Has The Bitcoin Rebound Begun? Predicting The Next Market Move

Table of Contents

Analyzing Recent Bitcoin Price Action

Understanding past price movements is crucial for predicting future trends in the Bitcoin market. Let's examine both short-term and long-term trends to get a clearer picture.

Short-Term Trends:

Recent price fluctuations have been dramatic. Analyzing key support and resistance levels is vital for short-term Bitcoin price prediction.

- Price Points: The recent break above the $28,000 resistance level, after consolidating around $26,000, is a significant development. However, a sustained break above $30,000 would provide stronger confirmation of a bullish trend. Conversely, a drop below $26,000 could signal further bearish pressure.

- Trading Volume: Increased trading volume accompanying price increases would lend more credence to a sustained rebound. Low volume breakouts are often less reliable indicators.

- News Events: Significant news, such as regulatory announcements or major institutional investments, can significantly impact short-term price action. Monitoring these events is crucial for accurate Bitcoin market analysis.

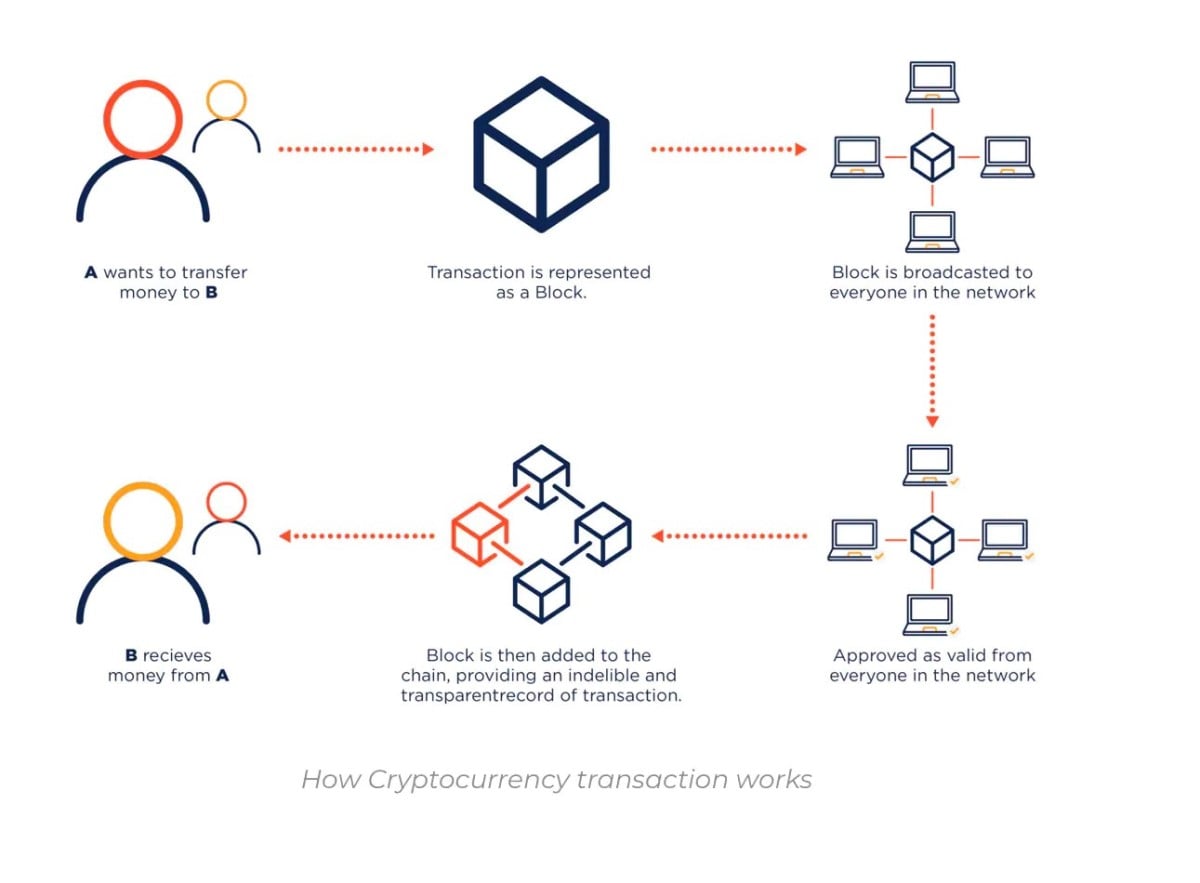

A chart visualizing these short-term fluctuations, highlighting support and resistance levels, would provide a much clearer visual representation of the current Bitcoin price action. (Insert chart here)

Long-Term Trends:

Looking beyond the short-term noise, analyzing the long-term historical trends of Bitcoin reveals cyclical patterns.

- Halving Cycles: Bitcoin's halving events, which reduce the rate of new Bitcoin creation, have historically been followed by periods of significant price appreciation. The next halving is approaching, which some analysts believe could be a catalyst for a bullish run.

- Market Cycles: Bitcoin's price has historically followed cyclical bull and bear markets. Understanding where we are in the current cycle is key to forming a Bitcoin price prediction.

- Adoption Rates: Increased adoption by institutions and governments can drive long-term price growth. Tracking adoption rates provides valuable insights into Bitcoin's future trajectory.

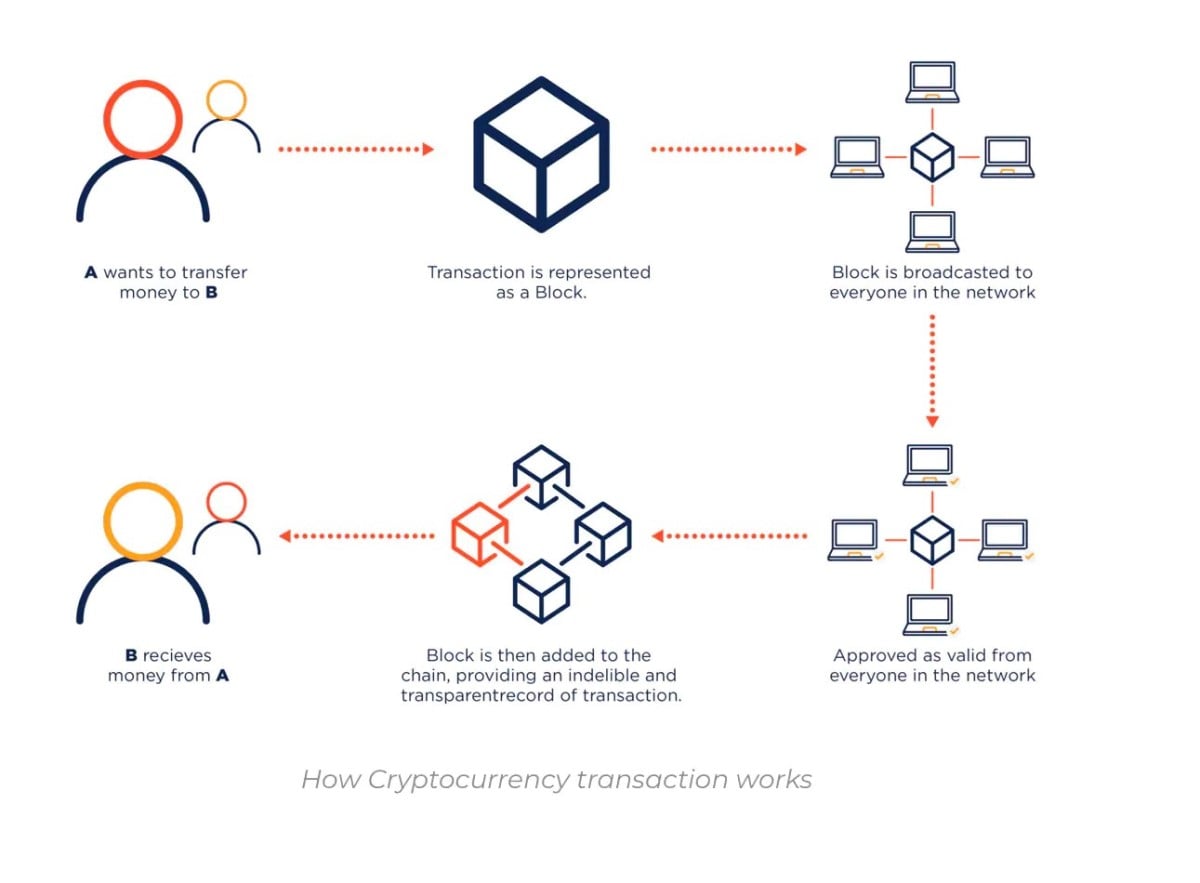

A long-term chart displaying past bull and bear markets alongside halving events would showcase these cyclical patterns effectively. (Insert chart here)

Key Factors Influencing the Bitcoin Market

Numerous factors beyond price action influence Bitcoin's value. Let's analyze some of the most important.

Macroeconomic Conditions:

Global macroeconomic conditions heavily influence Bitcoin's price.

- Inflation and Interest Rates: High inflation and rising interest rates can make Bitcoin a more attractive hedge against inflation, driving demand and potentially boosting its price.

- Global Economic Uncertainty: Periods of economic instability can increase investor interest in Bitcoin as a safe-haven asset.

- Correlation with Traditional Markets: Bitcoin's correlation with traditional markets has varied over time. Understanding this correlation is crucial for accurate Bitcoin market analysis and forecasting.

Regulatory Developments:

Government regulations significantly impact Bitcoin's adoption and price.

- Positive Regulations: Clear and favorable regulations in major economies could legitimize Bitcoin and attract institutional investment, leading to price appreciation.

- Negative Regulations: Conversely, harsh or unclear regulations could stifle growth and lead to price declines.

- Global Regulatory Landscape: It's vital to consider the regulatory environment globally, not just in one country.

Technological Advancements:

Technological improvements within the Bitcoin ecosystem impact its usability and scalability.

- Layer-2 Solutions: Technologies like the Lightning Network aim to improve Bitcoin's scalability and transaction speed, potentially driving increased adoption.

- Institutional Adoption: Increased institutional investment and integration of Bitcoin into existing financial systems are significant drivers of price appreciation.

- Network Upgrades: Successful network upgrades enhance security and efficiency, contributing to a more robust and attractive asset.

Market Sentiment and Social Media:

Social media sentiment and news cycles greatly influence investor perception.

- Influencer Impact: Statements and actions from prominent figures in the crypto space can significantly influence market sentiment.

- News Cycles: Positive news stories often correlate with price increases, while negative news can trigger sell-offs.

- Social Media Analysis: Tracking social media sentiment using tools that analyze the overall tone of discussions on platforms like Twitter can provide valuable insights.

Predicting the Next Move: Bullish or Bearish?

Weighing the bullish and bearish arguments is crucial for forming a realistic prediction.

Bullish Case:

A Bitcoin rebound is plausible based on:

- Approaching Halving: Historically, halving events have preceded significant price increases.

- Macroeconomic Uncertainty: Continued inflation and economic instability could drive investors towards Bitcoin as a hedge.

- Positive Regulatory Developments: Favorable regulatory changes could boost investor confidence.

- Technological Advancements: Improvements in scalability and usability could increase adoption rates.

Bearish Case:

However, several factors could hinder a Bitcoin rebound:

- Regulatory Crackdowns: Stricter regulations could stifle growth and reduce investor interest.

- Macroeconomic Instability: A global economic downturn could negatively impact risk assets like Bitcoin.

- Decreased Investor Interest: A lack of new investment could lead to continued price stagnation or decline.

- Technological Challenges: Unresolved scalability issues could limit adoption and price appreciation.

Conclusion of Predictions:

The current situation presents both bullish and bearish possibilities. While the approaching halving and potential for increased institutional adoption are positive signs, macroeconomic uncertainty and regulatory risks remain significant. A balanced approach is needed when considering a Bitcoin price prediction.

Conclusion

Several key factors influence the Bitcoin market's potential for a rebound. The approaching halving, macroeconomic conditions, regulatory developments, technological advancements, and market sentiment all play critical roles. While the bullish case presents compelling arguments, the bearish case highlights significant risks. Ultimately, predicting the next Bitcoin market move is inherently uncertain.

Call to Action: While the future of Bitcoin is uncertain, understanding these key factors is crucial for navigating the market and potentially benefiting from a Bitcoin rebound. Conduct thorough research, assess your risk tolerance, and make informed decisions about your Bitcoin investment strategy. Remember that investing in cryptocurrencies carries inherent risks, and you could lose some or all of your investment. Don't invest more than you can afford to lose.

Featured Posts

-

Understanding The Factors Contributing To Dogecoin Shiba Inu And Suis Growth

May 08, 2025

Understanding The Factors Contributing To Dogecoin Shiba Inu And Suis Growth

May 08, 2025 -

Arsenal News Dembele Injury Update And Its Implications For Arteta

May 08, 2025

Arsenal News Dembele Injury Update And Its Implications For Arteta

May 08, 2025 -

Miras Planlamasi Kripto Varliklarinizi Guevence Altina Alin

May 08, 2025

Miras Planlamasi Kripto Varliklarinizi Guevence Altina Alin

May 08, 2025 -

Liga De Quito Vs Flamengo Reporte Del Empate En La Libertadores

May 08, 2025

Liga De Quito Vs Flamengo Reporte Del Empate En La Libertadores

May 08, 2025 -

Data Transfer Best Practices For A Seamless Transition

May 08, 2025

Data Transfer Best Practices For A Seamless Transition

May 08, 2025