FTC Appeals Activision Blizzard Acquisition: Implications For Gaming

Table of Contents

The FTC's Concerns Regarding Competition

The FTC's core argument centers on the potential for the Microsoft-Activision Blizzard merger to stifle competition within the gaming market. The commission worries about the creation of a market-dominant entity with the power to manipulate prices, limit consumer choice, and ultimately harm gamers. Their concerns are rooted in antitrust law and the principle of fair competition. The FTC specifically points to Microsoft's potential to leverage its ownership of Activision Blizzard's popular franchises, particularly Call of Duty, to gain an unfair advantage.

- Reduced competition among game developers and publishers: The merger could significantly reduce the number of major players in the industry, leading to less innovation and fewer choices for consumers.

- Higher game prices for consumers: A less competitive market could result in artificially inflated prices for games and related services.

- Limited consumer choice: Microsoft could potentially make popular titles like Call of Duty exclusive to its Xbox ecosystem, limiting consumer choice and forcing players onto a specific platform.

- Potential for Microsoft to make Call of Duty exclusive to Xbox: This is a major point of contention, raising concerns about the future availability of a beloved franchise on competing consoles like PlayStation.

- Impact on game subscription services: The merger could also significantly impact the competitive landscape of game subscription services, potentially leading to less attractive options for consumers.

Keywords: antitrust law, market dominance, competition concerns, Call of Duty, Xbox, PlayStation, game prices.

Microsoft's Defense and Arguments

Microsoft counters the FTC's claims by emphasizing the benefits of the acquisition for gamers and the broader gaming industry. They argue that the merger will actually increase competition and innovation. A key part of their defense revolves around their repeated commitments to keep Call of Duty multi-platform, ensuring its continued availability on PlayStation and other consoles.

- Microsoft's claims of increased competition: Microsoft argues the merger will bring together complementary strengths, ultimately benefiting consumers with more innovative games and services.

- Promises regarding Call of Duty availability on other platforms: Microsoft has publicly pledged to maintain Call of Duty on PlayStation for at least the next decade, aiming to alleviate the FTC's concerns about exclusivity.

- Investment in game development and accessibility: Microsoft asserts that the acquisition will allow for increased investment in game development, potentially leading to higher-quality games and improved accessibility for players.

- Arguments about expanding the gaming market: Microsoft claims the merger will help expand the gaming market as a whole, bringing more players into the fold through innovation and broader accessibility.

Keywords: Microsoft defense, merger benefits, Call of Duty exclusivity, multi-platform, gaming market expansion.

Wider Implications for the Gaming Industry and Future M&A Activity

The FTC's appeal carries significant implications beyond the immediate Microsoft-Activision Blizzard deal. This legal battle sets a precedent for future mergers and acquisitions (M&A) in the gaming sector and the broader tech industry. The outcome will influence regulatory scrutiny of future deals and potentially reshape the investment landscape.

- Increased regulatory scrutiny of future gaming mergers: This case will likely lead to increased regulatory oversight of future mergers and acquisitions in the gaming industry.

- Impact on the valuation of gaming companies: The uncertainty surrounding the legality of large mergers could impact the valuation of gaming companies, making future deals more complex and potentially less frequent.

- Potential for stricter antitrust enforcement in the tech sector: A ruling in favor of the FTC could lead to stricter antitrust enforcement across the tech sector, impacting other industries besides gaming.

- Uncertainty for smaller game studios: Smaller game studios might face increased uncertainty due to the heightened regulatory scrutiny and potential for shifts in the industry's power dynamics.

Keywords: M&A activity, regulatory scrutiny, gaming industry future, antitrust enforcement, game studio valuations.

The Role of Cloud Gaming and its Impact

The rise of cloud gaming adds another layer of complexity to this case. Cloud gaming services, which allow users to stream games over the internet, have the potential to significantly impact the future of game distribution and competition. The FTC's arguments might extend to concerns about control over cloud gaming platforms and the potential for anti-competitive practices in that rapidly growing space.

- Access to games across multiple devices: Cloud gaming increases access to games across various devices, potentially mitigating some of the FTC's concerns about platform exclusivity.

- Potential to reduce barriers to entry for smaller game developers: Cloud gaming could lower barriers to entry for smaller developers, fostering more competition in the market.

- Impact on game streaming services: The merger could significantly affect the competitive landscape of game streaming services, such as Xbox Cloud Gaming and PlayStation Now.

- FTC concerns about control over cloud gaming platforms: The FTC might worry about Microsoft's potential control over cloud gaming platforms, allowing them to influence competition in that area.

Keywords: cloud gaming, game streaming, game distribution, access to games, cloud gaming competition.

Conclusion: The FTC Appeal and the Future of Gaming Acquisitions

The FTC's appeal against the Microsoft-Activision Blizzard acquisition presents a crucial test for antitrust law in the gaming industry. Both the FTC's concerns regarding competition and Microsoft's arguments regarding market expansion highlight the significant implications of this merger. The potential impact on game prices, consumer choice, and future M&A activity is substantial. This landmark case will shape the future of gaming for years to come. The outcome will significantly affect the regulatory landscape, investor confidence, and ultimately, the gaming experience for millions. Follow further developments in the FTC’s appeal of the Activision Blizzard acquisition and its impact on the gaming landscape to understand the evolving future of this crucial sector. Keywords: Activision Blizzard acquisition, FTC ruling, gaming industry future, future of gaming, competition in gaming.

Featured Posts

-

M6 Closed Van Crash Causes Extensive Traffic Disruption

May 24, 2025

M6 Closed Van Crash Causes Extensive Traffic Disruption

May 24, 2025 -

Planning Your Escape To The Country A Practical Guide

May 24, 2025

Planning Your Escape To The Country A Practical Guide

May 24, 2025 -

Is An Escape To The Country Right For You Pros And Cons

May 24, 2025

Is An Escape To The Country Right For You Pros And Cons

May 24, 2025 -

Maryland Softball Defeats Delaware 11 1 Aubrey Wursts Contributions

May 24, 2025

Maryland Softball Defeats Delaware 11 1 Aubrey Wursts Contributions

May 24, 2025 -

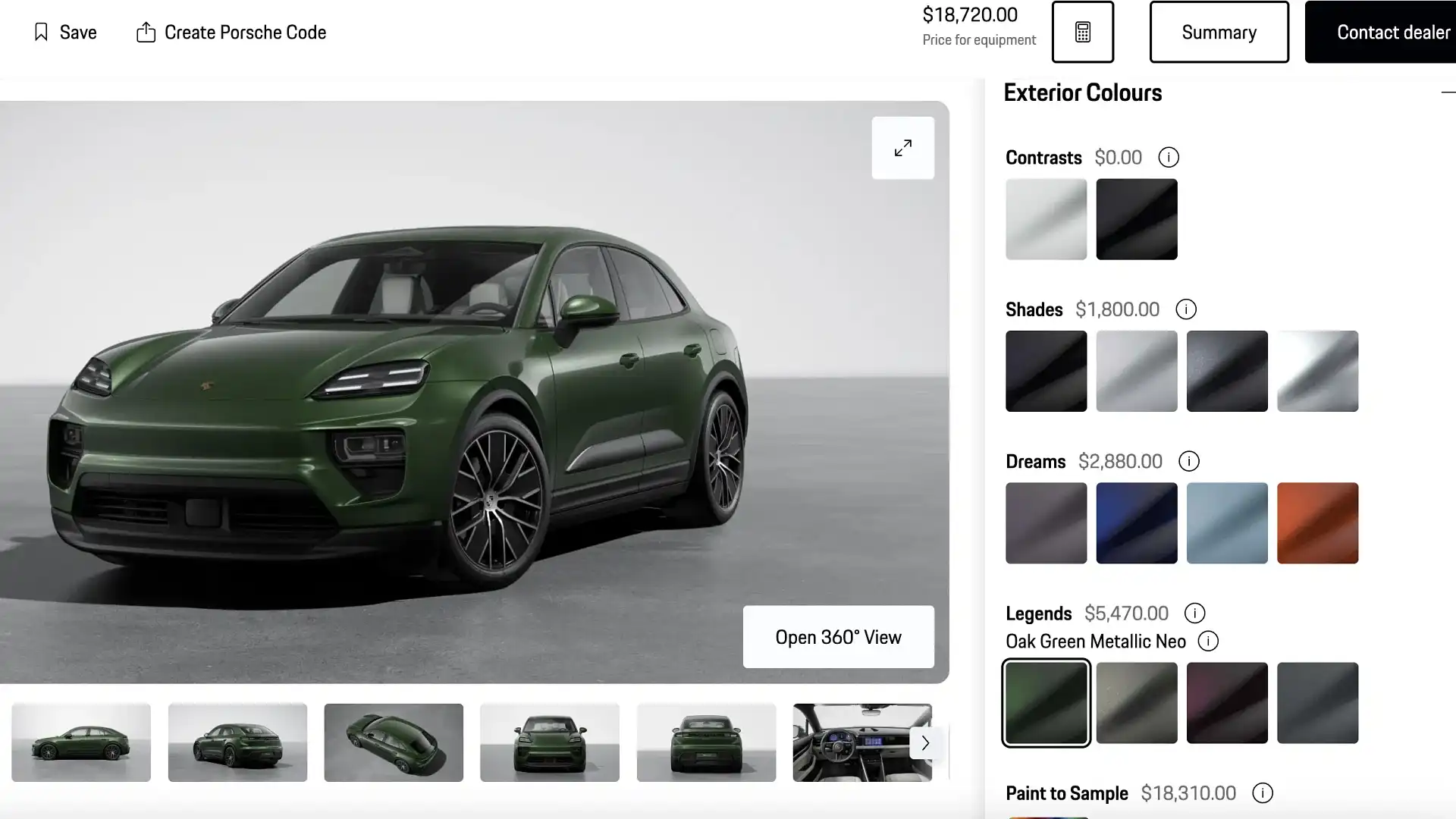

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Latest Posts

-

Today Show Host Dylan Dreyer Details Of A Near Disaster

May 24, 2025

Today Show Host Dylan Dreyer Details Of A Near Disaster

May 24, 2025 -

Dylan Dreyer And Brian Fichera A Look At Their Relationship

May 24, 2025

Dylan Dreyer And Brian Fichera A Look At Their Relationship

May 24, 2025 -

Dylan Dreyer And The Today Show A Close Call You Wont Believe

May 24, 2025

Dylan Dreyer And The Today Show A Close Call You Wont Believe

May 24, 2025 -

The Today Show Dylan Dreyers Unexpected Hosting Challenge

May 24, 2025

The Today Show Dylan Dreyers Unexpected Hosting Challenge

May 24, 2025 -

Dylan Dreyers Health And Fitness Journey A Today Show Success Story

May 24, 2025

Dylan Dreyers Health And Fitness Journey A Today Show Success Story

May 24, 2025