Find No Credit Check Loans With Guaranteed Approval From A Direct Lender

Table of Contents

Understanding No Credit Check Loans

No credit check loans are short-term loans that don't require a traditional credit check as part of the application process. Unlike traditional loans from banks or credit unions, which heavily rely on your credit score to determine eligibility and interest rates, these loans focus more on your ability to repay the loan based on your income and employment history.

This type of loan offers several advantages:

- Faster application and approval process: Because a credit check isn't required, the application and approval process is typically much faster than for traditional loans. You may receive funding within a day or two.

- Accessibility for individuals with poor credit history: This is the primary advantage. If you have bad credit, a bankruptcy, or other credit issues, a no credit check loan might be your only option for quick financial relief.

However, there are also disadvantages to consider:

- Potentially higher interest rates and fees: Because lenders are taking on more risk by not conducting a credit check, they often charge higher interest rates and fees to compensate.

- Limited loan amounts: The loan amounts available are usually smaller than traditional loans due to the increased risk.

- Importance of responsible borrowing: It's crucial to only borrow what you can realistically repay, given the higher interest rates involved.

Finding a Reputable Direct Lender for No Credit Check Loans

Dealing directly with a lender is crucial to avoid scams and predatory lending practices. Many unscrupulous companies advertise online, promising easy approval for no credit check loans but then charge exorbitant fees or engage in deceptive practices. To find a legitimate direct lender:

- Check for licensing and registration information: Ensure the lender is licensed and registered in your state or jurisdiction. This information is usually readily available on their website.

- Read online reviews and testimonials from previous borrowers: Check reputable review sites like Trustpilot, Yelp, or the Better Business Bureau to gauge the lender's reputation.

- Verify their physical address and contact information: Avoid lenders who only provide a PO Box or virtual address. Legitimate lenders will have a physical office.

- Beware of lenders promising guaranteed approval without any qualifications: No reputable lender can guarantee approval without assessing your ability to repay.

- Understand the terms and conditions before signing any agreement: Carefully review the loan agreement before accepting it. Pay close attention to the interest rate, fees, repayment schedule, and any potential penalties.

The Application Process for No Credit Check Loans

Applying for a no credit check loan online is typically a straightforward process:

- Gather necessary documents: This usually includes your government-issued ID, proof of income (pay stubs or bank statements), and sometimes proof of address.

- Complete the online application form carefully: Ensure you provide accurate information; inaccurate information can lead to application rejection or further complications.

- Wait for the lender's decision: The decision is often made quickly, sometimes within minutes or hours.

- Review the loan agreement before accepting it: Don't rush into signing. Read the fine print thoroughly to understand all the terms and conditions.

- Understand repayment terms and potential penalties for late payments: Late payments can result in significant fees and damage your credit rating, even with a no credit check loan.

Alternatives to No Credit Check Loans

While no credit check loans can be a quick solution, they are not always the best option. Consider these alternatives for borrowers with poor credit:

- Secured loans (using collateral): If you own assets like a car or house, you can use them as collateral to secure a loan with a lower interest rate.

- Credit builder loans: These loans are specifically designed to help you build your credit history. They usually involve small loan amounts and regular payments.

- Loans from credit unions: Credit unions often offer more flexible loan options than banks and may be more willing to work with borrowers who have less-than-perfect credit.

- Negotiating with creditors for payment plans: If you're struggling with existing debt, contact your creditors to explore payment plan options.

- Seeking financial counseling: A financial counselor can help you develop a budget, manage debt, and create a long-term financial plan.

Important Considerations Before Applying

Before applying for a no credit check loan, carefully consider the total cost of borrowing and the potential risks involved. Responsible borrowing habits are essential:

- Compare interest rates and fees from multiple lenders: Don't settle for the first offer you receive. Shop around and compare terms from different lenders.

- Create a realistic repayment plan: Ensure you can afford the monthly payments without compromising your other financial obligations.

- Avoid taking on more debt than you can comfortably manage: Overextending yourself financially can lead to serious problems.

- Consider the long-term implications of your borrowing decisions: A no credit check loan may seem convenient, but the higher interest rates can have a significant impact on your finances over time.

Conclusion

Finding no credit check loans with guaranteed approval from a direct lender requires careful research and a responsible approach. While these loans offer a convenient solution for those with poor credit, it's crucial to understand the terms, fees, and potential risks involved. By following the steps outlined above and choosing a reputable direct lender, you can improve your chances of securing the financial assistance you need. Remember to always borrow responsibly and only take out a loan you can realistically repay. Start your search for no credit check loans today and take control of your financial situation.

Featured Posts

-

Access To Birth Control The Over The Counter Revolution After Roe V Wade

May 28, 2025

Access To Birth Control The Over The Counter Revolution After Roe V Wade

May 28, 2025 -

Pirates Lose To Braves Triolos Standout Performance Effective Bullpen

May 28, 2025

Pirates Lose To Braves Triolos Standout Performance Effective Bullpen

May 28, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods Allegations

May 28, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods Allegations

May 28, 2025 -

Nl West Power Shift Dodgers Hot Streak Diamondbacks Rise And The Impact Of Arraezs Injury

May 28, 2025

Nl West Power Shift Dodgers Hot Streak Diamondbacks Rise And The Impact Of Arraezs Injury

May 28, 2025 -

Eu Sanctions Against Shein For Consumer Rights Violations Imminent

May 28, 2025

Eu Sanctions Against Shein For Consumer Rights Violations Imminent

May 28, 2025

Latest Posts

-

Ruuds French Open Campaign Ends With Knee Injury And Loss To Borges

May 30, 2025

Ruuds French Open Campaign Ends With Knee Injury And Loss To Borges

May 30, 2025 -

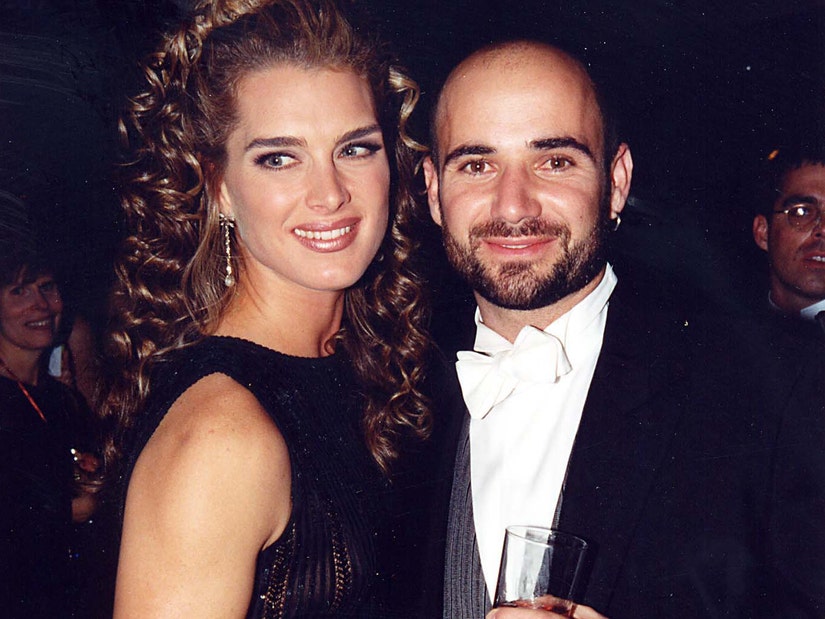

Brooke Shields Reflects On Life Choices Children And Andre Agassi

May 30, 2025

Brooke Shields Reflects On Life Choices Children And Andre Agassi

May 30, 2025 -

Steffi Graf Auf Instagram Diese Stars Folgen Ihr

May 30, 2025

Steffi Graf Auf Instagram Diese Stars Folgen Ihr

May 30, 2025 -

Brooke Shields Book Reveals Regret Over Not Having Children With Agassi

May 30, 2025

Brooke Shields Book Reveals Regret Over Not Having Children With Agassi

May 30, 2025 -

French Open 2025 Knee Injury Ends Ruuds Run Against Borges

May 30, 2025

French Open 2025 Knee Injury Ends Ruuds Run Against Borges

May 30, 2025