Has The Bitcoin Rebound Begun? Exploring Future Price Predictions

Table of Contents

Analyzing the Current Bitcoin Market Trends

To determine if a Bitcoin rebound is truly happening, we must first analyze the current market landscape. This involves examining recent price action, on-chain metrics, and overall market sentiment.

Recent Price Action and Volatility

Bitcoin's price has experienced significant fluctuations in recent months. After reaching a high of [Insert Recent High Price and Date], the price experienced a correction, dipping to a low of [Insert Recent Low Price and Date]. This represents a percentage change of approximately [Insert Percentage Change]. Analyzing this price action is crucial to understanding the potential for a sustained Bitcoin rebound.

- Specific Price Points: We saw a notable increase of X% between [Date] and [Date], followed by a Y% decrease between [Date] and [Date].

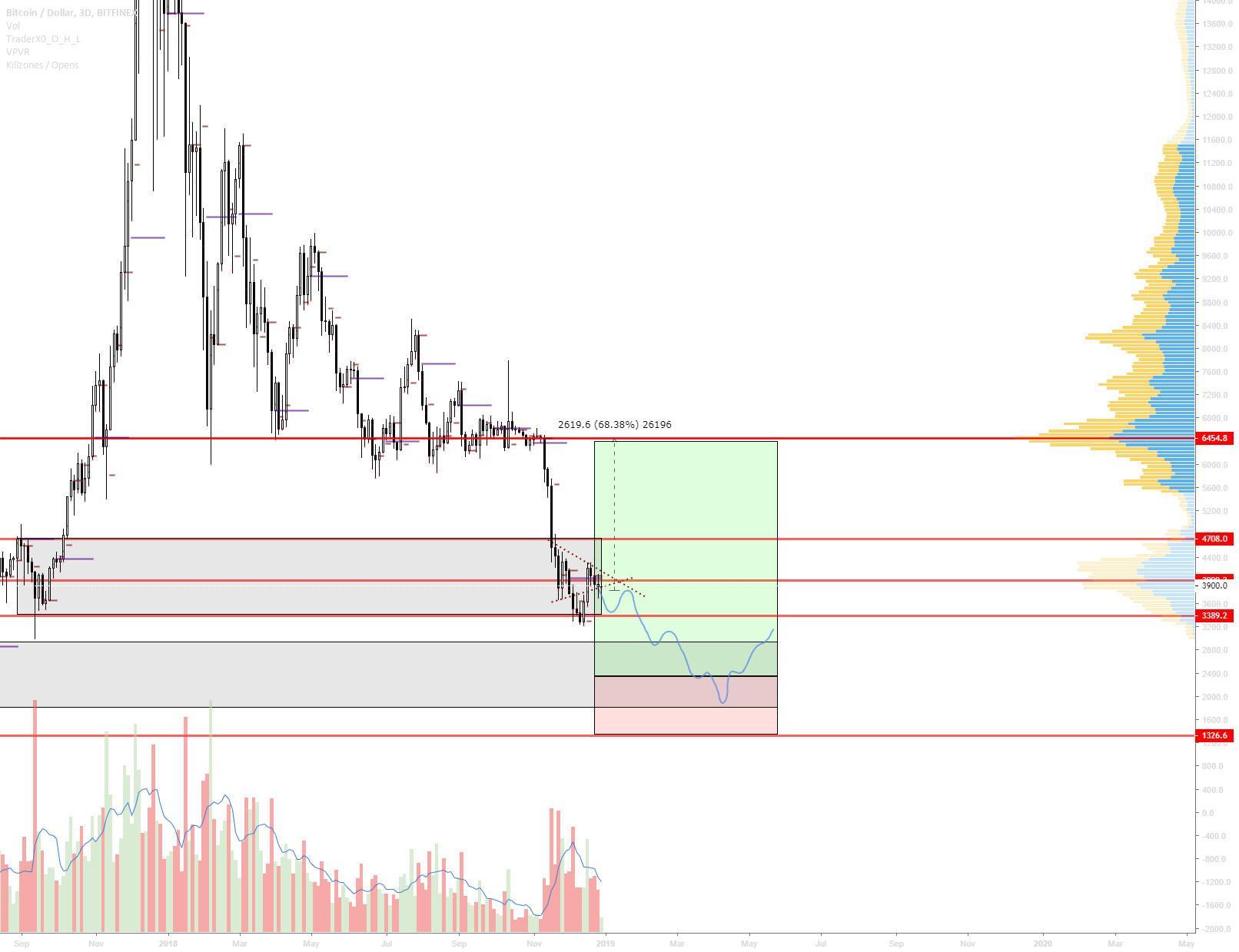

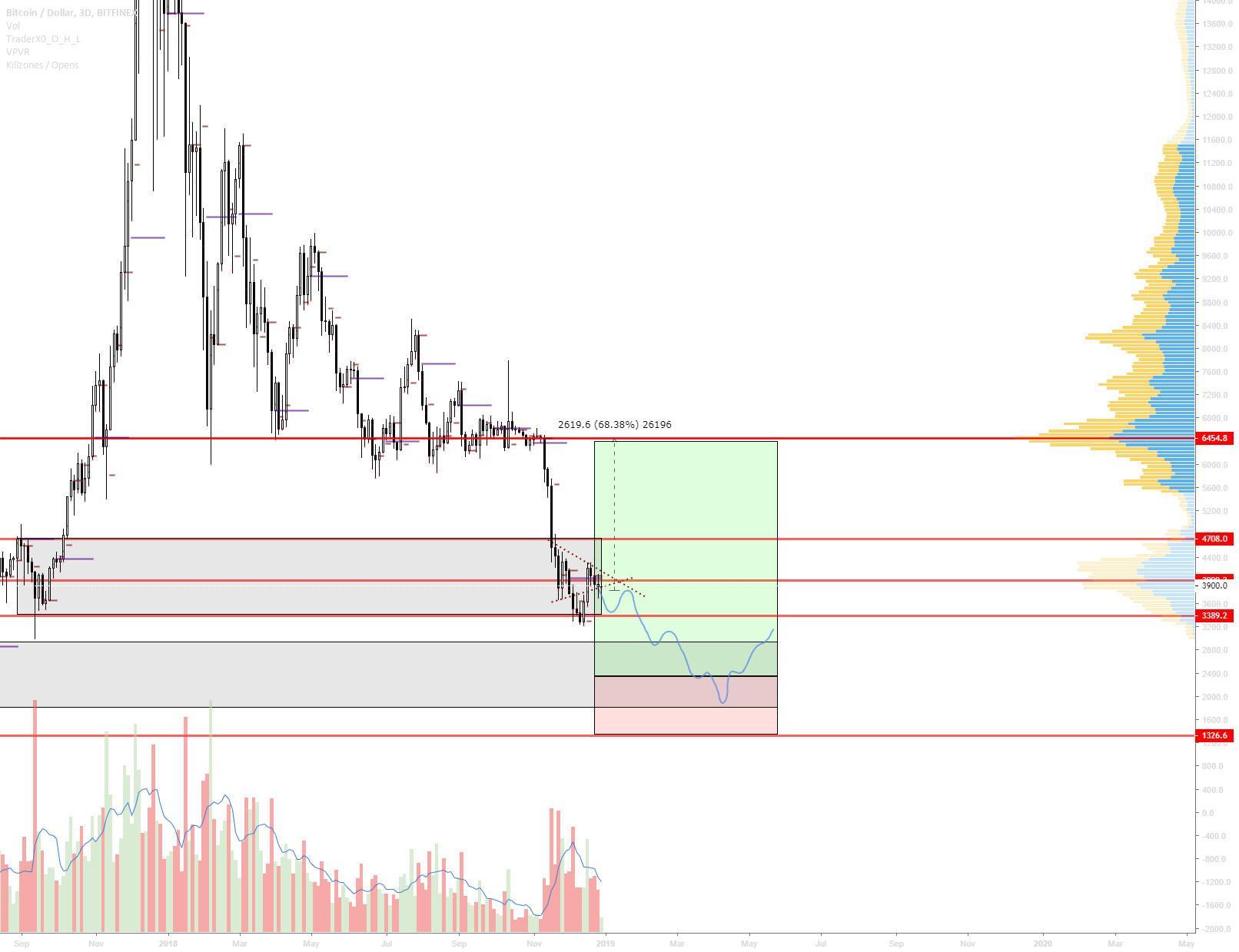

- Trading Volume and Market Capitalization: Trading volume has [Increased/Decreased] significantly during this period, indicating [Increased/Decreased] market participation. Market capitalization currently stands at [Insert Current Market Cap], reflecting the overall value of Bitcoin. [Insert relevant chart or graph visualizing price action and volume].

On-Chain Metrics and Indicators

Beyond price alone, analyzing on-chain data provides valuable insights into market sentiment and potential future price movements. Key metrics to consider include:

- Transaction Volume: High transaction volume suggests increased network activity and potential for price appreciation. Data from [Link to reputable data source, e.g., Glassnode] shows [Current Transaction Volume and trend].

- Miner Activity: Miner activity, represented by the network hash rate, indicates the computational power securing the Bitcoin network. A consistently high hash rate suggests strong network health and a bullish signal. [Link to reputable data source showing hash rate].

- Network Hash Rate: [Explain current hash rate and its significance for Bitcoin's security and potential for a rebound].

Macroeconomic Factors Influencing Bitcoin's Price

Bitcoin's price is not immune to macroeconomic forces. Global economic conditions and monetary policy play a significant role in its price fluctuations.

Inflation and Interest Rates

The relationship between inflation, interest rates, and Bitcoin's value as a hedge against inflation is complex but crucial to understand.

- Central Bank Policies: The actions of central banks, such as raising interest rates to combat inflation, can negatively impact Bitcoin's price in the short term, as investors may shift to more traditional assets.

- Inflationary Pressures: Conversely, high inflation can drive investors towards Bitcoin, viewing it as a store of value that is less susceptible to inflationary pressures. This could fuel a Bitcoin rebound.

Global Economic Uncertainty

Geopolitical events and economic downturns often trigger safe-haven buying, potentially benefiting Bitcoin.

- Past Events: [Provide examples of past geopolitical events or economic crises and their impact on Bitcoin's price, linking to credible news sources].

- Decentralized Nature: Bitcoin's decentralized nature and limited supply might make it a desirable asset during times of economic or political uncertainty, potentially driving a rebound.

Technological Advancements and Bitcoin's Future

Technological advancements impacting Bitcoin's scalability and usability are key factors driving its long-term price trajectory.

Layer-2 Scaling Solutions

Layer-2 scaling solutions like the Lightning Network are crucial for addressing Bitcoin's scalability challenges.

- Improved Scalability: By processing transactions off-chain, Layer-2 solutions significantly reduce transaction fees and increase transaction speeds, making Bitcoin more practical for everyday use.

- Increased Adoption: This improvement in usability can attract a broader range of users, potentially leading to increased demand and a Bitcoin price rebound.

Institutional Adoption and Regulatory Landscape

Growing institutional adoption and regulatory clarity (or lack thereof) are vital considerations.

- Regulatory Clarity: Clear and favorable regulatory frameworks can increase institutional investment and mainstream adoption of Bitcoin, supporting a rebound.

- Institutional Investments: Major financial institutions like [Mention examples] investing in Bitcoin demonstrates growing confidence and can influence price positively.

Expert Bitcoin Price Predictions

While predicting Bitcoin's price is inherently challenging, analyzing expert opinions provides valuable context.

Analyzing Predictions from Leading Analysts

Various analysts and research firms offer Bitcoin price predictions. [Mention predictions from reputable sources, citing their methodologies and assumptions]. These predictions range from [Low Prediction] to [High Prediction] by [Date].

Caveats and Limitations of Price Predictions

It is crucial to remember that price predictions are not guarantees.

- Market Volatility: The cryptocurrency market is highly volatile, making accurate long-term predictions extremely difficult.

- Unpredictable Factors: Unexpected events (e.g., regulatory changes, technological breakthroughs, or major market shifts) can significantly impact Bitcoin's price.

Conclusion: Has a Bitcoin Rebound Truly Begun? Final Thoughts and Call to Action

Analyzing current market trends, macroeconomic factors, technological developments, and expert predictions suggests the potential for a Bitcoin rebound. However, the cryptocurrency market remains inherently volatile. The evidence presented points towards the possibility of a rebound, but definitive statements are impossible. Conducting thorough research and understanding inherent risks are crucial before making any investment decisions. Remember that even with a bullish outlook on Bitcoin, careful analysis of the markets is still essential.

Stay informed about the Bitcoin rebound and its potential by following our blog for updates on the latest market analysis and price predictions. Continue your own research and make informed decisions based on your risk tolerance and investment goals.

Featured Posts

-

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025

Inter Milan Contract Expirations Key Players Out In 2026

May 08, 2025 -

Thunder Vs Pacers Injury Report And Player Availability For March 29th

May 08, 2025

Thunder Vs Pacers Injury Report And Player Availability For March 29th

May 08, 2025 -

Jones Beach Concert Cyndi Lauper And Counting Crows

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows

May 08, 2025 -

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025 -

Sufian Praises Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025

Sufian Praises Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025