Finding A Direct Lender For Bad Credit Personal Loans: Up To $5000

Table of Contents

Understanding Direct Lenders vs. Brokers

When searching for a bad credit personal loan, it's crucial to understand the difference between direct lenders and loan brokers. Direct lenders provide the funds directly to you, while brokers act as intermediaries connecting you with potential lenders. For those with bad credit, dealing directly with a lender offers significant advantages.

- Direct lenders provide the funds directly. This means faster processing times and potentially better terms, as there's no extra layer of communication and negotiation.

- Brokers act as intermediaries, potentially increasing fees and processing time. They earn commissions, which can impact the overall cost of your loan. The added steps can also significantly delay the loan approval process.

- Direct lenders often offer more transparent terms. You'll have a clearer understanding of the interest rates, fees, and repayment schedule upfront.

- Finding a reputable direct lender is crucial for bad credit borrowers. This ensures you avoid scams and predatory lending practices.

Locating Reputable Direct Lenders for Bad Credit

Finding a reliable direct lender specializing in bad credit personal loans requires research and comparison. Don't rush the process; take the time to carefully vet potential lenders.

- Use online search engines, but be cautious of scams. Use specific keywords like "direct lender bad credit loans," "bad credit personal loans online," "same-day bad credit loans," and "personal loans for bad credit with guaranteed approval" (while being aware that guaranteed approval is rarely realistic). Be wary of lenders with overly aggressive advertising or promises that seem too good to be true.

- Check online reviews and ratings from sources like the Better Business Bureau (BBB). These independent reviews provide valuable insights into a lender's reputation and customer service.

- Look for lenders transparent about their fees and APRs. Avoid lenders who are vague or secretive about their fees. A high APR can significantly increase your overall loan cost.

- Be wary of lenders promising guaranteed approval. While some lenders specialize in bad credit loans, no lender can guarantee approval. Be cautious of those who make such claims.

Key Factors to Consider When Choosing a Lender

Once you've identified several potential direct lenders, compare their offerings based on these key factors:

- Compare Annual Percentage Rates (APRs) from multiple lenders. The APR reflects the total cost of borrowing, including interest and fees. Choose the lender with the lowest APR you qualify for.

- Understand all associated fees, such as origination fees or prepayment penalties. These fees can significantly impact the overall cost of your loan.

- Consider the loan term and its impact on monthly payments. A shorter loan term means higher monthly payments but less interest paid overall. A longer term results in lower monthly payments but higher total interest.

- Evaluate repayment flexibility options. Some lenders may offer options such as skip-a-payment or extended repayment plans, which can be helpful if you experience unexpected financial difficulties.

Improving Your Chances of Approval for a Bad Credit Loan

While securing a bad credit personal loan is more challenging, you can improve your odds by taking proactive steps:

- Check your credit report for errors and dispute them if necessary. Errors on your credit report can negatively impact your credit score.

- Pay down existing debts to improve your credit utilization ratio. This shows lenders that you're managing your finances responsibly.

- Consider adding a co-signer to strengthen your application. A co-signer with good credit can significantly improve your chances of approval.

- Provide accurate and complete information on your application. Inaccurate or incomplete information can lead to delays or rejection.

The Application Process for a Direct Lender Bad Credit Loan

The application process is typically straightforward:

- Gather necessary documentation (income proof, ID). Having these documents readily available speeds up the process.

- Complete the online application form. Be accurate and thorough when filling out the application.

- Wait for approval (often within 24-48 hours). The timeframe can vary depending on the lender.

- Review and sign the loan agreement carefully before accepting. Understand all terms and conditions before committing to the loan.

Conclusion

Securing a personal loan with bad credit can seem challenging, but finding a direct lender simplifies the process and increases your chances of approval. By carefully researching reputable lenders, understanding the key factors to consider, and improving your credit profile where possible, you can significantly increase your chances of securing a bad credit personal loan up to $5000. Don't delay – start your search for a reliable direct lender for bad credit personal loans today!

Featured Posts

-

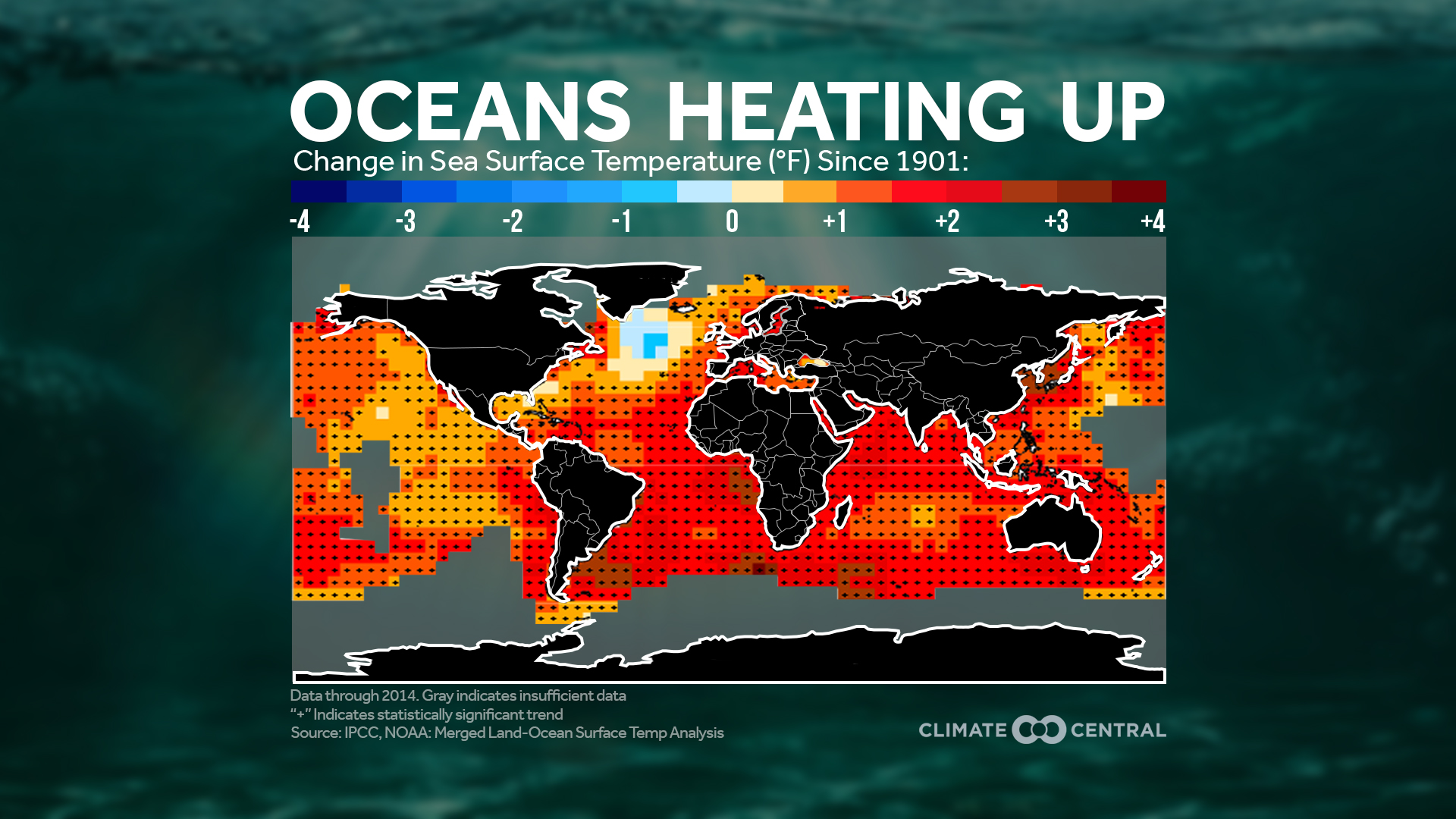

Western Massachusetts Rainfall Trends And Climate Change Impacts

May 28, 2025

Western Massachusetts Rainfall Trends And Climate Change Impacts

May 28, 2025 -

Ignoring The Bond Crisis The Risks Investors Face

May 28, 2025

Ignoring The Bond Crisis The Risks Investors Face

May 28, 2025 -

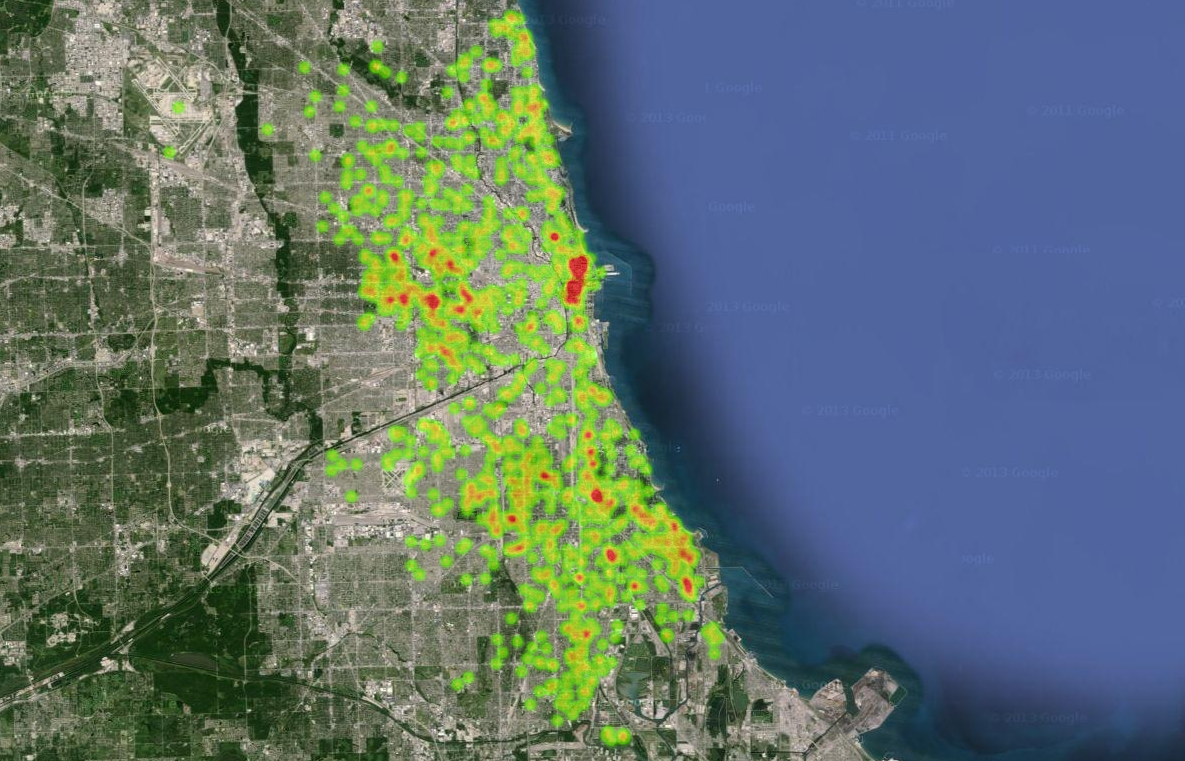

Chicago Crime Statistics A Look At The Recent Drop

May 28, 2025

Chicago Crime Statistics A Look At The Recent Drop

May 28, 2025 -

Jalan Raya Bali Rusak Surya Paloh Soroti Krisis Infrastruktur

May 28, 2025

Jalan Raya Bali Rusak Surya Paloh Soroti Krisis Infrastruktur

May 28, 2025 -

202m Euromillions Jackpot A Life Of Luxury Awaits The Winner

May 28, 2025

202m Euromillions Jackpot A Life Of Luxury Awaits The Winner

May 28, 2025

Latest Posts

-

Agassi Dezvaluie Stresul Inainte De Meciuri Era Coplesitor

May 30, 2025

Agassi Dezvaluie Stresul Inainte De Meciuri Era Coplesitor

May 30, 2025 -

Steffi Graf Neuer Sport Und Die Ehe Mit Andre Agassi

May 30, 2025

Steffi Graf Neuer Sport Und Die Ehe Mit Andre Agassi

May 30, 2025 -

La Bestia Sudamericana Agassi Rememora A Rios

May 30, 2025

La Bestia Sudamericana Agassi Rememora A Rios

May 30, 2025 -

Andre Agassi Marturie Neasteptata Despre Presiunea Competitiei

May 30, 2025

Andre Agassi Marturie Neasteptata Despre Presiunea Competitiei

May 30, 2025 -

Die Ungewoehnliche Ehe Regel Von Steffi Graf Und Andre Agassi

May 30, 2025

Die Ungewoehnliche Ehe Regel Von Steffi Graf Und Andre Agassi

May 30, 2025