Finding The Real Safe Bet In Today's Market

Table of Contents

Government Bonds: A Traditional Safe Haven

Government bonds have long been considered a cornerstone of low-risk investment strategies. Understanding government bond yields and risks is crucial for assessing their suitability within your portfolio.

Understanding Government Bond Yields and Risks

Government bonds represent a loan you make to a government. In return, you receive regular interest payments (the yield) and the principal back at maturity. The safety of these bonds stems from the perceived low default risk of developed nations. However, bond yields are influenced by several factors, primarily interest rates and inflation. Rising interest rates generally lead to lower bond prices (though future interest payments may be higher), while inflation erodes the real value of returns.

- Low default risk: Government bonds issued by stable economies like the US, UK, or Germany carry a significantly lower default risk than corporate bonds or other high-yield investments.

- Relatively predictable returns: The fixed interest payments provide a degree of predictability, making them suitable for investors seeking stability.

- Importance of diversification: Diversifying your government bond holdings across different maturities and countries helps mitigate risk. Holding bonds with various maturity dates minimizes the impact of interest rate fluctuations.

- Potential impact of inflation: Inflation can significantly reduce the real return on bonds. Consider inflation-protected securities (TIPS) to hedge against this risk.

These factors make government bonds a solid component of a diversified, low-risk portfolio, offering a dependable safe bet for conservative investors. Finding the right mix of low-risk bonds is key to maximizing returns while minimizing exposure to volatility.

Diversified Index Funds: Spreading the Risk

Index funds offer a powerful approach to risk mitigation through diversification. This strategy is particularly relevant when searching for a safe bet in a turbulent market.

The Power of Diversification

Investing in broad market index funds, which track a specific market index like the S&P 500, provides exposure to a vast number of companies across various sectors. This diversification significantly reduces the volatility associated with investing in individual stocks.

- Lower management fees: Index funds typically have significantly lower management fees than actively managed funds, leading to higher returns over time.

- Exposure to a wide range of assets: By investing in an index fund, you gain exposure to a diverse portfolio of companies, reducing your dependence on the performance of any single business.

- Long-term growth potential: While not guaranteeing high returns, index funds have historically provided strong long-term growth potential aligned with the overall market performance.

- Importance of selection: Choose index funds carefully based on your investment goals. Consider factors such as market capitalization (large-cap, mid-cap, small-cap) and sector focus (e.g., technology, healthcare).

Diversified index funds represent a reliable safe bet for long-term investors seeking steady growth with reduced volatility. Investing in these funds promotes a balanced and less risky approach to portfolio management.

High-Yield Savings Accounts and CDs: Short-Term Stability

For short-term stability and easy access to funds, high-yield savings accounts and certificates of deposit (CDs) offer a compelling safe bet.

Balancing Liquidity and Returns

High-yield savings accounts provide readily accessible funds with competitive interest rates, while CDs offer higher returns for locking your money away for a predetermined period.

- FDIC insurance: In the US, deposits in FDIC-insured banks are protected up to $250,000 per depositor, per insured bank, offering an additional layer of security.

- Easy access: Savings accounts allow you to withdraw funds whenever needed, offering superior liquidity.

- Fixed returns (CDs): CDs offer a fixed interest rate for the duration of the term, providing predictable returns.

- Comparing rates and terms: Shop around and compare interest rates and terms across different financial institutions to maximize your returns.

These short-term options offer a safe bet for emergency funds or short-term financial goals, providing a balance between liquidity and returns.

Real Estate: A Tangible Asset with Long-Term Potential (But Higher Risk)

Real estate is often considered a safe bet, but its higher risk profile requires careful consideration.

Navigating the Real Estate Market

Real estate offers the potential for long-term appreciation and rental income. However, it demands a larger initial investment, and its value can fluctuate significantly depending on market conditions.

- Potential for long-term appreciation: Historically, real estate has shown the potential for substantial long-term value appreciation.

- Rental income generation: Rental properties can generate passive income, helping offset expenses and boost your overall returns.

- Higher initial investment: Real estate typically requires a significant upfront investment, making it less accessible to some investors.

- Market volatility: The real estate market is susceptible to economic cycles and can experience periods of depreciation.

Real estate can be part of a diversified portfolio but should be considered a higher-risk investment compared to bonds and index funds. Due diligence and professional advice are vital before committing to real estate as a safe bet.

Conclusion

Finding a safe bet in today's market requires a diversified approach. Government bonds offer stability, index funds provide diversification, high-yield savings accounts and CDs provide liquidity, and real estate offers long-term potential (with higher risk). Each option carries its own set of risks and rewards. Remember to assess your risk tolerance and financial goals before making any investment decisions. Start your journey to finding the perfect safe bet for your financial future today! Thorough research and seeking professional financial advice are crucial steps in building a secure portfolio and achieving your financial objectives. Don't hesitate to consult with a financial advisor to find the best safe bet strategies for your specific needs and circumstances.

Featured Posts

-

Unraveling The Nyt Strands April 9 2025 Puzzle Solutions

May 09, 2025

Unraveling The Nyt Strands April 9 2025 Puzzle Solutions

May 09, 2025 -

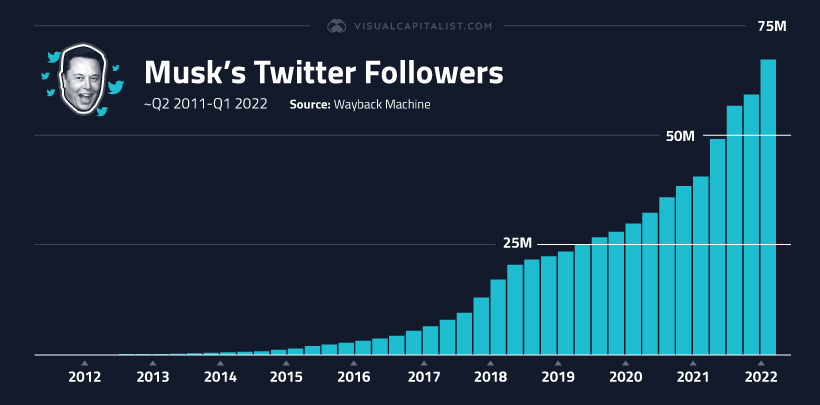

Elon Musks Net Worth Fluctuations During Trumps First 100 Days

May 09, 2025

Elon Musks Net Worth Fluctuations During Trumps First 100 Days

May 09, 2025 -

Spring Fashion Elizabeth Stewart X Lilysilk Collaboration Unveiled

May 09, 2025

Spring Fashion Elizabeth Stewart X Lilysilk Collaboration Unveiled

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025 -

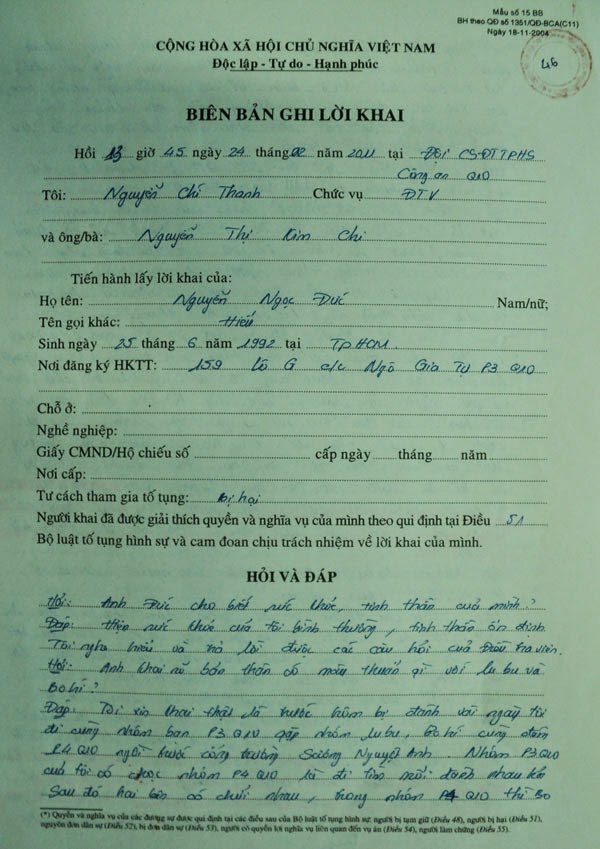

Dieu Tra Vu Bao Hanh Tre Loi Khai Cua Bao Mau O Tien Giang

May 09, 2025

Dieu Tra Vu Bao Hanh Tre Loi Khai Cua Bao Mau O Tien Giang

May 09, 2025