FTC To Challenge Court's Approval Of Microsoft-Activision Deal

Table of Contents

FTC's Core Arguments Against the Merger

The FTC's opposition to the Microsoft-Activision merger rests on several key pillars, all centered on concerns about reduced competition and potential harm to consumers.

Concerns Regarding Market Domination

The FTC argues that Microsoft's acquisition of Activision Blizzard will lead to an unacceptable level of market domination, particularly within the console gaming market. This dominance, they contend, would stifle competition and innovation.

- Exclusion of Competitors: Microsoft could potentially leverage its ownership of Activision Blizzard titles to exclude competitors from accessing key franchises and technologies. This could involve exclusive deals, limiting cross-platform compatibility, or even entirely removing competing platforms from the ecosystem.

- Impact on Pricing and Innovation: A lack of competition often results in higher prices and reduced innovation. With Microsoft controlling a significant portion of the market, the FTC fears consumers will face less choice and fewer incentives for innovative game development.

- Leveraging Dominance: The FTC is concerned that Microsoft could use its newfound control to undermine rival gaming platforms like PlayStation and cloud gaming services, potentially forcing gamers to switch ecosystems.

The Call of Duty Controversy

The immensely popular Call of Duty franchise sits at the heart of the FTC's argument. The commission believes Microsoft's control over this behemoth could fundamentally alter the competitive landscape.

- Market Share and Influence: Call of Duty's massive market share and influence are undeniable. The FTC points to its consistent high ranking in sales charts and its significance to the overall gaming market as evidence of its power.

- Exclusivity Concerns: A key concern is the potential for Microsoft to make Call of Duty exclusive to the Xbox ecosystem, severely limiting access for PlayStation players and others.

- Impact on Competing Platforms: Restricting access to Call of Duty would undeniably impact PlayStation and other competing platforms, potentially driving players towards Xbox and damaging the viability of competing services.

Impact on Game Development and Innovation

The FTC believes that reduced competition, stemming from the merger, will significantly hinder game development and innovation.

- Reduced New Game Releases: A less competitive market can lead to fewer new game releases, as the incentive for innovation might decrease. Microsoft may prioritize its own titles over developing new franchises.

- Diminished Incentives for Innovation: With less pressure from competition, Microsoft may be less inclined to invest in cutting-edge game design and technology.

- Impact on Independent Developers: Smaller, independent game developers could find it harder to compete against a giant like Microsoft, potentially leading to a less diverse and less innovative game market.

The Court's Initial Ruling and its Rationale

A federal judge initially ruled in favor of Microsoft, approving the acquisition. However, the FTC disputes this ruling and is appealing the decision.

The Judge's Decision

The judge's decision focused on several factors, including the extensive evidence presented by Microsoft regarding their commitment to keeping Call of Duty multi-platform. The court seemingly accepted Microsoft's arguments that the merger would not substantially lessen competition.

- Points of Law: The court considered specific aspects of antitrust law, weighing the potential benefits of the merger against the potential harms.

- Evidence Presented: Both Microsoft and the FTC presented considerable amounts of evidence to support their positions, including market analysis, expert testimony, and internal documents.

- Court's Reasoning: The court’s reasoning for dismissing the FTC's concerns revolved around the belief that Microsoft’s commitment to maintaining Call of Duty on competing platforms would effectively mitigate the risk of reduced competition.

Potential Legal Precedents

This case bears comparison to other significant antitrust cases involving large technology mergers, particularly those involving dominant players in the digital marketplace. This ruling, and the FTC's appeal, could set important precedents for future merger reviews and regulatory oversight.

- Comparison to Other Cases: Legal experts are drawing parallels between this case and previous antitrust actions, examining similarities and differences in the arguments and rulings.

- Potential Legal Impact: The outcome will significantly influence how future mergers involving large technology companies are scrutinized and regulated.

- Broader Implications: The case could lead to adjustments in antitrust regulations and oversight of technology companies, significantly impacting future mergers and acquisitions within the tech sector.

What Happens Next? The FTC's Appeal Process

The FTC’s appeal will involve a complex legal process, potentially stretching over several months or even years.

The Appeal Process

The FTC will follow a formal appeals process, submitting legal arguments and evidence to challenge the initial court decision. This will likely involve multiple stages of legal proceedings.

- Legal Procedures: This includes submitting briefs, responding to the opposing party’s arguments, and potentially undergoing further hearings or court appearances.

- Timeline: The appeal process can be lengthy and unpredictable, with the potential for delays and protracted legal battles.

- Possible Outcomes: The appellate court could either uphold the original ruling, reverse it, or remand the case back to the lower court for further consideration.

Potential Outcomes and their Implications

Several potential outcomes exist, each with significant implications for Microsoft, Activision Blizzard, and the gaming industry.

- Scenario 1: FTC Wins the Appeal, Merger Blocked: This would be a major victory for the FTC and a significant setback for Microsoft. The merger would be blocked, and the gaming landscape would remain unchanged.

- Scenario 2: Court Upholds the Original Ruling, Merger Proceeds: This would solidify the initial court decision and allow the Microsoft-Activision merger to proceed. It could lead to further antitrust scrutiny of large tech mergers.

- Scenario 3: A Negotiated Settlement is Reached: A negotiated settlement is possible where Microsoft agrees to concessions to appease the FTC's concerns, perhaps relating to Call of Duty’s continued availability on competing platforms.

Conclusion:

The FTC's challenge to the Microsoft-Activision deal represents a critical juncture in the ongoing battle for fair competition in the gaming industry. The outcome will impact competition, innovation, and consumer choice for years to come. The appeal process will be closely watched by industry stakeholders, legal experts, and gamers alike. The future of this $69 billion merger and its impact on the future of gaming hang in the balance. Stay informed about further developments in this critical case and the ongoing debate surrounding the Microsoft-Activision deal.

Featured Posts

-

Nottingham Attack Investigation Experienced Judge Takes The Lead

May 10, 2025

Nottingham Attack Investigation Experienced Judge Takes The Lead

May 10, 2025 -

Turkey Blocks Jailed Mayors Social Media Opposition Outcry Leads To Censorship

May 10, 2025

Turkey Blocks Jailed Mayors Social Media Opposition Outcry Leads To Censorship

May 10, 2025 -

The Fallout From Metas 168 Million Whats App Spyware Settlement

May 10, 2025

The Fallout From Metas 168 Million Whats App Spyware Settlement

May 10, 2025 -

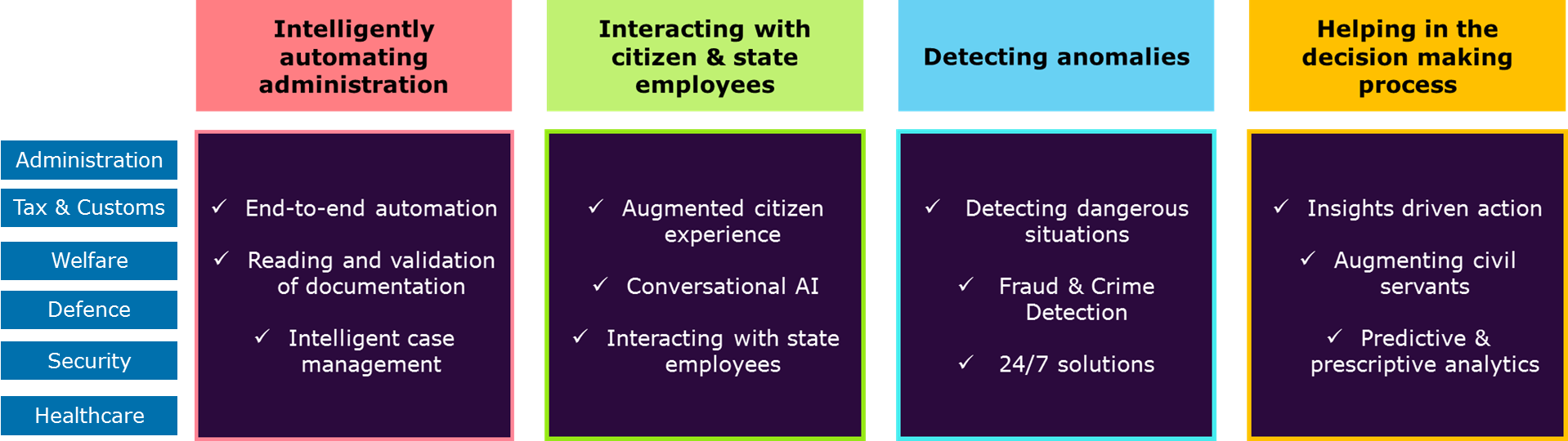

Public Sector Ai Revolution Understanding Palantirs Nato Deal

May 10, 2025

Public Sector Ai Revolution Understanding Palantirs Nato Deal

May 10, 2025 -

High Potential Episode Count Season 2 Renewal Information And Potential Return Date

May 10, 2025

High Potential Episode Count Season 2 Renewal Information And Potential Return Date

May 10, 2025