Global Bond Market Instability: A Posthaste Warning

Table of Contents

Rising Interest Rates and Their Impact

Central bank actions to combat inflation are significantly impacting bond yields and prices. Understanding these mechanics is crucial for navigating this unstable market.

The Mechanics of Interest Rate Hikes:

- Inverse Relationship: Bond prices and interest rates share an inverse relationship. When interest rates rise, the value of existing bonds with lower fixed interest rates decreases, as newer bonds offer higher yields.

- Impact on Bond Types: Government bonds, considered relatively safer, are also affected, though often less dramatically than corporate bonds, which are more sensitive to interest rate changes and credit risk.

- Inflation Expectations: Central banks consider inflation expectations when setting interest rates. Higher inflation expectations generally lead to higher interest rates to curb rising prices, further impacting bond values.

The Ripple Effect on Global Markets:

Rising rates in major economies like the US create a ripple effect across the globe.

- Capital Flight: Investors may move capital from countries with lower interest rates to those offering higher returns, impacting exchange rates and potentially destabilizing emerging markets.

- Currency Fluctuations: Changes in interest rates influence currency values, creating volatility and potentially impacting the value of international bond holdings.

- Contagion Risk: Instability in one market can quickly spread to others, creating a domino effect across the global financial system.

Geopolitical Risks and Bond Market Volatility

Geopolitical events significantly influence investor sentiment and bond market stability.

The War in Ukraine and its Economic Fallout:

- Energy Price Shocks: The war disrupted energy supplies, leading to price surges and increased inflation, impacting bond yields globally.

- Supply Chain Disruptions: Global supply chains have been severely impacted, contributing to inflationary pressures and increasing uncertainty in the market.

- Increased Risk Aversion: Geopolitical uncertainty makes investors more risk-averse, leading to a flight to safety and potentially impacting demand for riskier bonds.

Rising Geopolitical Tensions in Other Regions:

Several geopolitical flashpoints contribute to global bond market instability.

- US-China Relations: Tensions between the US and China create uncertainty impacting global trade and investment flows, affecting bond markets.

- Middle East Tensions: Political instability in the Middle East can impact oil prices, inflation, and global investor confidence, leading to market volatility.

- Other Conflicts: Emerging conflicts worldwide add to the overall geopolitical risk environment, impacting bond market sentiment negatively.

Inflation and its Persistent Threat to Bond Returns

Persistent inflation poses a severe threat to the real return of bond investments.

The Inflationary Spiral and its Impact on Bond Yields:

- Inflation-Interest Rate Relationship: High inflation typically leads to higher interest rates to control price increases, reducing the attractiveness of existing bonds with lower yields.

- Real Yield: Investors need to consider the real yield of bonds, which accounts for inflation. High inflation can erode the real return of bond investments significantly.

- Fixed-Income Strategies: Traditional fixed-income strategies relying on predictable returns are significantly challenged by high inflation and volatile interest rates.

Central Bank Responses and Their Effectiveness:

Central banks are employing various measures to curb inflation, but their effectiveness remains uncertain.

- Quantitative Tightening (QT): Central banks are reducing their balance sheets, potentially reducing liquidity and impacting bond markets.

- Interest Rate Hikes: Raising interest rates is a standard tool to curb inflation, but it can also slow economic growth or even trigger a recession.

- Recession Risk: Aggressive interest rate hikes increase the risk of a recession, potentially creating further instability in bond markets.

Strategies for Navigating Global Bond Market Instability

Investors need to adopt proactive strategies to mitigate the risks associated with the current market conditions.

Diversification and Portfolio Rebalancing:

- Asset Class Diversification: Diversifying investments across different asset classes (e.g., equities, real estate, commodities) can reduce overall portfolio risk.

- Geographic Diversification: Investing in bonds from different countries can reduce exposure to specific regional risks.

- Portfolio Rebalancing: Regularly rebalancing your portfolio helps maintain your desired asset allocation and reduces the impact of market fluctuations.

Hedging Strategies and Risk Management:

- Interest Rate Swaps: These can be used to hedge against interest rate risk, protecting against losses from rising rates.

- Options Strategies: Options contracts can provide flexibility and protection against adverse market movements.

- Professional Advice: Seeking advice from experienced financial advisors is crucial to develop a robust investment strategy and navigate the complex challenges of the current market.

Conclusion

The current global bond market instability is a serious concern driven by rising interest rates, geopolitical risks, and persistent inflation. The consequences could be significant for individuals and the global economy. Investors must be aware of these challenges. Don't ignore the warning signs. Take control of your investments and seek expert advice to mitigate the risks associated with global bond market instability. A proactive and diversified approach, coupled with professional guidance, is crucial for navigating this uncertain environment and protecting your financial future.

Featured Posts

-

First Away Test Win In Two Years Zimbabwe Triumphs In Sylhet

May 23, 2025

First Away Test Win In Two Years Zimbabwe Triumphs In Sylhet

May 23, 2025 -

Antonys Almost Transfer To Manchester Uniteds Biggest Rivals

May 23, 2025

Antonys Almost Transfer To Manchester Uniteds Biggest Rivals

May 23, 2025 -

Siren A Dark Comedy Series Starring Julianne Moore Trailer Reaction

May 23, 2025

Siren A Dark Comedy Series Starring Julianne Moore Trailer Reaction

May 23, 2025 -

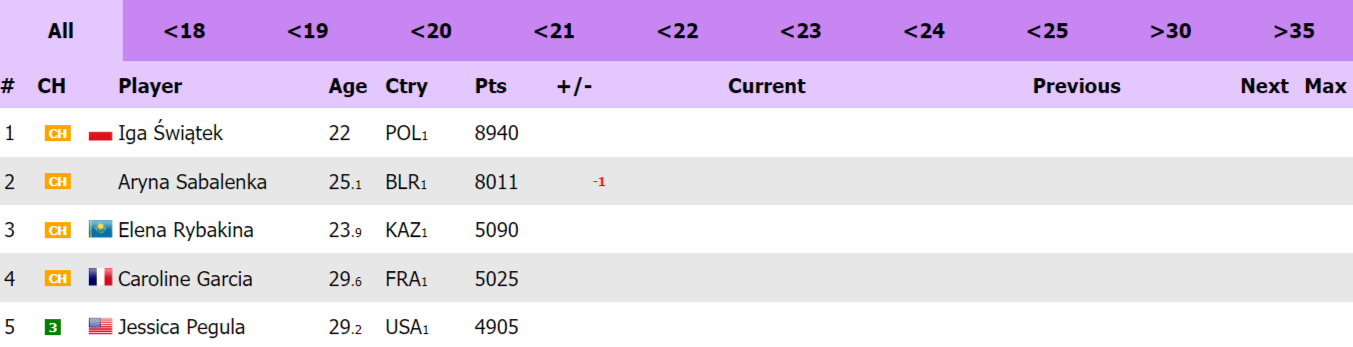

Rybakina Match S Eks Tretey Raketkoy Mira Pryamaya Translyatsiya

May 23, 2025

Rybakina Match S Eks Tretey Raketkoy Mira Pryamaya Translyatsiya

May 23, 2025 -

Check Before They Re Gone Movies Leaving Hulu This Month

May 23, 2025

Check Before They Re Gone Movies Leaving Hulu This Month

May 23, 2025

Latest Posts

-

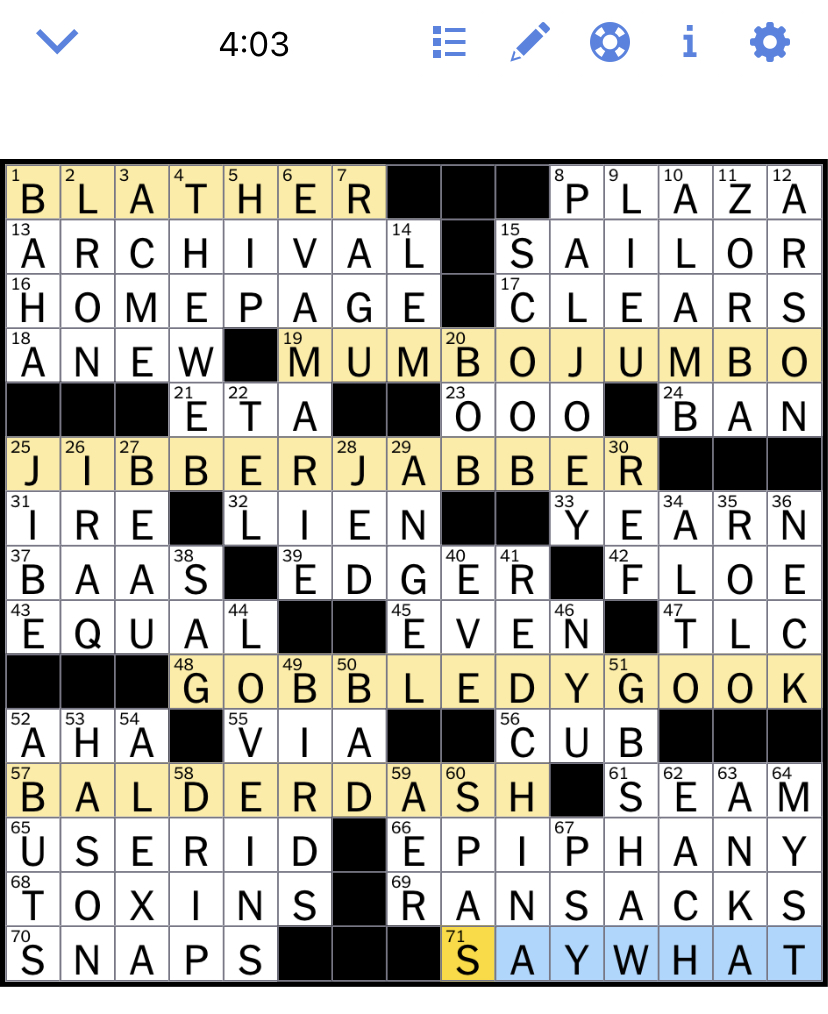

Nyt Mini Crossword March 6 2025 Complete Solution

May 23, 2025

Nyt Mini Crossword March 6 2025 Complete Solution

May 23, 2025 -

Nyt Mini Crossword Answers For March 6 2025

May 23, 2025

Nyt Mini Crossword Answers For March 6 2025

May 23, 2025 -

Nyt Mini Crossword March 13 2025 Hints To Help You Solve

May 23, 2025

Nyt Mini Crossword March 13 2025 Hints To Help You Solve

May 23, 2025 -

Just In Time Review Groffs Performance Makes This Bobby Darin Musical A Must See

May 23, 2025

Just In Time Review Groffs Performance Makes This Bobby Darin Musical A Must See

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025