Fremantle's Q1 Revenue: A 5.6% Drop Due To Reduced Buyer Spending

Table of Contents

Analysis of Fremantle's Q1 Revenue Drop (5.6%)

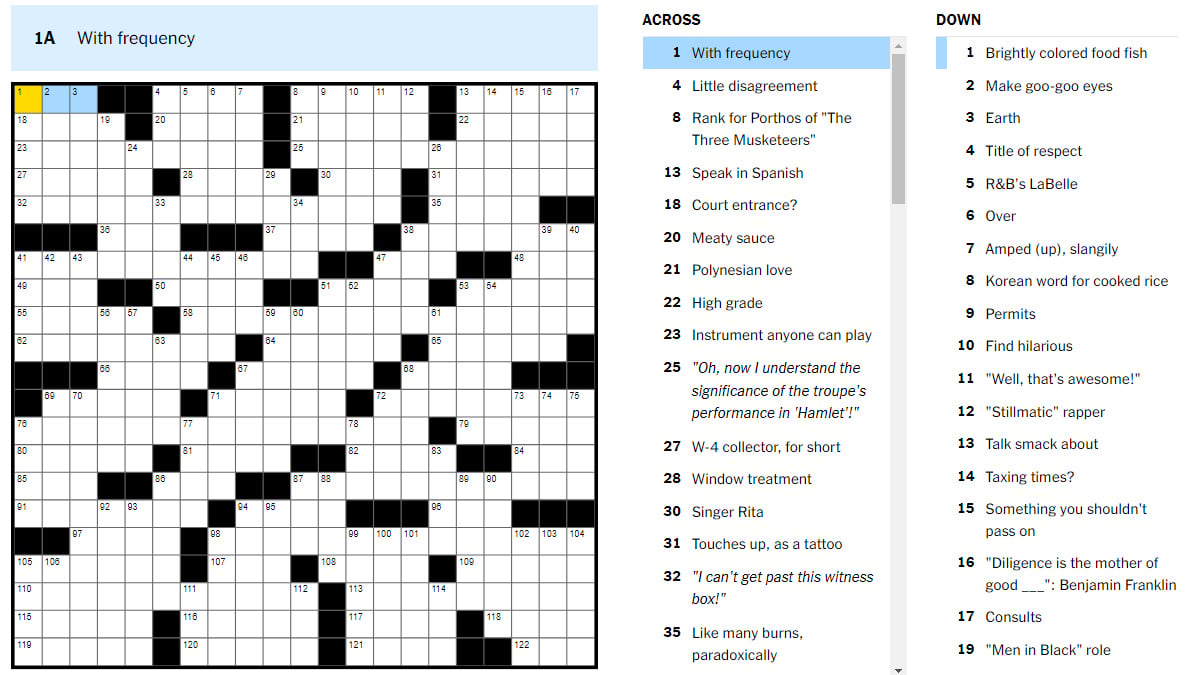

The 5.6% decrease in Fremantle's Q1 revenue represents a significant deviation from previous quarters and potentially industry averages. While precise comparisons to competitors require access to their financial reports, this drop signals a concerning trend within the broader television production and content creation sector. The following chart illustrates the revenue decline visually, comparing Q1 2024 to Q1 2023 (hypothetical data for illustrative purposes):

[Insert Chart/Graph here showing Q1 2023 revenue vs Q1 2024 revenue – a clear visual representation of the 5.6% drop]

Impact of Reduced Buyer Spending on Key Program Areas

This revenue decline wasn't uniformly distributed across all Fremantle programs. The impact of reduced buyer spending varied significantly depending on the genre and geographic market.

-

Reality TV: While some reality formats continued to perform well, others experienced a noticeable drop in orders from broadcasters and streaming platforms. For example, a planned second season of a successful dating show was canceled due to budget constraints from the buyer.

-

Drama Series: The impact on drama series was more pronounced, with several projects facing delays or cancellations due to reduced commissioning budgets. This reflects a broader trend of buyers showing more caution in commissioning high-budget, long-form content.

-

Documentaries: The documentary sector experienced a more moderate impact, though certain niche documentaries faced challenges securing distribution deals.

-

Geographic Impact: European markets, particularly those experiencing economic slowdown, showed a more significant decrease in buyer spending compared to North American or Asian markets.

-

Quantifiable Data (Hypothetical):

- Reality TV: 15% decrease in program orders.

- Drama Series: 25% decrease in program orders.

- Documentaries: 5% decrease in program orders.

-

Strategic Shifts: Fremantle responded by focusing on cost optimization strategies, including streamlining production processes and exploring more cost-effective filming locations.

Market Factors Contributing to Decreased Buyer Spending

The reduction in buyer spending is not solely attributable to Fremantle's internal factors. The broader economic climate, intensified competition, and shifting audience preferences all played significant roles.

-

Economic Climate: Global economic uncertainty and inflationary pressures have led to tighter budgets across various industries, including the entertainment sector. Broadcasters and streaming platforms are scrutinizing their content acquisition strategies, prioritizing ROI and cost efficiency.

-

Streaming Platform Competition: The fierce competition among streaming platforms has created a saturated market, forcing platforms to be more selective in their content acquisition, leading to less commissioning and potentially lower licensing fees.

-

Shifting Audience Preferences: Audience viewing habits are constantly evolving. The rise of short-form video content and the increased demand for diverse and inclusive programming require production companies to adapt their strategies.

Competition and the Changing Media Landscape

Fremantle faces intense competition from other major production companies like Endemol Shine, Banijay, and ITV Studios, as well as from the streaming giants themselves, who are increasingly investing in their own original productions.

-

Competitor Strategies: Competitors are employing various strategies, including offering bundled packages, securing exclusive rights to popular formats, and leveraging data analytics to target specific audiences.

-

Evolving Content Consumption: The shift from linear television to on-demand streaming is a major factor. This necessitates adapting programming to suit shorter attention spans and diverse viewing platforms.

-

Future Market Trends: The future will likely see further consolidation in the media landscape, with increased emphasis on data-driven decision-making and personalized content.

Fremantle's Strategic Response to Revenue Decline

Fremantle is actively implementing strategies to mitigate the impact of reduced buyer spending and position itself for future growth.

-

Cost Optimization: The company is actively streamlining its operations, focusing on efficiency gains, and exploring new cost-effective production models.

-

Content Strategy Shift: Fremantle is diversifying its content portfolio, investing in formats that appeal to broader audiences and exploring new genres and platforms.

-

Restructuring: Internal restructuring efforts focus on improving efficiency and allocating resources to high-potential projects.

Future Outlook and Potential Growth Areas

Fremantle's focus is on regaining momentum and market share.

-

New Program Formats: The company is investing in innovative program formats that cater to current audience trends, such as interactive content and immersive experiences.

-

Market Expansion: Fremantle is exploring opportunities in emerging markets, leveraging its global network to expand its reach and access new revenue streams.

-

Technological Investments: Investing in new technologies and production methods aims to improve efficiency and reduce costs while enhancing the quality of its content.

Conclusion: Understanding and Addressing Fremantle's Q1 Revenue Challenges

The 5.6% drop in Fremantle's Q1 revenue underscores the challenges facing the television production industry. Reduced buyer spending, intensified competition, and evolving audience preferences all contributed to this decline. However, Fremantle's strategic response, focusing on cost optimization, content diversification, and technological investment, demonstrates its commitment to navigating these challenges and securing future growth. Stay informed about Fremantle's performance and the evolving media landscape by following their reports and analyses on Fremantle's Q1 revenue and related topics. Understanding the dynamics of Fremantle's Q1 revenue and the broader media industry is crucial for anyone involved in or interested in the future of television production and content creation.

Featured Posts

-

Dexter Resurrection De Impact Van De Terugkeer Van John Lithgow En Jimmy Smits

May 21, 2025

Dexter Resurrection De Impact Van De Terugkeer Van John Lithgow En Jimmy Smits

May 21, 2025 -

Solve The Nyt Mini Crossword May 13 2025 Complete Guide

May 21, 2025

Solve The Nyt Mini Crossword May 13 2025 Complete Guide

May 21, 2025 -

Trans Australia Run Will The Record Be Broken

May 21, 2025

Trans Australia Run Will The Record Be Broken

May 21, 2025 -

Fastest Australian Crossing On Foot A New Record Is Set

May 21, 2025

Fastest Australian Crossing On Foot A New Record Is Set

May 21, 2025 -

Paulina Gretzkys Hottest Pictures Topless Selfies And More

May 21, 2025

Paulina Gretzkys Hottest Pictures Topless Selfies And More

May 21, 2025

Latest Posts

-

A Photographers Perspective James Wiltshire On 10 Years With The Border Mail

May 23, 2025

A Photographers Perspective James Wiltshire On 10 Years With The Border Mail

May 23, 2025 -

A Photographers Retrospective James Wiltshire And The Border Mail

May 23, 2025

A Photographers Retrospective James Wiltshire And The Border Mail

May 23, 2025 -

Analysis Of Egan Bernals Recovery Following A Severe Cycling Accident

May 23, 2025

Analysis Of Egan Bernals Recovery Following A Severe Cycling Accident

May 23, 2025 -

The Border Mails James Wiltshire 10 Years In Pictures

May 23, 2025

The Border Mails James Wiltshire 10 Years In Pictures

May 23, 2025 -

James Wiltshire Reflecting On A Decade Of Photography With The Border Mail

May 23, 2025

James Wiltshire Reflecting On A Decade Of Photography With The Border Mail

May 23, 2025