GOP's Student Loan Plan: Impacts On Pell Grants, Repayment, And Borrowers

Table of Contents

<p>The Republican Party's proposed student loan plan is generating significant debate, with potential implications for millions of borrowers, Pell Grant recipients, and the future of higher education funding. This article examines the key aspects of the plan, focusing on its potential effects on Pell Grants, repayment options, and overall borrower experience. We will analyze the proposed changes and assess their likely impact on student debt and access to higher education. The keywords we'll be focusing on include: GOP student loan plan, student loan forgiveness, Pell Grants, student loan repayment, student loan debt, Republican student loan plan, and higher education costs.</p>

<h2>Potential Impacts on Pell Grants</h2>

<p>The GOP's student loan plan may significantly alter Pell Grant funding, a crucial source of financial aid for low-income students pursuing higher education. Understanding the potential impact on Pell Grant funding, Pell Grant eligibility, and affordable higher education is critical.</p>

<ul> <li><strong>Potential Cuts or Changes to Pell Grant Funding:</strong> While specific proposals vary, some GOP plans suggest reducing overall Pell Grant funding or altering eligibility criteria. This could involve increasing the Expected Family Contribution (EFC) threshold, effectively reducing the number of students eligible for the grant. There are also discussions about limiting the maximum grant amount, making it harder for students to cover rising tuition costs.</li> <li><strong>Impact on Low-Income Students and Access to Higher Education:</strong> Reduced Pell Grant funding would disproportionately affect low-income students, who rely heavily on these grants to afford college. Statistics show that Pell Grant recipients are predominantly from families earning less than $60,000 annually. Cuts could drastically reduce their access to higher education and limit their future opportunities.</li> <li><strong>Effects on College Affordability and Enrollment Rates:</strong> Changes to Pell Grants could significantly impact college affordability and enrollment rates, particularly among vulnerable populations. With less federal aid, students may need to rely more on loans, potentially increasing their overall debt burden. This could lead to a decrease in college enrollment, exacerbating existing inequalities in higher education access.</li> <li>Increased reliance on private loans to cover tuition costs.</li> <li>Potential decrease in college enrollment for low-income students.</li> <li>Increased inequality in access to higher education.</li> </ul>

<h2>Proposed Changes to Student Loan Repayment</h2>

<p>The GOP's student loan plan may also introduce significant changes to student loan repayment options, affecting income-driven repayment (IDR) plans, student loan interest rates, and loan forgiveness programs. Keywords here include income-driven repayment, student loan interest rates, loan forgiveness programs, student loan refinancing, and repayment plans.</p>

<ul> <li><strong>Modifications to Income-Driven Repayment (IDR) Plans:</strong> The GOP might propose altering existing IDR plans, potentially increasing monthly payments for borrowers or changing the eligibility criteria. This could make it harder for borrowers, especially those with lower incomes, to manage their student loan debt.</li> <li><strong>Impact on Monthly Payments and Overall Debt Burden:</strong> Changes to IDR plans could significantly affect borrowers' monthly payments and their overall debt burden. For example, a stricter calculation formula could result in higher monthly payments, extending the repayment period and increasing the total interest paid over the life of the loan.</li> <li><strong>Proposed Changes to Student Loan Interest Rates:</strong> The GOP’s stance on interest rates could significantly impact borrowers. Increased interest rates would directly translate to higher total repayment costs. Decreased interest rates, while beneficial, are unlikely given current economic conditions.</li> <li><strong>Loan Forgiveness Programs:</strong> The GOP's position on loan forgiveness programs is a key area of concern. Proposals to eliminate or significantly modify these programs could leave millions of borrowers with substantial debt, impacting their financial stability and economic prospects. </li> <li>Changes to interest rates and their impact on overall debt.</li> <li>Potential elimination or reduction of loan forgiveness programs.</li> <li>Increased burden on borrowers with existing loans.</li> </ul>

<h3>The Impact on Specific Borrower Groups</h3>

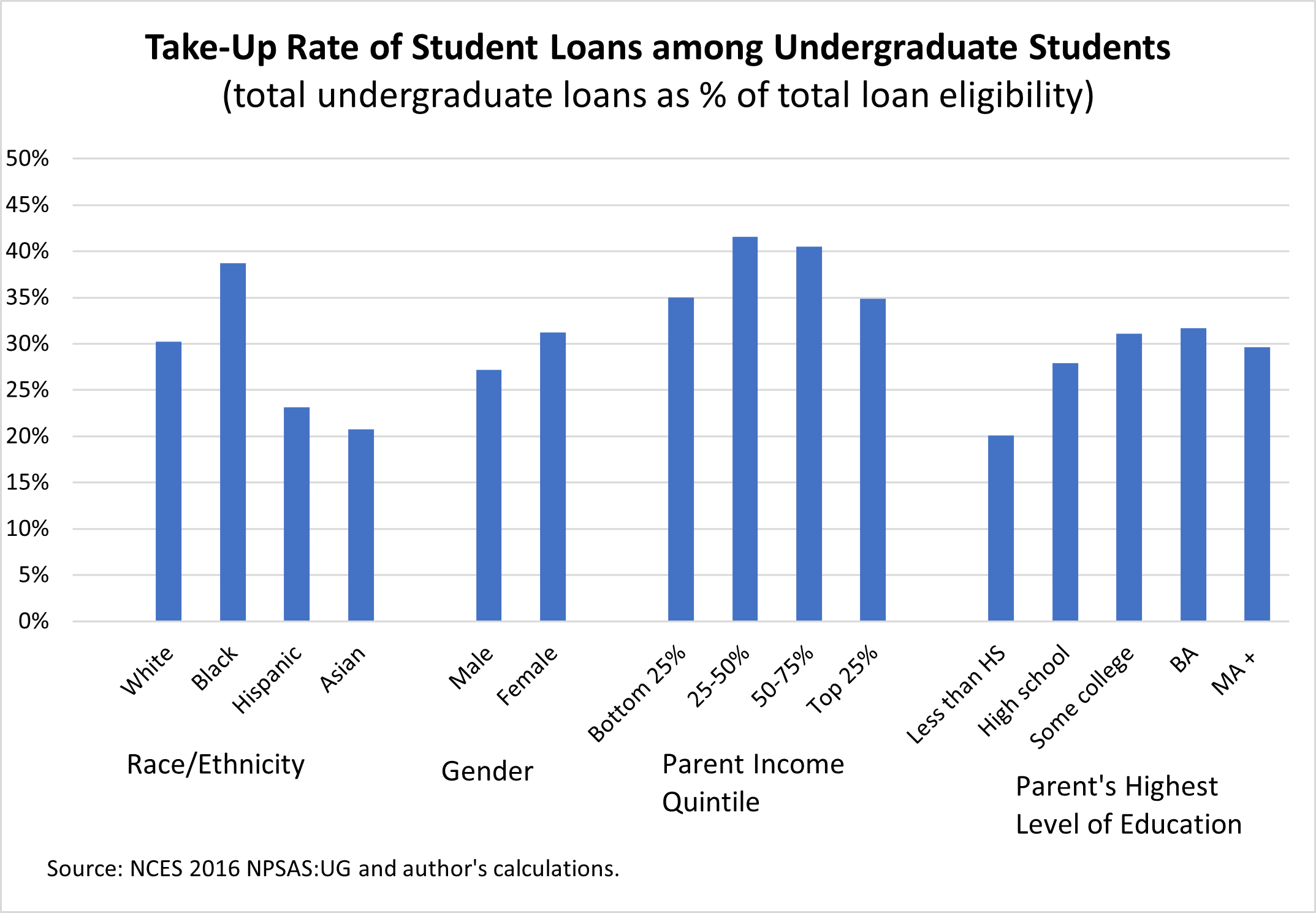

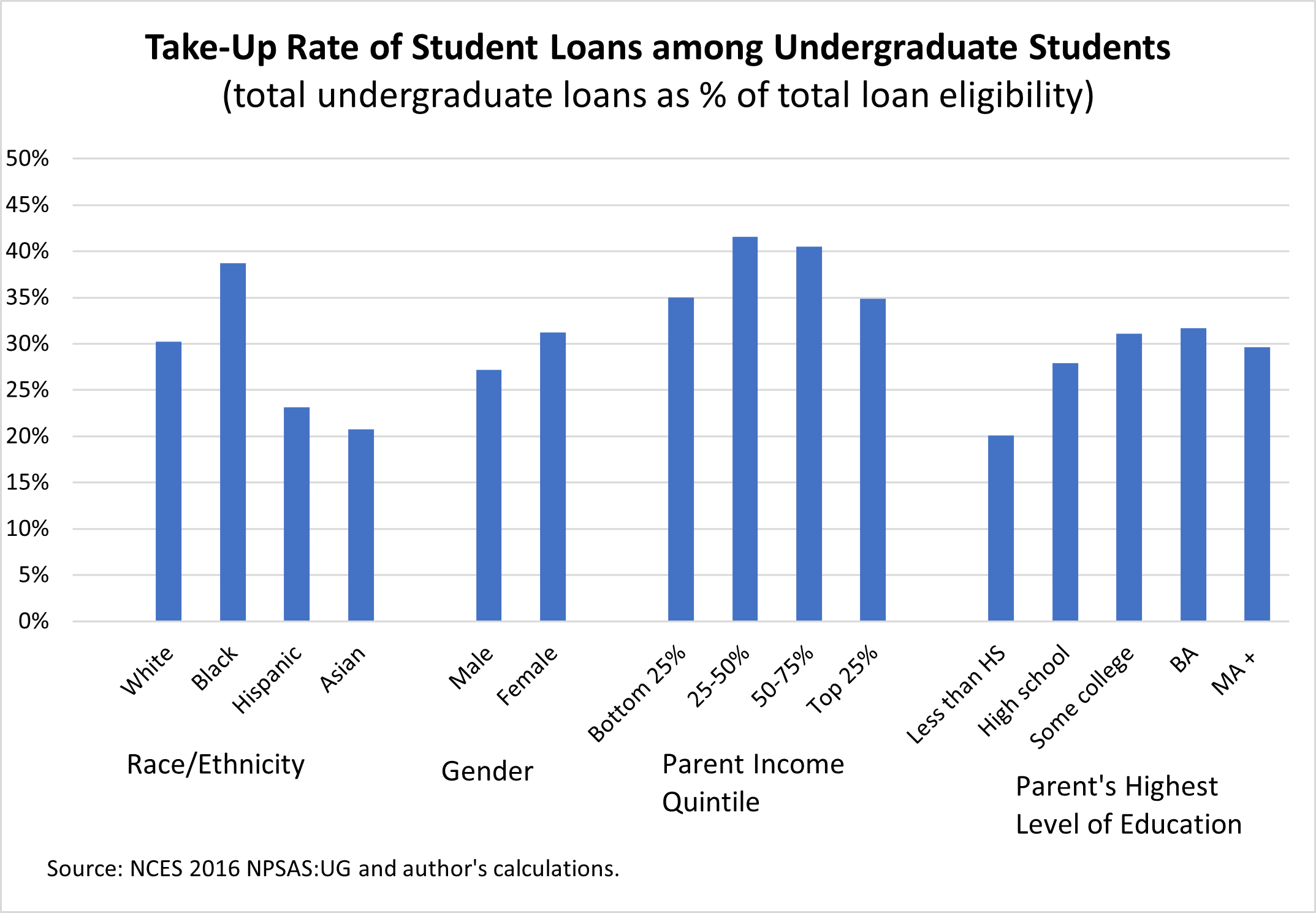

<p>The GOP student loan plan's impact won't be uniform across all borrowers. Certain groups, such as graduate students, minority students, and those with Parent PLUS loans, may face disproportionately negative consequences. This section will focus on keywords like graduate student loans, undergraduate student loans, parent PLUS loans, minority student borrowers, and high-debt borrowers.</p>

<p>Graduate students often accumulate significantly higher debt than undergraduates, making them particularly vulnerable to changes in repayment plans and forgiveness programs. Minority students, who often face greater financial barriers to higher education, may be disproportionately affected by reduced Pell Grant funding. Parents with PLUS loans could see increased financial strain if repayment terms become less favorable.</p>

<h2>Analysis of the GOP Plan's Economic and Social Implications</h2>

<p>The GOP's student loan plan has significant economic and social ramifications that extend beyond individual borrowers. This section explores the broader impact, using keywords like economic impact, social impact, higher education access, national debt, and economic inequality.</p>

<ul> <li><strong>Economic and Social Consequences:</strong> The plan's effects could ripple through the economy, impacting national debt, economic growth, and social mobility. Increased student debt could hinder economic productivity and workforce participation.</li> <li><strong>Impact on Higher Education:</strong> Changes in student aid could negatively impact the financial health of colleges and universities, potentially leading to tuition increases or program cuts.</li> <li><strong>Long-Term Economic Productivity:</strong> A significant increase in student debt could negatively impact future economic productivity as borrowers struggle to manage debt and participate fully in the economy. </li> </ul>

<h2>Conclusion</h2>

The GOP's proposed student loan plan carries significant implications for Pell Grant recipients, repayment options, and the overall financial well-being of student loan borrowers. Proposed changes to Pell Grant funding, repayment plans, and loan forgiveness programs could have a profound impact on access to higher education and the financial stability of millions. Understanding the potential ramifications of this plan is crucial for students, parents, and policymakers alike. Further research and public dialogue are essential to fully grasp the long-term effects of the GOP's student loan plan on borrowers and the future of higher education. Stay informed about the ongoing developments concerning the GOP student loan plan and its potential impact on your financial future.

Featured Posts

-

Detroit Pistons Vs New York Knicks Season Matchup Analysis

May 17, 2025

Detroit Pistons Vs New York Knicks Season Matchup Analysis

May 17, 2025 -

Is Reddit Currently Down Find Out Now

May 17, 2025

Is Reddit Currently Down Find Out Now

May 17, 2025 -

2025s Leading Bitcoin And Crypto Casinos Players Guide

May 17, 2025

2025s Leading Bitcoin And Crypto Casinos Players Guide

May 17, 2025 -

Experience Uber One Free Deliveries And Discounts Now In Kenya

May 17, 2025

Experience Uber One Free Deliveries And Discounts Now In Kenya

May 17, 2025 -

27 Puntos De Anunoby Guian A Knicks A Victoria Sobre Sixers Que Sufren Su Novena Derrota

May 17, 2025

27 Puntos De Anunoby Guian A Knicks A Victoria Sobre Sixers Que Sufren Su Novena Derrota

May 17, 2025