FIU-IND Imposes ₹5.45 Crore Penalty On Paytm Payments Bank: Money Laundering Lapses

Table of Contents

Details of the FIU-IND Penalty

The FIU-IND, India's central agency for receiving, processing, analyzing, and disseminating information related to financial crimes, levied the ₹5.45 crore penalty on Paytm Payments Bank on [Insert Date of Penalty Imposition – find this information from a reliable source]. This penalty underscores the seriousness with which the Indian government views lapses in AML and KYC compliance within the financial services sector. The FIU-IND plays a vital role in combating financial crime in India, working closely with other regulatory bodies to ensure the integrity of the country's financial system. [Insert Link to Official FIU-IND Statement, if available].

- Breakdown of the Penalty: The exact breakdown of the ₹5.45 crore penalty hasn't been publicly disclosed, but it likely reflects the severity and nature of the violations.

- Specific Regulations Violated: Paytm Payments Bank's violations stemmed from lapses in adhering to the Prevention of Money Laundering Act (PMLA), 2002, and other relevant KYC guidelines mandated by the Reserve Bank of India (RBI).

- Consequences of Non-Compliance: Non-compliance with AML/KYC norms carries severe penalties, including hefty fines, reputational damage, operational restrictions, and even license revocation. This case serves as a stark warning to other financial institutions.

Paytm Payments Bank's Response to the Penalty

Following the imposition of the penalty, Paytm Payments Bank released an official statement [Insert Link to Paytm's Official Statement, if available]. While the exact details of their response may vary, it is likely to include acknowledgment of the shortcomings, a commitment to improved compliance, and a detailed outline of remedial measures.

- Key Points from Paytm's Response: This section should summarize the key points of Paytm’s official statement, focusing on their acceptance of responsibility and their plans for improved compliance.

- Steps Taken to Improve AML/KYC Compliance: Paytm will likely detail specific steps taken to strengthen its AML/KYC framework, including technological upgrades, staff training, and enhanced due diligence procedures.

- Future Implications for Paytm's Operations: The penalty could impact Paytm's reputation and customer trust. However, swift and decisive action to rectify the situation might mitigate the long-term consequences.

Implications for the Indian Fintech Sector

The FIU-IND penalty on Paytm Payments Bank has far-reaching implications for the entire Indian fintech sector. It signals a heightened level of regulatory scrutiny on digital payment platforms and emphasizes the importance of robust AML/KYC measures.

- Increased Regulatory Oversight: Expect increased regulatory oversight for all fintech companies operating in India. The government is likely to enhance monitoring and enforcement to prevent similar incidents.

- Importance of Robust AML/KYC Measures: The penalty underlines the critical need for all fintech companies to implement and maintain robust AML/KYC procedures. This includes thorough customer verification, transaction monitoring, and suspicious activity reporting.

- Potential for Stricter Penalties: Future violations of AML/KYC regulations are likely to result in even stricter penalties, deterring non-compliance.

Strengthening AML/KYC Compliance in Indian Fintech

The Indian fintech sector needs to prioritize AML/KYC compliance. This requires a multi-pronged approach:

- Regular Audits and Internal Reviews: Regular audits and internal reviews are crucial for identifying weaknesses and ensuring compliance with evolving regulations.

- Employee Training on AML/KYC Procedures: Adequate training for all employees involved in customer onboarding and transaction processing is essential.

- Investment in Technology for Enhanced Compliance: Investing in advanced technologies for KYC verification, transaction monitoring, and risk assessment can significantly improve compliance. This includes AI-powered solutions.

Conclusion: Understanding the Impact of the FIU-IND Penalty on Paytm

The ₹5.45 crore penalty imposed on Paytm Payments Bank by the FIU-IND serves as a stark reminder of the critical importance of robust AML/KYC compliance in the Indian fintech sector. The incident highlights the potential for significant financial and reputational consequences for companies that fail to adhere to these regulations. The long-term impact on Paytm and other digital payment providers will depend on their ability to quickly and effectively address the identified vulnerabilities and strengthen their compliance frameworks.

To avoid similar situations, it is imperative for all fintech companies to stay informed about the evolving regulatory landscape and strengthen their understanding of FIU-IND regulations and penalties for money laundering. We encourage further research on the topic of AML/KYC compliance in Indian fintech to ensure the continued growth and stability of this vital sector.

Featured Posts

-

Former Goldman Sachs Banker Answers Carneys Call To Reform Canadas Resources

May 15, 2025

Former Goldman Sachs Banker Answers Carneys Call To Reform Canadas Resources

May 15, 2025 -

Rfk Jr S Pesticide Claims Face Pushback From Trump Administration Officials

May 15, 2025

Rfk Jr S Pesticide Claims Face Pushback From Trump Administration Officials

May 15, 2025 -

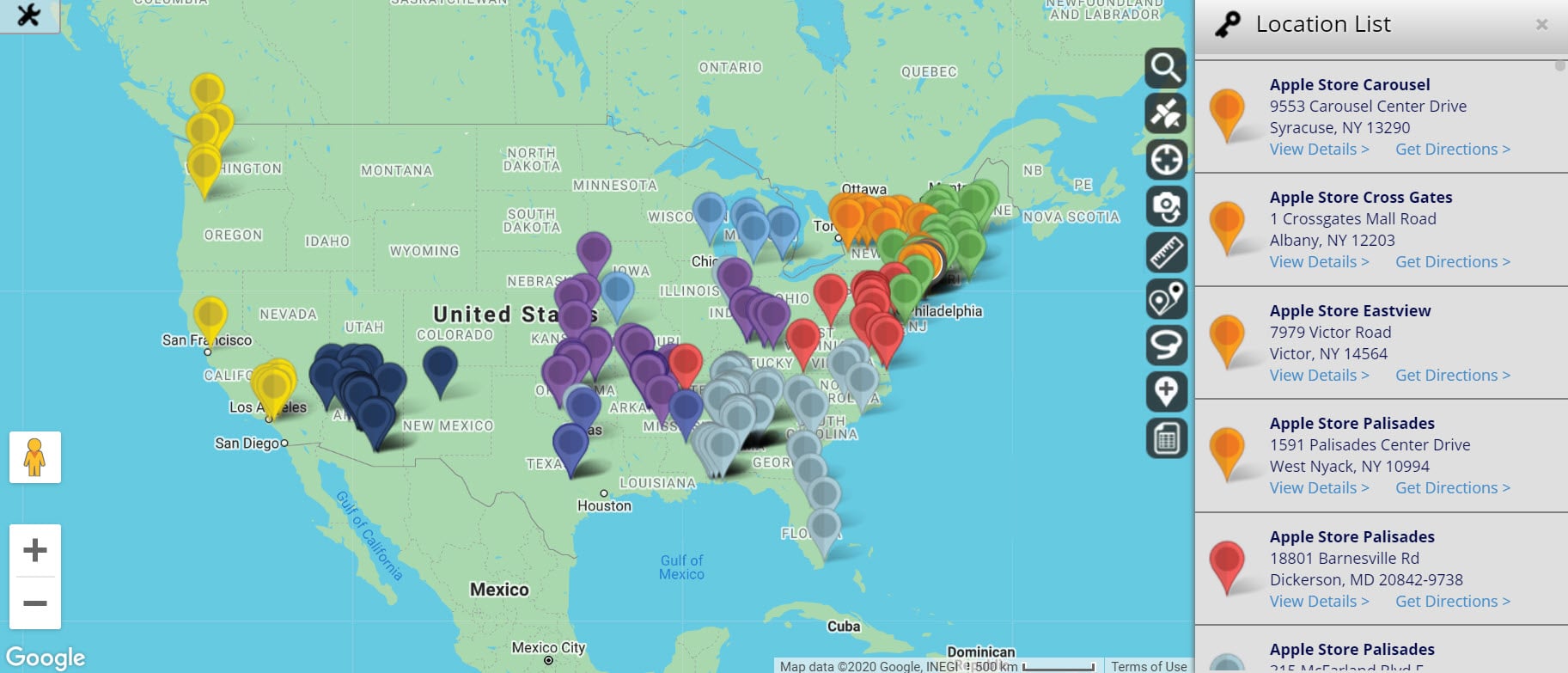

Where To Invest Mapping The Countrys Hottest Business Locations

May 15, 2025

Where To Invest Mapping The Countrys Hottest Business Locations

May 15, 2025 -

Leeflang Affaire Npo Toezichthouder Vereist Gesprek Met Bruins

May 15, 2025

Leeflang Affaire Npo Toezichthouder Vereist Gesprek Met Bruins

May 15, 2025 -

Bim In 25 Ve 26 Subat Tarihli Aktueel Ueruen Katalogu

May 15, 2025

Bim In 25 Ve 26 Subat Tarihli Aktueel Ueruen Katalogu

May 15, 2025

Latest Posts

-

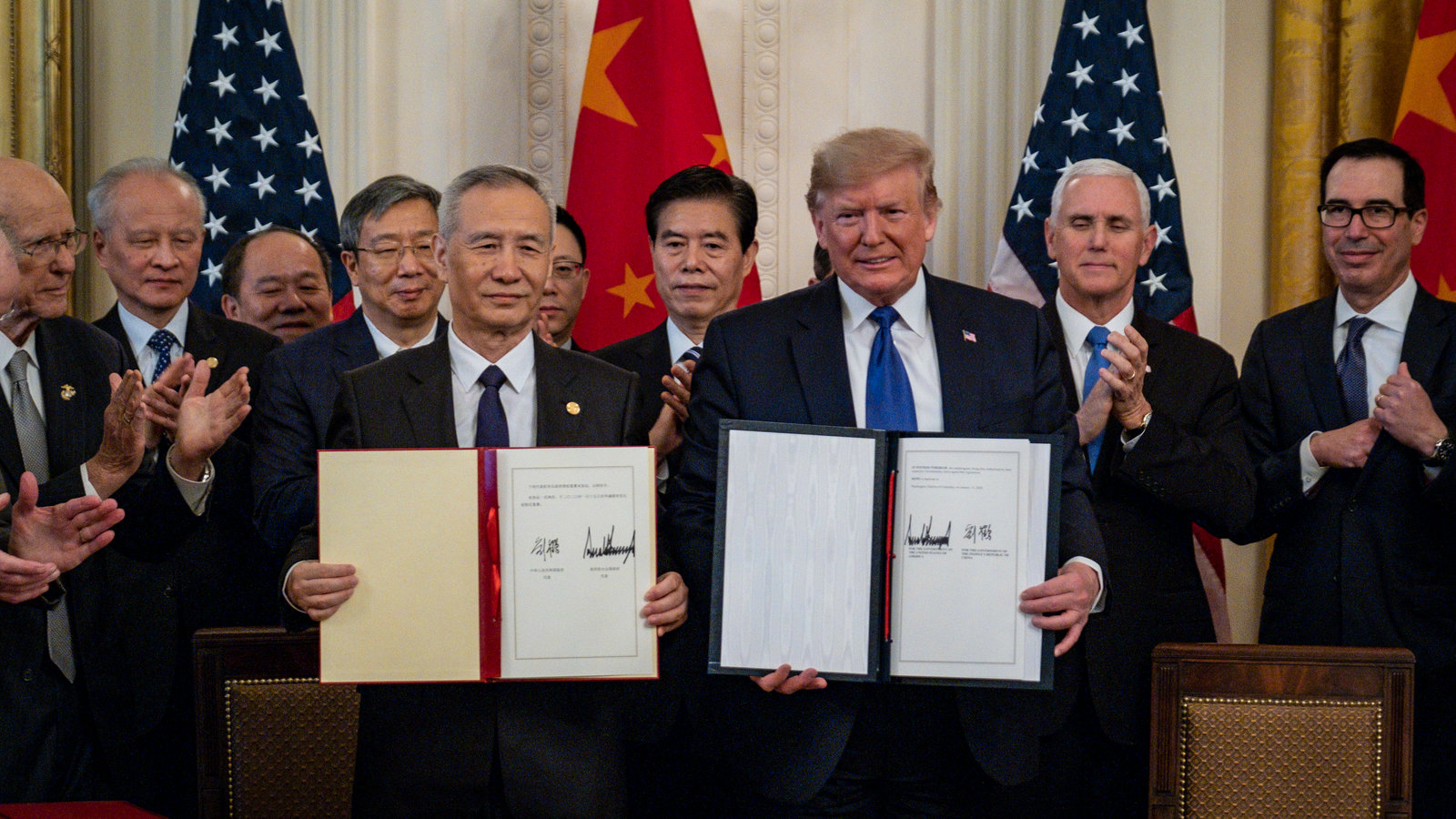

The Us And China Trade Deal Analyzing The Concessions And Compromises

May 15, 2025

The Us And China Trade Deal Analyzing The Concessions And Compromises

May 15, 2025 -

Hondas Ev Investment In Ontario Facing Challenges And Delays

May 15, 2025

Hondas Ev Investment In Ontario Facing Challenges And Delays

May 15, 2025 -

U S China Trade War A Look At The Breakthrough And What It Means

May 15, 2025

U S China Trade War A Look At The Breakthrough And What It Means

May 15, 2025 -

Ontarios Ev Future Uncertain As Honda Halts 15 Billion Project

May 15, 2025

Ontarios Ev Future Uncertain As Honda Halts 15 Billion Project

May 15, 2025 -

Record Egg Prices Fall Now 5 A Dozen In The United States

May 15, 2025

Record Egg Prices Fall Now 5 A Dozen In The United States

May 15, 2025