Forerunner Long Game: Startup Strategies Beyond The IPO Stalemate

Table of Contents

Redefining Success Beyond the IPO

For too long, the IPO has been considered the ultimate measure of startup success. However, this singular focus overlooks the broader picture of sustainable growth and long-term value creation. A forerunner long game strategy prioritizes building a fundamentally strong business, regardless of immediate exit opportunities.

-

Focus on sustainable profitability and strong unit economics: Instead of prioritizing rapid scaling at the expense of profitability, concentrate on building a business model with healthy margins and a clear path to consistent revenue generation. This involves meticulous cost management, efficient operations, and a pricing strategy that reflects the value provided. Analyze key metrics like customer acquisition cost (CAC) and lifetime value (CLTV) to ensure a sustainable business model.

-

Prioritize building a robust and loyal customer base: Customer retention is far more valuable than customer acquisition. Focus on building strong relationships with your customers, providing exceptional service, and fostering brand loyalty. This results in recurring revenue and positive word-of-mouth marketing, significantly reducing reliance on expensive acquisition strategies.

-

Emphasize long-term value creation over short-term gains: Resist the temptation to prioritize short-term growth at the expense of long-term sustainability. Focus on building a solid foundation for future growth, rather than chasing quick wins that may compromise the long-term health of the business.

-

Explore alternative metrics like customer lifetime value (CLTV) and recurring revenue: Shift your focus from solely pursuing rapid growth to understanding and optimizing metrics that reflect the true value of your customer base and the long-term health of your business. Recurring revenue models, subscription services, and strong customer loyalty programs all contribute to a more predictable and sustainable revenue stream.

Exploring Alternative Exit Strategies

While an IPO remains a viable exit strategy, a forerunner long game acknowledges the need for diversification. Several alternative options offer attractive returns and greater control.

-

Acquisition by a larger company: Positioning your startup for acquisition requires strategic planning. Focus on building a strong brand, achieving consistent profitability, and demonstrating clear market leadership. This makes your company an attractive target for strategic buyers looking to expand their market share or acquire valuable technology.

-

Strategic partnerships: Collaborating with established players in your industry can provide access to new markets, resources, and technologies. Strategic partnerships can enhance your brand's credibility, expand your reach, and accelerate growth without sacrificing ownership.

-

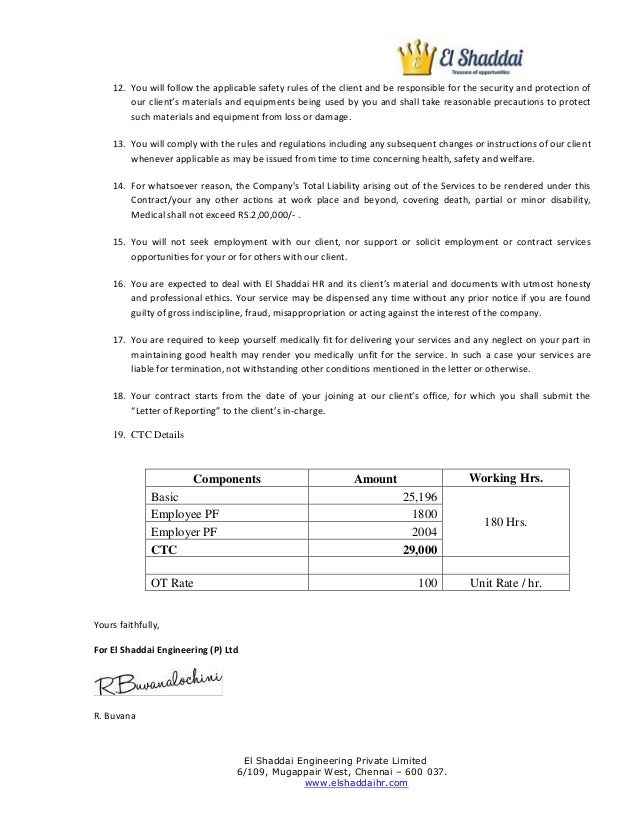

Succession planning and eventual sale to employees/management: An Employee Stock Ownership Plan (ESOP) or similar strategy allows for a smooth transition of ownership to employees, preserving company culture and potentially yielding a strong return for founders. This is particularly beneficial for founders prioritizing legacy and long-term employee well-being.

-

Long-term ownership and sustainable growth: Building a legacy company with enduring value is a rewarding alternative to a rapid exit. Focus on continuous innovation, customer satisfaction, and creating a positive impact. This approach offers long-term financial returns and immense personal satisfaction.

-

Initial Coin Offering (ICO) or Security Token Offering (STO): These options, suitable for specific sectors like blockchain and fintech, raise capital directly from investors but require careful consideration of legal and regulatory implications. They offer alternative funding and exit routes but carry significant risk.

Building a Strong Foundation for Long-Term Growth

A successful forerunner long game requires a robust foundation. This involves several key elements:

-

Strong team and culture: Attracting and retaining top talent is critical. Invest in building a positive and productive work environment that fosters creativity, innovation, and collaboration.

-

Scalable business model: Design a business model that can adapt to changing market conditions and accommodate significant growth without compromising efficiency or profitability.

-

Data-driven decision making: Utilize data analytics to inform strategic decisions, track progress, identify areas for improvement, and optimize performance.

-

Intellectual property protection: Secure key patents and trade secrets to protect your valuable intellectual assets from competitors. This can increase the long-term value of your company, especially in the case of an acquisition.

-

Focus on customer retention: Building a loyal customer base is essential for long-term revenue streams and sustainable growth. Prioritize customer satisfaction, build strong relationships, and encourage repeat business.

Adapting to Market Volatility and Uncertainty

The ability to adapt is crucial for long-term success. Market conditions are constantly changing, and a flexible approach is essential to navigate uncertainties.

-

Diversification of revenue streams: Reduce reliance on single products or customers. This provides a buffer against market fluctuations and reduces the risk of significant revenue loss from a single source.

-

Agile development process: Adopt agile methodologies to adapt quickly to changing market demands and customer feedback. This allows you to pivot and iterate quickly, enhancing your responsiveness and ability to meet evolving customer needs.

-

Strategic financial planning: Maintain a strong financial position to weather economic downturns or unforeseen challenges. Careful financial planning and disciplined spending are crucial for long-term sustainability.

-

Crisis management planning: Develop a comprehensive crisis management plan to address unexpected challenges, ensuring that the business can recover swiftly and effectively from setbacks.

-

Continuous learning and adaptation: Embrace change and learn from setbacks. Staying informed about industry trends and adapting your strategies accordingly are vital for navigating a dynamic marketplace.

Conclusion

The traditional startup narrative often culminates in an IPO. However, a forerunner long game offers a more sustainable and potentially more rewarding path to success. By prioritizing long-term value creation, exploring alternative exit strategies, and building a resilient business foundation, startups can navigate market uncertainties and achieve lasting success beyond the IPO. Don't just chase the IPO; build a lasting legacy by adopting a forerunner long game strategy for your startup today. Start planning your forerunner long game now, and consider exploring the alternative exit strategies discussed in this article to build a truly enduring and valuable company.

Featured Posts

-

A Chocolate Lovers Paradise Lindt Opens In Central London

May 14, 2025

A Chocolate Lovers Paradise Lindt Opens In Central London

May 14, 2025 -

Eurovision Song Contest 2025 Introducing The Hosts

May 14, 2025

Eurovision Song Contest 2025 Introducing The Hosts

May 14, 2025 -

Netflixs Nonna A Charismatic Food Movie Review

May 14, 2025

Netflixs Nonna A Charismatic Food Movie Review

May 14, 2025 -

Lion Electric Acquisition Revised Offer Details

May 14, 2025

Lion Electric Acquisition Revised Offer Details

May 14, 2025 -

Dean Huijsen Transfer Chelseas June 14th Deadline

May 14, 2025

Dean Huijsen Transfer Chelseas June 14th Deadline

May 14, 2025