Financial Literacy Redefined: A Podcast Series

Table of Contents

Expert Insights & Diverse Perspectives

Our "Financial Literacy Redefined" podcast stands out by offering a wealth of knowledge from diverse financial experts. We understand that personal finance isn't a one-size-fits-all solution, and that's why we feature a variety of voices and perspectives. This ensures you receive a holistic understanding of various financial strategies and approaches to budgeting, investing, and debt management. We believe in providing you with well-rounded financial education.

-

Interviews with Certified Financial Planners (CFPs): Gain insights from highly qualified professionals who can provide expert guidance on creating a comprehensive financial plan tailored to your specific needs and goals. They'll delve into topics such as retirement planning, estate planning, and tax optimization strategies.

-

Discussions with successful entrepreneurs on wealth building strategies: Learn directly from those who have built their financial empires. Discover their secrets to success, including business acumen, smart investing choices, and the mindset required for long-term financial growth. This provides practical, real-world examples of financial success.

-

Insights from behavioral economists on overcoming financial biases: Understanding the psychology behind your financial decisions is crucial. Our behavioral economists help you identify and overcome common biases that can hinder your progress towards financial independence. This includes topics like emotional spending and impulsive decision-making.

-

Guest appearances from financial literacy educators and authors: Benefit from the expertise of leading authors and educators in the field of personal finance. They'll offer valuable perspectives and actionable advice based on their extensive research and experience, providing a broad range of financial literacy education.

Practical, Actionable Advice

Forget confusing jargon and overwhelming theoretical concepts. Our personal finance podcast delivers practical, actionable advice that you can implement immediately to improve your financial well-being. We focus on providing clear, concise strategies that work in the real world.

-

Step-by-step guides to creating a realistic budget: Learn how to track your income and expenses effectively, identify areas for improvement, and create a sustainable budget that aligns with your financial goals. We provide simple budgeting strategies for beginners and more advanced techniques for seasoned savers.

-

Easy-to-understand explanations of different investment options: We demystify the world of investing, explaining various investment options such as stocks, bonds, mutual funds, and ETFs in a way that is accessible to everyone, regardless of their prior investment experience. Investing for beginners is made simple!

-

Effective strategies for paying down debt and improving your credit score: Learn proven strategies to tackle debt effectively, from creating a debt repayment plan to understanding the factors influencing your credit score. We share practical debt management strategies to get you on the path to financial freedom faster.

-

Tips for saving money on everyday expenses and building an emergency fund: Discover simple yet effective ways to reduce your spending and build a healthy emergency fund, protecting yourself against unexpected financial challenges. We offer practical tips for saving money on groceries, transportation, and other daily expenses.

Engaging & Easy-to-Listen-To Format

We understand that learning about personal finance doesn't have to be boring. Our financial education podcast is designed to be engaging, informative, and entertaining. We strive to make complex financial topics accessible to everyone, regardless of their prior knowledge.

-

Short, focused episodes perfect for commutes or workouts: Each episode is concise and packed with valuable information, making it easy to fit into your busy schedule. Listen during your commute, while exercising, or during any other free time.

-

Use of real-life examples and relatable stories: We use real-life examples and relatable stories to illustrate key concepts and make the information more memorable and engaging. This helps make abstract concepts easier to grasp.

-

Clear, concise language avoiding overly technical financial terms: We use clear, concise language and avoid overly technical jargon, making the information accessible to everyone, regardless of their financial background. We prioritize ease of understanding in our money management podcast.

-

A conversational tone that makes complex topics easy to grasp: We use a conversational and friendly tone to create a welcoming and approachable atmosphere, ensuring that complex topics are presented in a way that is easy to understand and digest.

Community & Resources

Become part of a supportive community of like-minded individuals on our social media channels and online forum. We encourage interaction and collaboration, fostering a supportive environment for learning and growth. We also provide access to valuable supplemental resources to further enhance your learning experience.

-

Links to helpful budgeting tools and calculators: We provide links to helpful budgeting tools and calculators to help you easily track your finances and make informed financial decisions.

-

Access to worksheets and templates for tracking your finances: Download our free worksheets and templates to help you stay organized and track your progress.

-

Opportunities to engage with our experts and other listeners: Engage with our experts and other listeners through Q&A sessions and online forums.

-

Regular Q&A sessions addressing listener questions: We regularly host Q&A sessions to address listener questions and concerns, providing personalized guidance and support.

Conclusion

"Financial Literacy Redefined" is more than just a podcast; it's your comprehensive guide to achieving financial independence. By providing expert insights, practical advice, and an engaging format, we empower you to take control of your financial future. Subscribe today to start your journey towards a more secure and prosperous life! Don't wait, start improving your financial literacy with our podcast series now! Listen to the "Financial Literacy Redefined" podcast and transform your relationship with money. Find us on [insert podcast platforms here]!

Featured Posts

-

The Bof A Perspective Why High Stock Market Valuations Shouldnt Deter Investors

May 31, 2025

The Bof A Perspective Why High Stock Market Valuations Shouldnt Deter Investors

May 31, 2025 -

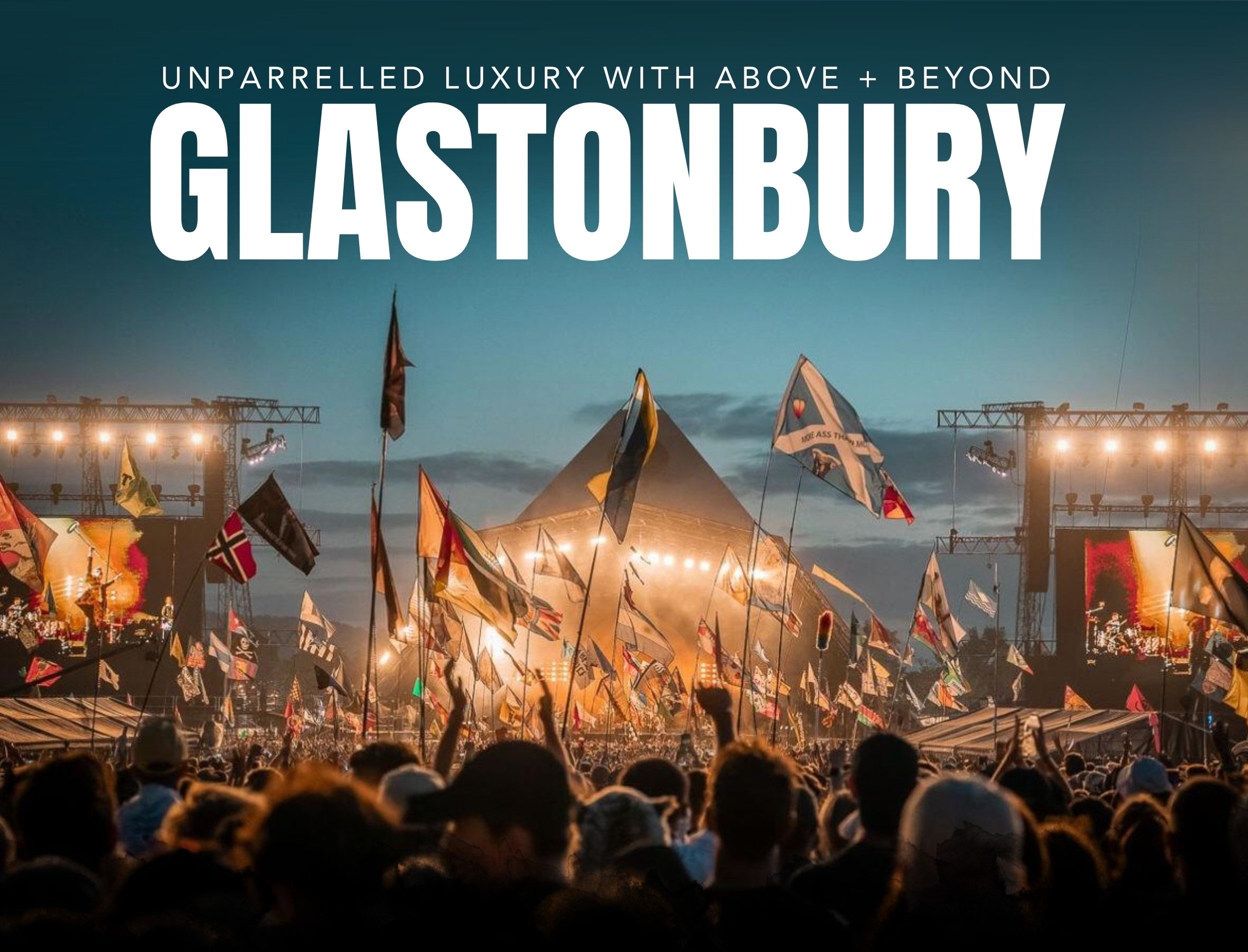

Full Lineup Announced For Glastonbury And Sanremo 2025 Festivals

May 31, 2025

Full Lineup Announced For Glastonbury And Sanremo 2025 Festivals

May 31, 2025 -

Dragon Den Investors New Padel Court Venture At Chafford Hundred Health Club

May 31, 2025

Dragon Den Investors New Padel Court Venture At Chafford Hundred Health Club

May 31, 2025 -

Princes Death March 26th 2016 Fentanyl Levels Revealed

May 31, 2025

Princes Death March 26th 2016 Fentanyl Levels Revealed

May 31, 2025 -

Munguia Defeats Surace By Points Decision In Riyadh

May 31, 2025

Munguia Defeats Surace By Points Decision In Riyadh

May 31, 2025