Gold Investment Soars: Impact Of Trump's Latest Trade Actions

Table of Contents

Understanding the Safe Haven Appeal of Gold

Gold as a Hedge Against Uncertainty

Gold has historically served as a safe haven asset during times of economic and political instability. Its value tends to rise when other assets, such as stocks and bonds, decline. This is because gold is considered a non-yielding asset, meaning its value is not tied to interest rates or company performance. This makes it a valuable hedge against inflation and currency devaluation.

- Examples: The 2008 financial crisis, the 2011 European debt crisis, and various geopolitical events (e.g., the Gulf War) all saw significant increases in gold prices as investors sought refuge from market volatility.

- Inverse Correlation: Gold often shows an inverse correlation with the US dollar. When the dollar weakens, the price of gold (denominated in USD) tends to rise, making gold an attractive investment during periods of dollar depreciation.

- Inflation Hedge: Gold is often considered a hedge against inflation. As inflation rises, the purchasing power of fiat currencies decreases, leading investors to seek stores of value like gold.

The Psychology of Fear and Investment

Investor sentiment and fear play a crucial role in driving gold investment during times of trade wars and global uncertainty. The "flight to safety" phenomenon is a key driver of gold demand. When investors perceive increased risk, they move away from riskier assets (stocks, bonds) towards perceived safe havens, such as gold.

- Flight to Safety: This phenomenon is amplified by media coverage of global events, often shaping investor perception and driving up demand for gold. Negative news surrounding trade wars increases uncertainty and fuels the flight to safety, boosting gold prices.

- Market Volatility: Increased market volatility, directly resulting from Trump's trade actions, exacerbates investor fear and accelerates the demand for gold. Investors seek the stability and perceived security that gold offers in tumultuous times.

Trump's Trade Actions and Their Impact on Global Markets

Specific Trade Policies and Their Influence

The Trump administration's trade actions, including the imposition of tariffs on various goods and the initiation of trade wars with major global economies, have significantly impacted market confidence and investor behavior. This unpredictability creates a climate of uncertainty, driving investors towards safer investment alternatives.

- Tariffs and Trade Wars: The imposition of tariffs on goods from China, the European Union, and other countries has created uncertainty about global trade flows and supply chains. This uncertainty negatively impacts investor confidence and market stability.

- Impact on Global Indices: Trade disputes and related uncertainty have led to fluctuations in major global market indices, such as the Dow Jones Industrial Average and the S&P 500, prompting many investors to seek the relative stability of gold.

Increased Market Volatility and Uncertainty

The unpredictability of Trump's trade policies has created a volatile market environment, characterized by significant fluctuations in asset prices and currency exchange rates. This heightened volatility prompts investors to seek safer alternatives, leading to increased gold investment.

- Currency Exchange Rates: Trade tensions and the resulting uncertainty often influence currency exchange rates. A weakening US dollar, for example, often boosts the price of gold, making it a more attractive investment for international investors.

- Gold Price Fluctuations: The inherent volatility in the market, fueled by Trump’s trade actions, contributes to unpredictable gold price fluctuations, both positive and negative. Understanding this volatility is essential for strategic gold investment.

Investment Strategies in the Current Gold Market

Diversification and Portfolio Allocation

Including gold as part of a diversified investment portfolio is crucial for risk mitigation during uncertain times. Gold's low correlation with other asset classes helps reduce overall portfolio volatility.

- Investment Options: Investors can access gold through various methods: physical gold (bars, coins), gold exchange-traded funds (ETFs), and gold mining stocks. Each option presents a different level of risk and potential return.

- Portfolio Allocation: The ideal allocation of gold within a portfolio depends on individual risk tolerance and investment goals. A small percentage allocation to gold can significantly reduce overall portfolio risk without drastically altering return expectations.

Analyzing the Long-Term Outlook for Gold

The long-term outlook for gold investment depends on several interconnected economic and geopolitical factors. While short-term price fluctuations are influenced by market sentiment and current events, long-term trends are shaped by broader economic conditions and global stability.

- Factors Influencing Gold Prices: Inflationary pressures, geopolitical instability, and a weakening US dollar can all drive further increases in gold prices. However, factors such as a strengthening dollar or increased interest rates could lead to a correction in gold prices.

- Long-Term Potential: Gold remains a valuable asset class for long-term investors seeking diversification and a hedge against inflation and economic uncertainty.

Conclusion

Trump's trade actions have fueled market uncertainty, leading to increased demand for gold as a safe haven asset. The "flight to safety" phenomenon, combined with increased market volatility, has boosted gold investment significantly. Understanding the role of gold in a diversified investment portfolio is crucial during times of economic and political instability. To mitigate risks associated with current market uncertainties, research and consider including gold investment as part of your overall investment strategy. Explore various gold investment options to find the approach that aligns with your risk tolerance and financial goals. Protect your portfolio with gold.

Featured Posts

-

The Disappearance Unraveling The Mystery

May 25, 2025

The Disappearance Unraveling The Mystery

May 25, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 25, 2025 -

Naomi Campbell Met Gala Ban Feud With Anna Wintour

May 25, 2025

Naomi Campbell Met Gala Ban Feud With Anna Wintour

May 25, 2025 -

Planning Your Memorial Day Trip Smart Tips For Booking Flights In 2025

May 25, 2025

Planning Your Memorial Day Trip Smart Tips For Booking Flights In 2025

May 25, 2025 -

Ces Unveiled Europe Devoilement Des Innovations A Amsterdam

May 25, 2025

Ces Unveiled Europe Devoilement Des Innovations A Amsterdam

May 25, 2025

Latest Posts

-

Ralph Fiennes As Coriolanus Snow Analyzing Fan Reaction And Casting Speculation

May 25, 2025

Ralph Fiennes As Coriolanus Snow Analyzing Fan Reaction And Casting Speculation

May 25, 2025 -

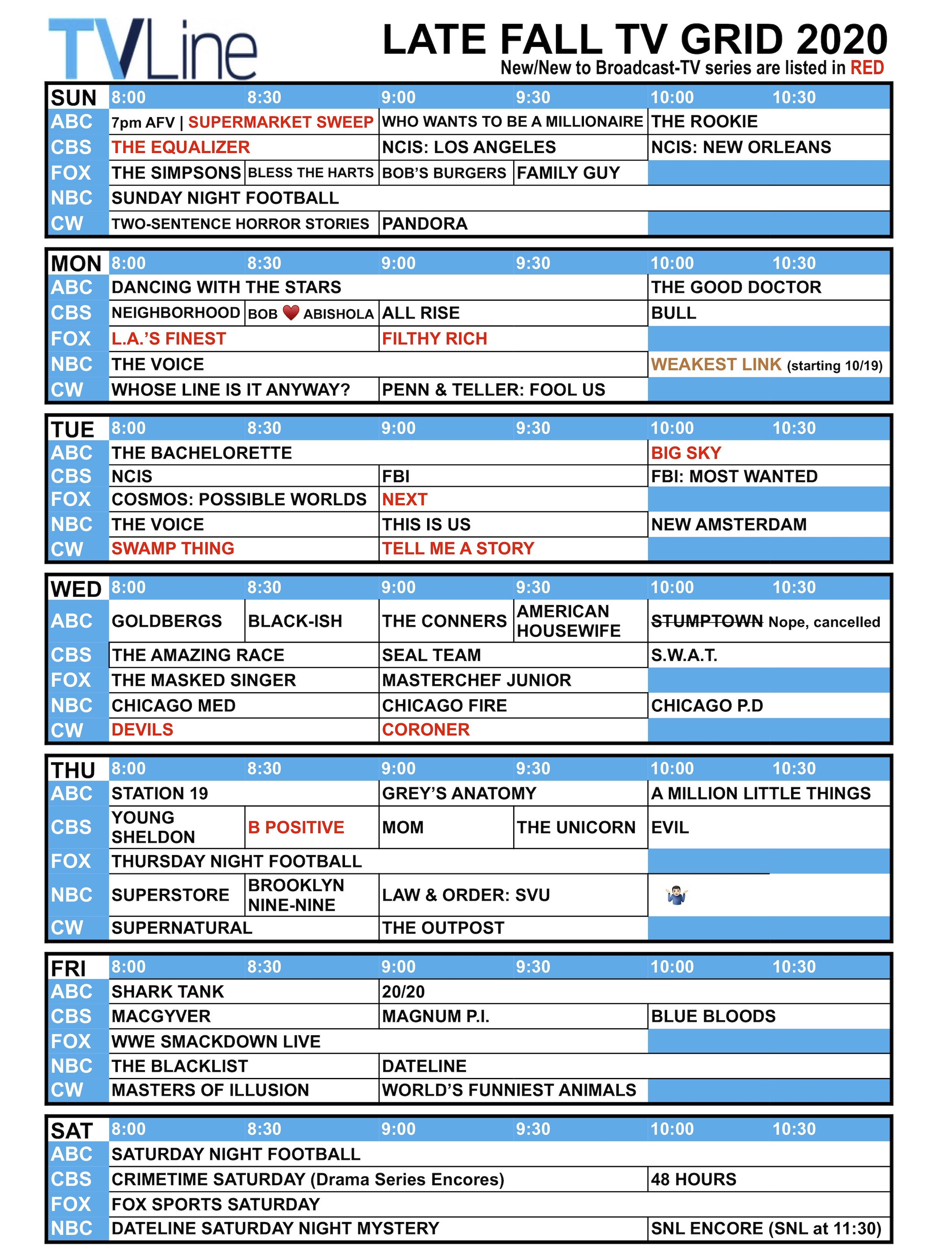

Lock Up Tv Guide Top 5 Action Episodes

May 25, 2025

Lock Up Tv Guide Top 5 Action Episodes

May 25, 2025 -

Lock Up 5 Action Packed Episodes You Shouldnt Miss Tv Guide

May 25, 2025

Lock Up 5 Action Packed Episodes You Shouldnt Miss Tv Guide

May 25, 2025 -

Solving The Disappearance Practical Steps And Strategies

May 25, 2025

Solving The Disappearance Practical Steps And Strategies

May 25, 2025 -

Escape Dr Terrors House Of Horrors Tips And Tricks For Survival

May 25, 2025

Escape Dr Terrors House Of Horrors Tips And Tricks For Survival

May 25, 2025