Heineken Revenue Surpasses Projections: A Closer Look At The Results

Table of Contents

Strong Global Sales Growth Fuels Heineken Revenue

Heineken's impressive revenue performance is primarily driven by robust global sales growth across its diverse portfolio. The company's success is a testament to its effective strategies in navigating a complex market environment.

Key Market Performance

Heineken experienced strong growth across several key markets. Analyzing regional performance provides crucial insights into the drivers of this success.

- Asia-Pacific: Experienced a 15% increase in Heineken sales growth year-over-year, driven by strong demand in China and Vietnam. Increased market share attributed to successful marketing campaigns targeting younger demographics.

- Europe: Saw a 10% rise in Heineken sales growth, despite economic headwinds in some countries. Growth was primarily driven by premium brands and successful promotional activities.

- Americas: Recorded an 8% increase in Heineken sales growth, with particularly strong performance in Mexico and Brazil. This success can be partly attributed to increased brand awareness and strategic partnerships.

Regional variations in performance reflect diverse market dynamics. For instance, the robust performance in Asia is partly attributable to the region's growing middle class and increasing consumption of premium beers. Conversely, the relatively lower growth in Europe reflects economic uncertainties impacting consumer spending in certain markets.

Premiumization Strategy's Success

Heineken's strategic focus on premium beer brands has significantly contributed to its revenue growth. The company's premium portfolio continues to outperform the overall market, further bolstering its bottom line.

- Heineken 0.0: The alcohol-free variant has seen exceptional growth, driven by the rising health-conscious consumer base.

- Heineken Silver: This lighter, refreshing option has tapped into growing demand for lower-calorie beers.

- Desperados: This flavored beer has seen consistent growth, expanding Heineken's reach into the broader flavored beverage market.

The increased contribution of premium products to overall revenue highlights the effectiveness of Heineken's strategy in catering to evolving consumer preferences and capturing a larger share of the luxury segment. Data shows premium brands now account for over 40% of Heineken's total revenue.

Operational Efficiency and Cost Management

Heineken's success also stems from its unwavering commitment to operational efficiency and strategic cost management. This focus has enabled the company to mitigate the impact of rising input costs and supply chain challenges.

Supply Chain Optimization

Heineken has invested significantly in optimizing its supply chain, resulting in increased efficiency and reduced costs.

- Technology Adoption: Implementation of advanced technologies, such as predictive analytics and AI-powered logistics, has streamlined operations and improved delivery times.

- Sustainable Practices: Initiatives focused on reducing water and energy consumption have not only lowered operating costs but also enhanced the company's environmental profile.

These improvements in supply chain management have resulted in significant cost reductions, allowing Heineken to maintain profitability despite inflationary pressures.

Marketing and Branding Initiatives

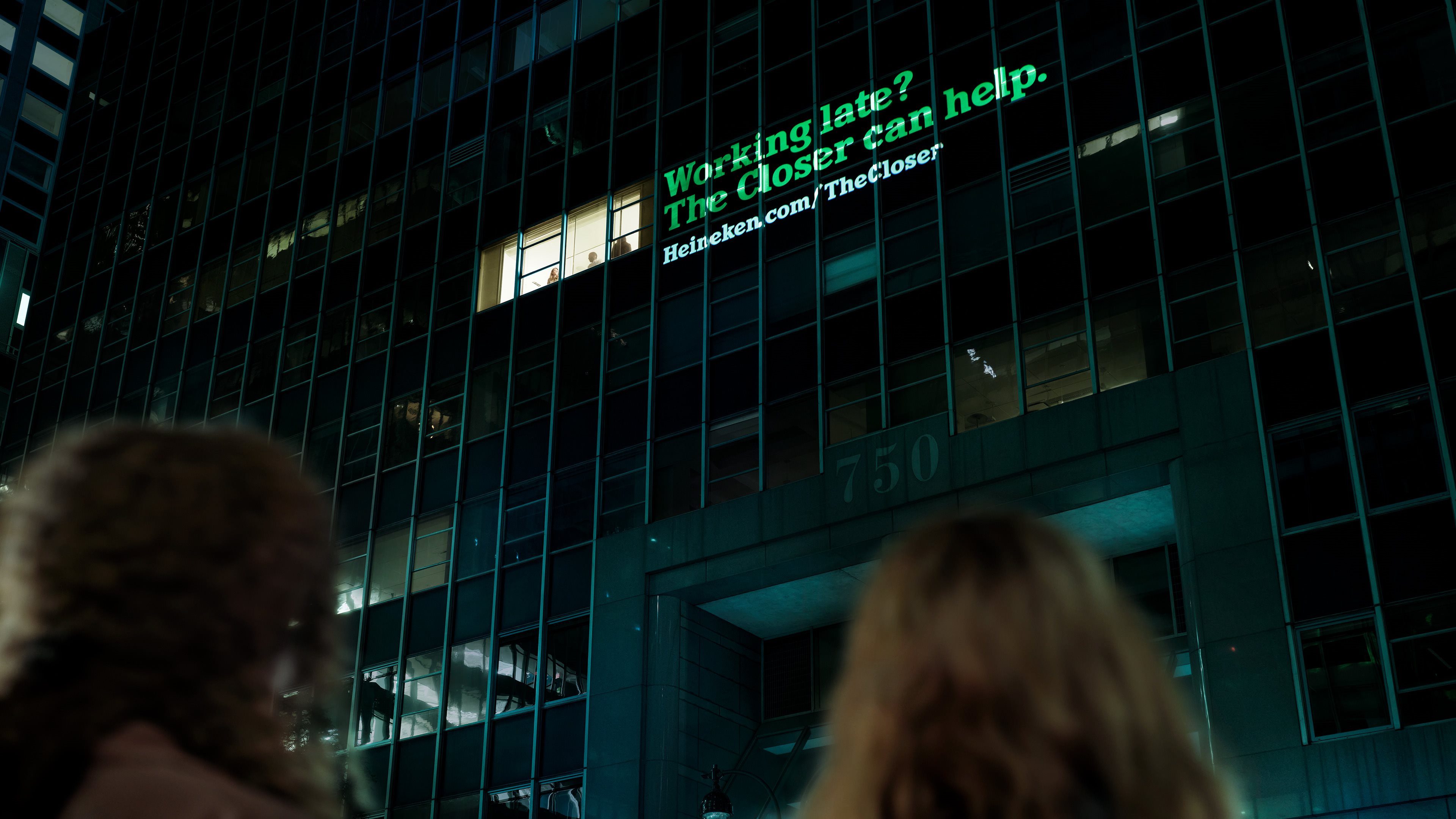

Targeted marketing campaigns and effective brand-building strategies have played a crucial role in driving Heineken's revenue growth.

- Digital Marketing: Investing heavily in digital marketing channels like social media and influencer partnerships to engage younger consumers.

- Experiential Marketing: Organizing engaging events and sponsoring relevant activities to strengthen brand loyalty and boost customer engagement.

Data shows that these initiatives have significantly increased brand awareness and positive brand perception among target demographics, positively impacting sales. Social media engagement has increased by 25% year-over-year.

Future Outlook and Investment Strategies

Heineken's strong Q3 2023 performance provides a solid foundation for future growth. The company remains optimistic about its prospects, driven by strategic investments and a commitment to sustainable practices.

Growth Projections and Investment Plans

Heineken projects continued revenue growth in the coming quarters, driven by both organic growth and strategic acquisitions.

- Market Expansion: Further expansion into high-growth markets, particularly in Asia and Africa.

- New Product Launches: Introduction of innovative products to cater to evolving consumer preferences and diversify its portfolio.

Management expresses confidence in achieving its ambitious growth targets, leveraging its strong brand portfolio and operational capabilities.

Sustainability and ESG Initiatives

Heineken is committed to reducing its environmental footprint and promoting social responsibility. This commitment strengthens brand reputation and fosters long-term growth.

- Water Conservation: Implementing various initiatives to reduce water usage across its brewing operations.

- Renewable Energy: Transitioning to renewable energy sources to lessen its carbon emissions.

These sustainability initiatives not only contribute to a positive environmental impact but also enhance the company’s brand image and attract environmentally-conscious consumers, fostering long-term growth.

Conclusion

Heineken's exceeding revenue projections demonstrates the effectiveness of its strategic initiatives and adaptability to the evolving market landscape. The company's strong global sales growth, coupled with a focus on premiumization, operational efficiency, and a commitment to sustainability, positions it well for continued success. To stay updated on Heineken’s performance and future strategies, continue following news and reports related to Heineken revenue and its overall financial health. Understanding the drivers behind Heineken's revenue growth is crucial for investors and industry professionals alike.

Featured Posts

-

Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Analisi Della Classifica

May 25, 2025

Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Analisi Della Classifica

May 25, 2025 -

Manny Garcias Lego Workshop At Veterans Memorial Elementary School

May 25, 2025

Manny Garcias Lego Workshop At Veterans Memorial Elementary School

May 25, 2025 -

Cac 40 Index Weeks End In Red Maintaining Weekly Strength

May 25, 2025

Cac 40 Index Weeks End In Red Maintaining Weekly Strength

May 25, 2025 -

Memorial Day 2025 Air Travel Avoid These Busy Dates

May 25, 2025

Memorial Day 2025 Air Travel Avoid These Busy Dates

May 25, 2025 -

Apple Stock Long Term Outlook After Wedbushs Price Target Revision

May 25, 2025

Apple Stock Long Term Outlook After Wedbushs Price Target Revision

May 25, 2025

Latest Posts

-

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025 -

The Problem With Thames Waters Executive Bonuses

May 25, 2025

The Problem With Thames Waters Executive Bonuses

May 25, 2025 -

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025 -

Thames Water Executive Compensation A Public Outcry

May 25, 2025

Thames Water Executive Compensation A Public Outcry

May 25, 2025 -

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025