Gold Investment Rises Amidst Trump's EU Trade Dispute

Table of Contents

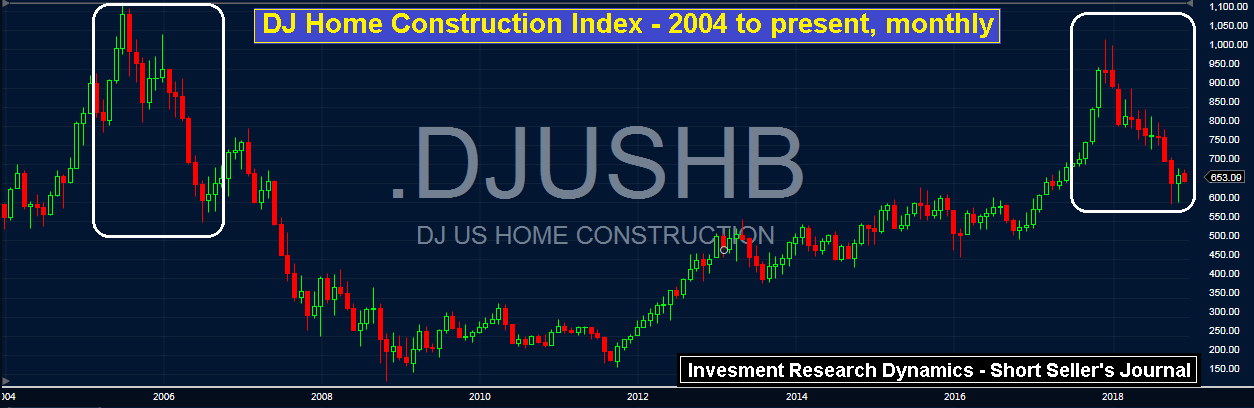

The Impact of Trade Wars on Global Markets

Trade disputes, like the ongoing conflict between the US and the EU, inject significant volatility into global markets. These disputes, characterized by escalating tariffs and protectionist measures, create a climate of uncertainty that negatively impacts various sectors.

- Increased tariffs lead to higher prices for consumers: Tariffs increase the cost of imported goods, leading to inflation and reduced consumer purchasing power.

- Uncertainty discourages business investment and expansion: Businesses hesitate to invest and expand when facing unpredictable trade policies, hindering economic growth.

- Weakening global economic growth negatively impacts stock markets: The uncertainty and decreased business activity translate to lower corporate profits and a decline in stock market performance.

- Safe-haven assets like gold become more attractive: In times of economic turmoil, investors seek refuge in assets perceived as stable and less susceptible to market fluctuations. This is where the appeal of gold investment intensifies.

These factors combine to create a perfect storm for investors looking for stability, pushing them towards gold investment as a way to protect their portfolios. The related keywords, trade war, economic uncertainty, market volatility, and safe haven assets, all highlight the current climate driving this trend.

Gold as a Safe Haven Asset During Economic Uncertainty

Gold has a long and well-established history as a safe haven asset, particularly during times of economic turmoil and geopolitical instability. Its inherent properties make it a desirable investment when market confidence wanes.

- Gold's inherent value is unaffected by currency fluctuations: Unlike fiat currencies, gold's value is not tied to any government or economic policy.

- It's a tangible asset, providing a sense of security: Holding physical gold offers a tangible sense of security that many investors find appealing, especially during times of uncertainty.

- Gold prices often rise during times of geopolitical instability: Historically, geopolitical events and uncertainty have driven up demand for gold, increasing its price.

- Historically, gold investment has provided a hedge against inflation: Gold's price often rises in line with or even outpaces inflation, making it a valuable tool for preserving purchasing power.

The keywords safe haven, inflation hedge, precious metals, tangible asset, and portfolio diversification all underscore gold's role as a secure investment option in uncertain times. This makes understanding the benefits of gold investment crucial for navigating economic volatility.

Analyzing the Recent Surge in Gold Investment

Since the escalation of the EU trade dispute, gold investment has seen a notable increase. While precise figures fluctuate daily, several indicators point to a significant surge.

- Significant increases in gold ETF holdings: Exchange-traded funds (ETFs) that track gold prices have seen substantial inflows of capital, reflecting increased investor interest.

- Increased demand for physical gold (bullion, coins): Demand for physical gold bars and coins has also risen, indicating a flight to tangible assets.

- Investor sentiment plays a crucial role: Negative sentiment towards global economic prospects, fueled by trade disputes, directly contributes to the higher demand for gold.

- Current gold investment levels are comparable to previous periods of market instability: The current surge echoes similar trends observed during other periods of significant global economic uncertainty.

The related keywords gold ETF, gold bullion, gold coins, investor sentiment, gold price forecast, and precious metal investment help to describe this recent phenomenon and its underlying causes.

Who is Investing in Gold?

The increased demand for gold is being driven by a diverse range of investors:

- Retail investors seeking diversification: Individual investors are adding gold to their portfolios to diversify their holdings and mitigate risk.

- Institutional investors hedging against risk: Large institutions, such as pension funds and hedge funds, are increasing their gold holdings as a hedge against market downturns.

- Central banks adding to their gold reserves: Several central banks worldwide are bolstering their gold reserves, viewing gold as a stable store of value.

Understanding the types of investors – retail investor, institutional investor, central bank gold reserves, portfolio diversification, and risk management – helps to explain the breadth of the current surge in gold investment.

Conclusion

The escalating trade dispute between the US and EU has fueled uncertainty in global markets, leading to a significant increase in gold investment. This surge reflects gold's established role as a safe-haven asset during times of economic turmoil. The benefits of gold investment, such as its resistance to currency fluctuations and its historical role as an inflation hedge, are attracting investors seeking stability and security in a volatile market. Consider diversifying your investment portfolio with gold. Learn more about the benefits of gold investment and how to incorporate it into your financial strategy by researching different gold investment options. Don't miss out on the opportunities presented by the current surge in gold investment. Explore your gold investment options today!

Featured Posts

-

Janet Jackson 2025 Icon Award Recipient

May 27, 2025

Janet Jackson 2025 Icon Award Recipient

May 27, 2025 -

The Blue Books Comeback Are Exams Getting Harder

May 27, 2025

The Blue Books Comeback Are Exams Getting Harder

May 27, 2025 -

Trump Kueloenmegbizottja Ismet Talalkozott Putyinnal

May 27, 2025

Trump Kueloenmegbizottja Ismet Talalkozott Putyinnal

May 27, 2025 -

Dylan Efron Rescues Two Women From Drowning In Miami

May 27, 2025

Dylan Efron Rescues Two Women From Drowning In Miami

May 27, 2025 -

The Only Logical Choice One Legacy Character For The Next Alien Film

May 27, 2025

The Only Logical Choice One Legacy Character For The Next Alien Film

May 27, 2025

Latest Posts

-

Exclusion De Marine Le Pen En 2027 Jacobelli Repond A Hanouna

May 30, 2025

Exclusion De Marine Le Pen En 2027 Jacobelli Repond A Hanouna

May 30, 2025 -

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025 -

Le 9 Mai 2025 Laurent Jacobelli Decortique La Presence D Arcelor Mittal En Russie

May 30, 2025

Le 9 Mai 2025 Laurent Jacobelli Decortique La Presence D Arcelor Mittal En Russie

May 30, 2025 -

Hanouna Le Pen 2027 Jacobelli S Insurge Contre Une Potentielle Exclusion

May 30, 2025

Hanouna Le Pen 2027 Jacobelli S Insurge Contre Une Potentielle Exclusion

May 30, 2025 -

Emission Integrale Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Emission Integrale Europe 1 Soir Du 19 Mars 2025

May 30, 2025