Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

Safe Haven Asset: Why Gold Rises During Trade Wars

Gold has long been considered a safe-haven asset, a store of value that holds its worth during times of economic and political turmoil. This characteristic becomes particularly pronounced during periods of heightened trade war uncertainty. When global trade relations sour, investors often seek refuge in assets perceived as less risky. This flight to safety significantly boosts demand for gold.

- Increased volatility in stock markets due to trade wars: Trade wars introduce uncertainty into the global economy, leading to increased volatility in stock markets. Investors, fearing losses in riskier assets like stocks and bonds, often turn to gold as a more stable investment.

- Decline in investor confidence in riskier assets: The unpredictable nature of trade wars erodes investor confidence in riskier assets. This decline in confidence translates into a shift towards safer investments, driving up gold prices.

- Gold's historical performance as a hedge against inflation and uncertainty: Historically, gold has served as a reliable hedge against inflation and economic uncertainty. During periods of high inflation, the purchasing power of fiat currencies diminishes, while gold tends to retain its value.

- Diversification strategies incorporating gold to mitigate risk: Many investors include gold in their portfolios as a diversification strategy. By diversifying investments across different asset classes, investors can mitigate risk and reduce the overall volatility of their portfolio. Gold's low correlation with other asset classes makes it a valuable addition to a diversified portfolio. This is especially true during times of global economic uncertainty generated by trade wars, such as the current situation.

Trade War Uncertainty and Currency Fluctuations

Trade wars significantly impact currency exchange rates and create volatility in the global currency markets. This volatility, in turn, influences gold prices. Gold is typically priced in US dollars, meaning that fluctuations in the dollar's value directly affect the price of gold.

- Impact of tariffs on currency exchange rates: Imposition of tariffs can lead to currency devaluation. When a country imposes tariffs, it can negatively impact its trading partners, leading to retaliatory measures and potentially triggering a weakening of its currency.

- Weakening of national currencies during trade disputes: Trade disputes often result in a weakening of involved nations' currencies. This is because uncertainty and decreased economic activity can reduce demand for that currency.

- Gold's pricing in US dollars and its correlation with dollar strength/weakness: As the US dollar weakens, the price of gold (priced in USD) tends to rise, making it more attractive to investors holding other currencies. Conversely, a strong dollar often puts downward pressure on gold prices.

- How currency fluctuations influence gold investment decisions: Investors carefully consider currency fluctuations when making gold investment decisions. A weakening of their home currency can make gold a more attractive investment, as its value in their local currency will increase.

Inflationary Pressures and Gold's Value

Trade wars can contribute to inflationary pressures, further increasing the demand for gold. Tariffs and trade restrictions disrupt supply chains, leading to shortages and increased prices for goods and services.

- Tariffs increasing the cost of goods and services: Tariffs directly increase the cost of imported goods, contributing to overall inflation. This increased cost of living can push investors toward gold as a store of value.

- Supply chain disruptions causing inflationary pressures: Disruptions to global supply chains due to trade wars lead to shortages and increased prices for various goods. This inflationary pressure can boost gold's appeal as an inflation hedge.

- Gold's historical role as an inflation hedge: Throughout history, gold has consistently served as a hedge against inflation. Its inherent value remains relatively stable even as fiat currencies lose purchasing power during inflationary periods.

- How investors use gold to protect against inflation risk: Investors utilize gold to protect their wealth against the eroding effects of inflation. As the purchasing power of their money declines due to rising prices, gold helps to preserve their financial standing.

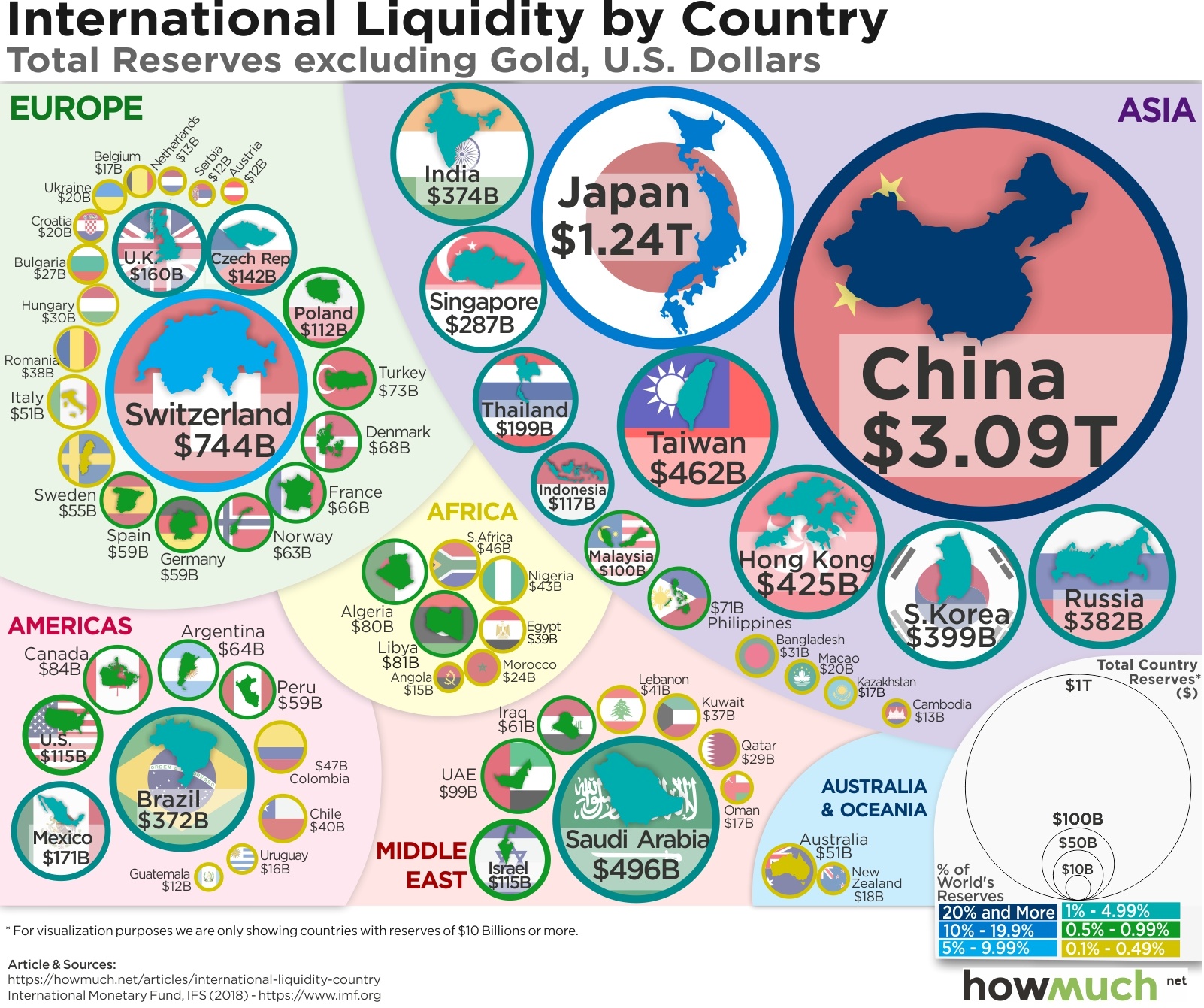

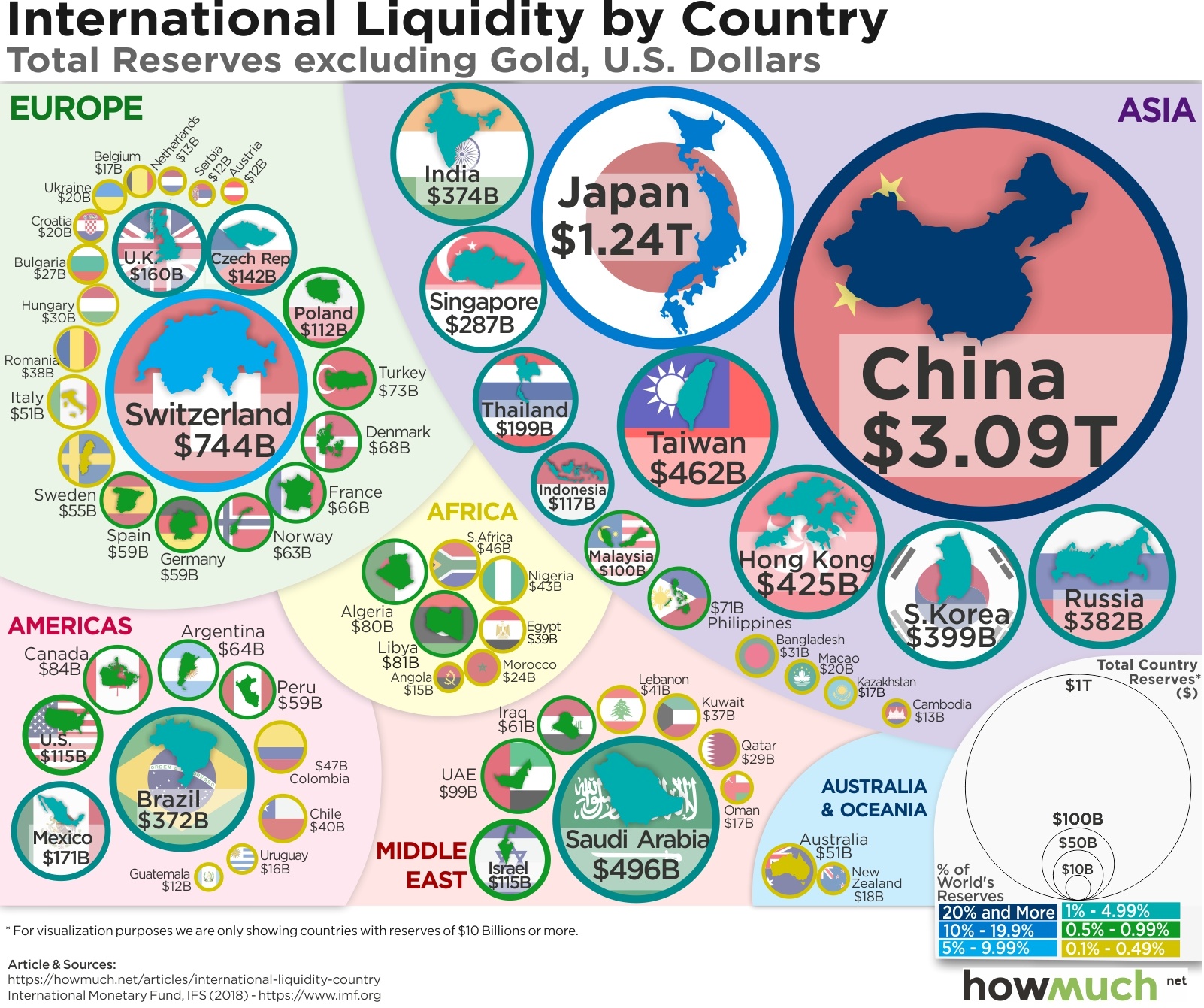

Central Bank Interventions and Gold Reserves

Central banks play a crucial role in influencing gold prices through their buying and selling of bullion. Their actions can significantly impact the gold market.

- Increased gold reserves by central banks as a diversification strategy: Many central banks have increased their gold reserves in recent years as a way to diversify their assets and mitigate risks associated with holding large amounts of other currencies.

- Central bank actions influencing gold market dynamics: Central bank buying and selling activity can dramatically influence the price of gold, often affecting market sentiment and investor behavior.

- Geopolitical factors impacting central bank gold policies: Geopolitical instability and uncertainty often lead central banks to increase their gold holdings as a safe-haven asset.

Conclusion

The surge in gold prices to record highs is undeniably linked to the ongoing global trade wars. The uncertainty and volatility generated by trade disputes have increased the demand for gold as a safe-haven asset, a hedge against inflation, and a tool for portfolio diversification. Understanding the complex relationship between trade wars and gold bullion prices is crucial for investors navigating these turbulent economic times. To make informed investment decisions during this period of uncertainty, consider exploring the role of gold in your portfolio and how to effectively manage your exposure to gold bullion.

Featured Posts

-

Blue Origin Postpones Launch Subsystem Malfunction Investigation

Apr 26, 2025

Blue Origin Postpones Launch Subsystem Malfunction Investigation

Apr 26, 2025 -

Colgate Shares Suffer As Tariffs Add 200 Million To Costs

Apr 26, 2025

Colgate Shares Suffer As Tariffs Add 200 Million To Costs

Apr 26, 2025 -

Ukraines Nato Prospects The Impact Of Trumps Opinion

Apr 26, 2025

Ukraines Nato Prospects The Impact Of Trumps Opinion

Apr 26, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 26, 2025

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 26, 2025 -

La Wildfires A Reflection Of Our Times Through Disaster Gambling

Apr 26, 2025

La Wildfires A Reflection Of Our Times Through Disaster Gambling

Apr 26, 2025