Have Trump's Billionaire Pals Lost Money Since Liberation Day? A Look At Tariff Impacts

Table of Contents

The Billionaire Network and Trump's Trade Policies

Several billionaires enjoyed close ties to the Trump administration, with their business interests significantly impacting or being impacted by the administration's trade policies. Individuals like Wilbur Ross, known for his investments in steel and coal, and others with holdings in various sectors directly affected by tariffs, offer compelling case studies. These figures often found themselves at the center of discussions surrounding the economic implications of Trump's protectionist stance.

Their business interests spanned various sectors heavily influenced by the tariffs imposed. These tariffs targeted a range of imported goods including:

- Steel and Aluminum: These tariffs directly impacted manufacturing industries, impacting companies reliant on imported metals.

- Consumer Goods: Tariffs on goods like clothing and electronics led to increased prices for consumers and shifted supply chains.

- Agricultural Products: Tariffs imposed by other countries in retaliation impacted American agricultural exports.

Some billionaires publicly voiced support for these tariffs, arguing they would protect American jobs and industries. Others, however, expressed concerns about the potential negative consequences, including retaliatory tariffs from other nations and increased costs for consumers. The nuances of their positions, and the complexities of their vast and diverse business holdings, require further analysis to uncover the true effects of the tariffs.

Analyzing Post-Tariff Financial Performance

To assess the impact of the tariffs, we examined the net worth of select billionaires before and after the implementation of major tariff measures. Data sourced from reputable financial publications like Forbes and Bloomberg reveals a mixed picture. While some experienced minimal changes, others saw both significant increases and decreases in their net worth.

- Visual Representation: [Insert chart or graph here showing net worth fluctuations of selected billionaires alongside relevant market indices like the S&P 500]. This visual aid clearly demonstrates the relative performance of these individuals compared to broader market trends.

- Industry-Specific Impacts: The steel and aluminum industries, for instance, exhibited varied responses. Some companies thrived, while others struggled amidst increased production costs and reduced demand. This underscores the complexities of assessing direct tariff impacts in isolation.

- Data Limitations: It's crucial to acknowledge that stock market fluctuations are influenced by a myriad of factors beyond tariffs. Global economic conditions, individual company performance, and geopolitical events all contribute to the overall economic landscape.

Beyond Tariffs: Other Factors Affecting Billionaire Wealth

Attributing changes in billionaire wealth solely to tariffs would be an oversimplification. Numerous other factors significantly impact their financial performance:

- Macroeconomic Factors: Global economic conditions, inflation rates, and recessionary fears all influence market valuations.

- Company-Specific Events: Mergers, acquisitions, successful product launches, and internal management decisions play crucial roles.

- Geopolitical Events: International conflicts, trade disputes (beyond those directly related to Trump's tariffs), and political instability can dramatically affect business environments.

These factors often overshadow the direct impact of any single policy, making isolating the specific influence of tariffs extremely challenging.

The Broader Economic Impact of Trump's Tariffs

Trump's tariffs sparked intense debate regarding their overall economic impact on the United States. While proponents argued they protected American industries and jobs, critics pointed to increased consumer prices, trade wars with other countries, and disruptions to global supply chains.

- Job Creation/Loss: Studies on the net effect on employment remain inconclusive, with estimates ranging from minimal job gains to significant job losses depending on the industry and methodology.

- Inflationary Pressures: Tariffs undeniably contributed to increased costs for consumers, exacerbating inflationary pressures in certain sectors.

- Economic Studies: Numerous economic studies have examined the impacts of the tariffs, offering divergent conclusions that depend on model assumptions and methodologies. Further research is needed to achieve a clear consensus.

Conclusion: Have Trump's Billionaire Pals Truly Benefited (or Suffered)? A Final Assessment of Tariff Impacts

Our analysis reveals that the relationship between Trump's tariffs and the financial performance of his billionaire associates is complex and not easily quantifiable. While some might have experienced short-term gains or losses potentially linked to the tariffs, disentangling the impact from other economic factors is impossible. Attributing specific wealth changes solely to tariff policies oversimplifies a multifaceted economic reality. The broader economic implications of these policies remain a subject of ongoing discussion and research. Deepen your understanding of Trump's tariff impacts by exploring reputable economic studies and forming your own informed conclusions. Continue learning about the long-term consequences of trade policies on various economic actors, going beyond this limited case study of a select group of billionaires.

Featured Posts

-

Neden Bitcoin Madenciligi Artik Eskisi Gibi Karli Degil

May 09, 2025

Neden Bitcoin Madenciligi Artik Eskisi Gibi Karli Degil

May 09, 2025 -

Snls Bad Harry Styles Impression Leaves Him Devastated

May 09, 2025

Snls Bad Harry Styles Impression Leaves Him Devastated

May 09, 2025 -

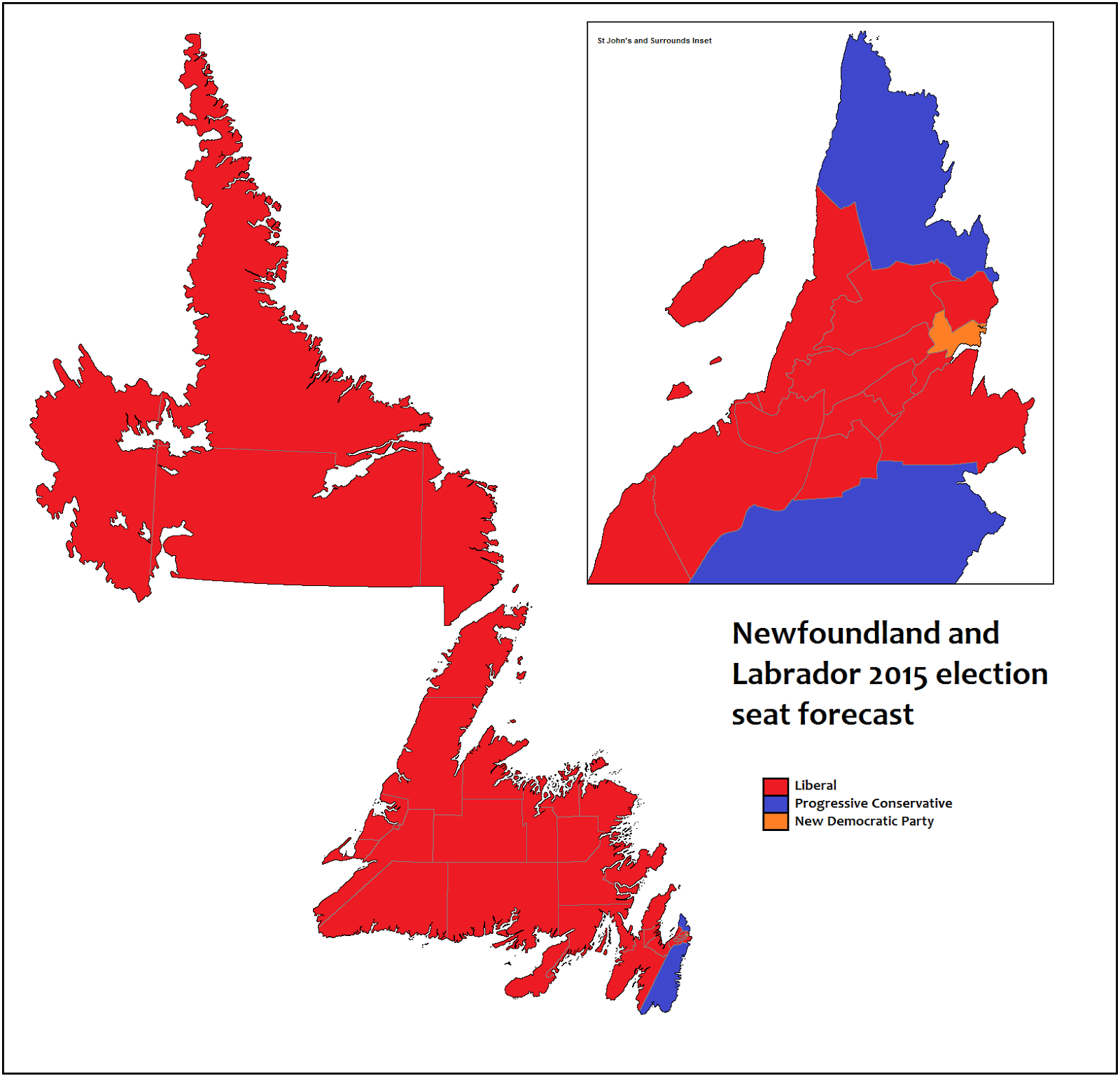

Get To Know Your Nl Federal Election Candidates

May 09, 2025

Get To Know Your Nl Federal Election Candidates

May 09, 2025 -

Polonesa Afirma Ser Maddie Mc Cann Prisao No Reino Unido

May 09, 2025

Polonesa Afirma Ser Maddie Mc Cann Prisao No Reino Unido

May 09, 2025 -

Adin Hills Strong Goaltending Propels Vegas Golden Knights Past Columbus Blue Jackets

May 09, 2025

Adin Hills Strong Goaltending Propels Vegas Golden Knights Past Columbus Blue Jackets

May 09, 2025