Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to today's DAX slump. This section will delve into the specific economic and geopolitical headwinds influencing investor sentiment and impacting the performance of the DAX and the wider Frankfurt Stock Market.

-

Rising inflation and potential interest rate hikes by the European Central Bank (ECB): Persistent inflation across the Eurozone is forcing the ECB to consider further interest rate increases. Higher interest rates make borrowing more expensive for businesses, potentially slowing economic growth and impacting corporate profits, thus affecting the DAX. This uncertainty is a major factor in the current market decline.

-

Geopolitical instability stemming from the ongoing war in Ukraine and its impact on energy prices: The war in Ukraine continues to create significant geopolitical risks. The disruption to energy supplies and the subsequent surge in energy prices are putting pressure on businesses and consumers across Europe, impacting economic growth and investor confidence in the German and broader European markets. This uncertainty is heavily influencing the DAX's performance.

-

Concerns about a potential global recession and slowdown in economic growth: Global economic growth is slowing, with many economists predicting a potential recession. This fear of a downturn is impacting investor sentiment, leading to a risk-off environment where investors are moving away from riskier assets like stocks, thus contributing to the DAX decline. The Frankfurt Stock Market is not immune to this global trend.

-

Weak corporate earnings reports from key German companies impacting investor confidence: Several major German companies have recently reported weaker-than-expected earnings, further dampening investor confidence. This reflects the challenges faced by businesses in the current economic climate and contributes to the negative sentiment surrounding the DAX. Analyzing these individual company performances provides deeper insight into the overall market decline.

-

Increased uncertainty regarding the future of the Eurozone economy: The Eurozone faces multiple challenges, including high inflation, energy crisis, and potential recessionary pressures. This uncertainty is weighing on investor sentiment and contributing to the decline in the DAX. The Frankfurt Stock Market's future is inextricably linked to the health of the wider Eurozone.

Impact on Investors and Trading Strategies

The DAX decline significantly impacts investors and necessitates adjustments to trading strategies. Navigating this period of market volatility requires careful consideration of risk and potential opportunities within the Frankfurt Stock Market.

-

Increased market volatility creates both opportunities and risks for investors: The current volatility presents both opportunities and risks. Short-term traders may attempt to profit from price swings, but this strategy involves considerable risk.

-

Diversification of investment portfolios is crucial to mitigate risks: Diversifying investments across different asset classes and sectors can help mitigate risk during periods of market uncertainty. This is a key strategy for investors concerned about the DAX's current performance.

-

Short-term trading strategies might benefit from the increased volatility, although they also carry heightened risks: Short-term trading strategies, while potentially lucrative, are considerably riskier due to the heightened volatility. Careful risk management is paramount.

-

Long-term investors may consider the current downturn as a potential buying opportunity: Long-term investors may view the current dip as a potential buying opportunity, assuming a recovery in the future. This approach requires a long-term perspective and tolerance for market fluctuations.

-

Robust risk management strategies are essential during periods of market uncertainty: Risk management is paramount during volatile periods. Investors should carefully assess their risk tolerance and adjust their portfolios accordingly.

Analyzing the Performance of Specific DAX Companies

A closer examination of individual DAX companies reveals sector-specific trends within the Frankfurt Stock Market. This granular analysis helps identify areas of relative strength and weakness.

-

Analysis of the performance of automotive, technology, and financial sectors within the DAX: Examining sector-specific performance provides a more nuanced understanding of the market dynamics. Some sectors may be more resilient than others.

-

Examining the impact of recent earnings reports on individual stock prices: Individual company earnings announcements offer crucial insights into the financial health of companies and impact investor sentiment.

-

Identifying companies that outperformed or underperformed the overall market: Identifying these companies allows for a more targeted investment approach.

Outlook and Predictions for the Frankfurt Stock Market

Predicting the future trajectory of the DAX is challenging, but considering the current economic climate and market sentiment offers some insights into the potential for the Frankfurt Stock Market.

-

Expert opinions and market forecasts for the DAX's short-term and long-term performance: While specific predictions vary, most analysts acknowledge the continued uncertainty.

-

Discussion on potential catalysts for a market rebound or further decline: Factors like ECB decisions, geopolitical developments, and corporate earnings will play a crucial role in determining the DAX's future direction.

-

Considerations for investors regarding future investment decisions: Investors should remain informed and adapt their strategies based on evolving market conditions.

Conclusion

The Frankfurt Stock Market's recent decline, pushing the DAX below 24,000 points, highlights the significant impact of global economic and geopolitical uncertainties. While the current market volatility presents challenges, it also offers potential opportunities for shrewd investors. By carefully analyzing market trends, diversifying portfolios, and employing robust risk management strategies, investors can navigate this period of uncertainty within the Frankfurt Stock Market. Stay informed about the latest developments and adjust your investment strategies accordingly. Continue monitoring the DAX and other key economic indicators to make informed decisions regarding your investment in the Frankfurt Stock Market.

Call to Action: Stay tuned for further updates on the DAX and the Frankfurt Stock Market. Regularly check our site for the latest news and analysis on the DAX index and German market performance.

Featured Posts

-

The Kyle Walker And Annie Kilner Controversy Details Of The Allegations

May 25, 2025

The Kyle Walker And Annie Kilner Controversy Details Of The Allegations

May 25, 2025 -

M56 Traffic Delays Current Updates Following Crash

May 25, 2025

M56 Traffic Delays Current Updates Following Crash

May 25, 2025 -

Avrupa Borsalarinda Karisik Seyir Guenuen Oezeti

May 25, 2025

Avrupa Borsalarinda Karisik Seyir Guenuen Oezeti

May 25, 2025 -

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 25, 2025

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

Latest Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025 -

Schekotat Nervy Intervyu S Fedorom Lavrovym O Pavle I I Zhanre Trillera

May 25, 2025

Schekotat Nervy Intervyu S Fedorom Lavrovym O Pavle I I Zhanre Trillera

May 25, 2025 -

100 Let Innokentiyu Smoktunovskomu Dokumentalnaya Istoriya Velikogo Aktera

May 25, 2025

100 Let Innokentiyu Smoktunovskomu Dokumentalnaya Istoriya Velikogo Aktera

May 25, 2025 -

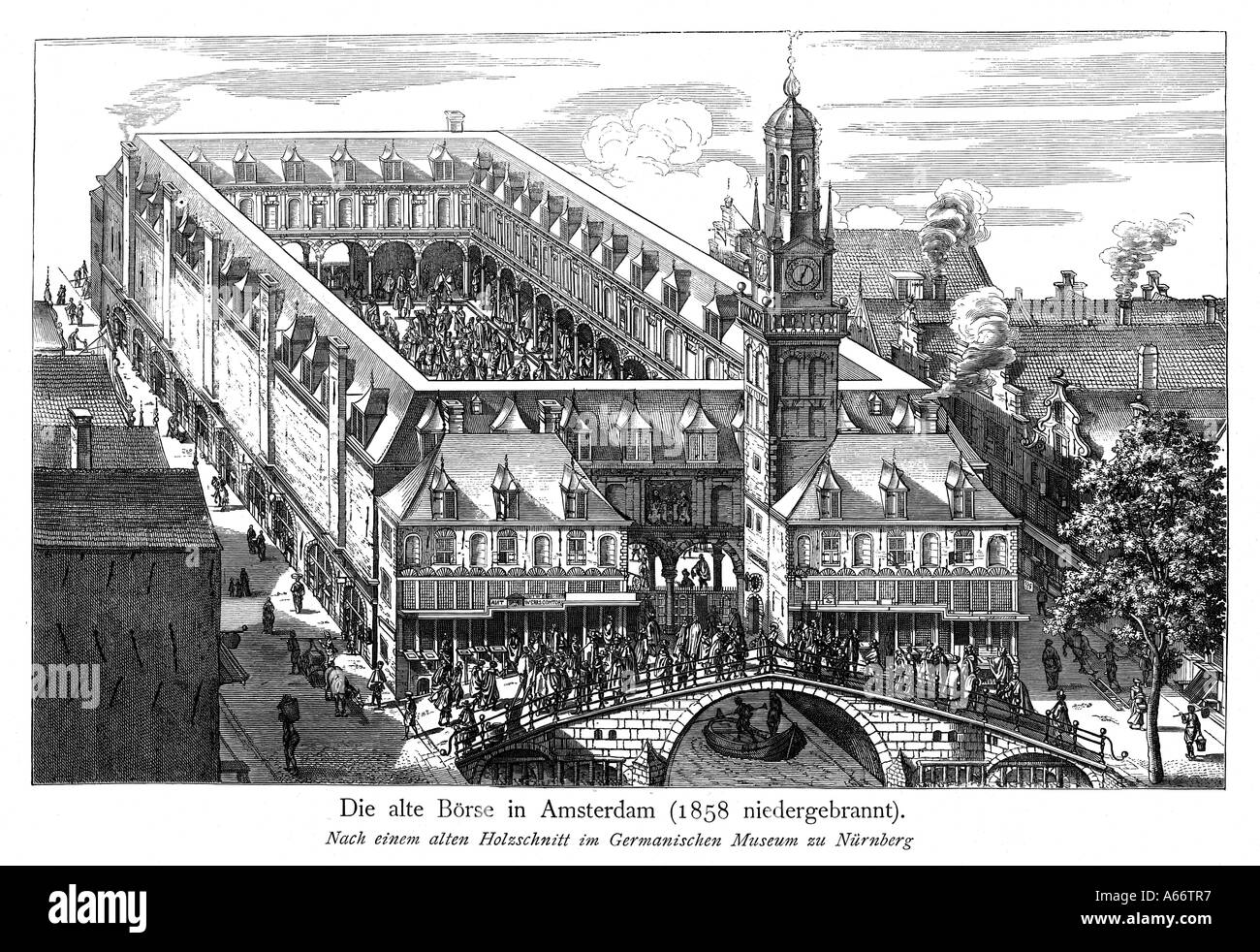

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 25, 2025

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 25, 2025 -

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 25, 2025

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 25, 2025