FTC Appeals Activision Blizzard Acquisition: A Deep Dive

Table of Contents

The FTC's Case Against the Merger

The FTC's core argument centers on the assertion that the merger would create an anti-competitive environment, granting Microsoft undue market power within the video game industry. This concern is primarily fueled by the potential for Microsoft to leverage its control over Activision Blizzard's portfolio, especially the immensely popular Call of Duty franchise, to stifle competition.

- Stifling Competition: The FTC argues the merger would significantly reduce competition, potentially leading to higher prices, less innovation, and reduced choice for consumers.

- Call of Duty Exclusivity: A major focus of the FTC's case is the potential for Microsoft to make Call of Duty exclusive to its Xbox ecosystem, thereby harming competitors like Sony PlayStation and potentially harming gamers who prefer other consoles. This argument hinges on the franchise's immense popularity and influence on the market.

- Market Domination: The FTC's concern extends beyond Call of Duty. The acquisition would combine Microsoft's existing gaming power with Activision Blizzard's vast library of titles, creating a dominant force capable of influencing pricing, distribution, and the overall competitive landscape of the gaming market. This includes concerns about market domination in the rapidly growing cloud gaming sector.

- Innovation Stagnation: The FTC suggests that reduced competition could lead to a decline in innovation, as Microsoft would have less incentive to push the boundaries of game development and technology if it faces minimal competitive pressure.

Microsoft's Defense and Proposed Remedies

Microsoft vehemently denies the FTC's accusations, arguing that the merger would ultimately benefit consumers and promote competition. Their defense strategy incorporates several key points:

- Call of Duty's Multi-Platform Commitment: Microsoft has repeatedly pledged to keep Call of Duty available on multiple platforms, including PlayStation, aiming to alleviate the FTC's concerns about exclusivity. They've even proposed long-term contractual agreements to solidify this commitment.

- Proposed Remedies: Microsoft has offered various remedies to address the FTC's concerns, including potential licensing agreements and other concessions to maintain competition. These remedies aim to showcase their willingness to cooperate and mitigate potential anti-competitive practices.

- Competitive Landscape Argument: Microsoft emphasizes that the gaming market is dynamic and competitive, with numerous players vying for market share. They argue their acquisition wouldn't create a monopoly, given the existence of Nintendo, Sony, and other major players.

- Cloud Gaming's Impact: Microsoft highlights the growing importance of cloud gaming and asserts that its acquisition would foster innovation and competition within this rapidly evolving sector, offering wider access to gaming for a broader audience.

International Regulatory Landscape and Implications

The FTC's appeal isn't the only regulatory hurdle Microsoft faces. The international regulatory landscape is complex, with varying stances on the merger:

- EU and UK Regulations: Regulatory bodies in the European Union and the United Kingdom have also scrutinized the merger, resulting in differing conclusions. The UK's Competition and Markets Authority (CMA), for example, initially blocked the deal but later re-evaluated its decision.

- Global Competition: The varying approaches highlight the challenges of applying antitrust laws in a globalized industry. What constitutes anti-competitive behavior can differ based on regional market conditions and legal interpretations.

- Regulatory Approvals: The acquisition has received approvals in some jurisdictions, while others remain undecided or have expressed concerns. This fragmented regulatory response underscores the complex nature of international antitrust law and its application to large-scale tech mergers.

- Cross-Border Implications: The differing regulatory outcomes have far-reaching implications, potentially impacting the future of cross-border mergers and acquisitions in the tech sector. The case is setting a precedent for how global regulatory bodies will approach future deals of this magnitude.

The Role of Call of Duty in the FTC's Appeal

The Call of Duty franchise is central to the FTC's appeal. Its immense popularity and market influence make it a focal point of the debate:

- Call of Duty Exclusivity Concerns: The possibility of making Call of Duty exclusive to Xbox is a significant concern for the FTC, potentially harming PlayStation users and creating an uneven playing field.

- Franchise Value: The financial value and cultural significance of Call of Duty highlight the stakes involved in the merger. The franchise's success has established its importance as a major driver of the video game market.

- Game Streaming's Role: The rise of game streaming services like Xbox Cloud Gaming further complicates the issue. Microsoft's potential to leverage Call of Duty within these services adds another layer to the FTC's concerns about market dominance.

- Competitor Concerns (Sony): Competitors like Sony have voiced significant concerns, emphasizing the competitive disadvantage they'd face if Call of Duty were made exclusive to Xbox.

Conclusion

The FTC's appeal of the Microsoft-Activision Blizzard acquisition is a complex case with far-reaching implications for the gaming industry and antitrust law. The arguments presented by both sides highlight the ongoing debate about market dominance, the future of gaming, and the role of regulators in shaping the technological landscape. The outcome will undoubtedly set a precedent for future mergers and acquisitions in the tech sector, influencing how regulators approach similar deals in the future.

Call to Action: Stay informed on the evolving legal battle surrounding the FTC's appeal of the Activision Blizzard acquisition. Follow our updates for further analysis and insights into this landmark case. Understanding the implications of the FTC's actions is crucial for anyone involved in or interested in the future of the gaming industry and antitrust legislation.

Featured Posts

-

Stranger Things 5 Release Date Plot Details And Cast Updates

May 29, 2025

Stranger Things 5 Release Date Plot Details And Cast Updates

May 29, 2025 -

Sfqt Mrtqbt Jwnathan Tah Ila Bayrn Mywnykh

May 29, 2025

Sfqt Mrtqbt Jwnathan Tah Ila Bayrn Mywnykh

May 29, 2025 -

Mbappe To Real Madrid A Realistic Possibility

May 29, 2025

Mbappe To Real Madrid A Realistic Possibility

May 29, 2025 -

Experience The Stranger Things Universe Further With The Comics A Season 5 Wait

May 29, 2025

Experience The Stranger Things Universe Further With The Comics A Season 5 Wait

May 29, 2025 -

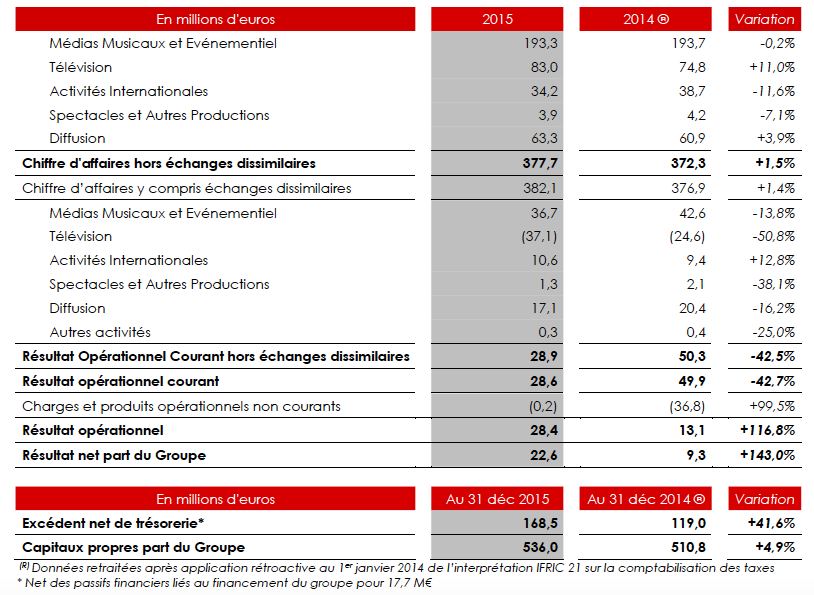

Nrj Group Chiffre D Affaires En Baisse Au 1er Trimestre 2024

May 29, 2025

Nrj Group Chiffre D Affaires En Baisse Au 1er Trimestre 2024

May 29, 2025

Latest Posts

-

Gorillaz Tickets Four Special London Shows At Copper Box Arena On Sale Now

May 30, 2025

Gorillaz Tickets Four Special London Shows At Copper Box Arena On Sale Now

May 30, 2025 -

House Of Kong Gorillaz Immersive Exhibition Lands In London This Summer

May 30, 2025

House Of Kong Gorillaz Immersive Exhibition Lands In London This Summer

May 30, 2025 -

London Hosts Gorillazs 25th Anniversary Concerts And Exhibition

May 30, 2025

London Hosts Gorillazs 25th Anniversary Concerts And Exhibition

May 30, 2025 -

Experience Gorillaz House Of Kong Exhibition At Londons Copper Box Arena

May 30, 2025

Experience Gorillaz House Of Kong Exhibition At Londons Copper Box Arena

May 30, 2025 -

Gorillaz 25 Years Of Music And Art Celebrated In London

May 30, 2025

Gorillaz 25 Years Of Music And Art Celebrated In London

May 30, 2025