FirstUp: IMF To Review $1.3 Billion Pakistan Loan Package

Table of Contents

Key Conditions and Reforms Demanded by the IMF

The IMF typically attaches stringent conditions to its loan disbursements, aiming to ensure the recipient country implements necessary reforms to achieve macroeconomic stability and sustainable growth. For Pakistan, these conditions are likely to focus on fiscal consolidation, structural adjustments, and tackling corruption. The IMF’s demands will be rigorous, requiring substantial changes to Pakistan's economic policies.

- Fiscal reforms: These will likely involve increasing tax revenue through improved tax collection and broadening the tax base, coupled with a significant reduction in government spending, particularly on subsidies. This means tough choices about public services and potential unpopular cuts.

- Structural reforms: Pakistan will be expected to address inefficiencies in its state-owned enterprises (SOEs), potentially through privatization or restructuring. Improvements in the energy sector, plagued by circular debt, are also anticipated. This involves addressing inefficiencies and improving energy production and distribution.

- Monetary policy adjustments: Controlling inflation and stabilizing the exchange rate will be crucial. This might involve raising interest rates, which can have a negative impact on economic growth in the short term, but is necessary for long-term stability.

- Anti-corruption measures: Strengthening institutions and enhancing transparency are vital to restore confidence in the economy and attract foreign investment. This requires addressing systemic corruption and improving governance.

Pakistan's Current Economic Situation and Challenges

Pakistan's economy is currently facing a perfect storm of challenges. High inflation is eroding purchasing power, impacting the most vulnerable segments of the population. Dwindling foreign exchange reserves are creating concerns about the country's ability to import essential goods. The unsustainable level of external debt adds further pressure. Global factors, such as rising energy prices and global inflation, have exacerbated these pre-existing vulnerabilities.

- Inflation rates: Soaring inflation is causing widespread hardship, with the cost of essential goods and services increasing rapidly. This fuels social unrest and impacts the living standards of ordinary Pakistanis.

- Foreign exchange reserves: The depletion of foreign exchange reserves limits Pakistan's ability to finance imports, potentially leading to shortages of essential goods.

- External debt burden: The significant external debt burden restricts Pakistan's fiscal flexibility and hinders its ability to invest in crucial sectors.

- Geopolitical instability: Geopolitical instability in the region further complicates the economic outlook, adding to uncertainty and hindering investment.

Potential Outcomes of the IMF Review

The IMF review could result in several scenarios, each with significant consequences for Pakistan.

- Positive outcome: A successful review, contingent on the implementation of the agreed-upon reforms, would lead to the full disbursement of the $1.3 billion loan package. This would provide much-needed financial support, potentially stabilizing the economy and paving the way for recovery.

- Negative outcome: Rejection of the loan package would plunge Pakistan into a deeper economic crisis, potentially leading to a sovereign debt default with severe consequences for its citizens.

- Mixed outcome: A partial disbursement, with continued monitoring and conditional releases, would offer some relief but leave Pakistan grappling with persistent economic challenges.

Impact on Pakistan's Political Landscape

The IMF review and its outcome will undoubtedly have significant political ramifications. The government's response to the IMF's conditions and the public's reaction will shape the political landscape. The implementation of unpopular reforms could spark political instability.

- Government's response: The government's ability to implement the IMF's tough conditions will test its political will and potentially lead to policy shifts and political realignments.

- Public opinion: Public dissatisfaction with the austerity measures and reforms imposed by the IMF could lead to protests and further political turmoil.

- Political instability: The inability to implement necessary reforms or widespread public unrest could destabilize the government and lead to political uncertainty.

Conclusion: The Future of the IMF Loan Package and Pakistan's Economic Recovery

The IMF's review of the $1.3 billion loan package is a pivotal moment for Pakistan's economy. The outcome will determine whether the country can avert a deeper crisis and embark on a path towards sustainable economic recovery. While the potential for positive change exists, the challenges are significant. Pakistan needs to implement meaningful reforms to address its economic vulnerabilities, achieve fiscal sustainability, and restore confidence in its economy. Stay informed about the latest developments regarding the IMF loan package and its implications for Pakistan's economic future. For further reading on this critical issue, explore resources from the IMF and reputable financial news outlets.

Featured Posts

-

Debut D Incendie A La Mediatheque Champollion Le Bilan Et Les Causes

May 10, 2025

Debut D Incendie A La Mediatheque Champollion Le Bilan Et Les Causes

May 10, 2025 -

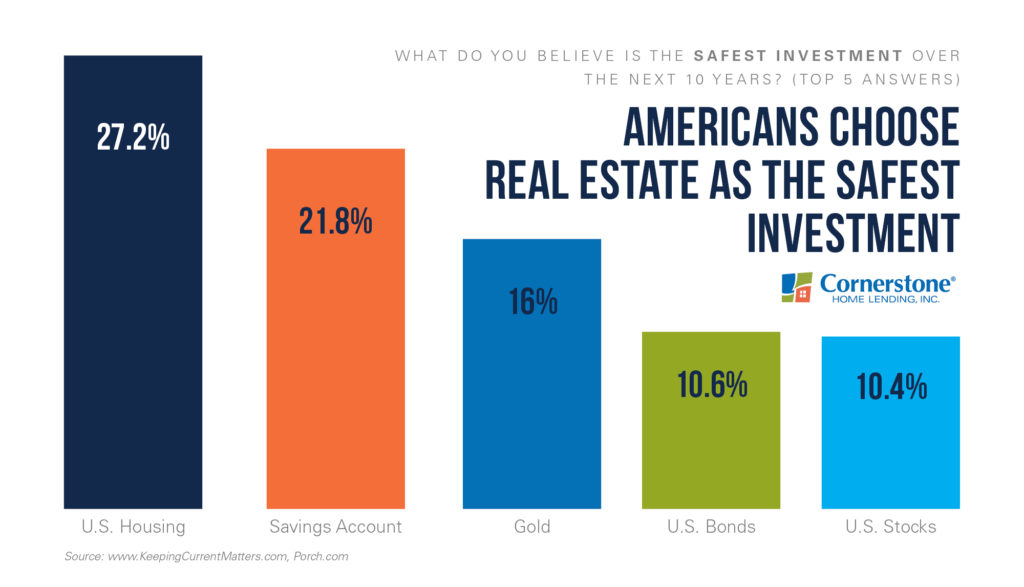

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025

Is This Investment Really A Safe Bet A Practical Guide

May 10, 2025 -

Nyt Strands Game 405 Saturday April 12 Hints And Solutions

May 10, 2025

Nyt Strands Game 405 Saturday April 12 Hints And Solutions

May 10, 2025 -

Trumps Choice Of Jeanine Pirro Implications For Fox News And Dc Politics

May 10, 2025

Trumps Choice Of Jeanine Pirro Implications For Fox News And Dc Politics

May 10, 2025 -

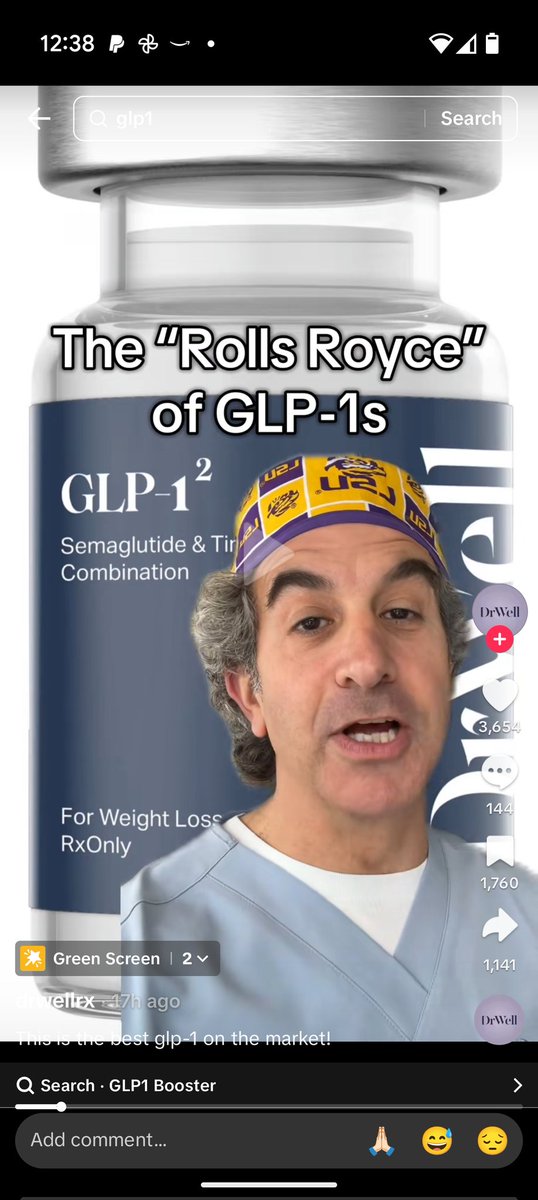

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs Explored

May 10, 2025

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs Explored

May 10, 2025