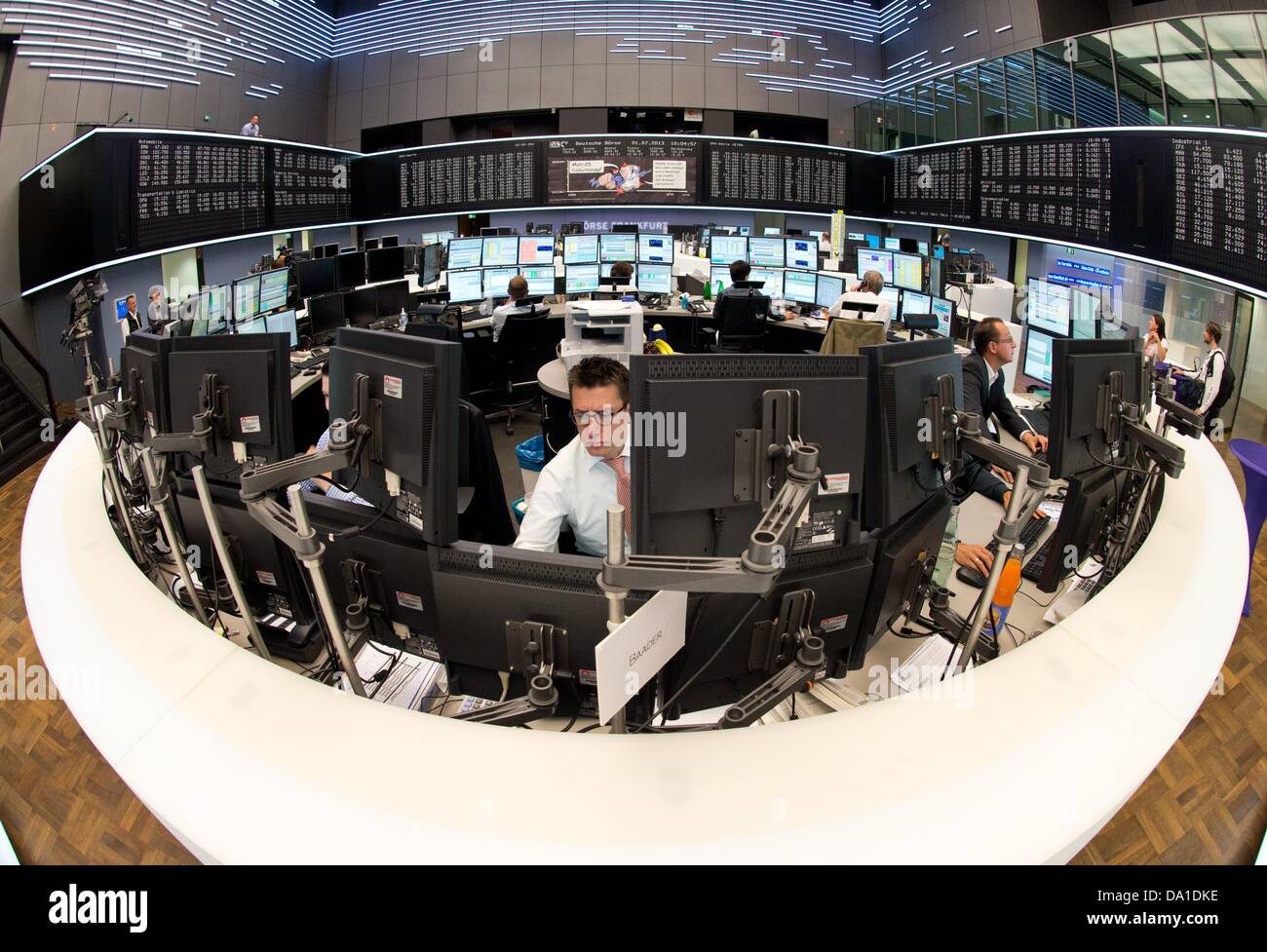

Frankfurt Stock Exchange: DAX Ends Day Below 24,000 Points

Table of Contents

Factors Contributing to DAX's Decline

Several interconnected factors contributed to the DAX's fall below 24,000 points. Understanding these elements is crucial for navigating the current climate of the Frankfurt Stock Exchange.

Inflationary Pressures and Interest Rate Hikes

Rising inflation across the Eurozone continues to exert significant pressure on the DAX. The European Central Bank (ECB) has responded with several interest rate hikes aimed at curbing inflation. However, these measures have unintended consequences for the German stock market.

- Reduced consumer spending: Higher interest rates increase borrowing costs, leading to reduced consumer spending and impacting the profitability of consumer-focused companies listed on the DAX.

- Increased borrowing costs for businesses: Companies face higher costs for borrowing money to invest and expand, potentially slowing economic growth and impacting their stock prices.

- Impact on corporate profits: Increased input costs due to inflation and higher interest expenses squeeze corporate profit margins, making companies less attractive to investors.

For example, the latest inflation figures released by Eurostat showed inflation at [insert current Eurozone inflation rate]%, prompting the ECB to raise its key interest rate by [insert interest rate hike percentage]%. This action directly impacts the cost of capital for businesses listed on the Frankfurt Stock Exchange.

Geopolitical Uncertainty and its Ripple Effect

Geopolitical uncertainty remains a significant headwind for the DAX and the broader German economy. The ongoing war in Ukraine, for example, has caused significant energy price volatility and supply chain disruptions.

- Energy price volatility: The dependence of German industry on Russian energy has been severely disrupted, leading to soaring energy costs and impacting the profitability of numerous companies.

- Supply chain disruptions: The war has exacerbated existing global supply chain issues, further increasing input costs for businesses and contributing to inflationary pressures.

- Investor risk aversion: Geopolitical instability generally leads to increased investor risk aversion, prompting investors to move funds into safer assets, causing a sell-off in riskier stocks like those listed on the DAX.

The impact of the war in Ukraine on the German economy and the Frankfurt Stock Exchange is significant and continues to be a primary concern for investors. News sources such as the Financial Times and Reuters consistently highlight these challenges.

Performance of Key DAX Companies

The decline in the DAX index reflects the performance of its constituent companies. Several key players have experienced significant declines, while others have shown relative resilience.

- [Company A]: Experienced a [percentage]% drop due to [reason for decline, e.g., lower-than-expected earnings, supply chain issues].

- [Company B]: Showed a slight increase of [percentage]% driven by [reason for increase, e.g., strong sales figures, successful product launch].

- [Company C]: Remained relatively stable, reflecting [reason for stability, e.g., diversified business model, resilient demand for its products].

[Include a chart or table visually representing the performance of these key companies].

Investor Sentiment and Market Outlook

Understanding investor sentiment and market forecasts is crucial for navigating the current volatility on the Frankfurt Stock Exchange.

Analyst Predictions and Market Forecasts

Financial analysts hold differing views on the future performance of the DAX. Some remain optimistic about a long-term recovery, citing the resilience of the German economy and the potential for future growth. Others express caution, highlighting the persistent challenges of inflation and geopolitical uncertainty.

- Optimistic views: Focus on the potential for technological advancements and the ongoing recovery from the pandemic.

- Cautious views: Emphasize the risks posed by inflation, rising interest rates, and geopolitical instability.

Reports from leading financial institutions such as Goldman Sachs and Morgan Stanley offer diverse perspectives on the future trajectory of the DAX.

Investment Strategies in a Volatile Market

The current market conditions call for a cautious and well-defined investment strategy. Investors should consider the following:

- Diversification: Spread investments across different asset classes to reduce risk.

- Risk management strategies: Employ stop-loss orders and other risk management techniques to limit potential losses.

- Long-term vs. short-term investment approaches: Consider a long-term investment horizon to weather short-term market fluctuations.

Disclaimer: This article provides general market commentary and does not constitute investment advice. Consult a financial advisor before making any investment decisions.

Conclusion

Today's DAX performance below 24,000 points reflects a confluence of factors, including persistent inflationary pressures, ongoing geopolitical uncertainty, and the performance of individual DAX-listed companies. This volatility underscores the need for cautious investment strategies and careful monitoring of market developments within the Frankfurt Stock Exchange. Understanding the interplay between these factors is essential for navigating the complexities of the German stock market.

Call to Action: Stay informed about the fluctuations in the Frankfurt Stock Exchange and the DAX index by regularly checking our website for the latest updates and in-depth analysis on the German stock market. Understanding the factors impacting the DAX is crucial for effective investment decisions in this dynamic environment.

Featured Posts

-

Ferrari Hot Wheels Mamma Mia A Look At The New Releases

May 24, 2025

Ferrari Hot Wheels Mamma Mia A Look At The New Releases

May 24, 2025 -

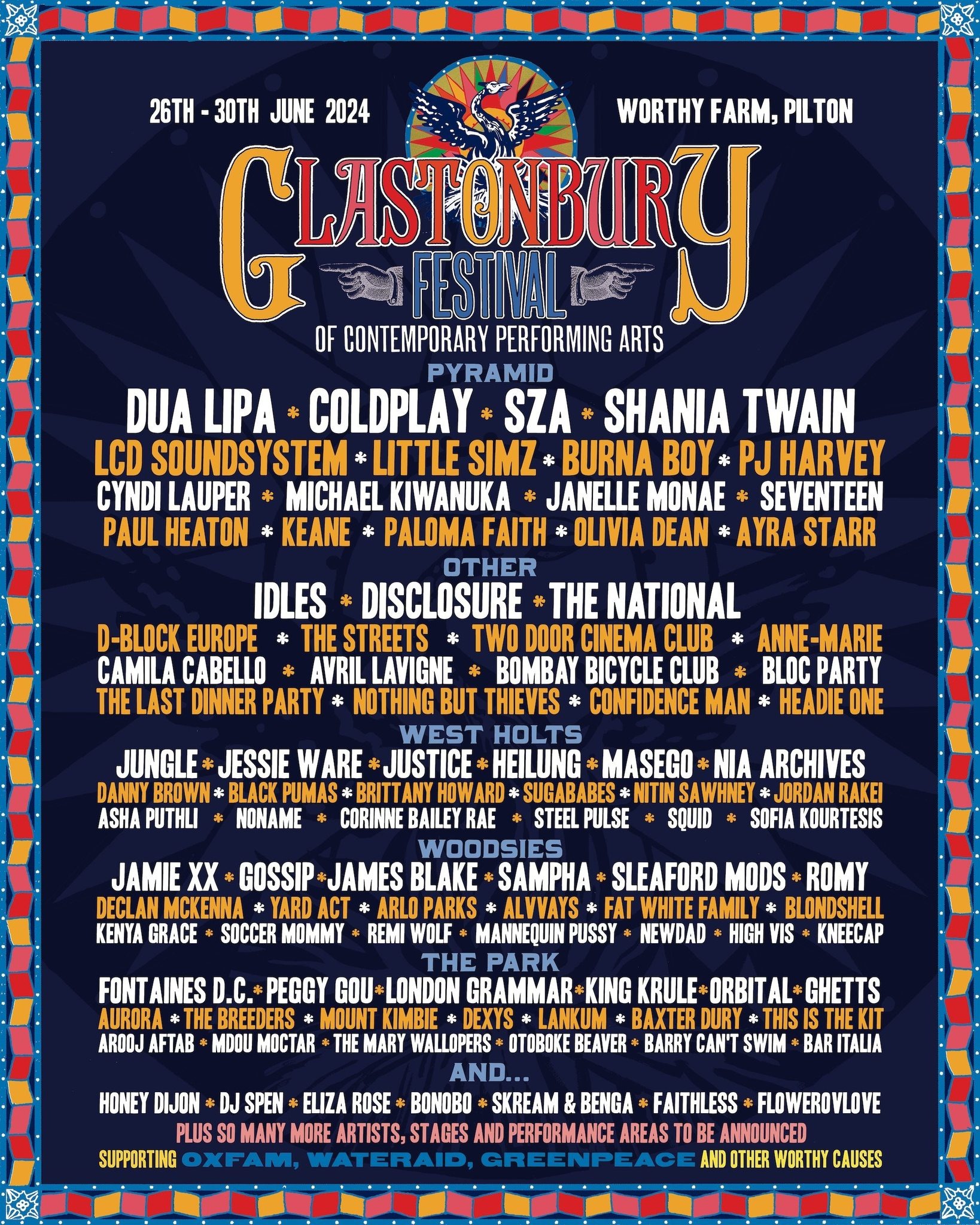

Glastonbury Festival 2024 Unannounced Us Band Performance Speculation

May 24, 2025

Glastonbury Festival 2024 Unannounced Us Band Performance Speculation

May 24, 2025 -

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025 -

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025 -

Dazi Trump Sul 20 L Impatto Negativo Sul Settore Moda

May 24, 2025

Dazi Trump Sul 20 L Impatto Negativo Sul Settore Moda

May 24, 2025

Latest Posts

-

Demnas Gucci Designs Kering Announces Sales Decrease And September Launch Date

May 24, 2025

Demnas Gucci Designs Kering Announces Sales Decrease And September Launch Date

May 24, 2025 -

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025 -

Kerings Financial Report Sales Down Demnas Gucci Designs Coming In September

May 24, 2025

Kerings Financial Report Sales Down Demnas Gucci Designs Coming In September

May 24, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine Krasivaya Data Sobrala 89 Par

May 24, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine Krasivaya Data Sobrala 89 Par

May 24, 2025 -

La Classifica Forbes 2025 I Nuovi Uomini Piu Ricchi Del Mondo

May 24, 2025

La Classifica Forbes 2025 I Nuovi Uomini Piu Ricchi Del Mondo

May 24, 2025