Goldman Sachs Deciphers Trump's Preferred Oil Price Range

Table of Contents

Goldman Sachs' Methodology

Goldman Sachs employed a multifaceted approach to determine Trump's preferred oil price range. Their research wasn't a simple matter of polling or speculation; it involved a rigorous analysis of several key data points. The bank's economists and analysts meticulously pieced together a picture by examining various indicators.

- Analysis of Trump's public statements and tweets regarding oil prices: The team scrutinized every public utterance by the former president, including formal speeches, press conferences, and informal comments on social media (tweets). These statements often provided clues to his preferences regarding energy prices.

- Examination of economic policies implemented during his presidency: The researchers investigated the economic policies enacted during the Trump administration, particularly those relating to energy production, regulation, and international trade. Policies favoring domestic energy production, for instance, suggest a preference for a specific price range.

- Assessment of the impact of oil prices on key economic indicators during his tenure: Goldman Sachs analyzed the correlation between oil prices and key economic indicators like GDP growth, inflation, and unemployment during Trump's presidency. This helped identify the price points that seemed to correlate with positive economic outcomes in his view.

- Comparison with price ranges under previous administrations: Finally, the research included a comparative analysis of oil price ranges and economic policies under previous administrations, providing context for Trump's approach and highlighting any significant deviations.

The Identified Oil Price Range

Goldman Sachs' research, while not revealing an exact figure, pinpointed a broad range that seemingly aligned most favorably with Trump's economic agenda. This range generally fell within a band considered relatively favorable for US energy producers, while simultaneously aiming to avoid excessively high prices that could harm consumers and trigger inflation. The reasoning behind this range is multi-faceted:

- Impact on US energy independence: A price range that supports domestic production strengthens energy independence, a key policy goal of the Trump administration.

- Effects on domestic job creation (oil and gas sector): Maintaining prices within this band would likely have supported employment within the US oil and gas sector, a major focus of his economic policies.

- Influence on inflation rates: The identified range likely aimed for a balance that avoided triggering runaway inflation caused by surging oil prices.

- Relationship to consumer spending: Trump’s administration probably sought to avoid excessively high gasoline prices, which could stifle consumer spending and overall economic growth.

Economic Implications of the Preferred Range

Maintaining oil prices within the identified range would have had significant economic consequences, both positive and negative. The impact varied greatly depending on the stakeholder:

- Impact on gasoline prices and consumer affordability: Lower oil prices generally translate to lower gasoline prices, benefiting consumers. However, excessively low prices could hurt domestic oil producers.

- Effects on the profitability of oil and gas companies: Higher oil prices boost the profitability of oil and gas companies, but excessively high prices might lead to economic instability.

- Geopolitical implications for US relations with OPEC nations: The interplay between US policy and OPEC's production decisions is complex and can greatly influence prices. This makes maintaining a desired price range a significant geopolitical challenge.

- Influence on global energy markets and stability: The US's energy policy decisions have profound impacts on global energy markets and the stability thereof. Trump's policy choices in this area demonstrate this connection.

Comparing Trump's Preference to Other Administrations

Goldman Sachs’ analysis also provided valuable insight into how Trump's approach to oil prices compared with those of his predecessors. While each administration's approach is unique, certain patterns emerge.

- Contrast with Obama administration's approach: The Obama administration placed a greater emphasis on renewable energy and climate change mitigation, which may have influenced a different preferred oil price range.

- Comparison with Bush administration's policies: The Bush administration's policies, largely focused on energy security, had different implications for oil prices and global energy policy.

- Discussion of long-term energy policy implications: Comparing these administrations highlights the long-term strategic implications of differing energy policies and their influence on oil price preferences.

Understanding Goldman Sachs' Insights on Trump's Oil Price Preferences

Goldman Sachs' research offers valuable insights into former President Trump's economic priorities and the strategic considerations behind his energy policies. The analysis highlights a preferred oil price range that aimed to balance domestic energy production, job creation, consumer affordability, and inflation. Understanding Trump's Oil Price Preferences is crucial for interpreting past economic decisions and anticipating potential future market fluctuations. To gain a more comprehensive understanding of Goldman Sachs' Analysis of Trump's Energy Policy, we encourage you to delve into their detailed research reports. Staying informed about the ongoing dynamics of oil prices and their impact on the US economy is vital, and further research into Trump's Ideal Oil Price Range will be necessary for future economic forecasting and policy analysis.

Featured Posts

-

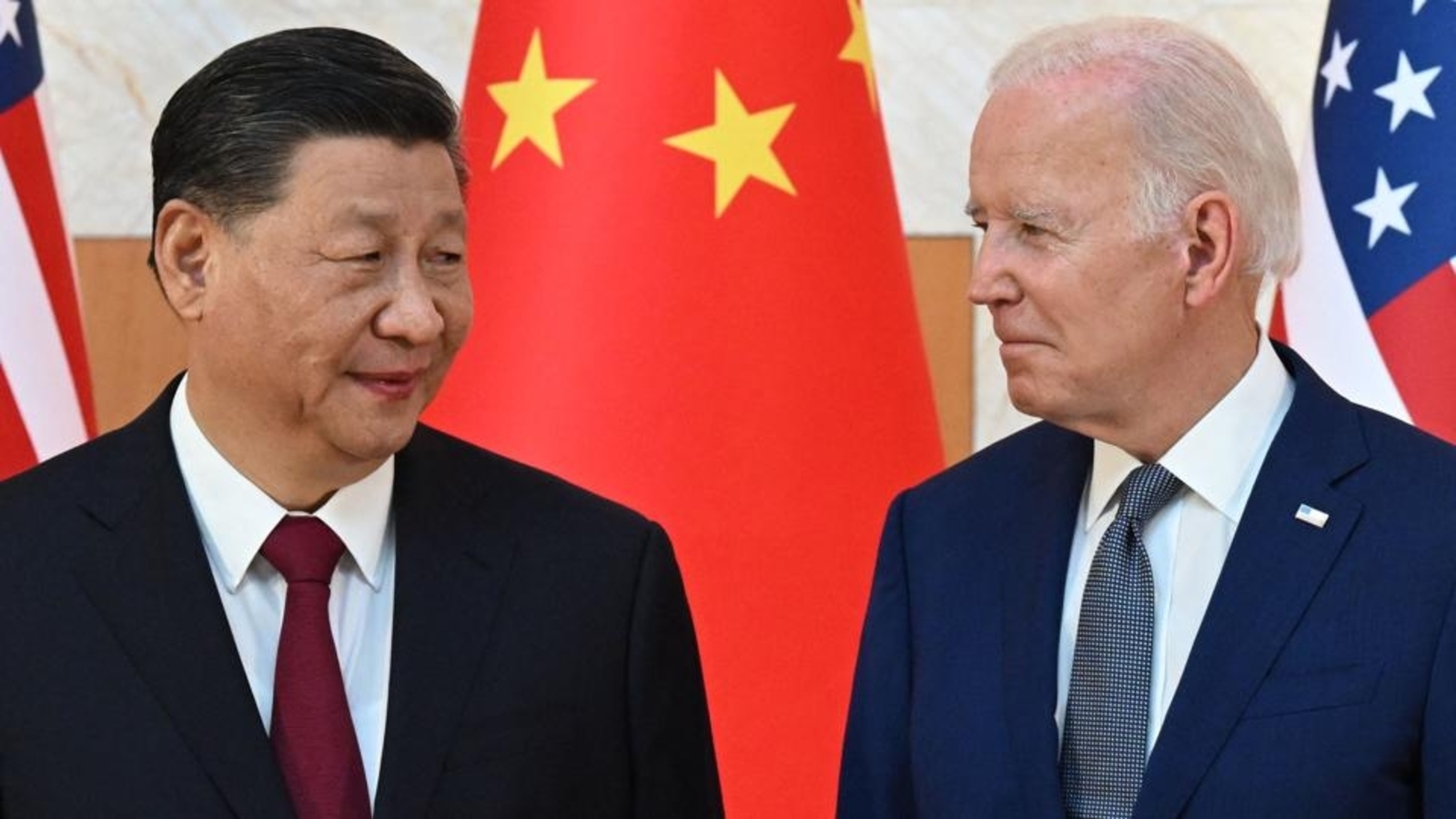

Xi Jinpings Team Negotiates Key Us Agreement Expert Analysis

May 15, 2025

Xi Jinpings Team Negotiates Key Us Agreement Expert Analysis

May 15, 2025 -

Creatine 101 Your Guide To Understanding And Using Creatine

May 15, 2025

Creatine 101 Your Guide To Understanding And Using Creatine

May 15, 2025 -

Viet Jet Payment Stay Denied Implications For The Airlines Finances

May 15, 2025

Viet Jet Payment Stay Denied Implications For The Airlines Finances

May 15, 2025 -

2026 Bmw I X Examining Its Strengths And Weaknesses As A Top Ev Contender

May 15, 2025

2026 Bmw I X Examining Its Strengths And Weaknesses As A Top Ev Contender

May 15, 2025 -

Selling Sunset Star Highlights Post Fire Rent Hikes In Los Angeles

May 15, 2025

Selling Sunset Star Highlights Post Fire Rent Hikes In Los Angeles

May 15, 2025

Latest Posts

-

Taylor Wards 9th Inning Grand Slam Stuns Padres Angels Victory

May 15, 2025

Taylor Wards 9th Inning Grand Slam Stuns Padres Angels Victory

May 15, 2025 -

Complete Sweep Rays Defeat Padres In Commanding Fashion

May 15, 2025

Complete Sweep Rays Defeat Padres In Commanding Fashion

May 15, 2025 -

Padres Fall To Rays In Clean Sweep

May 15, 2025

Padres Fall To Rays In Clean Sweep

May 15, 2025 -

Padres Fall To Rays In Series Sweep Fm 96 9 The Game Analysis

May 15, 2025

Padres Fall To Rays In Series Sweep Fm 96 9 The Game Analysis

May 15, 2025 -

Padres Aim For Sweep Arraez Heyward To Start Against Opponent Name

May 15, 2025

Padres Aim For Sweep Arraez Heyward To Start Against Opponent Name

May 15, 2025