Five-Year Bitcoin Forecast: A Potential 1,500% Surge

Table of Contents

Bitcoin's Growing Institutional Adoption

H3: Increased Institutional Investment

The cryptocurrency market is witnessing a significant shift, with large financial institutions increasingly embracing Bitcoin. This institutional adoption is a major catalyst for potential price appreciation. The growing acceptance of Bitcoin as a viable asset class is driving substantial investment.

- Examples of institutional adoption: MicroStrategy's substantial Bitcoin holdings, Tesla's foray into Bitcoin, and the growing number of publicly traded companies adding Bitcoin to their balance sheets.

- Data on increasing institutional holdings: Numerous reports indicate a steady increase in Bitcoin held by institutional investors, representing a significant portion of the overall market capitalization. This trend suggests growing confidence in Bitcoin's long-term value.

- Impact on price: Increased institutional demand directly impacts price, pushing it upwards as large players compete to acquire Bitcoin. This buying pressure is a key driver of the projected price surge.

H3: Regulatory Clarity and Acceptance

Regulatory clarity is crucial for mainstream adoption. As governments worldwide grapple with regulating cryptocurrencies, positive regulatory developments will significantly influence Bitcoin's price.

- Examples of countries adopting or considering Bitcoin regulations: El Salvador's adoption of Bitcoin as legal tender, alongside other countries exploring regulatory frameworks, indicate a global shift towards acceptance.

- How positive regulation boosts investor confidence: Clear, consistent regulations reduce uncertainty and attract more institutional and retail investors, boosting demand and price.

- Effect of regulatory uncertainty on Bitcoin price: Regulatory uncertainty can create volatility, but a move towards clear, favorable regulations could be a significant catalyst for growth.

Technological Advancements and Network Upgrades

H3: Layer-2 Scaling Solutions

Bitcoin's scalability has long been a point of discussion. However, the development and adoption of Layer-2 scaling solutions like the Lightning Network are addressing this concern.

- How Layer-2 solutions impact Bitcoin's usability and adoption: Layer-2 solutions significantly enhance Bitcoin's transaction speed and reduce fees, making it more user-friendly and accessible for everyday transactions.

- How improved scalability can lead to increased price: Increased usability and accessibility lead to wider adoption, driving up demand and ultimately, the price.

H3: Taproot and Other Protocol Upgrades

Ongoing protocol upgrades such as Taproot enhance Bitcoin's security, efficiency, and functionality.

- Benefits of Taproot and other upgrades: Taproot improves transaction privacy and efficiency, strengthening the Bitcoin network and further solidifying its position as a secure and reliable store of value.

- How these upgrades contribute to long-term Bitcoin growth: These improvements attract developers and investors, contributing to Bitcoin's long-term health and potential for growth.

Global Economic Uncertainty and Inflation

H3: Bitcoin as a Hedge Against Inflation

Bitcoin's finite supply and decentralized nature make it an attractive hedge against inflation and economic uncertainty.

- Historical data showing Bitcoin's performance during periods of inflation: Historical data suggests a positive correlation between periods of inflation and Bitcoin's price appreciation, reinforcing its role as a potential inflation hedge.

- How macroeconomic factors can influence Bitcoin's price: Global economic instability can drive investors towards alternative assets like Bitcoin, increasing demand and pushing prices higher.

H3: Decreased Confidence in Fiat Currencies

Growing concerns about the stability of fiat currencies are pushing investors towards alternative assets, including Bitcoin.

- Examples of economic instability affecting fiat currencies: Rising inflation rates, government debt, and geopolitical uncertainties are eroding confidence in traditional currencies.

- How this decreased confidence can boost Bitcoin adoption: The perceived stability and scarcity of Bitcoin make it an increasingly attractive alternative to traditional financial systems.

Growing Adoption in Emerging Markets

H3: Bitcoin's Use in Developing Countries

Bitcoin is gaining traction in emerging markets with limited access to traditional financial services.

- Examples of countries experiencing high Bitcoin adoption: Several countries in Africa, Latin America, and Asia are experiencing significant Bitcoin adoption due to its potential to provide financial inclusion.

- How increased usage in emerging markets can impact price: Increased adoption in these markets significantly expands Bitcoin's user base, driving demand and price increases.

H3: Remittance and Cross-Border Payments

Bitcoin's ability to facilitate faster, cheaper cross-border payments is revolutionizing the remittance industry.

- Statistics on the global remittance market: The global remittance market is substantial, and Bitcoin has the potential to disrupt and capture a significant share.

- How Bitcoin can solve remittance challenges and boost adoption: Lower transaction fees and faster transfer times make Bitcoin an attractive alternative to traditional remittance methods.

Scarcity and Limited Supply

H3: Halving Events and Their Impact

Bitcoin's halving events, which reduce the rate of new Bitcoin creation, are historically correlated with price increases.

- How halving events reduce the rate of new Bitcoin creation: Halving events systematically decrease the supply of newly mined Bitcoin, creating scarcity and potentially driving up the price.

- Historical correlation between halving events and price increases: Past halving events have generally been followed by periods of significant price appreciation, suggesting a strong correlation between scarcity and price.

H3: Fixed Supply of 21 Million Bitcoins

The inherent scarcity of Bitcoin, with a fixed supply of only 21 million coins, is a fundamental driver of its long-term value proposition.

- Importance of Bitcoin's limited supply: Limited supply creates scarcity, a key driver of value in various asset classes, including precious metals and collectibles.

- How scarcity drives value in other assets: The principle of scarcity is well-established in economics, and Bitcoin embodies this principle, contributing to its potential for long-term appreciation.

Conclusion

This Five-Year Bitcoin Forecast points to a potential 1,500% price surge driven by a confluence of factors: increased institutional adoption, technological advancements, global economic uncertainty, burgeoning adoption in emerging markets, and the inherent scarcity of Bitcoin. The rising interest from institutional investors, coupled with regulatory clarity and significant technological improvements, strongly suggests continued growth. The use of Bitcoin as a hedge against inflation and its potential to disrupt traditional financial systems in developing economies further fuels this prediction. The upcoming halving event and the fixed supply of 21 million Bitcoin further underpin the scarcity and value proposition.

Learn more about a Five-Year Bitcoin Forecast and start planning your investment strategy today! Remember, investing in cryptocurrencies carries significant risk, and you should conduct thorough research and seek professional financial advice before making any investment decisions.

Featured Posts

-

Saving Private Ryan Dethroned A Look At The New Contender For Best War Film

May 08, 2025

Saving Private Ryan Dethroned A Look At The New Contender For Best War Film

May 08, 2025 -

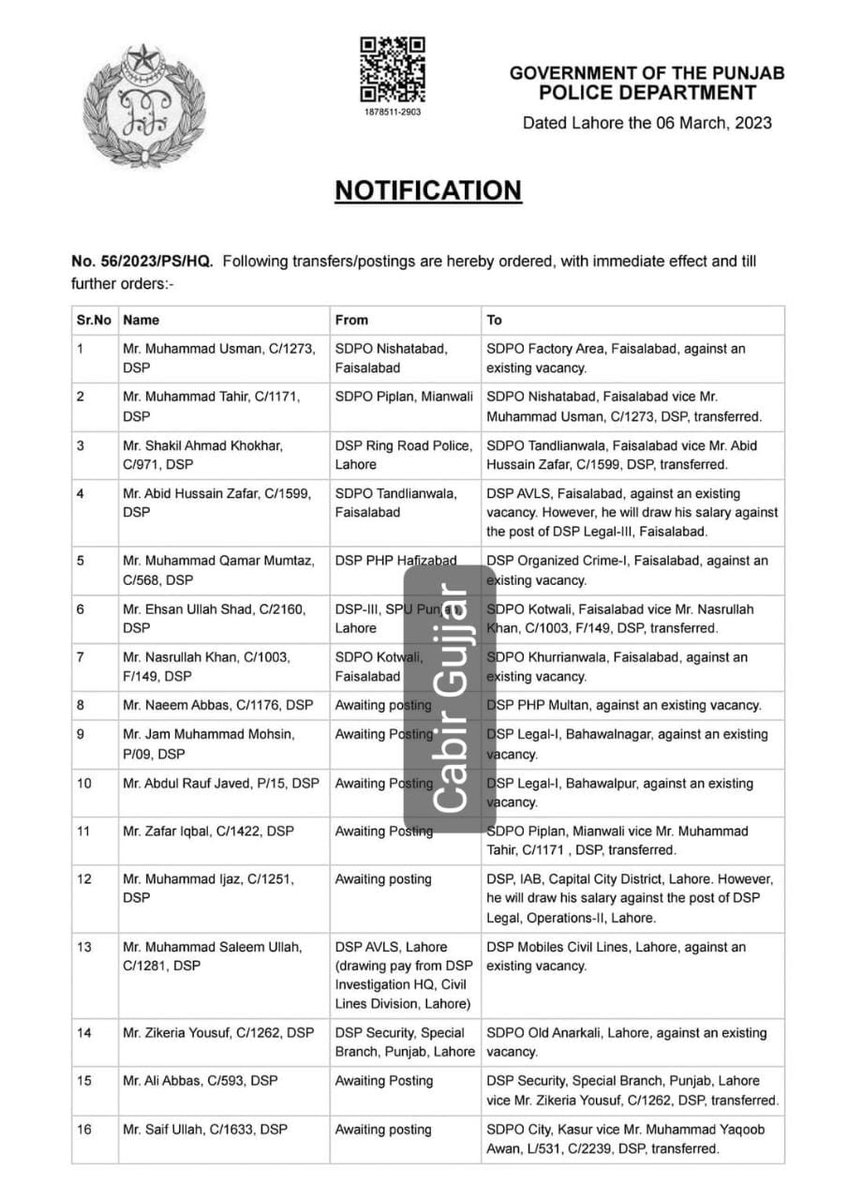

Pnjab Pwlys 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025

Pnjab Pwlys 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025 -

The Colin Cowherd Jayson Tatum Debate A Detailed Analysis

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Detailed Analysis

May 08, 2025 -

Bitcoin De Buguen Neler Oluyor Guencel Fiyat Ve Oengoerueler

May 08, 2025

Bitcoin De Buguen Neler Oluyor Guencel Fiyat Ve Oengoerueler

May 08, 2025 -

Flamengo Derrota Gremio Com Atuacao Decisiva De Arrascaeta No Brasileirao

May 08, 2025

Flamengo Derrota Gremio Com Atuacao Decisiva De Arrascaeta No Brasileirao

May 08, 2025