High Stock Market Valuations: Understanding BofA's Optimistic Outlook

Table of Contents

BofA's Rationale for a Positive Outlook Despite High Valuations

BofA's optimistic outlook, despite acknowledging high stock market valuations, rests on several key pillars. Their analysis suggests that current valuations, while high, are not necessarily unsustainable. The firm points to a confluence of factors supporting continued market growth.

- Strong Corporate Earnings: BofA highlights the robust earnings growth reported by many companies, suggesting that current valuations are justified by strong fundamentals. They cite consistent upward revisions in earnings estimates as a significant indicator of future growth.

- Low Interest Rates: The persistently low interest rate environment continues to support borrowing and investment, fueling economic activity and bolstering corporate profitability. This, BofA argues, helps offset concerns about high price-to-earnings ratios.

- Technological Innovation: Continued technological advancements and disruptive innovation are cited as key drivers of future growth. BofA's report emphasizes the potential for these innovations to create new markets and drive sustained earnings growth, justifying premium valuations in certain sectors.

- Government Stimulus: Continued government spending and potential future stimulus packages are seen by BofA as providing further support to economic growth and mitigating downside risks associated with high valuations.

BofA acknowledges counterarguments, such as the potential for inflation to erode corporate profits. However, they contend that current inflationary pressures are manageable and unlikely to derail the ongoing economic recovery. They support this claim with an analysis of current inflation data and projections. (Source: [Insert citation to BofA's report here]).

Analyzing the Current High Stock Market Valuation Metrics

Understanding current high stock market valuations requires examining key valuation metrics. These metrics provide crucial context for assessing whether prices accurately reflect underlying company performance and future growth potential.

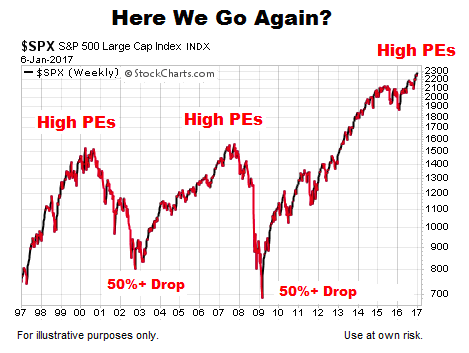

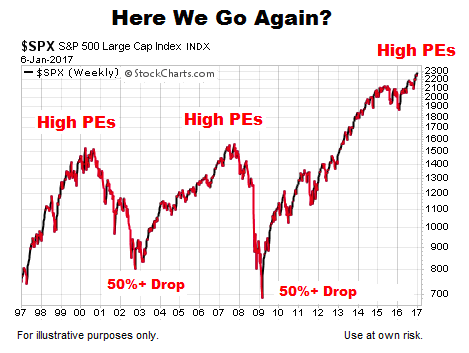

- Price-to-Earnings Ratio (P/E): The P/E ratio compares a company's stock price to its earnings per share. Currently, many market indices show P/E ratios above historical averages, suggesting that stocks are trading at a premium.

- Price-to-Sales Ratio (P/S): The P/S ratio compares a company's stock price to its revenue per share. This metric is particularly useful for evaluating companies with negative earnings. Similar to P/E ratios, current P/S ratios in many sectors are elevated compared to historical averages.

[Insert chart or graph here comparing current P/E and P/S ratios to historical averages.]

These high valuations raise concerns about potential market vulnerability. However, BofA's report suggests that these elevated metrics are partially justified by the factors mentioned above, such as strong earnings growth and low interest rates. They caution, however, that investors need to remain vigilant and conduct thorough due diligence.

Potential Risks and Challenges Associated with High Valuations

While BofA maintains a positive outlook, acknowledging the risks associated with high stock market valuations is crucial. These risks could trigger a market correction or even a more significant downturn.

- Interest Rate Hikes: A rise in interest rates could increase borrowing costs for companies, potentially impacting profitability and reducing investor appetite for equities.

- Inflation: Sustained high inflation could erode corporate earnings and lead to a decline in stock prices.

- Geopolitical Instability: Geopolitical events, such as international conflicts or trade wars, can negatively impact market sentiment and trigger sell-offs.

- Market Correction: A sudden market correction is always a possibility, even in the face of positive economic indicators.

BofA addresses these risks in their report by emphasizing the need for a diversified investment strategy and careful stock selection. They suggest focusing on companies with strong fundamentals and a proven track record of consistent earnings growth.

BofA's Investment Strategies and Recommendations for High Valuation Environments

In light of high stock market valuations, BofA recommends a balanced and diversified investment approach. Their strategies emphasize careful stock selection and diversification across different asset classes.

- Focus on Quality: BofA suggests prioritizing companies with strong balance sheets, consistent earnings growth, and a competitive advantage in their respective industries.

- Sector-Specific Recommendations: [Insert specific sector recommendations from BofA's report, if available].

- Asset Allocation: BofA might suggest a diversified portfolio that includes equities, bonds, and possibly alternative investments to mitigate risks.

The rationale behind these recommendations is to capitalize on potential growth while mitigating the downside risks associated with high valuations.

Alternative Perspectives on High Stock Market Valuations

It's important to acknowledge that not all analysts share BofA's optimistic outlook. Some experts warn that current valuations are unsustainable and predict a significant market correction. These alternative perspectives highlight the inherent uncertainties involved in market forecasting. A balanced assessment considers both the bullish and bearish viewpoints to form a well-informed investment strategy.

Conclusion: Navigating the High Stock Market Valuation Landscape: A Call to Action

BofA's optimistic outlook on high stock market valuations is based on a number of positive economic indicators, including strong corporate earnings and low interest rates. However, significant risks remain, including potential interest rate hikes, inflation, and geopolitical instability. While BofA's analysis provides valuable insight, it's crucial to remember that market predictions are never certain.

Thorough due diligence, diversification, and consultation with a qualified financial advisor are essential for navigating the complexities of high stock market valuations. Conduct further research into BofA's report and explore other market analyses to make informed investment decisions. Understanding the nuances of high stock market valuations is paramount for long-term investment success.

Featured Posts

-

Nba Playoffs Jimmy Butler Injury Impacts Game 4 Fan Reactions

May 16, 2025

Nba Playoffs Jimmy Butler Injury Impacts Game 4 Fan Reactions

May 16, 2025 -

Andor Season 2 Trailer The Long Wait Intensifies Fan Theories And Debate

May 16, 2025

Andor Season 2 Trailer The Long Wait Intensifies Fan Theories And Debate

May 16, 2025 -

Coquimbo Unido Y Everton Vina Empatan 0 0 Reporte Del Partido

May 16, 2025

Coquimbo Unido Y Everton Vina Empatan 0 0 Reporte Del Partido

May 16, 2025 -

Butlers Golden State Stint Impact On Miami Heats Future Star Power

May 16, 2025

Butlers Golden State Stint Impact On Miami Heats Future Star Power

May 16, 2025 -

Padres Road Trip Pittsburgh First Stop On Lengthy Journey

May 16, 2025

Padres Road Trip Pittsburgh First Stop On Lengthy Journey

May 16, 2025