High Down Payments In Canada: A Major Obstacle To Homeownership

Table of Contents

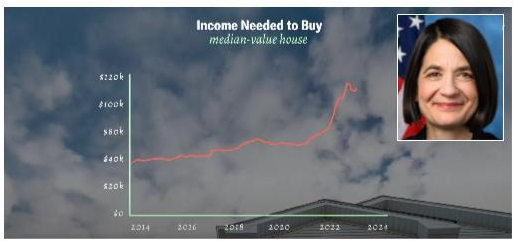

The Rising Cost of Housing and its Impact on Down Payments

The soaring cost of housing across Canada is the primary driver behind the difficulty of saving for a down payment. Average house prices have skyrocketed in major cities like Toronto, Vancouver, and Montreal over the past five years, making even entry-level properties unattainable for many. This escalating cost directly impacts the required down payment percentage, typically ranging from 5% to 20% of the purchase price.

-

Average house price increase in major cities over the last 5 years: Toronto has seen increases exceeding 50%, Vancouver even more, while Montreal has experienced a more moderate, yet still significant, rise. These figures dramatically increase the down payment needed.

-

Down payment amounts needed for different price ranges: A 5% down payment on a $750,000 home in Toronto requires $37,500, while a 20% down payment necessitates a substantial $150,000. This stark difference underscores the financial burden for first-time buyers.

-

Impact of CMHC insurance premiums on overall costs: Even with a smaller down payment, securing a mortgage often involves Canada Mortgage and Housing Corporation (CMHC) insurance, adding to the overall cost. These premiums increase significantly as the down payment percentage decreases, further complicating the process.

CMHC Insurance and its Limitations

The CMHC plays a crucial role in facilitating homeownership by insuring mortgages with down payments less than 20%. This allows lenders to offer mortgages to individuals who might not otherwise qualify. However, CMHC insurance comes with limitations:

-

CMHC insurance requirements and premiums for various down payment percentages: The higher the loan-to-value ratio (the percentage of the home's value borrowed), the higher the CMHC premium, adding substantial costs to the mortgage.

-

The impact of these premiums on monthly mortgage payments: These added premiums are factored into the monthly payments, increasing the overall financial burden on the borrower.

-

Alternative lenders and their higher interest rates: Individuals who cannot meet CMHC requirements may turn to alternative lenders, often facing significantly higher interest rates and less favorable terms.

Saving for a Large Down Payment: A Herculean Task for Many

Accumulating a substantial down payment in today's economic climate is a significant challenge for many Canadians. Rising living costs – including rent, groceries, and transportation – significantly impact saving capacity, especially for young adults, new immigrants, and low-income earners.

-

Average savings rates among Canadians: Statistics reveal that a considerable portion of the Canadian population struggles to save sufficient funds for a substantial down payment.

-

Strategies for saving for a down payment (budgeting, high-yield savings accounts, etc.): Effective budgeting, utilizing high-yield savings accounts, and exploring government-sponsored savings plans are crucial steps.

-

Government programs and initiatives aimed at helping first-time homebuyers: Several government programs offer assistance with down payments, but these often have eligibility requirements that can be difficult to meet.

Alternative Strategies to Overcome High Down Payments

Facing the challenges of high down payments, some individuals explore alternative routes to homeownership:

-

Co-buying: Sharing the purchase and responsibility with another individual or family can significantly reduce the individual down payment burden.

-

Family assistance: Financial support from family members can provide a vital boost to down payment savings, allowing individuals to enter the market sooner.

-

Rent-to-own: This option offers a gradual path to ownership, allowing tenants to build equity over time before ultimately purchasing the property.

Conclusion: Navigating the Challenges of High Down Payments in Canada

High house prices, the burden of CMHC insurance, and the difficulty of saving for significant down payments represent substantial barriers to homeownership in Canada. These challenges disproportionately affect first-time buyers and specific demographics. Careful planning, financial literacy, and exploration of available resources, including government programs and alternative strategies, are crucial for navigating the complex landscape of high down payments in Canada. Start your journey towards homeownership today – explore the options for navigating high down payments and find the solution that works best for your circumstances. Seek professional financial advice to create a realistic and achievable plan.

Featured Posts

-

10 Unforgettable Film Noir Classics You Need To See

May 10, 2025

10 Unforgettable Film Noir Classics You Need To See

May 10, 2025 -

A Simple Path To Profitable Dividend Investing

May 10, 2025

A Simple Path To Profitable Dividend Investing

May 10, 2025 -

Un Incendie Se Declare A La Mediatheque Champollion A Dijon

May 10, 2025

Un Incendie Se Declare A La Mediatheque Champollion A Dijon

May 10, 2025 -

Analyzing The Changes In Elon Musks Net Worth Under The Trump Administration First 100 Days

May 10, 2025

Analyzing The Changes In Elon Musks Net Worth Under The Trump Administration First 100 Days

May 10, 2025 -

La Fires Fuel Landlord Price Gouging Controversy A Reality Tv Stars Perspective

May 10, 2025

La Fires Fuel Landlord Price Gouging Controversy A Reality Tv Stars Perspective

May 10, 2025