High Stock Market Valuations: BofA's Analysis And Reasons For Investor Calm

Table of Contents

BofA's Analysis of High Stock Market Valuations

Key Findings

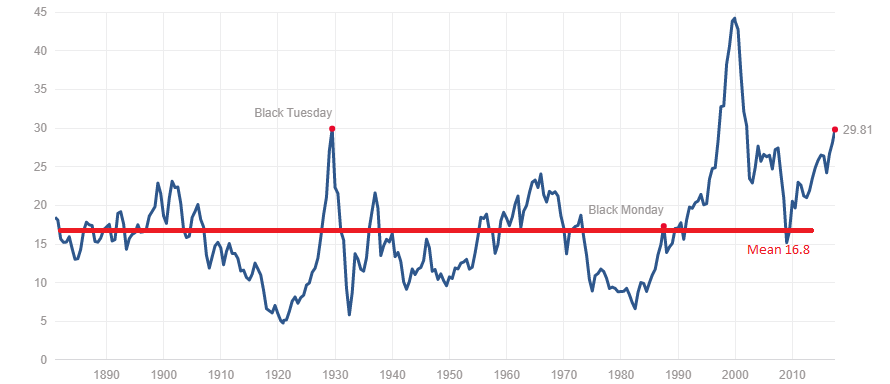

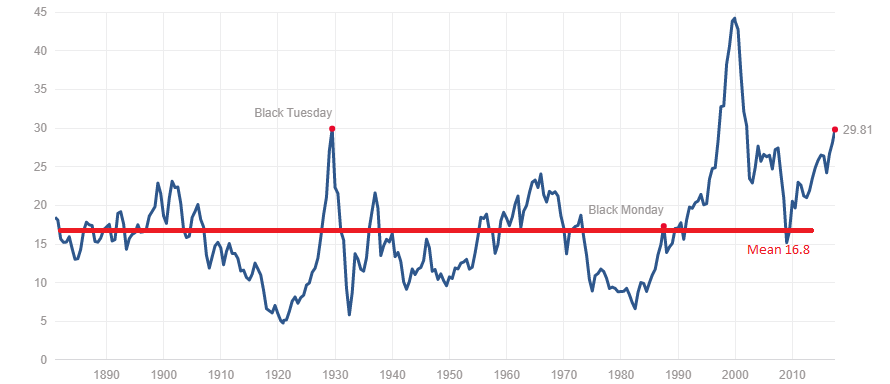

BofA's recent report paints a picture of historically high stock market valuations. Their analysis utilizes several key valuation metrics:

- Price-to-Earnings (P/E) Ratios: BofA reports that the forward P/E ratio for the S&P 500 currently sits at 22, exceeding the long-term average by approximately 15%. This indicates that investors are paying a premium for each dollar of earnings.

- Shiller P/E Ratio (CAPE): The cyclically adjusted price-to-earnings ratio (CAPE), a measure that smooths out earnings fluctuations over a 10-year period, is also significantly above its historical average. BofA's data suggests a CAPE ratio exceeding historical averages by a concerning margin, signaling potentially overvalued market conditions.

- Other Valuation Metrics: BofA's comprehensive analysis also includes other valuation metrics, such as price-to-sales and price-to-book ratios, which further support their conclusion of elevated valuations across various sectors.

BofA's assessment acknowledges the potential risks associated with these high valuations, including:

- Increased Market Volatility: High valuations often precede periods of increased market volatility and potential corrections.

- Market Corrections: A significant market downturn is a distinct possibility given the current levels.

- Reduced Returns: Investors who enter the market at these elevated valuations may experience lower future returns compared to those who invested at lower valuations.

BofA's analysis also pinpoints certain sectors and specific companies as particularly overvalued, though these specifics are usually included in their paid research reports and not always public knowledge.

Methodology and Data Sources

BofA's analysis employs a robust methodology, combining quantitative and qualitative factors. Their research leverages extensive historical data on stock prices, earnings, and economic indicators. Data sources include proprietary databases, publicly available market data, and economic forecasts from reputable sources. The bank's rigorous approach strengthens the credibility of its findings and helps to inform their stock market outlook.

BofA's Predictions and Recommendations (if any)

While specific predictions and recommendations from BofA’s recent reports are often reserved for their clients, the general consensus points toward a cautious approach. The implication is to carefully manage risk and potentially consider diversifying portfolios to mitigate the impact of a potential market correction.

Reasons for Continued Investor Calm Despite High Valuations

Despite BofA's warnings, investor calm persists. Several factors contribute to this apparent contradiction:

Low Interest Rates

Historically low interest rates play a crucial role in supporting high stock market valuations. With bond yields remaining relatively low, equities become a more attractive investment alternative, driving demand and pushing prices higher.

- Monetary Policy Impact: Central bank policies aimed at maintaining low interest rates (such as quantitative easing) inject liquidity into the market, bolstering investor confidence and fueling stock price increases.

- Future Interest Rate Hikes: While future interest rate hikes are anticipated, their pace and impact remain uncertain, contributing to ongoing investor optimism in the short term.

Strong Corporate Earnings and Growth Expectations

Robust corporate earnings and positive future growth projections are key factors bolstering investor confidence and sustaining high stock prices, even with high stock market valuations.

- Strong Earnings Reports: Many major companies have reported strong earnings, exceeding expectations and fueling market optimism.

- Positive Growth Projections: Analysts’ forecasts for future earnings growth remain generally positive, indicating continued confidence in the underlying strength of the economy.

Investor Risk Appetite and Sentiment

Investor sentiment and risk appetite are crucial elements in determining market behavior. Currently, despite concerns over high valuations, investor risk appetite remains relatively high.

- Geopolitical Events: While geopolitical uncertainties exist, they haven't significantly dampened investor enthusiasm.

- Technological Advancements: Continued technological innovation and disruption contribute to a sense of optimism and potential growth opportunities.

- Market Indices: Major market indices reflect continued positive investor sentiment, although this can change rapidly.

The Search for Yield

In a low-interest-rate environment, investors are actively searching for yield. Equities, even at high valuations, offer potentially higher returns compared to low-yielding bonds. This search for yield contributes to the sustained demand for stocks.

Conclusion

BofA's analysis clearly indicates high stock market valuations, presenting potential risks. However, countervailing factors like low interest rates, strong corporate earnings, positive investor sentiment, and the search for yield have combined to create a climate of relative investor calm. Understanding these complexities is crucial for making informed investment decisions.

While BofA's assessment highlights the elevated stock market valuations, it’s vital to remember that markets are dynamic. Continuing to monitor the market closely and seeking professional financial advice are critical to navigating these high stock market valuations effectively. Consider diversifying your portfolio to mitigate potential risks associated with these high valuations. Remember, responsible investing is about understanding and managing risk, not merely chasing high returns.

Featured Posts

-

Gaza Hostages The Nightmare Continues For Families

May 13, 2025

Gaza Hostages The Nightmare Continues For Families

May 13, 2025 -

From Poop To Podcast Ais Role In Transforming Repetitive Documents

May 13, 2025

From Poop To Podcast Ais Role In Transforming Repetitive Documents

May 13, 2025 -

Sag Aftra Joins Wga On Strike What It Means For Hollywood

May 13, 2025

Sag Aftra Joins Wga On Strike What It Means For Hollywood

May 13, 2025 -

April Prinasa Aktualizaciu Atlasu Romskych Komunit Zacina Sa Zber Dat

May 13, 2025

April Prinasa Aktualizaciu Atlasu Romskych Komunit Zacina Sa Zber Dat

May 13, 2025 -

Planning Your Winterwatch Adventure A Comprehensive Guide

May 13, 2025

Planning Your Winterwatch Adventure A Comprehensive Guide

May 13, 2025

Latest Posts

-

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025 -

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025 -

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait In Sweet Video Watch Now

May 14, 2025

Scotty Mc Creerys Son Honors George Strait In Sweet Video Watch Now

May 14, 2025