Gibraltar's Presentation At The Sidoti Small-Cap Conference

Table of Contents

Gibraltar's Financial Performance and Key Metrics

Gibraltar's presentation showcased impressive financial results, demonstrating robust growth and strong profitability. Key performance indicators (KPIs) presented painted a positive picture of the company's financial health.

- Revenue Growth: Gibraltar reported [insert percentage]% year-over-year (YoY) revenue growth, exceeding expectations and demonstrating strong market demand for their products/services. This significant increase can be attributed to [mention key factors driving revenue growth, e.g., successful new product launches, expansion into new markets].

- EBITDA Margin: The company achieved an EBITDA margin of [insert percentage]%, reflecting improved operational efficiency and cost management. This signifies a healthy and sustainable business model.

- Profitability: Gibraltar demonstrated strong profitability, with [mention net income or other relevant profitability metrics] showing significant improvement compared to the previous year. This underlines the effectiveness of their business strategy and its potential for continued success.

These financial results clearly demonstrate Gibraltar's ability to deliver consistent and significant growth, making it an attractive prospect for investors interested in small-cap stocks with a proven track record.

Growth Strategy and Future Outlook

Gibraltar outlined an ambitious growth strategy focused on several key initiatives:

- Market Expansion: The company plans to expand into [mention target markets], leveraging its existing strengths and adapting its offerings to meet the specific needs of these new regions. This strategic move is expected to significantly contribute to future revenue growth.

- New Product Launches: Gibraltar highlighted several upcoming product launches designed to cater to evolving market demands and enhance its competitive advantage. These include [mention specific products and their intended impact].

- Strategic Partnerships: The company is actively pursuing strategic partnerships to expand its reach and access new technologies. [Mention specific partnerships if disclosed, highlighting their potential benefits].

These initiatives, coupled with Gibraltar's strong competitive advantage in [mention area of competitive advantage], position the company for sustained growth and market leadership in the coming years.

Management's Vision and Key Initiatives

Gibraltar's management team expressed a clear vision for the future, emphasizing innovation, customer focus, and sustainable growth. [Insert a quote from management if available, emphasizing their key initiatives]. Their commitment to strategic investments in [mention specific areas like R&D, technology, or talent acquisition] underscores their long-term vision for the company. The key initiatives driving this growth include a focus on [list key initiatives with brief descriptions]. This strategic focus reinforces investor confidence in the company's long-term potential.

Investor Q&A and Key Questions Addressed

The investor Q&A session provided valuable insights into the concerns and expectations of potential investors. Key questions addressed included [mention key topics discussed, such as market competition, risk factors, and future financial projections]. Management effectively addressed concerns regarding [mention specific concerns and how management addressed them]. The overall tone of the Q&A session was positive, reflecting a confident outlook on the future. This open dialogue with investors highlights Gibraltar's commitment to transparency and communication.

Conclusion: Gibraltar's Strong Showing at the Sidoti Small-Cap Conference

Gibraltar's presentation at the Sidoti Small-Cap Conference highlighted strong financial performance, a well-defined growth strategy, and a confident management team. The company's impressive revenue growth, improved profitability, and ambitious expansion plans point towards a promising future. The investor Q&A session further solidified investor confidence. Gibraltar presents a compelling investment opportunity for those interested in high-growth small-cap stocks. Learn more about Gibraltar and its investment opportunities by visiting their website [link to website] or contacting investor relations.

Featured Posts

-

Braunschweiger Schoduvel So Erleben Sie Den Karnevalsumzug Optimal

May 13, 2025

Braunschweiger Schoduvel So Erleben Sie Den Karnevalsumzug Optimal

May 13, 2025 -

The Doom The Dark Age Spoiler Problem What Went Wrong

May 13, 2025

The Doom The Dark Age Spoiler Problem What Went Wrong

May 13, 2025 -

Novye Standarty Po Fizike I Khimii Dlya Detskikh Sadov

May 13, 2025

Novye Standarty Po Fizike I Khimii Dlya Detskikh Sadov

May 13, 2025 -

Community Highlights Earth Day May Day Parade And Junior League Gala

May 13, 2025

Community Highlights Earth Day May Day Parade And Junior League Gala

May 13, 2025 -

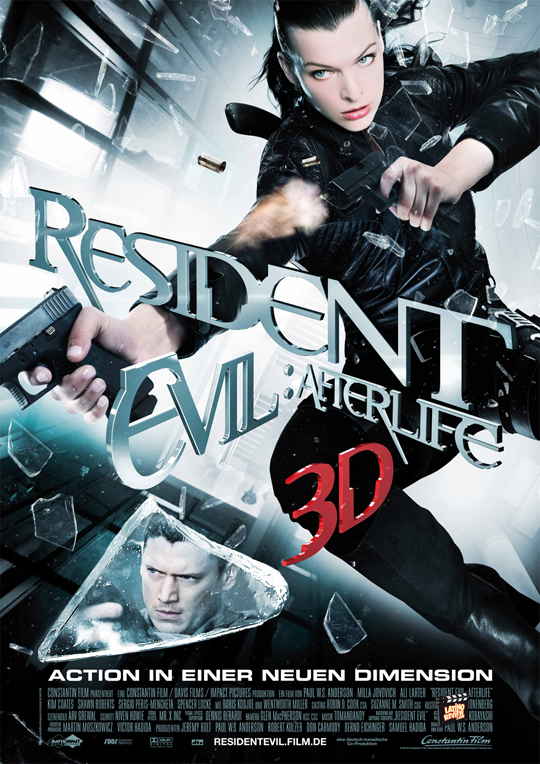

Resident Evil Afterlife Review A Critical Analysis Of The 3 D Action Horror

May 13, 2025

Resident Evil Afterlife Review A Critical Analysis Of The 3 D Action Horror

May 13, 2025

Latest Posts

-

The How To Train Your Dragon Remake Almost Made A Controversial Decision Heres How Close They Came

May 13, 2025

The How To Train Your Dragon Remake Almost Made A Controversial Decision Heres How Close They Came

May 13, 2025 -

How To Train Your Dragon Live Action A Near Miss Controversial Choice

May 13, 2025

How To Train Your Dragon Live Action A Near Miss Controversial Choice

May 13, 2025 -

How Close Did The How To Train Your Dragon Live Action Remake Come To A Controversial Decision

May 13, 2025

How Close Did The How To Train Your Dragon Live Action Remake Come To A Controversial Decision

May 13, 2025 -

Get Ready Heist Movie Sequel Premieres On Amazon Prime This Month

May 13, 2025

Get Ready Heist Movie Sequel Premieres On Amazon Prime This Month

May 13, 2025 -

Heist Film Sequel Arrives On Amazon Prime A Date For The Calendar

May 13, 2025

Heist Film Sequel Arrives On Amazon Prime A Date For The Calendar

May 13, 2025