Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Gibraltar Industries is a leading manufacturer and distributor of building products for various sectors, including residential and commercial construction. Its recent performance has been a mixed bag, influenced by broader macroeconomic trends. This preview aims to provide a comprehensive analysis of the company's financial health and future prospects.

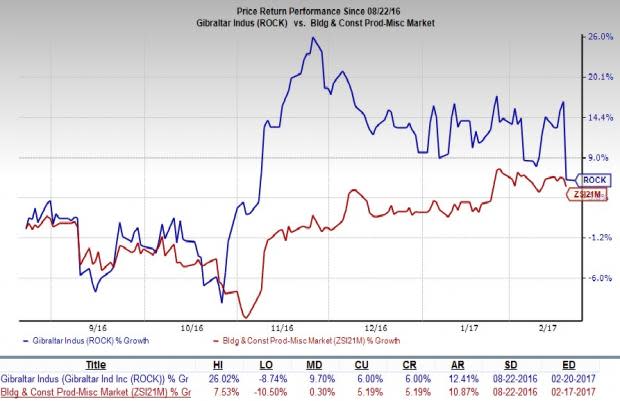

Analyzing Gibraltar Industries' Recent Performance (ROCK Stock Performance)

Revenue Growth and Trends

Gibraltar Industries' revenue growth has shown some fluctuations in recent quarters. Analyzing year-over-year comparisons is crucial to understanding the underlying trends. Key factors influencing revenue include:

- Residential Construction: The strength of the housing market directly impacts demand for Gibraltar Industries' products. Any slowdown in this sector could significantly impact revenue.

- Commercial Construction: Similarly, the commercial construction sector's health is another key driver. Large-scale projects significantly influence sales.

- Pricing Strategies: The company's pricing power and ability to pass along rising input costs affect revenue margins.

Specific data points on revenue growth, segment-wise revenue breakdown, and key drivers of revenue growth or decline should be inserted here based on the most recent financial reports. For example: "Q3 2024 saw a 5% year-over-year increase in total revenue, driven primarily by a 7% surge in residential construction products. However, commercial construction segment revenue declined by 2%." (Remember to replace this with actual data from Gibraltar Industries' financial reports).

Profitability and Margins

Profitability is a key indicator of Gibraltar Industries' financial health. We need to look at:

- Gross Profit Margin: This metric reflects the efficiency of Gibraltar Industries' manufacturing and production processes. Changes in this margin can indicate shifts in input costs or pricing strategies.

- Operating Margin: Operating margin provides a more comprehensive view of profitability by considering operating expenses. A decline in operating margin might point towards increasing operational inefficiencies or competitive pressures.

- Net Income: Net income represents the company's bottom line, after accounting for all expenses and taxes. A decrease in net income could signal weakening profitability.

Specific data points on gross profit margin, operating margin, net income, and their year-over-year comparisons should be inserted here using the company's financial reports. For example: "Gross profit margin decreased slightly to 35% in Q3 2024 compared to 37% in Q3 2023, primarily due to increased raw material costs." (Again, replace with actual data).

Key Market Drivers Influencing ROCK Stock

Several macroeconomic and industry-specific factors influence Gibraltar Industries' performance and ROCK stock price:

- Inflation: Rising inflation affects input costs, impacting Gibraltar Industries' profitability. Higher inflation might necessitate price increases, potentially impacting demand.

- Interest Rates: Higher interest rates can slow down the housing and commercial construction markets, dampening demand for Gibraltar Industries' products.

- Housing Market Trends: The health of the housing market is a critical driver for Gibraltar Industries. A strong housing market usually translates to higher demand for building products.

Specific examples of market drivers and their potential impact on Gibraltar Industries' performance should be added here, based on current economic conditions and industry analysis. For example: "The current high interest rate environment poses a challenge, potentially slowing down the growth of the residential construction market, and consequently, impacting ROCK stock."

Key Factors to Watch in the Gibraltar Industries (ROCK) Earnings Report

Guidance for Future Performance

Investors should carefully analyze Gibraltar Industries' guidance for the coming quarters and fiscal year. This guidance will offer insights into:

- Revenue Projections: The company's projections for future revenue will reflect their expectations regarding market demand and their ability to capture market share.

- Earnings Expectations: The projected earnings per share (EPS) will indicate the company's expected profitability.

- Growth Prospects: Management's overall outlook on the company's future growth will give important information about future plans and strategies.

Specific expectations for future performance based on past trends and any available company statements should be included here. For instance, "Based on the Q3 2024 performance and current market conditions, analysts predict a conservative outlook for the next fiscal year for ROCK stock."

Capital Expenditures and Investments

Any significant capital expenditures, acquisitions, or investments by Gibraltar Industries will shape its future performance.

- Capital Expenditure Plans: Investment in new facilities or equipment might boost future production capacity and efficiency.

- Acquisition Activity: Mergers and acquisitions could expand Gibraltar Industries' product portfolio or market reach, but also carry inherent financial risks.

- Research & Development Spending: Investments in R&D suggest that the company is committed to innovation and the development of new, competitive products.

Details on capital expenditure plans, acquisition activity, and their potential impact on profitability and growth should be added here, based on company disclosures or market analysis. For example, "Recent announcements suggest that Gibraltar Industries is focusing on capital expenditures related to enhancing production efficiency, potentially boosting future margins."

Debt Levels and Financial Health

Assessing Gibraltar Industries' financial health involves analyzing its debt levels and liquidity.

- Debt-to-Equity Ratio: This ratio reveals the proportion of Gibraltar Industries' financing that comes from debt compared to equity. A high ratio could indicate increased financial risk.

- Credit Rating: The company's credit rating from agencies like Moody's or S&P will reflect its creditworthiness and ability to repay debt.

- Liquidity: Adequate liquidity ensures that Gibraltar Industries can meet its short-term financial obligations.

Data points on debt levels, credit ratings, and liquidity should be added here, drawn from Gibraltar Industries' financial statements and credit rating agencies. For instance, "Gibraltar Industries maintains a relatively healthy debt-to-equity ratio, suggesting a manageable level of financial leverage."

Conclusion: Gibraltar Industries (ROCK) Earnings Preview: Key Takeaways and Next Steps

This Gibraltar Industries (ROCK) Earnings Preview highlights the importance of analyzing the company's recent performance, focusing on revenue growth, profitability, and key market drivers. The upcoming earnings report will provide crucial insights into Gibraltar Industries' future outlook, including guidance, capital expenditures, and overall financial health. These factors will significantly influence the ROCK stock price. Investors should monitor these indicators closely to formulate informed investment strategies.

The potential impact of the earnings report on ROCK stock could be substantial, presenting both opportunities and risks. A strong earnings report could boost the stock price, while weaker-than-expected results might lead to a decline. Therefore, thorough analysis of the earnings release is essential.

Stay tuned for our post-earnings analysis of Gibraltar Industries (ROCK)! Follow us for further updates on ROCK stock and other important investment insights.

Featured Posts

-

Tasman Council Road Closure A Truckies Realistic Perspective

May 13, 2025

Tasman Council Road Closure A Truckies Realistic Perspective

May 13, 2025 -

The Judge Crawford Cliffhanger What To Expect In Elsbeth Season 2

May 13, 2025

The Judge Crawford Cliffhanger What To Expect In Elsbeth Season 2

May 13, 2025 -

Dy Kabryw Ythda Qanwn Lyw Qst Hbh Aljdyd

May 13, 2025

Dy Kabryw Ythda Qanwn Lyw Qst Hbh Aljdyd

May 13, 2025 -

Aces Preseason Game Undrafted Rookie Deja Kellys Dramatic Game Winner

May 13, 2025

Aces Preseason Game Undrafted Rookie Deja Kellys Dramatic Game Winner

May 13, 2025 -

Evreyskaya Avtonomnaya Oblast Vyplaty Veteranam K 80 Letiyu Velikoy Pobedy

May 13, 2025

Evreyskaya Avtonomnaya Oblast Vyplaty Veteranam K 80 Letiyu Velikoy Pobedy

May 13, 2025

Latest Posts

-

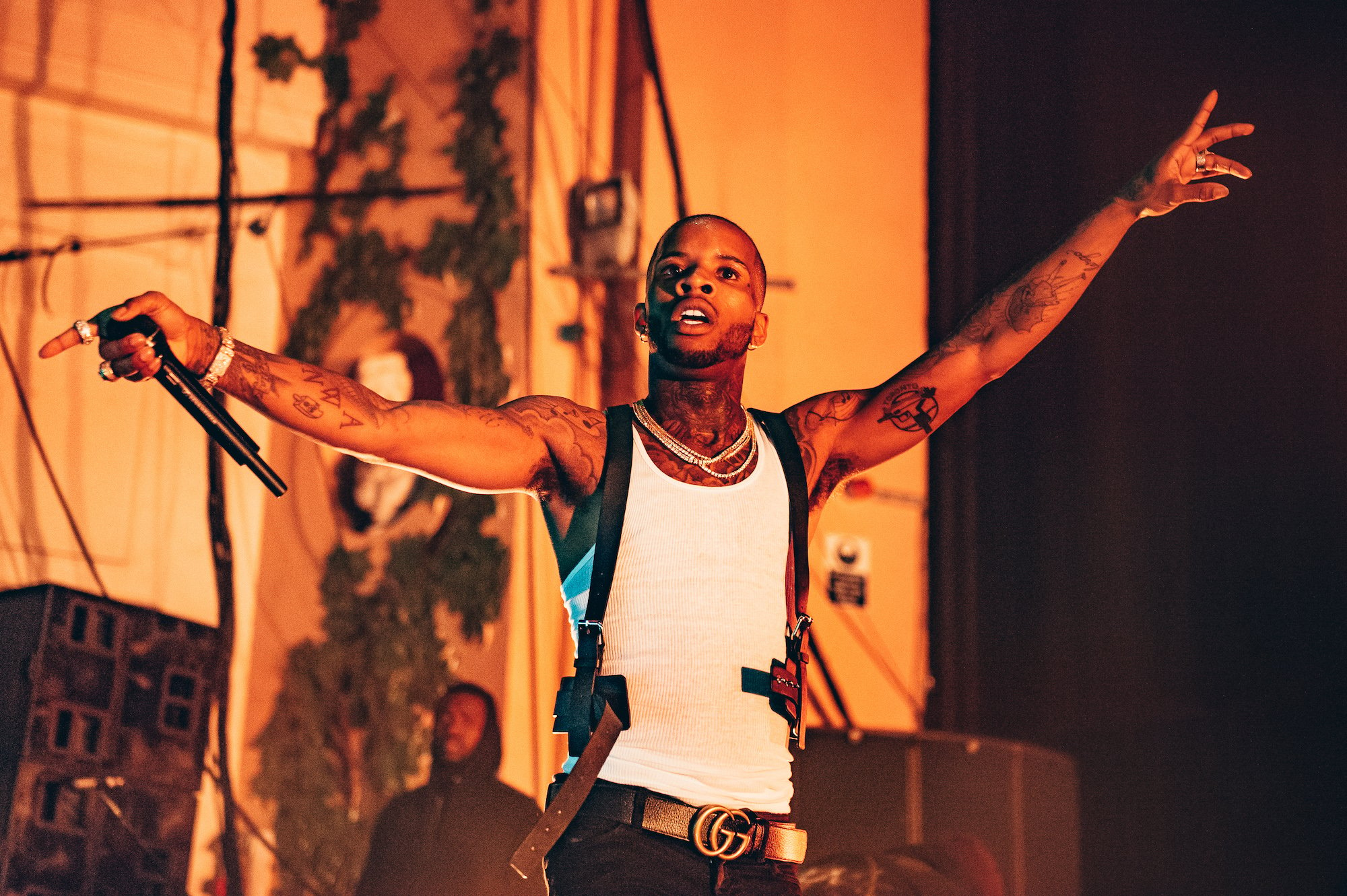

Tory Lanez Stabbed In Prison Rushed To Hospital For Emergency Treatment

May 13, 2025

Tory Lanez Stabbed In Prison Rushed To Hospital For Emergency Treatment

May 13, 2025 -

Partynextdoors Apology To Tory Lanez Full Story And Fallout

May 13, 2025

Partynextdoors Apology To Tory Lanez Full Story And Fallout

May 13, 2025 -

Report Tory Lanez Attacked In Prison Following Cell Raid

May 13, 2025

Report Tory Lanez Attacked In Prison Following Cell Raid

May 13, 2025 -

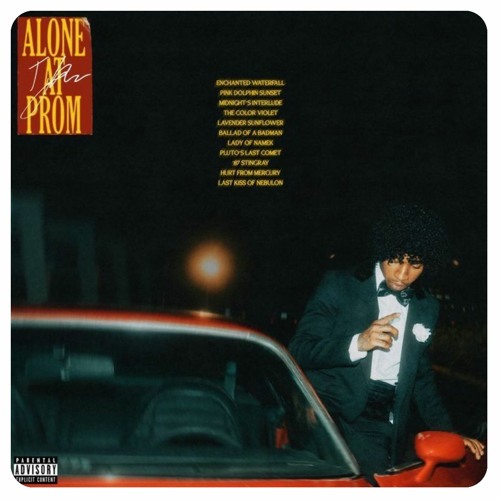

Decoding Tory Lanezs Alone At Prom Understanding The Messages In Peterson

May 13, 2025

Decoding Tory Lanezs Alone At Prom Understanding The Messages In Peterson

May 13, 2025 -

Tory Lanez Prison Stabbing Details Emerge After Cell Raid

May 13, 2025

Tory Lanez Prison Stabbing Details Emerge After Cell Raid

May 13, 2025