FTC Challenges Court Ruling On Microsoft-Activision Merger

Table of Contents

The FTC's Antitrust Concerns

The FTC's opposition to the Microsoft-Activision merger stems from serious antitrust concerns, primarily focused on potential market domination and exclusionary practices.

Market Domination Fears

The FTC fears that Microsoft's acquisition of Activision Blizzard would grant it undue market dominance across multiple sectors of the gaming industry. This concern extends to:

- Game Consoles: Microsoft's Xbox already competes with Sony's PlayStation and Nintendo's Switch. Acquiring Activision Blizzard's portfolio would significantly strengthen Xbox's position.

- Game Subscriptions: Microsoft's Game Pass subscription service would become even more attractive by including popular Activision Blizzard titles like Call of Duty, World of Warcraft, and Candy Crush. This could lure gamers away from competing subscription services.

- Cloud Gaming: The merger could stifle competition in the burgeoning cloud gaming market, where Microsoft is already a major player. Activision Blizzard's vast catalogue would give Microsoft a significant advantage.

This dominance, the FTC argues, could harm rival game developers and publishers, limiting their ability to compete and potentially leading to less innovation and higher prices for consumers.

Exclusionary Practices

The FTC also argues that Microsoft might engage in exclusionary practices, leveraging its control over Activision Blizzard's titles to stifle competition. This could manifest in several ways:

- Exclusivity: Making Activision Blizzard games exclusive to Xbox consoles or the Game Pass service could severely limit consumer choice and harm rival platforms.

- Pricing: Microsoft could use its market power to set higher prices for Activision Blizzard games, exploiting its dominant position.

- Degradation of Competing Services: Microsoft could potentially degrade the experience on competing services to push users to its own offerings.

These practices, the FTC contends, would ultimately harm consumers by reducing choice, increasing prices, and stifling innovation.

The Court's Initial Ruling and the FTC's Response

A court initially ruled in favor of the merger, but the FTC swiftly appealed.

The Judge's Decision

The judge's decision to initially approve the merger hinged on arguments that Microsoft's acquisition of Activision Blizzard wouldn't substantially lessen competition. Key points included:

- Evidence presented by Microsoft: The court considered evidence presented by Microsoft which suggested that the merger would not substantially lessen competition in the gaming market.

- Lack of persuasive evidence from the FTC: The court did not find the FTC's arguments about market dominance to be persuasive enough to block the merger.

- Focus on the availability of competing games: The court considered the existing range of games on the market and the presence of active competitors, suggesting there would be alternatives.

The FTC's Appeal

The FTC's appeal centers on its belief that the court's initial ruling failed to adequately address the potential for anti-competitive behavior. The FTC's strategy includes:

- Re-emphasizing market dominance concerns: The FTC will likely reiterate its concerns about Microsoft's potential market power.

- Highlighting potential for exclusionary practices: The appeal will likely focus on the risk of Microsoft using its newfound power to exclude competitors and limit consumer choice.

- Presenting additional evidence: The FTC may present further evidence to bolster its case.

This appeal sets a significant legal precedent, potentially impacting future mergers and acquisitions in the tech industry.

Impact on the Gaming Industry and Consumers

The outcome of this legal battle will significantly impact the gaming industry and its consumers.

Potential Price Increases

If the merger proceeds, there's a potential for increased prices for popular games and subscription services. This is a direct concern for consumers and raises worries about the impact on smaller studios' ability to compete against such price increases.

Game Exclusivity Concerns

The potential for exclusivity deals is a major concern. Titles like Call of Duty could become Xbox exclusives, limiting access for PlayStation and other platform users. This could alter the cross-platform gaming landscape.

Innovation and Competition

The merger's impact on innovation is uncertain. While some argue that the combined resources could spur new developments, others fear that reduced competition could stifle innovation and limit the variety of gaming experiences.

Conclusion: The Future of the FTC Challenges Court Ruling on Microsoft-Activision Merger

The FTC's challenge to the Microsoft-Activision merger represents a crucial battle in the ongoing debate about antitrust regulations in the tech industry. Both the FTC and the court presented compelling arguments, highlighting the complex interplay between market dominance, innovation, and consumer choice. The ongoing legal battle remains uncertain, with the potential for significant repercussions for the gaming industry and antitrust law. Stay informed about further developments in the FTC Challenges Court Ruling on Microsoft-Activision Merger case by checking back for updates or subscribing to reliable gaming news sources. The future of gaming may well depend on the outcome.

Featured Posts

-

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

Analyzing Ethereums Price Movement The Road To 2 000

May 08, 2025

Analyzing Ethereums Price Movement The Road To 2 000

May 08, 2025 -

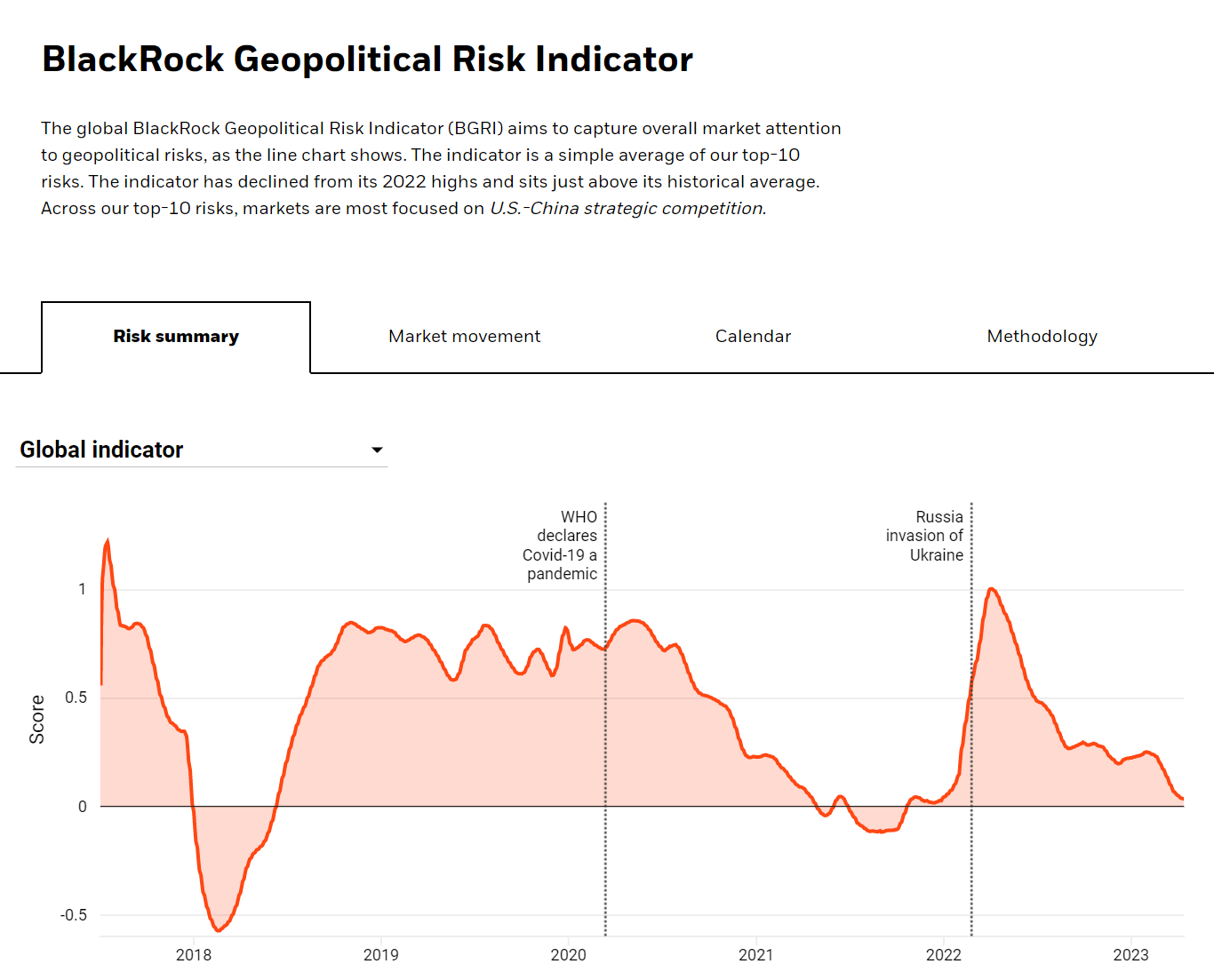

Cryptocurrency And Geopolitical Risk A Winning Strategy

May 08, 2025

Cryptocurrency And Geopolitical Risk A Winning Strategy

May 08, 2025 -

The Kuzma Tatum Instagram Exchange A Detailed Look

May 08, 2025

The Kuzma Tatum Instagram Exchange A Detailed Look

May 08, 2025