High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Assessment of Current Market Valuations

This section delves into BofA's research and reports on current stock market valuations, examining their methodology and key findings. BofA, a major financial institution, regularly publishes market analyses that offer valuable insights for investors. Their assessments often incorporate a range of valuation metrics and economic indicators.

-

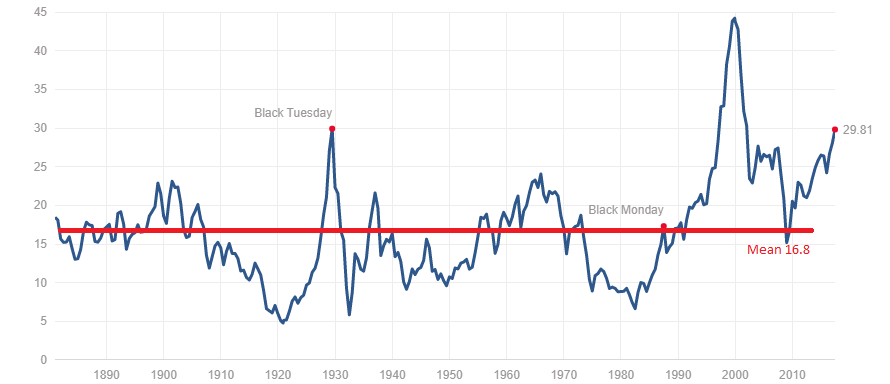

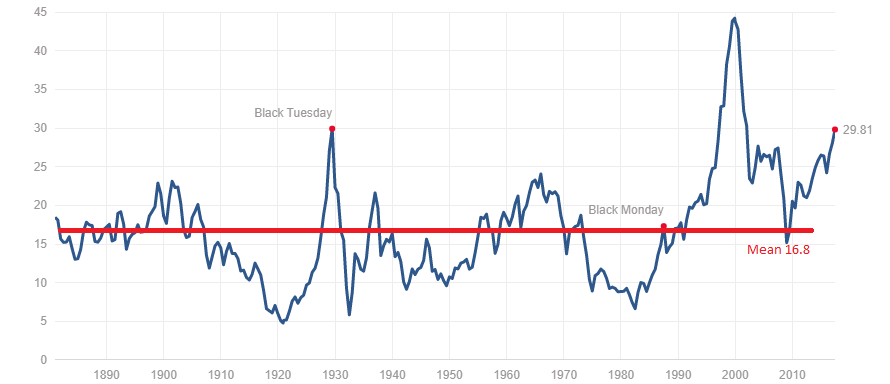

Summary of BofA's valuation metrics: BofA's analysis typically includes key metrics like the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other valuation multiples. These metrics provide a comparative measure of current market valuations relative to historical averages and earnings expectations. They often consider various market segments and sectors, providing a nuanced view of valuation levels.

-

BofA's outlook on potential market corrections or bubbles: BofA's reports often address the potential for market corrections or even the emergence of a speculative bubble. Their outlook considers factors such as the pace of economic growth, inflation levels, and monetary policy. They might caution against overvaluation in specific sectors while highlighting potentially undervalued segments. Understanding their outlook helps investors gauge the potential risks associated with the current market conditions.

-

Comparison of current valuations to historical averages: BofA's analysis usually includes a historical perspective, comparing current valuations to long-term averages. This contextualizes current levels, showing whether valuations are significantly above or below historical norms. This historical comparison is crucial in determining whether the current valuations are truly excessive or within a reasonable range.

-

BofA's consideration of factors like interest rates and economic growth: BofA's assessment accounts for macroeconomic factors, such as interest rates and economic growth, which significantly impact stock valuations. Rising interest rates, for instance, can negatively affect company earnings and, consequently, stock prices, potentially leading to market corrections. Conversely, robust economic growth can support higher valuations.

Understanding the Risks Associated with High Valuations

High valuations inherently carry greater risk. This section discusses potential downsides investors should be aware of when navigating a market characterized by high stock valuations.

-

Increased vulnerability to market corrections and volatility: Highly valued markets are more susceptible to sharp corrections. A sudden shift in investor sentiment or an unexpected economic downturn can trigger significant price declines. This heightened volatility requires a more cautious approach to investment strategies.

-

The potential for lower future returns compared to periods of lower valuations: Investing in a highly valued market generally implies lower potential returns in the future compared to periods when valuations are more moderate. This is because future growth is already largely priced in.

-

Impact of rising interest rates on stock prices: Rising interest rates increase borrowing costs for companies, potentially impacting profitability and reducing their attractiveness to investors. This can exert downward pressure on stock prices, especially in growth sectors which are highly sensitive to interest rate changes.

-

Geopolitical risks and their influence on market sentiment: Geopolitical events and uncertainty can significantly influence investor sentiment and market valuations. Unexpected global events can lead to market corrections even in a market characterized by seemingly high valuations.

Strategies for Investors in a High Valuation Environment

Even with high valuations, investors can still make informed decisions. This section offers strategies to mitigate risks and potentially benefit from the market, even with elevated stock market valuations.

-

Diversification across asset classes: Diversifying across different asset classes, such as bonds, real estate, and commodities, can reduce overall portfolio risk. This strategy helps mitigate losses if one asset class underperforms.

-

Focus on quality companies with strong fundamentals and sustainable growth prospects: Investing in high-quality companies with robust financial fundamentals and sustainable growth prospects reduces the impact of market volatility. These companies are generally more resilient during market corrections.

-

Value investing strategies to identify undervalued opportunities: Value investing strategies focus on identifying companies whose stock prices are below their intrinsic value. This approach can potentially yield higher returns, even during periods of high market valuations.

-

Regular portfolio rebalancing to manage risk: Regularly rebalancing your portfolio to maintain your target asset allocation helps manage risk and capitalize on market fluctuations. This helps ensure you're not overexposed to any particular sector.

-

Consideration of alternative investment strategies: Exploring alternative investment strategies, such as private equity or hedge funds, can provide diversification benefits and potentially higher returns, albeit with potentially higher risks.

The Importance of Long-Term Investing

This subsection emphasizes the importance of maintaining a long-term perspective in navigating market fluctuations and high stock market valuations.

-

Advantages of a buy-and-hold approach: A buy-and-hold strategy minimizes the impact of short-term market volatility. It allows investors to benefit from the long-term growth potential of their investments.

-

Averaging down during market dips: Market dips offer opportunities to average down your cost basis by purchasing additional shares at lower prices. This strategy reduces the average cost per share and enhances potential returns.

-

The importance of ignoring short-term market noise: Focusing on the long-term investment horizon allows investors to ignore short-term market noise and fluctuations. This approach is especially important during periods of high valuations.

Conclusion

This article examined BofA's analysis of high stock market valuations, highlighting both the potential risks and strategies for investors to navigate this environment. Understanding BofA's perspective, along with the inherent risks and mitigating strategies, empowers investors to make informed decisions. Remember that market timing is challenging, and a long-term approach is often the most successful strategy for navigating high stock market valuations.

Call to Action: While high stock market valuations present challenges, they don't necessarily signal an impending crash. By carefully considering BofA's insights and employing sound investment strategies, you can navigate the complexities of high stock market valuations and build a resilient portfolio. Continue researching and seeking professional financial advice to best manage your investments during periods of high stock market valuations.

Featured Posts

-

Indias Trade Relations A Shift Away From Pakistan Turkey And Azerbaijan

May 18, 2025

Indias Trade Relations A Shift Away From Pakistan Turkey And Azerbaijan

May 18, 2025 -

Indias Economic Isolation Of Pakistan Turkey And Azerbaijan

May 18, 2025

Indias Economic Isolation Of Pakistan Turkey And Azerbaijan

May 18, 2025 -

Us Army Embraces Right To Repair A New Era For Military Equipment Maintenance

May 18, 2025

Us Army Embraces Right To Repair A New Era For Military Equipment Maintenance

May 18, 2025 -

Students Ai Research Paper Mits Official Response

May 18, 2025

Students Ai Research Paper Mits Official Response

May 18, 2025 -

Political Clash Trump And Springsteen Trade Accusations Of Treason

May 18, 2025

Political Clash Trump And Springsteen Trade Accusations Of Treason

May 18, 2025

Latest Posts

-

Moncada And Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025

Moncada And Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025 -

Angels Stars Family Health Crisis Details Of This Offseasons Tragic Events

May 18, 2025

Angels Stars Family Health Crisis Details Of This Offseasons Tragic Events

May 18, 2025 -

Angels 1 0 Win A Testament To Sorianos Pitching Prowess

May 18, 2025

Angels 1 0 Win A Testament To Sorianos Pitching Prowess

May 18, 2025 -

Jose Sorianos Shutout Performance Secures Angels 1 0 Victory Over White Sox

May 18, 2025

Jose Sorianos Shutout Performance Secures Angels 1 0 Victory Over White Sox

May 18, 2025 -

Angels Defeat White Sox 1 0 Moncada And Soriano Shine

May 18, 2025

Angels Defeat White Sox 1 0 Moncada And Soriano Shine

May 18, 2025