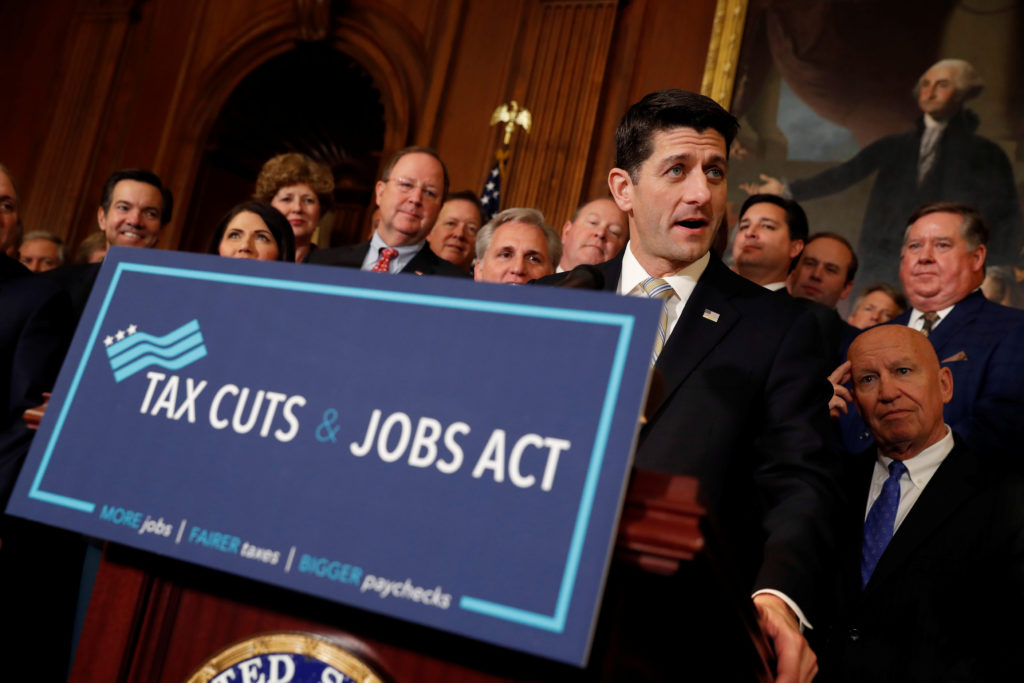

GOP Tax Overhaul In Jeopardy: Medicaid And Clean Energy Amendments Sought

Table of Contents

Medicaid Amendments: A Budgetary Battleground

Several senators are pushing for amendments that would significantly alter Medicaid funding, potentially leading to reduced coverage and higher costs for millions of Americans. This is a critical aspect of the GOP tax overhaul debate, sparking heated discussions around healthcare reform and budgetary constraints. The keywords associated with this section – Medicaid expansion, healthcare costs, budget cuts, Affordable Care Act (ACA), healthcare reform – highlight the complex issues at stake.

-

Reduced Coverage and Increased Costs: Amendments aim to reduce federal Medicaid spending, potentially forcing states to shoulder a larger portion of the costs or cut benefits. This could lead to reduced access to healthcare services for low-income individuals and families.

-

ACA Rollback Implications: Many proposed amendments directly target provisions of the Affordable Care Act (ACA), potentially reversing progress made in expanding healthcare coverage. The debate over repealing or replacing parts of the ACA is central to the discussion.

-

State Budgetary Strain: Shifting more financial responsibility to state governments could create severe budgetary challenges, forcing states to make difficult choices between funding Medicaid and other essential services.

-

Impact on Vulnerable Populations: Critics argue that cuts to Medicaid disproportionately affect vulnerable populations, including children, seniors, and individuals with disabilities, exacerbating existing health disparities.

-

Federal Budget Deficit Concerns: The long-term impact on the federal budget deficit is a major point of contention. Proponents of the amendments argue that reduced spending is necessary for fiscal responsibility, while opponents argue that the cuts are short-sighted and ultimately unsustainable.

Clean Energy Amendments: A Clash of Ideologies

Amendments seeking to expand or eliminate tax credits for renewable energy sources such as solar and wind power are generating considerable controversy. This section focuses on the keywords clean energy tax credits, renewable energy, environmental policy, climate change, tax incentives, reflecting the ideological clash surrounding environmental policy and economic incentives.

-

Incentives for Renewable Energy: Supporters of expanding clean energy tax credits argue that these incentives are crucial for driving innovation, creating jobs in the renewable energy sector, and achieving environmental goals, including mitigating climate change.

-

Market Distortion Concerns: Opponents contend that the subsidies distort the energy market, giving an unfair advantage to renewable energy sources over fossil fuels and placing an undue burden on taxpayers. They advocate for a free market approach to energy production.

-

Environmental Policy Debate: The debate over clean energy tax credits reflects broader disagreements about the role of government in addressing climate change and promoting sustainable development.

-

Impact on the Energy Sector: The outcome of this debate will have significant implications for the future of the American energy sector, influencing investment decisions and the overall trajectory of energy production and consumption.

-

Long-term Economic Considerations: The long-term economic impacts of either expanding or eliminating these tax credits require careful analysis, weighing the potential benefits of a cleaner energy future against the short-term economic consequences of shifting energy markets.

Political Fallout and Uncertain Future of the GOP Tax Overhaul

The proposed amendments are intensifying political divisions within Congress and jeopardizing the bill's prospects for passage. This section utilizes keywords like political gridlock, legislative process, bipartisan support, Senate vote, House of Representatives to emphasize the challenges of navigating the political landscape.

-

Bipartisan Support Crucial: The success of the GOP tax overhaul hinges on securing sufficient bipartisan support, which is far from guaranteed, given the deep divisions surrounding both Medicaid and clean energy issues.

-

Senate's Pivotal Role: The Senate's role in shaping the final legislation will be critical, with potential filibusters and amendments further complicating the process.

-

Negotiation and Delays: Any significant changes could trigger further rounds of negotiations and delays, potentially extending the legislative process indefinitely.

-

Impact on Investor Confidence: The uncertainty surrounding the tax overhaul impacts investor confidence and long-term economic planning, creating a climate of unpredictability for businesses and consumers.

-

Political Gridlock: The potential for political gridlock poses a significant threat to the timely passage of the bill and could have significant ramifications for the economy.

Conclusion

The proposed Medicaid and clean energy amendments pose a significant threat to the GOP's ambitious tax overhaul plan. The intense political battles surrounding these amendments underscore the deep divisions within Congress and the challenges of achieving meaningful tax reform. The ultimate fate of the bill remains uncertain, highlighting the need for careful consideration of the long-term economic and social consequences of any changes. Stay informed about the latest developments on this crucial GOP tax overhaul and its potential impact on the future of American policy. Follow our news updates to stay abreast of changes to this critical tax reform legislation and understand the potential ramifications of these proposed amendments.

Featured Posts

-

Michelle Williams Clarifies Dying For Sex Marcello Hernandez Scene

May 18, 2025

Michelle Williams Clarifies Dying For Sex Marcello Hernandez Scene

May 18, 2025 -

Ego Nwodims Snl Weekend Update Analysis Of Audience Outburst

May 18, 2025

Ego Nwodims Snl Weekend Update Analysis Of Audience Outburst

May 18, 2025 -

This Weeks You Toon Caption Contest Winner Booing Bears

May 18, 2025

This Weeks You Toon Caption Contest Winner Booing Bears

May 18, 2025 -

Will Michael Conforto Follow Teoscar Hernandezs Lead In La

May 18, 2025

Will Michael Conforto Follow Teoscar Hernandezs Lead In La

May 18, 2025 -

Key Dates And Issues For Southeast Texas May 2025 Municipal Elections

May 18, 2025

Key Dates And Issues For Southeast Texas May 2025 Municipal Elections

May 18, 2025

Latest Posts

-

You Toon Caption Contest Booing Bears Reign Supreme

May 18, 2025

You Toon Caption Contest Booing Bears Reign Supreme

May 18, 2025 -

You Toon Caption Contest Winner Announced Booing Bears Take The Prize

May 18, 2025

You Toon Caption Contest Winner Announced Booing Bears Take The Prize

May 18, 2025 -

This Weeks You Toon Caption Contest Winner Booing Bears

May 18, 2025

This Weeks You Toon Caption Contest Winner Booing Bears

May 18, 2025 -

2025 Nfl Draft Analysts Assessment Of The New England Patriots

May 18, 2025

2025 Nfl Draft Analysts Assessment Of The New England Patriots

May 18, 2025 -

Nfl Analyst Forecasts Patriots Trajectory Following 2025 Draft

May 18, 2025

Nfl Analyst Forecasts Patriots Trajectory Following 2025 Draft

May 18, 2025