Gold Market Reacts To Trump's EU Trade War Threats

Table of Contents

Safe Haven Demand and Gold Prices

Gold has long been considered a safe haven asset, a refuge for investors seeking to protect their portfolios during times of economic turmoil. Trade wars, by their very nature, inject significant volatility into the markets, fueling investor anxiety and uncertainty. This uncertainty drives investors towards assets perceived as less risky, pushing up demand for gold. Historically, periods of heightened geopolitical risk, such as escalating trade disputes, have shown a strong positive correlation with gold price increases.

The chart below (insert chart/graph illustrating correlation between trade war escalation and gold price fluctuations here) clearly illustrates this relationship. As trade tensions rise, so does the price of gold. Several factors contribute to this phenomenon:

- Increased geopolitical risk leads to higher gold demand: Uncertainty surrounding trade policy creates a flight to safety, with investors seeking refuge in tangible assets like gold.

- Weakening dollar often accompanies trade tensions, boosting gold prices (inverse relationship): A weaker US dollar typically makes gold more affordable for investors holding other currencies, further increasing demand.

- Investor flight to safety drives gold purchases: Fear of market corrections and potential losses in other asset classes fuels a rush into gold, driving up prices.

Impact on the Euro and Gold

The relationship between the Euro and gold prices is also crucial in understanding the impact of Trump's trade war threats. The EU is a major trading partner of the US, and the threat of escalating tariffs significantly impacts the Euro's strength. A weakening Euro makes gold more expensive for European investors, potentially dampening demand within the EU. However, the overall effect is nuanced. While a weaker Euro might reduce European demand, the increased global uncertainty caused by the trade war could simultaneously boost global demand for gold as a safe haven, offsetting the Euro's impact.

- EU economic vulnerability during trade disputes: The EU's economy is highly susceptible to disruptions caused by trade wars.

- Euro depreciation as a result of trade uncertainty: Market uncertainty concerning the EU economy weakens the Euro against other currencies.

- Impact on European gold investments: A weaker Euro increases the cost of gold for European investors, but global uncertainty can still drive demand.

Central Bank Reactions and Gold Reserves

Central banks play a significant role in the gold market, both as major holders of gold reserves and as influencers of monetary policy. In response to trade tensions, central banks might adjust their monetary policies, impacting interest rates and potentially influencing gold prices. For example, a decrease in interest rates could make gold a more attractive investment compared to low-yield bonds. Additionally, central banks' actions concerning their gold reserves can also affect market sentiment and prices. Increased purchases of gold by central banks signal confidence in the precious metal's long-term value.

- Potential interest rate adjustments by central banks: Lower interest rates can boost gold's attractiveness.

- Changes in central bank gold purchases or sales: Central bank activity significantly influences market perception.

- The influence of central bank actions on market sentiment: Central bank decisions can either reinforce or counter market trends.

Future Outlook for Gold Amidst Ongoing Trade Disputes

Predicting the future trajectory of gold prices amidst ongoing trade uncertainties is inherently challenging. However, considering the current geopolitical landscape and the historical correlation between trade wars and gold prices, several scenarios are plausible. A continuation or escalation of trade disputes could lead to further gold price increases as investors seek safe havens. Conversely, a resolution of trade tensions could potentially lead to a decline in gold prices as investor sentiment improves. Economic forecasts from reputable sources (cite specific sources here) will be key in gauging the future trajectory of gold.

- Predictions for gold price movements in the short and long term: (Insert predictions here, citing sources).

- Potential catalysts for further gold price increases or decreases: (List potential catalysts, e.g., further trade escalation, economic slowdown, etc.).

- Assessment of the overall risk environment: (Analyze the overall risk environment and its impact on gold's value).

Conclusion: Navigating the Gold Market During Trump's EU Trade War Threats

Trump's trade war threats against the EU have created significant uncertainty in the global markets, impacting the gold market substantially. Gold's role as a safe haven asset remains crucial during periods of economic and political turmoil. The weakening Euro and potential central bank reactions further complicate the picture. Investors considering gold as part of their portfolio diversification should carefully analyze the current market conditions and potential future scenarios. Consider long-term gold investments and incorporate robust diversification strategies to manage risk effectively. Stay updated on the latest developments in the gold market and how it reacts to Trump's EU trade war threats by subscribing to our newsletter!

Featured Posts

-

Is Immigration Fueling Californias Population Growth

May 27, 2025

Is Immigration Fueling Californias Population Growth

May 27, 2025 -

Benson Boone And Lainey Wilson Confirmed For American Music Awards Performance

May 27, 2025

Benson Boone And Lainey Wilson Confirmed For American Music Awards Performance

May 27, 2025 -

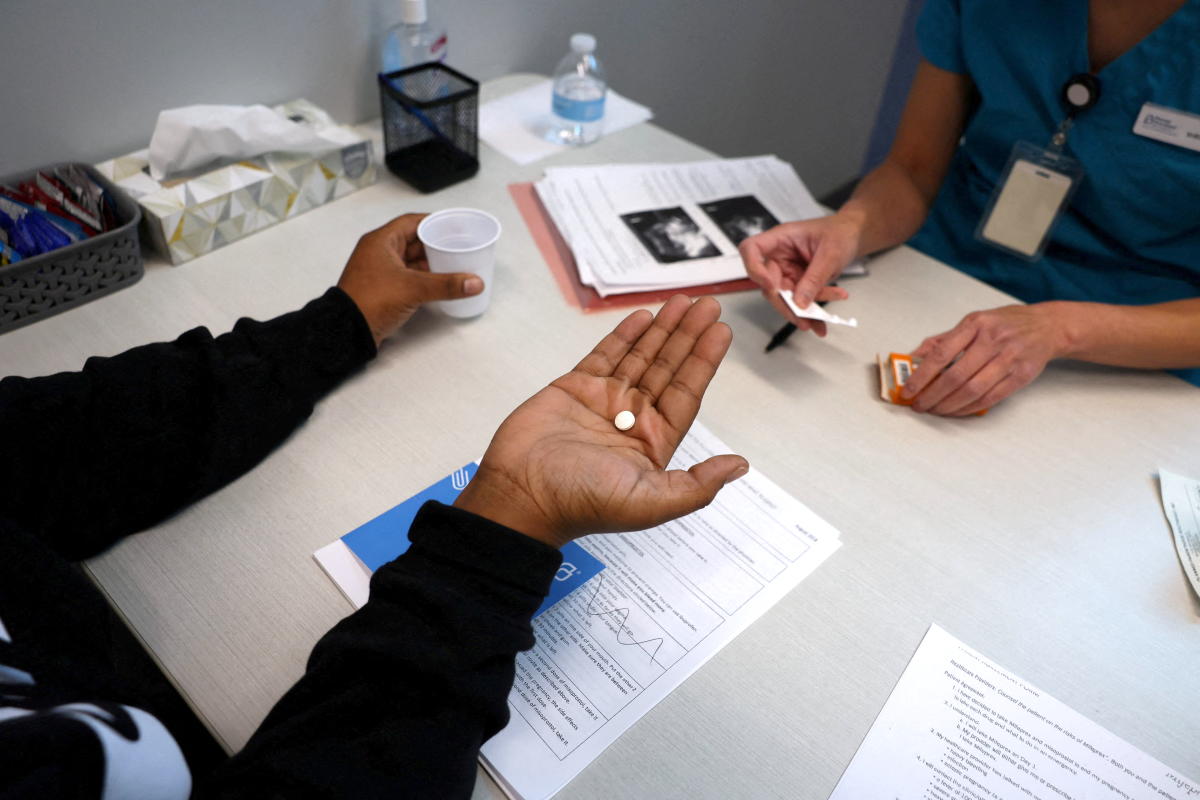

The Impact Of Over The Counter Birth Control In A Post Roe World

May 27, 2025

The Impact Of Over The Counter Birth Control In A Post Roe World

May 27, 2025 -

Where To Watch The 1923 Season 2 Finale Episode 7 Streaming Details

May 27, 2025

Where To Watch The 1923 Season 2 Finale Episode 7 Streaming Details

May 27, 2025 -

Blue Books Are Back A Look At Traditional Exams Resurgence

May 27, 2025

Blue Books Are Back A Look At Traditional Exams Resurgence

May 27, 2025

Latest Posts

-

19 Mars 2025 Ecouter L Integrale D Europe 1 Soir

May 30, 2025

19 Mars 2025 Ecouter L Integrale D Europe 1 Soir

May 30, 2025 -

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025

Podcast Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025 -

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025

Marine Le Pen Et La Presidentielle 2027 Un Possible Empechement Selon Jacobelli

May 30, 2025 -

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Reecouter L Integrale D Europe 1 Soir Du 19 Mars 2025

May 30, 2025