Gold Market Update: Profits Drive Prices Down Following Trade Deal News

Table of Contents

Profit-Taking Drives Gold Prices Lower

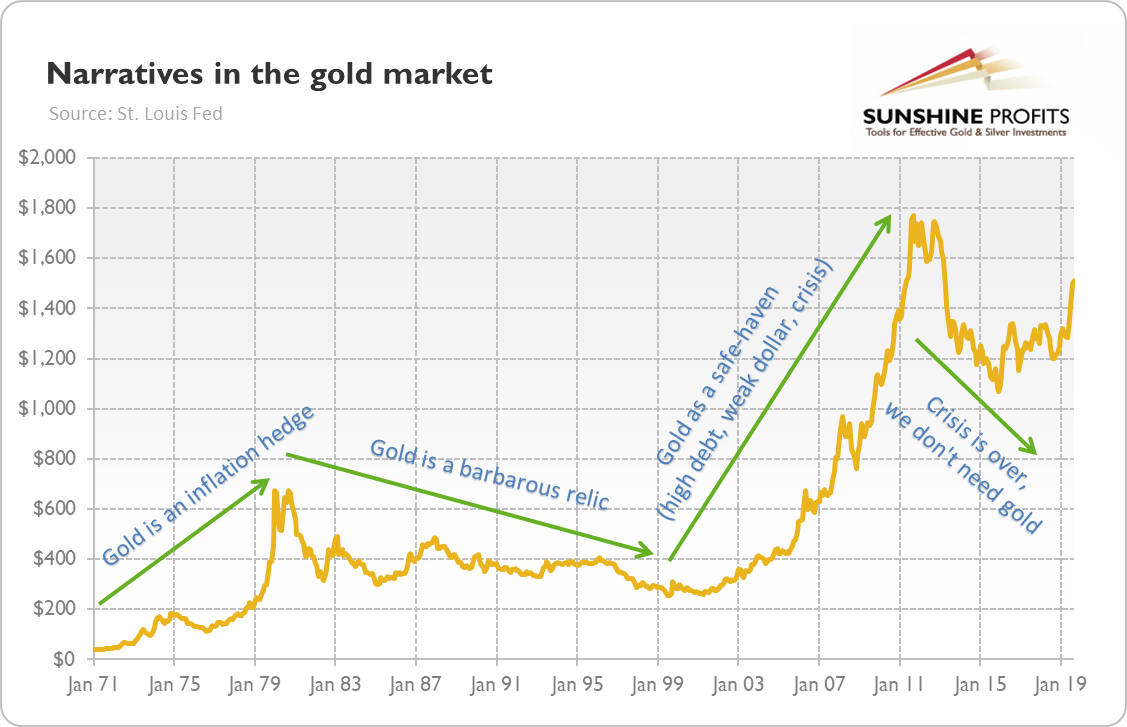

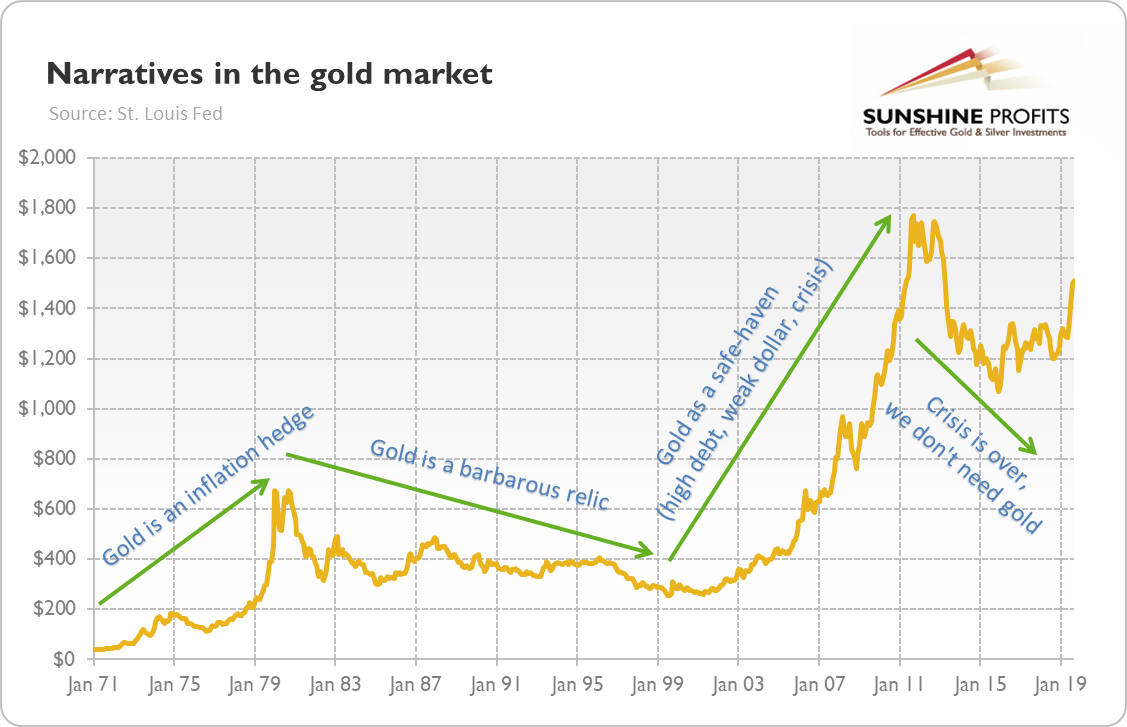

The sharp drop in gold prices can be largely attributed to profit-taking. As a safe-haven asset, gold often sees increased demand during times of economic uncertainty. However, with the signing of the trade deal, investor confidence has risen, leading many to believe the worst is behind us. This increased optimism has spurred profit-taking in the gold market, as investors cash in on their gains. They anticipate either further price drops or are simply looking to secure their profits before any potential market corrections.

- Increased investor confidence: The trade deal has significantly boosted investor confidence, reducing anxieties about future trade wars and economic instability.

- Shift from safe-haven assets: Investors are shifting away from traditional safe-haven assets like gold towards riskier investments, expecting higher returns in a more stable economic climate.

- Technical analysis: Technical analysis suggests that gold prices have reached resistance levels, indicating a potential for a price correction. Trading charts show a clear downward trend.

- Trading volume and price fluctuations: High trading volumes accompanied the recent price drops, suggesting significant investor activity and a rapid shift in market sentiment. Daily gold price fluctuations have been more pronounced than in previous weeks.

The Impact of the Trade Deal on Investor Sentiment

The specifics of the newly signed trade deal are crucial in understanding the shift in investor sentiment. The deal's provisions, focusing on reduced tariffs and increased trade cooperation, have created a sense of reduced uncertainty in the global marketplace. This reduced uncertainty is a primary driver behind investors moving away from gold, a traditional safe haven asset sought during times of geopolitical instability or economic uncertainty.

- Key features of the trade deal: The deal's key features include [insert specific details of the trade deal, e.g., tariff reductions on specific goods, increased market access, dispute resolution mechanisms]. These features contribute to improved trade relations and projected economic growth.

- Expert opinions: Leading financial analysts [cite specific analysts and their viewpoints] believe the trade deal will positively impact global growth, diminishing the appeal of gold as a safe-haven investment.

- Gold price comparison: Comparing gold prices before and after the trade deal announcement reveals a clear downward trend. [Insert specific data illustrating the price difference].

- Alternative investments: Investors are increasingly turning to alternative investment options like [mention specific alternatives, e.g., equities, corporate bonds, emerging market assets], which are viewed as offering higher potential returns in this improved economic outlook.

Other Factors Influencing Gold Prices

While the trade deal is a significant factor, it's not the only one influencing gold prices. Several other macroeconomic factors play a role.

- US dollar strength: A strengthening US dollar often puts downward pressure on gold prices, as gold is priced in USD. [Include data on the US dollar index and its correlation with gold prices].

- Interest rate changes: Potential interest rate hikes by central banks can also impact gold prices, as higher interest rates make holding non-yielding assets like gold less attractive. [Discuss the current interest rate environment and its potential implications].

- Inflation expectations: Inflation expectations play a crucial role. High inflation might push investors towards gold as a hedge against inflation, but low inflation reduces this appeal. [Include current inflation data and its potential effects].

- Geopolitical events: Significant geopolitical events, such as conflicts or political instability, can still impact investor sentiment and gold prices. [Mention any relevant recent geopolitical developments].

Looking Ahead: Future Predictions for the Gold Market

Predicting the future of gold prices is inherently challenging, but based on current market conditions, several scenarios are plausible.

- Short-term predictions: In the short term, a continued price decline is possible, driven by profit-taking and the ongoing positive sentiment surrounding the trade deal.

- Long-term outlook: The long-term outlook for gold is more uncertain. A potential rebound could occur if geopolitical tensions rise or economic uncertainty resurfaces.

- Potential catalysts: Future price changes could be driven by unforeseen geopolitical events, shifts in monetary policy, or unexpected changes in inflation rates.

- Investor strategies: Investors may want to consider their individual risk tolerance and investment goals when deciding whether to hold, sell, or buy gold.

Conclusion: Gold Market Update and Next Steps

This Gold Market Update highlights the significant impact of the recent trade deal on gold prices. Profit-taking, driven by increased investor confidence and a shift away from safe-haven assets, has been a primary factor in the recent decline. However, other macroeconomic factors, such as the strength of the US dollar and interest rate changes, continue to influence gold market trends. To stay informed about future gold market updates and gold price updates, subscribe to our regular newsletters or follow us on social media for the latest insights. Remember to consult a qualified financial advisor before making any investment decisions in the gold market. Stay informed on all gold market updates for the best investment strategies.

Featured Posts

-

Who Is Stephen Miller Understanding His Potential Nsa Appointment

May 18, 2025

Who Is Stephen Miller Understanding His Potential Nsa Appointment

May 18, 2025 -

Mlb History Made Riley Greenes Double Ninth Inning Home Run Performance

May 18, 2025

Mlb History Made Riley Greenes Double Ninth Inning Home Run Performance

May 18, 2025 -

Three Words Mike Myers And The Shrek Role

May 18, 2025

Three Words Mike Myers And The Shrek Role

May 18, 2025 -

11 Inmates Escape New Orleans Jail Murder Suspects Among Fugitives

May 18, 2025

11 Inmates Escape New Orleans Jail Murder Suspects Among Fugitives

May 18, 2025 -

Voyager Technologies Ipo A New Era For Space Defense

May 18, 2025

Voyager Technologies Ipo A New Era For Space Defense

May 18, 2025

Latest Posts

-

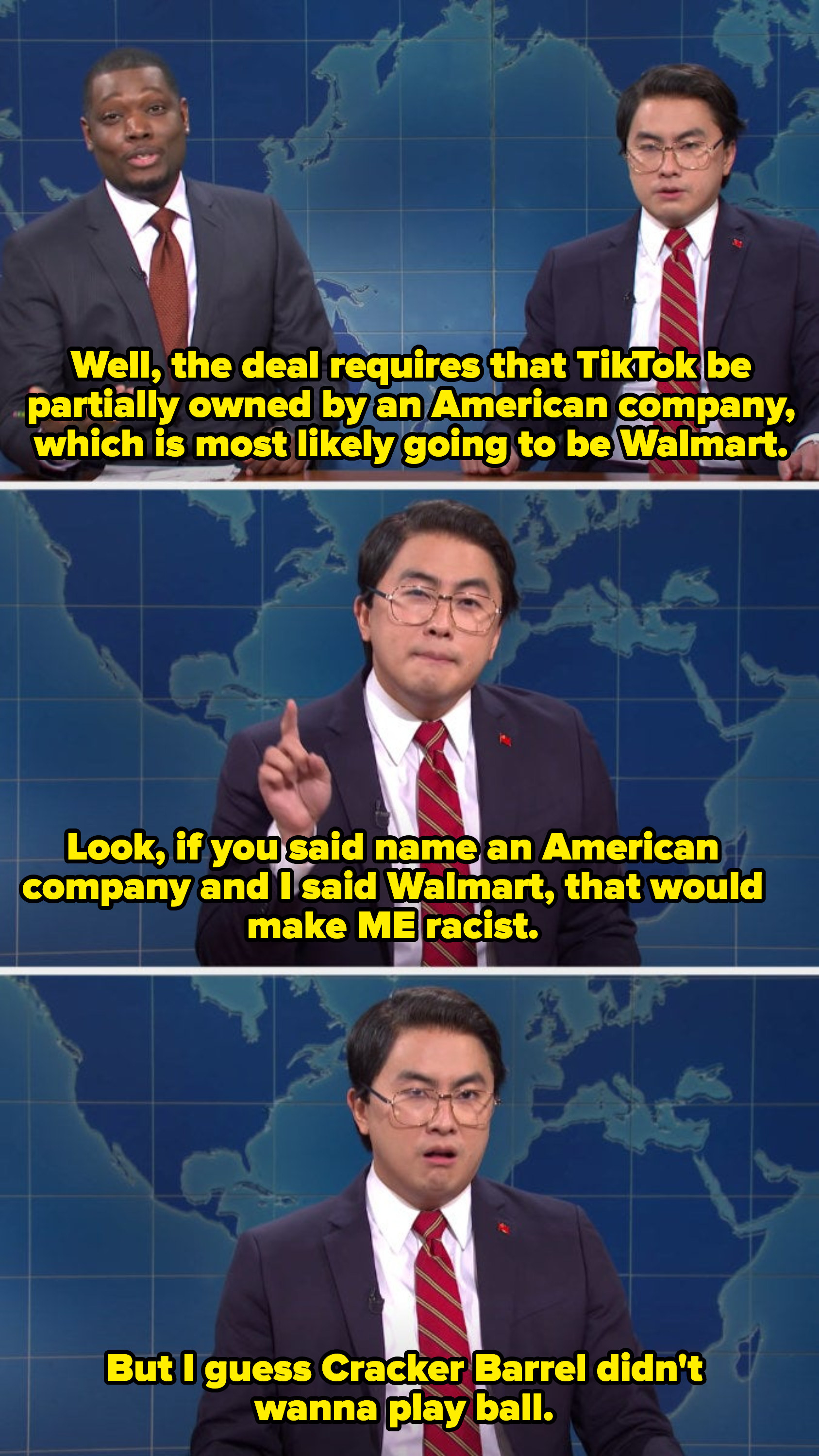

Bowen Yang Asks Lorne Michaels To Replace Him As Jd Vance On Snl

May 18, 2025

Bowen Yang Asks Lorne Michaels To Replace Him As Jd Vance On Snl

May 18, 2025 -

Bowen Yangs Plea Replacing Himself As Jd Vance On Snl

May 18, 2025

Bowen Yangs Plea Replacing Himself As Jd Vance On Snl

May 18, 2025 -

Lady Gaga Weighs In On Bowen Yangs Alejandro Ink

May 18, 2025

Lady Gaga Weighs In On Bowen Yangs Alejandro Ink

May 18, 2025 -

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025 -

Bowen Yangs Alejandro Tattoo Lady Gagas Reaction

May 18, 2025

Bowen Yangs Alejandro Tattoo Lady Gagas Reaction

May 18, 2025