Gold Prices Rise Amidst Trump's Escalating Trade Dispute With EU

Table of Contents

Safe Haven Demand for Gold Increases During Trade Uncertainty

Gold has long been considered a safe haven asset, a reliable store of value during times of economic and political turmoil. When uncertainty reigns, investors often seek refuge in assets perceived as less volatile and more likely to retain their value. The current climate of heightened trade uncertainty perfectly exemplifies this phenomenon.

- Increased investor anxiety due to trade wars: The ongoing trade war between the US and the EU has sparked considerable anxiety among investors, leading to a reassessment of risk profiles.

- Flight to safety – capital flows into gold as a hedge against risk: As investors seek to protect their portfolios from potential losses stemming from trade-related disruptions, a significant portion of capital is flowing into gold, driving up demand and prices.

- Weakening US dollar further boosting gold prices (inverse relationship): The US dollar and gold prices typically exhibit an inverse relationship. A weakening dollar, often a consequence of trade uncertainty, makes gold more attractive to international buyers using other currencies, further fueling price increases.

- Specific examples: We've witnessed a surge in investments in gold exchange-traded funds (ETFs) like GLD and physical gold purchases, indicating a clear shift towards safe haven assets.

Impact of US-EU Tariffs on Global Economic Growth

The imposition of tariffs by both the US and the EU has far-reaching negative consequences for global economic growth. These tariffs disrupt established supply chains, increase production costs, and ultimately reduce consumer purchasing power.

- Reduced consumer spending due to higher prices: Tariffs lead to higher prices for imported goods, reducing consumer spending and overall economic activity.

- Disrupted supply chains and decreased business investment: Uncertainty surrounding tariffs forces businesses to reconsider investment strategies, leading to slower growth and potentially job losses.

- Potential for global recession impacting investor confidence: The prolonged trade war poses a significant risk of a global recession, further eroding investor confidence and intensifying the flight to safety in assets like gold.

- Impacted industries: Sectors heavily reliant on international trade, such as automobiles, agriculture, and technology, are particularly vulnerable to the negative impacts of tariffs.

The Role of the US Dollar in Gold Price Fluctuations

The inverse relationship between the US dollar and gold prices is a key factor in understanding the recent gold price surge. A weakening dollar directly contributes to a rise in gold prices.

- Weakening dollar makes gold cheaper for buyers using other currencies: When the dollar weakens, the price of gold denominated in other currencies decreases, making it more affordable and driving up demand.

- Trade uncertainty weakens the dollar, boosting gold's appeal: The ongoing trade uncertainty contributes to the dollar's weakness, making gold a more attractive alternative investment.

- Current state of the US dollar: The US dollar has shown signs of weakening in recent months, partly due to the trade disputes and concerns about the global economy.

- Other influencing factors: While trade disputes play a significant role, other factors, such as interest rate changes and geopolitical events, also influence the value of the US dollar and, consequently, gold prices.

Alternative Investment Options During Trade Wars

While gold offers a safe haven during trade uncertainty, diversification is crucial for a robust investment strategy. Other options include:

- Diversification strategies: Diversifying across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk.

- Government bonds as a safe haven: Government bonds, particularly those issued by stable economies, are often considered a safe haven asset during times of economic uncertainty.

- Real estate as a long-term investment: Real estate can offer a hedge against inflation and provide long-term capital appreciation.

- Risks and rewards: Each investment option carries its own set of risks and rewards, which must be carefully considered before making any investment decisions.

Conclusion: Navigating the Gold Market Amidst Trump's Trade Policies

The recent surge in gold prices is largely driven by the intensifying US-EU trade war, fueled by President Trump's protectionist policies. The resulting economic uncertainty has increased the demand for gold as a safe haven asset, alongside a weakening US dollar. Understanding the interplay between these factors is crucial for investors navigating the current market conditions. Stay informed about the latest developments in the US-EU trade war and its influence on gold prices. Monitoring gold prices closely and considering diversification strategies to mitigate risks associated with escalating trade tensions are essential steps for informed investment decisions.

Featured Posts

-

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025 -

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 25, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 25, 2025 -

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 25, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 25, 2025 -

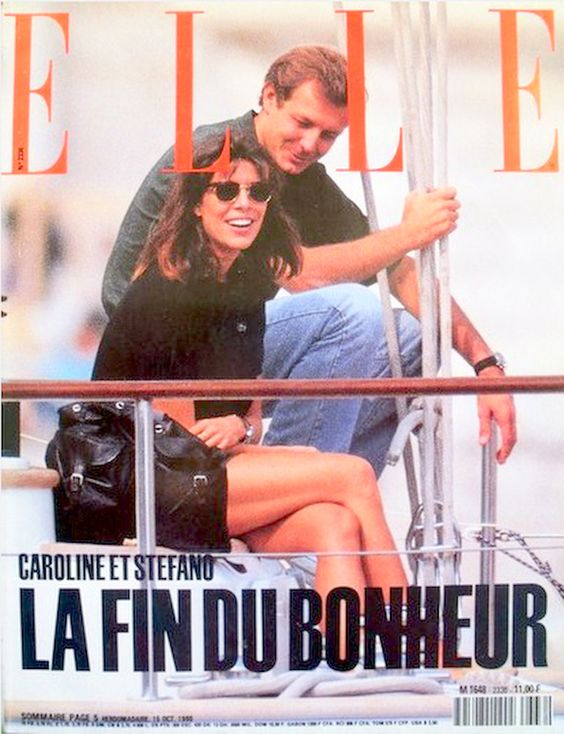

Monacos Royal Corruption Scandal The Prince And His Financial Advisor

May 25, 2025

Monacos Royal Corruption Scandal The Prince And His Financial Advisor

May 25, 2025 -

Pertimbangan Investasi Di Mtel Dan Mbma Dampak Penambahan Ke Msci Small Cap

May 25, 2025

Pertimbangan Investasi Di Mtel Dan Mbma Dampak Penambahan Ke Msci Small Cap

May 25, 2025

Latest Posts

-

Francis Sultana Designing The Interiors Of Robuchon Monaco Restaurants

May 25, 2025

Francis Sultana Designing The Interiors Of Robuchon Monaco Restaurants

May 25, 2025 -

Mwnakw Yjdd Eqd Mynamynw Mwsm Idafy Llnjm Alyabany

May 25, 2025

Mwnakw Yjdd Eqd Mynamynw Mwsm Idafy Llnjm Alyabany

May 25, 2025 -

Como Llevar Lino En Otono Consejos De Estilo De Charlene De Monaco

May 25, 2025

Como Llevar Lino En Otono Consejos De Estilo De Charlene De Monaco

May 25, 2025 -

Baile De La Rosa 2025 Los Vestidos Mas Elegantes De La Noche

May 25, 2025

Baile De La Rosa 2025 Los Vestidos Mas Elegantes De La Noche

May 25, 2025 -

La Elegancia Del Lino Segun Charlene De Monaco En Otono

May 25, 2025

La Elegancia Del Lino Segun Charlene De Monaco En Otono

May 25, 2025