Gold Investment Soars On Fears Of Trump's EU Trade Actions

Table of Contents

Rising Trade Tensions Fuel Gold Demand

The current state of US-EU trade relations is fraught with tension. Threats of increased tariffs and the potential for a full-blown trade war are creating significant market instability. This uncertainty is a primary driver behind the increased demand for gold. Investors, fearing losses in other asset classes, are turning to gold as a hedge against potential economic downturns.

- Increased tariffs and potential trade wars create market instability: The unpredictable nature of trade policies introduces significant risk into traditional investments like stocks and bonds.

- Investors seek safe haven assets during times of economic uncertainty: Gold's historical performance during periods of economic turmoil makes it an attractive option for risk-averse investors.

- Gold's historical performance as a hedge against inflation and economic downturn: Throughout history, gold has demonstrated its ability to maintain value, even during periods of high inflation or recession.

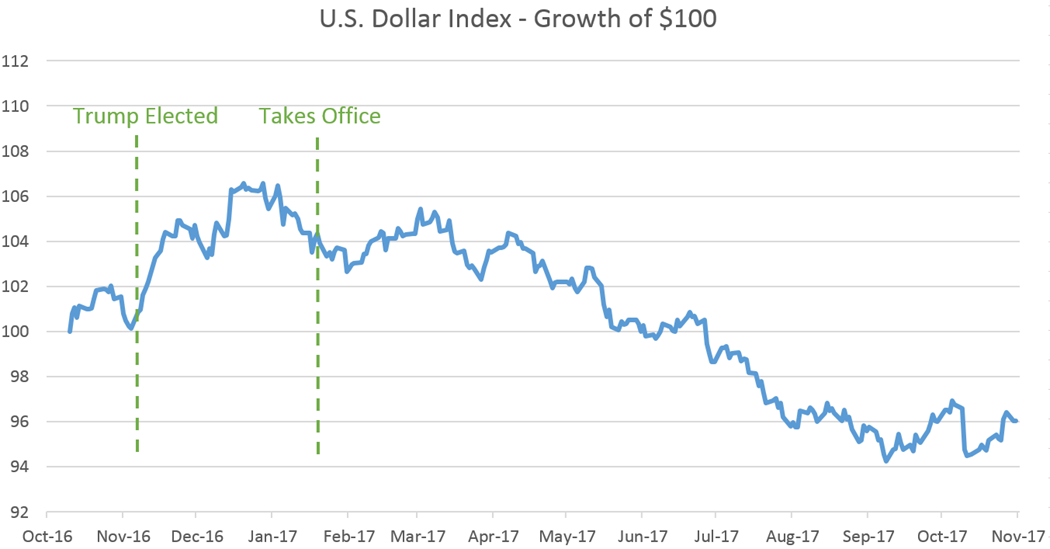

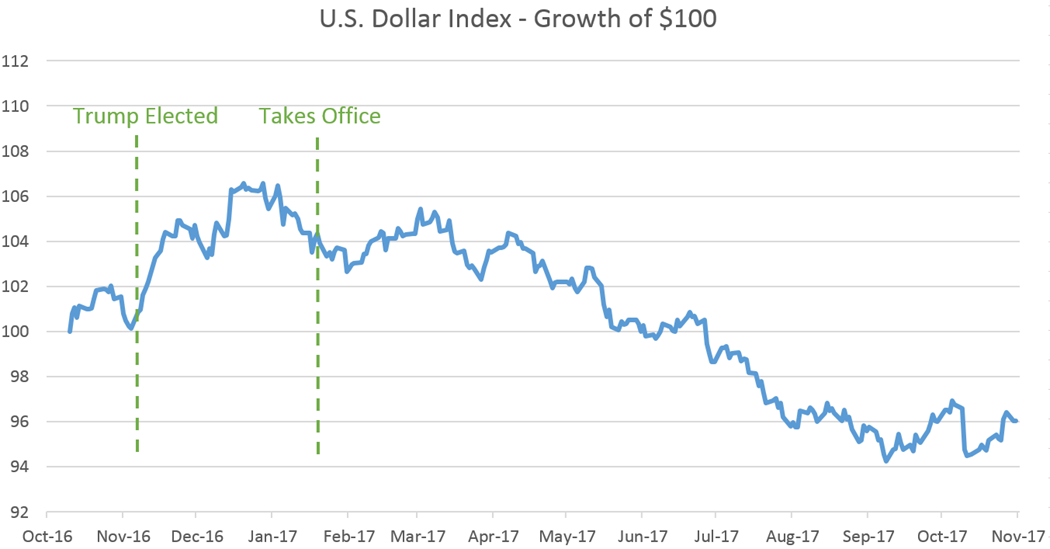

- Weakening dollar strengthens gold's appeal to international investors: A weaker US dollar makes gold more affordable for international investors, further increasing demand.

Gold as a Safe Haven Asset During Economic Uncertainty

Gold's reputation as a safe haven asset is well-established. During times of political and economic turmoil, investors flock to gold because of its inherent value and its lack of correlation with other asset classes. This makes it a valuable tool for portfolio diversification.

- Gold's inherent value and lack of correlation with other asset classes: Unlike stocks and bonds, gold's value is not tied to the performance of specific companies or economies.

- Portfolio diversification benefits of including gold: Adding gold to a portfolio can help reduce overall risk and improve returns by offsetting losses in other assets.

- Increased demand for physical gold and gold ETFs (exchange-traded funds): Investors are choosing both physical gold bars and coins, as well as gold ETFs, to gain exposure to the gold market.

- Central bank gold reserves and their impact on market sentiment: Central banks around the world continue to hold significant gold reserves, signaling confidence in gold's long-term value and influencing market sentiment.

Analyzing the Impact on Gold Prices and Investment Strategies

The current gold price trends clearly reflect the impact of US-EU trade tensions. As uncertainty increases, so does the demand for gold, pushing prices higher. This relationship highlights the importance of understanding the interplay between geopolitical events and gold investment strategies.

- Short-term and long-term price projections based on current market conditions: While predicting future gold prices is impossible, analysts often base projections on various economic indicators and geopolitical events.

- Different investment vehicles for accessing the gold market (physical gold, ETFs, mining stocks): Investors can access the gold market through various avenues, each with its own associated risks and rewards.

- Risk assessment and diversification strategies for gold investors: A well-diversified portfolio containing gold can significantly reduce risk. Investors should carefully assess their own risk tolerance before making investment decisions.

- Importance of considering individual investment goals and risk tolerance: Before investing in gold, investors should clearly define their financial goals and determine their comfort level with different levels of risk.

Potential Future Scenarios for Gold Investment

The future of gold investment depends largely on how the US-EU trade dispute unfolds. Several scenarios are possible:

- Gold price predictions under different trade scenarios: If tensions escalate, gold prices are likely to rise further. A resolution, however, could lead to a price correction.

- Impact on other precious metals markets (silver, platinum, palladium): Changes in gold prices often influence the markets for other precious metals.

- Implications for global financial markets: The gold market acts as a barometer for global economic health, and its movements often reflect broader financial market trends.

Conclusion

The escalating trade tensions between the US and the EU have undeniably fueled the surge in gold investment. Gold's status as a safe haven asset, combined with significant economic uncertainty, has driven investors to seek the security and stability it offers. Understanding the factors influencing gold prices and employing sound investment strategies are critical for navigating this dynamic market.

Call to Action: Are you considering adding gold to your investment portfolio to mitigate risks associated with the current global trade environment? Learn more about diversifying your holdings with effective gold investment strategies and secure your financial future. Contact a financial advisor to explore your options in gold investment today.

Featured Posts

-

How To Train Your Dragon A Detailed Look At The Toothless And Red Death Size Discrepancy

May 26, 2025

How To Train Your Dragon A Detailed Look At The Toothless And Red Death Size Discrepancy

May 26, 2025 -

Combattre La Desinformation Le Role De La Rtbf Lors De La Journee Mondiale Du Fact Checking

May 26, 2025

Combattre La Desinformation Le Role De La Rtbf Lors De La Journee Mondiale Du Fact Checking

May 26, 2025 -

Russell And The Typhoons A Deep Dive Into The Bands History And Music

May 26, 2025

Russell And The Typhoons A Deep Dive Into The Bands History And Music

May 26, 2025 -

Climate Change And The Rise Of Dangerous Fungi

May 26, 2025

Climate Change And The Rise Of Dangerous Fungi

May 26, 2025 -

Laviolette Out New York Rangers Seek New Coach Following Playoff Failure

May 26, 2025

Laviolette Out New York Rangers Seek New Coach Following Playoff Failure

May 26, 2025

Latest Posts

-

Rent Regulation Reform Assessing The Impact On Tenant Protection

May 28, 2025

Rent Regulation Reform Assessing The Impact On Tenant Protection

May 28, 2025 -

Green Home Loan Program Expands Cabinet Commits E750 Million Leverages Eu Funding

May 28, 2025

Green Home Loan Program Expands Cabinet Commits E750 Million Leverages Eu Funding

May 28, 2025 -

The Unintended Consequences Of Rent Regulation Tenants Bear The Brunt

May 28, 2025

The Unintended Consequences Of Rent Regulation Tenants Bear The Brunt

May 28, 2025 -

Eu Climate Funds Fuel E750 Million Green Home Loan Expansion

May 28, 2025

Eu Climate Funds Fuel E750 Million Green Home Loan Expansion

May 28, 2025 -

Analysis How Rent Regulation Changes Affect Tenants Well Being

May 28, 2025

Analysis How Rent Regulation Changes Affect Tenants Well Being

May 28, 2025