Glamorous Miami Hedge Funder Faces US Ban After Immigration Lie Allegations

Table of Contents

The Allegations Against the Hedge Fund Manager

The allegations against the Miami-based hedge fund manager center around fraudulent statements made in their visa application. Specifically, the accusations involve misrepresentations related to their financial status and business activities, crucial elements for obtaining an investor visa (EB-5) or a green card.

- False Statement of Income: Authorities allege the manager significantly inflated their income and assets in their visa application, providing fabricated financial documents to support their claims.

- Omission of Material Facts: The accusations include omitting key information about previous business ventures and legal issues, which could have impacted their eligibility for the visa.

- Perjury Charges: Based on the evidence gathered, the manager is facing potential charges of perjury for knowingly making false statements under oath during the visa application process. This could lead to severe penalties, both financially and legally.

- Supporting Evidence: Authorities reportedly possess evidence including bank statements, tax returns, and witness testimonies that contradict the information provided in the visa application, strengthening the case against the manager.

Impact on the Hedge Fund and its Investors

The fallout from this scandal extends far beyond the individual. The hedge fund itself faces significant reputational damage, potentially leading to:

- Erosion of Investor Confidence: Investors are likely to withdraw their funds, causing financial instability and impacting the fund's ability to meet its obligations. This loss of investor confidence could lead to a significant market downturn for the firm.

- Regulatory Scrutiny: The SEC and other regulatory bodies are likely to launch investigations into the fund's operations, looking for any potential wrongdoing related to the manager's actions. This could lead to further financial penalties and limitations on the fund's activities.

- Loss of Assets Under Management (AUM): The scandal will undoubtedly affect the fund's ability to attract new investors and manage existing assets, potentially resulting in significant losses.

- Legal Battles: The hedge fund may face lawsuits from investors who suffered losses due to the manager's actions and the resulting market volatility.

Regulatory Scrutiny and Potential Penalties

The gravity of the situation has triggered intense regulatory scrutiny. The SEC and other relevant agencies are likely to investigate the matter thoroughly. Potential penalties for the hedge fund manager include:

- Significant Financial Penalties: Large fines are anticipated as punishment for immigration fraud and perjury.

- Imprisonment: Depending on the severity of the charges, the manager could face a prison sentence.

- Deportation: The most immediate consequence is likely to be deportation, ending the manager's career in the US and potentially impacting their ability to operate elsewhere.

- Industry-Wide Impact: This case could lead to stricter regulations and increased scrutiny of the visa application process for high-net-worth individuals within the financial industry.

The "Glamorous Lifestyle" and Public Perception

The hedge fund manager's lavish lifestyle, often publicized on social media, has amplified public scrutiny. The contrast between their glamorous image and the serious allegations has fueled media attention and public outrage.

- Negative Media Coverage: News outlets have extensively covered the story, focusing on the manager's opulent lifestyle and highlighting the irony of their alleged fraudulent actions.

- Social Media Backlash: Social media platforms have seen a significant backlash, with many criticizing the manager's actions and questioning the ethics of the financial industry.

- Reputation Damage: The scandal has severely damaged the manager's personal brand and future career prospects, regardless of the outcome of the legal proceedings.

Conclusion

This case of a glamorous Miami hedge fund manager facing a potential US ban after immigration lie allegations underscores the severe repercussions of immigration fraud. The incident not only threatens the individual's career and personal life but also has far-reaching consequences for the hedge fund industry, investor confidence, and regulatory oversight. The significant financial penalties, potential imprisonment, and certain deportation highlight the gravity of misrepresenting information on visa applications.

Call to Action: The implications of this scandal emphasize the importance of strict adherence to immigration laws and regulations. Individuals and organizations involved in visa applications must ensure complete accuracy and transparency to avoid facing similar consequences. Learning from this Miami hedge fund case serves as a stark warning against immigration fraud and the severe repercussions it can entail. Honest and ethical practices are crucial for maintaining integrity within the financial industry and avoiding costly legal battles.

Featured Posts

-

Recenzija Nova Drama I Glumacka Postava Na Jutarnjem Listu

May 20, 2025

Recenzija Nova Drama I Glumacka Postava Na Jutarnjem Listu

May 20, 2025 -

Trafic Portuaire D Abidjan Hausse Modeste En 2022

May 20, 2025

Trafic Portuaire D Abidjan Hausse Modeste En 2022

May 20, 2025 -

F1 Champions Support Bolsters Mick Schumachers Cadillac Bid

May 20, 2025

F1 Champions Support Bolsters Mick Schumachers Cadillac Bid

May 20, 2025 -

Pro D2 Colomiers Vs Oyonnax Et Montauban Vs Brive Le Match A Ne Pas Manquer

May 20, 2025

Pro D2 Colomiers Vs Oyonnax Et Montauban Vs Brive Le Match A Ne Pas Manquer

May 20, 2025 -

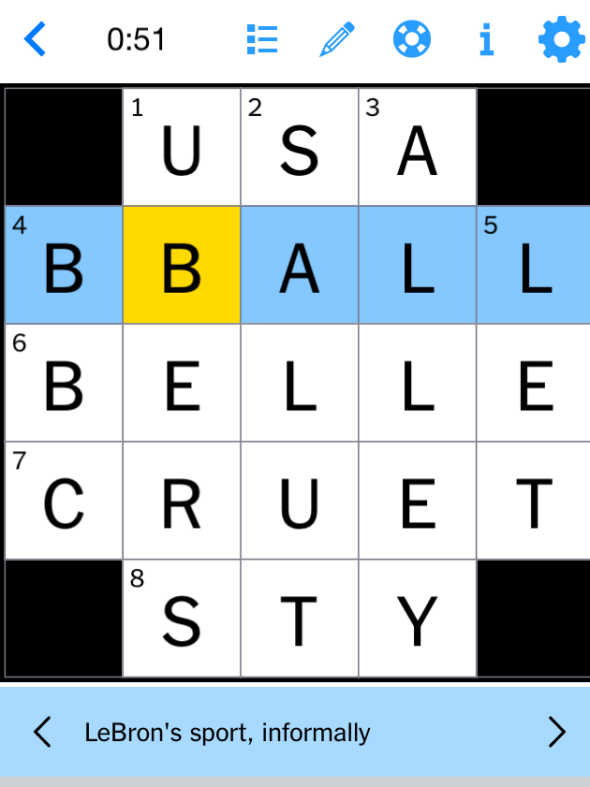

Quick Answers Nyt Mini Crossword March 13

May 20, 2025

Quick Answers Nyt Mini Crossword March 13

May 20, 2025

Latest Posts

-

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025 -

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025 -

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025