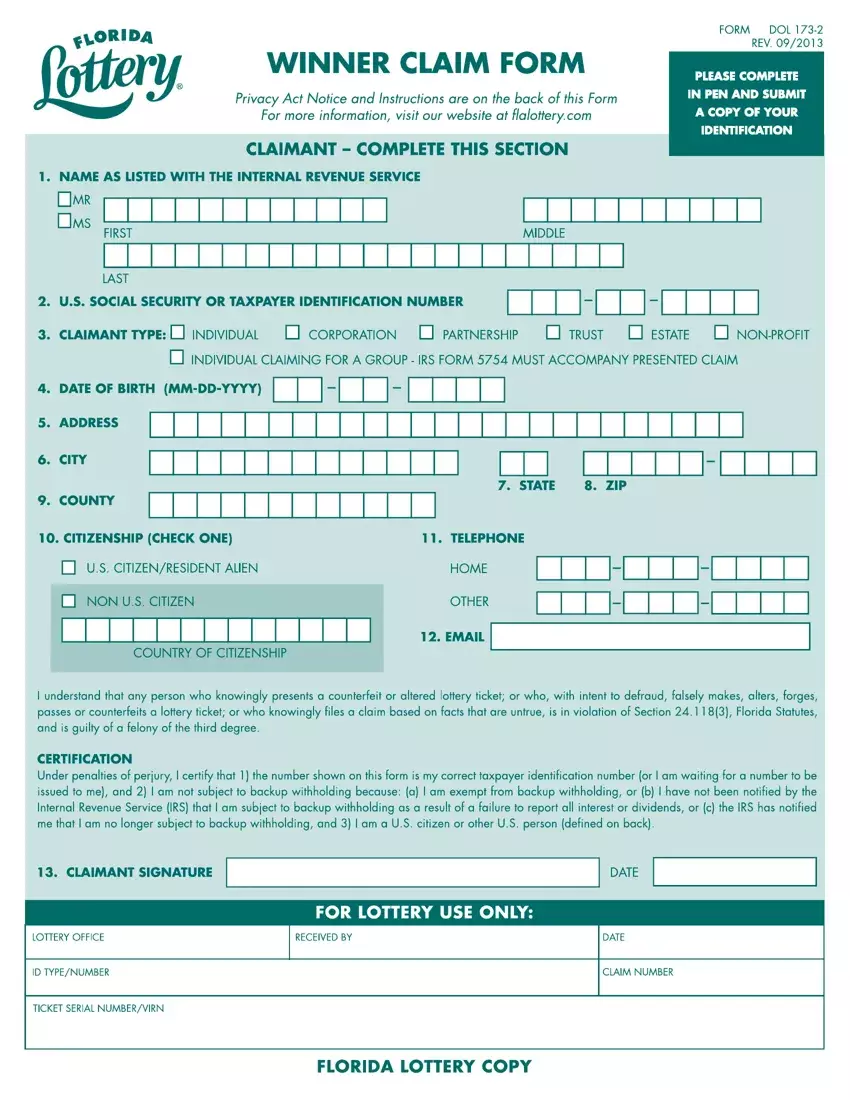

The Loan Application Process: A Step-by-Step Guide

Gathering Required Documents

Typically, lenders require:

- Proof of income (pay stubs, tax returns)

- Government-issued photo ID

- Bank statements

- Proof of address

Completing the Application

Accuracy is paramount. Inaccurate information can lead to delays or rejection.

Understanding Loan Terms and Conditions

Carefully review the Annual Percentage Rate (APR), fees (origination fees, prepayment penalties), and repayment schedule before signing.

Negotiating Loan Terms

While not always possible, it's worth attempting to negotiate a lower interest rate or fees, especially with larger loan amounts.

- Tips for a successful loan application: Be prepared, be organized, and be truthful.

- Common reasons for loan application rejection: Poor credit score, insufficient income, and incomplete applications are common causes.

- What to do if your loan application is denied: Understand the reasons for denial and work on improving your financial standing before reapplying.

- Importance of comparing offers from multiple lenders: Shopping around is crucial to securing the best possible terms.

Choosing the Right Lender for Your Finance Loans

Banks vs. Credit Unions vs. Online Lenders

Each type of lender offers different advantages and disadvantages. Banks are typically large and established, while credit unions often offer more competitive rates for their members. Online lenders offer convenience but require careful vetting.

Factors to Consider When Choosing a Lender

-

Interest rates: The cost of borrowing.

-

Fees: Origination fees, late payment fees, etc.

-

Customer service: The lender's responsiveness and helpfulness.

-

Reputation: Research the lender's history and reviews.

-

Researching lenders and reading reviews: Check online reviews and ratings before choosing a lender.

-

Understanding lender fees and charges: Be aware of all associated fees and their impact on the overall cost.

-

The importance of a reputable and trustworthy lender: Choose a lender with a strong reputation and a proven track record.

-

Checking the lender's licensing and registration: Ensure the lender is properly licensed and registered in your state.

Managing Your Finance Loans Effectively

Creating a Repayment Plan

Budget carefully and prioritize loan repayments to avoid falling behind.

Avoiding Late Payments

Late payments significantly damage your credit score and can lead to additional fees.

Exploring Debt Consolidation Options

Consolidating multiple loans into a single loan might simplify repayment and potentially lower your interest rate. However, be cautious about the terms of any consolidation loan.

- Tips for staying on track with loan repayments: Set up automatic payments, track your progress, and create a realistic budget.

- Strategies for managing multiple loans: Prioritize high-interest loans and consider debt consolidation options.

- Consequences of defaulting on a loan: Defaulting can severely damage your credit score and result in legal action.

Conclusion

Securing the right finance loans requires careful planning and understanding. By following the steps outlined in this guide, you can navigate the loan application process confidently. Remember to research thoroughly, compare offers from multiple lenders, and carefully review all loan terms and conditions before signing any agreements. Don't hesitate to seek professional financial advice if needed. Start your journey towards securing the best finance loans for your needs today!

Featured Posts

-

Is April The Rainiest A Look At Current Rainfall Data

May 28, 2025

Is April The Rainiest A Look At Current Rainfall Data

May 28, 2025 -

Justin Baldoni Vs Ryan Reynolds Lawsuit Update And Next Steps

May 28, 2025

Justin Baldoni Vs Ryan Reynolds Lawsuit Update And Next Steps

May 28, 2025 -

300k Euro Millions Prize National Lotterys Five Day Claim Deadline Notice

May 28, 2025

300k Euro Millions Prize National Lotterys Five Day Claim Deadline Notice

May 28, 2025 -

Polresta Balikpapan Kasatlantas Baru Akp Djauhari Sholat Subuh Bersama Warga

May 28, 2025

Polresta Balikpapan Kasatlantas Baru Akp Djauhari Sholat Subuh Bersama Warga

May 28, 2025 -

Ipswich Town Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025

Ipswich Town Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025

Latest Posts

-

De Las Pistas De Tenis A Un Nuevo Desafio La Sorprendente Regreso De Andre Agassi

May 30, 2025

De Las Pistas De Tenis A Un Nuevo Desafio La Sorprendente Regreso De Andre Agassi

May 30, 2025 -

Un Tenista Argentino Declara A Marcelo Rios Como Una Leyenda Del Tenis

May 30, 2025

Un Tenista Argentino Declara A Marcelo Rios Como Una Leyenda Del Tenis

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Marcelo Rios La Idolatria De Un Tenista Argentino

May 30, 2025

Marcelo Rios La Idolatria De Un Tenista Argentino

May 30, 2025 -

Andre Agassi Vuelve Al Deporte Su Nueva Cancha De Juego

May 30, 2025

Andre Agassi Vuelve Al Deporte Su Nueva Cancha De Juego

May 30, 2025