Finding The Real Safe Bet: How To Minimize Risk And Maximize Returns

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment strategies, understanding your personal risk tolerance is paramount. This involves a thorough self-assessment to determine your comfort level with potential losses.

Assessing Your Financial Situation

- Analyze your current financial resources: How much money do you have available to invest? What are your monthly expenses? Do you have a robust emergency fund (ideally 3-6 months of living expenses)? A clear picture of your financial health is crucial.

- Determine your investment timeline: Are you investing for short-term goals (like a down payment on a car) or long-term goals (like retirement)? Longer time horizons generally allow for greater risk-taking, as there's more time to recover from potential losses.

- Define your comfort level with potential losses: Are you a conservative, moderate, or aggressive investor? Conservative investors prioritize capital preservation, while aggressive investors are willing to accept higher risk for potentially higher returns. Honest self-assessment is key here. Consider using risk tolerance questionnaires available online.

Identifying Your Investment Goals

Setting clear goals is essential for guiding your investment strategy. Use the SMART framework:

- Specific: Define your goals precisely. Instead of "save for retirement," aim for "accumulate $1 million by age 65."

- Measurable: Track your progress toward your goals.

- Achievable: Set realistic goals based on your financial situation and risk tolerance.

- Relevant: Ensure your goals align with your values and lifestyle.

- Time-bound: Set deadlines for achieving your goals.

Align your risk tolerance with your goals. Long-term goals, such as retirement planning, generally allow for a more aggressive investment approach with a higher allocation to stocks. Short-term goals might necessitate a more conservative approach with lower-risk investments like bonds or high-yield savings accounts.

Diversification: Spreading Your Bets

Diversification is a cornerstone of effective risk management. It involves spreading your investments across different asset classes to reduce your overall portfolio risk. A diversified portfolio is less vulnerable to the fluctuations of any single asset.

The Power of Diversification

Imagine putting all your eggs in one basket. If that basket falls, you lose everything. Diversification is like using multiple baskets. If one basket falls, you still have others. This significantly reduces your risk exposure.

Asset Allocation Strategies

Different asset allocation strategies cater to varying risk tolerances and investment goals:

- 60/40 portfolio: A classic approach allocating 60% to stocks (higher risk, higher potential return) and 40% to bonds (lower risk, lower potential return).

- Growth portfolio: A higher-risk portfolio with a larger allocation to stocks, suitable for long-term investors with higher risk tolerance.

- Conservative portfolio: A lower-risk portfolio with a larger allocation to bonds and less volatile investments.

The optimal asset allocation depends on your individual circumstances and investment goals.

Geographic Diversification

Don't limit yourself to your home country. Investing in different countries and markets reduces your exposure to single-market risks. A global portfolio can weather economic downturns in individual regions more effectively.

Research and Due Diligence: Making Informed Decisions

Before investing in anything, thorough research is non-negotiable. This is crucial for identifying truly "safe bets."

Thorough Research

Never invest in something you don't understand. Read company reports, analyze financial statements, and stay updated on market trends. Utilize credible news sources and financial analysis websites.

Analyzing Financial Statements

Learning to interpret key financial metrics, like the price-to-earnings ratio (P/E ratio) and debt-to-equity ratio, provides invaluable insights into a company's financial health and potential. Numerous online resources explain these metrics in detail.

Seeking Professional Advice

Consider consulting with a qualified financial advisor. They can provide personalized guidance tailored to your specific financial situation, risk tolerance, and investment goals. This can be particularly helpful for those new to investing or lacking the time to conduct extensive research.

Recognizing and Avoiding Common Pitfalls

Even with careful planning, certain pitfalls can derail your investment strategy.

Emotional Investing

Avoid making impulsive decisions based on fear or greed. Market fluctuations are normal; stick to your investment plan.

Chasing High Returns

High returns often come with high risks. Don't chase unrealistic promises of quick riches. Focus on sustainable, long-term growth.

Ignoring Fees and Expenses

Investment fees and expenses can significantly impact your returns over time. Carefully compare fees before making investment choices.

Conclusion

Finding a "safe bet" is about informed decision-making, not about eliminating risk entirely. By understanding your risk tolerance, diversifying your investments, conducting thorough research, and avoiding common pitfalls, you can significantly improve your chances of achieving your financial goals. Remember, a truly "safe bet" involves a strategic approach to risk management, maximizing potential returns while minimizing potential losses. Take proactive steps to improve your risk management strategies and start finding your own "safe bets" today. Explore additional resources on investing and risk management to further enhance your knowledge and build a secure financial future. Making informed decisions is the key to long-term financial success and finding truly "safe bets."

Featured Posts

-

Examining The Double Speak Surrounding Trumps Transgender Military Policy

May 10, 2025

Examining The Double Speak Surrounding Trumps Transgender Military Policy

May 10, 2025 -

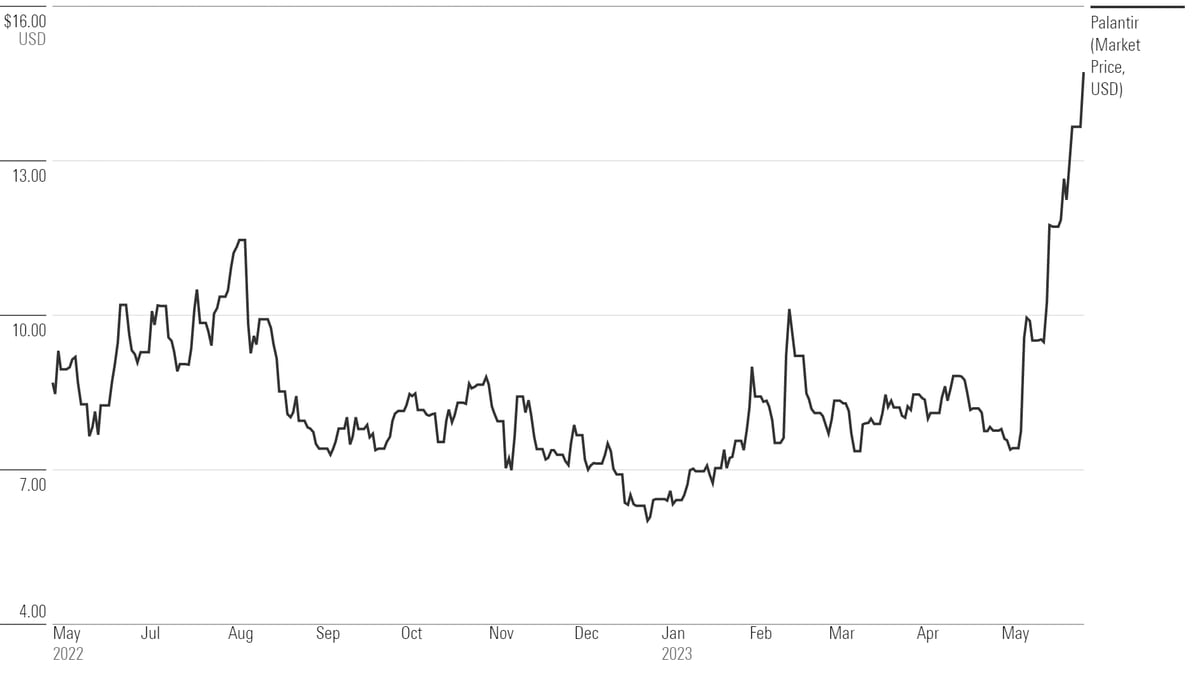

Should You Buy Palantir Stock Now A Detailed Investors Guide

May 10, 2025

Should You Buy Palantir Stock Now A Detailed Investors Guide

May 10, 2025 -

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 10, 2025

Measles Outbreak Prompts School Quarantine In North Dakota Unvaccinated Children Affected

May 10, 2025 -

Remembering Americas Pioneer The Passing Of A Nonbinary Icon

May 10, 2025

Remembering Americas Pioneer The Passing Of A Nonbinary Icon

May 10, 2025 -

Benson Boone On Harry Styles Comparison A Direct Response

May 10, 2025

Benson Boone On Harry Styles Comparison A Direct Response

May 10, 2025