HKD/USD Exchange Rate: Analyzing The Recent Interest Rate Drop

Table of Contents

The US Federal Reserve's Interest Rate Decision and its Rationale

The US Federal Reserve (Fed)'s recent decision to lower interest rates was a significant move with far-reaching consequences. This monetary policy adjustment was primarily driven by several key economic factors.

-

Inflation Levels: While inflation remained relatively subdued, the Fed signaled concerns about potential inflationary pressures easing too quickly, hindering economic growth. A rate cut aimed to stimulate demand and prevent deflationary risks.

-

Economic Growth Concerns: Slower-than-expected economic growth, both domestically and globally, prompted the Fed to act preemptively. Lower interest rates are intended to boost borrowing and investment, thereby stimulating economic activity.

-

Recession Risks: A growing concern about the potential for a global recession fueled the need for proactive monetary easing. Lowering interest rates is a classic tool to prevent or mitigate a recession.

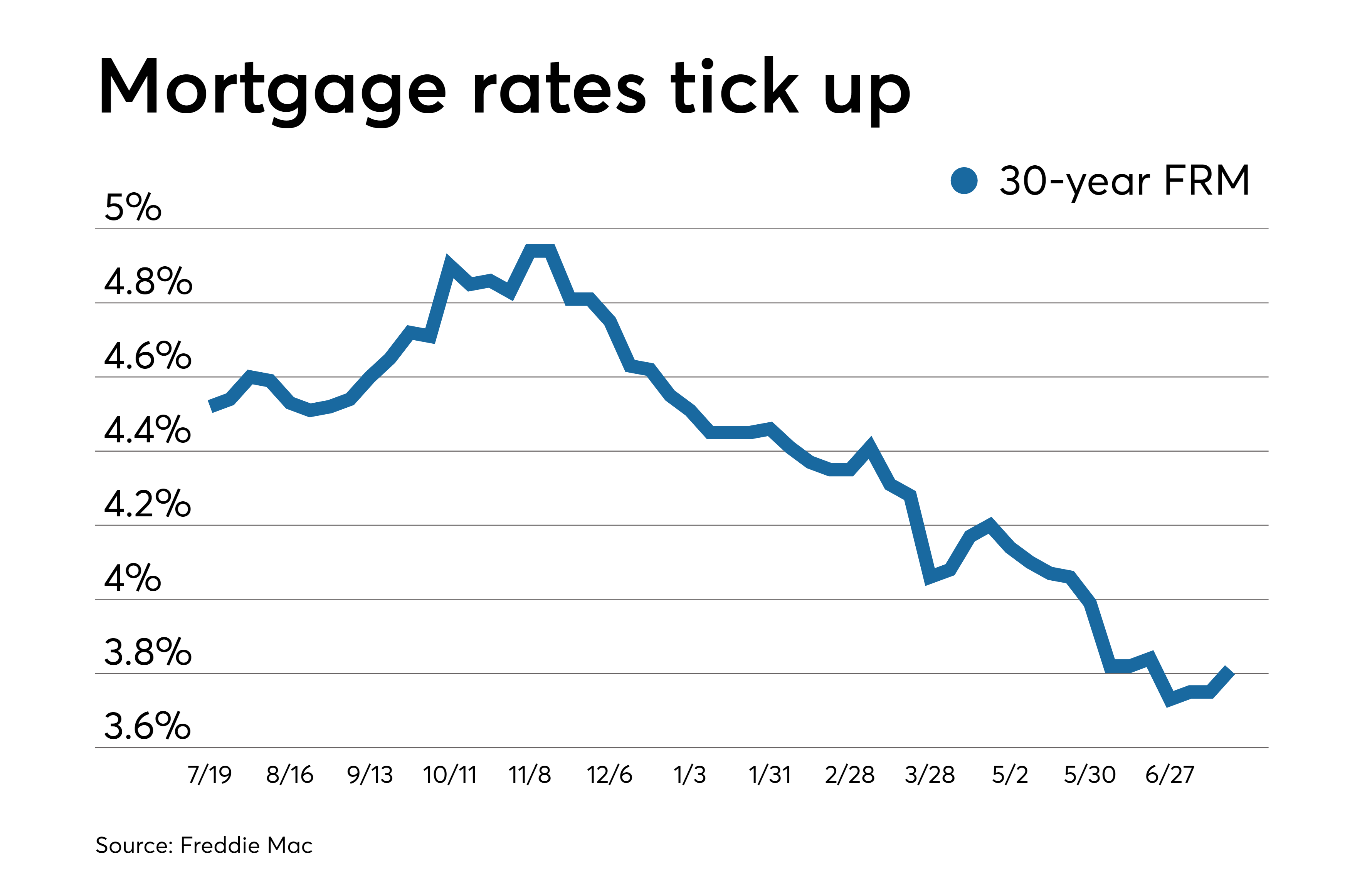

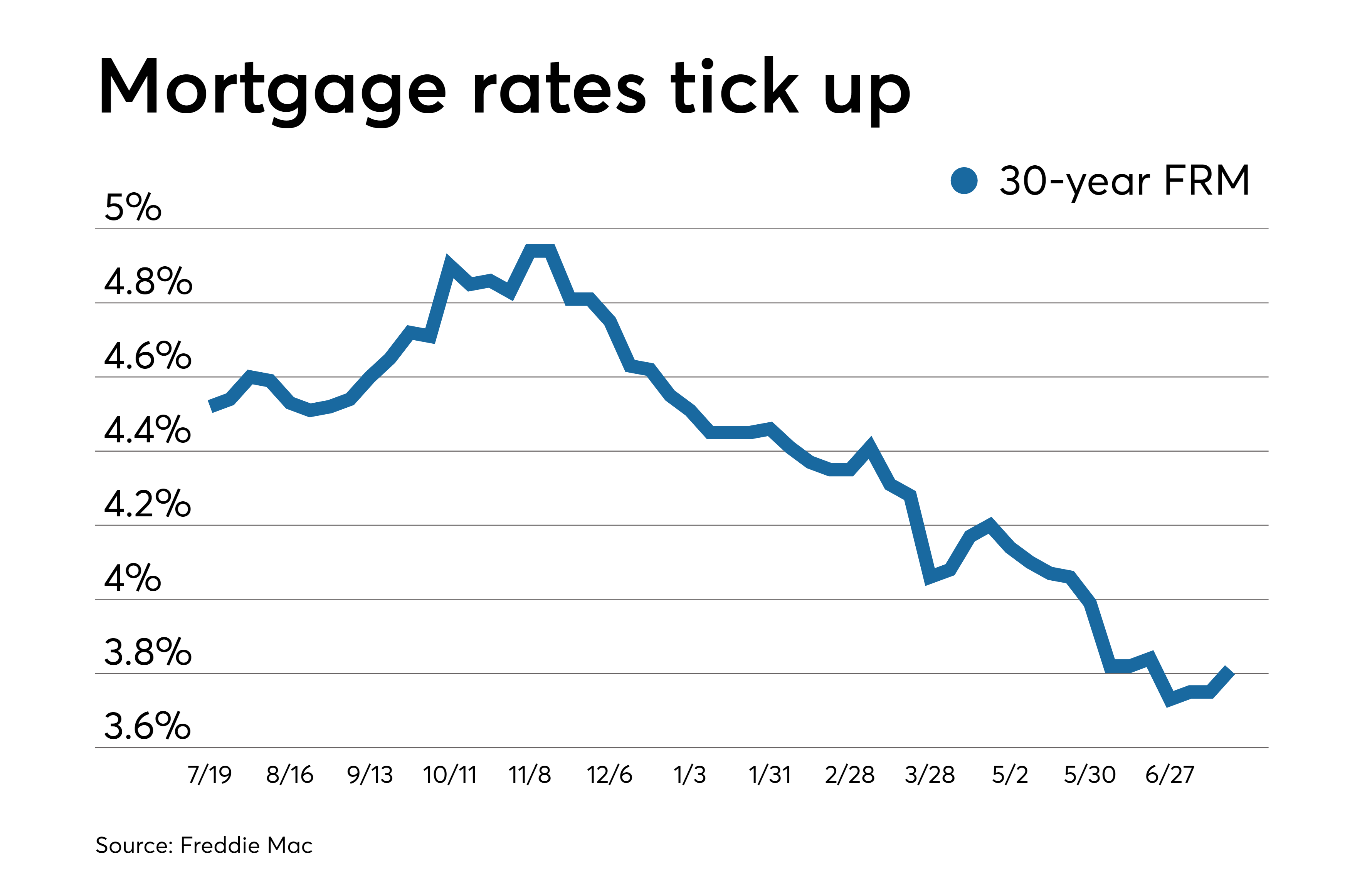

Data released by the Fed, including GDP growth figures and inflation indicators, provided the basis for this decision. Charts illustrating these trends further support the analysis and demonstrate the correlation between the economic indicators and the subsequent rate cut. The impact on the US economy is projected to be a boost to consumer spending and business investment, but there's a risk of exacerbating existing inflationary pressures if not carefully managed. The global market impact is complex, with some markets benefiting from increased liquidity and others facing challenges due to currency fluctuations.

The Hong Kong Monetary Authority (HKMA) and its Response

The Hong Kong dollar (HKD) is pegged to the US dollar (USD) under a linked exchange rate system managed by the Hong Kong Monetary Authority (HKMA). This peg maintains a narrow band of fluctuation between 7.75 and 7.85 HKD per USD.

-

Linked Exchange Rate System: The HKMA's primary goal is to maintain this peg, ensuring relative stability in the HKD/USD exchange rate.

-

HKMA Response to US Rate Cuts: Historically, the HKMA has typically followed the Fed's lead in adjusting its own interest rates to maintain the peg. A reduction in US interest rates usually prompts a corresponding reduction in Hong Kong's interest rates.

-

HKMA's Likely Response to the Recent Drop: Following the recent US rate cut, the HKMA is expected to have mirrored the reduction to avoid large-scale capital outflows and maintain the peg’s stability.

-

Challenges for the HKMA: Maintaining the peg, however, presents ongoing challenges. Significant divergences in economic growth between the US and Hong Kong, or substantial capital flows, can put pressure on the HKMA's ability to maintain the exchange rate within the designated band. This requires careful monitoring and strategic intervention through buying or selling USD in the forex market.

Impact on the HKD/USD Exchange Rate

The interest rate drop's impact on the HKD/USD exchange rate is multifaceted, influencing both short-term volatility and long-term trends.

-

Immediate Effects: The initial reaction usually involves increased volatility as markets adjust to the new interest rate environment. Capital flows might shift based on relative interest rate differentials, leading to short-term fluctuations.

-

Long-Term Effects: Over the long term, the impact depends on several factors, including economic growth in both the US and Hong Kong, global market conditions, and the HKMA's interventions.

-

Implications for Businesses: Businesses engaged in international transactions need to carefully manage their forex risk exposure given the potential for increased currency volatility. Hedging strategies might become more important to mitigate losses.

-

Investment Strategies: Investors need to adapt their portfolios in response to the shifting exchange rate and interest rate environment. This might involve revising asset allocations or employing different investment strategies to take advantage of potential trading opportunities in the HKD/USD forex market.

Analyzing Short-Term Volatility

Short-term fluctuations in the HKD/USD exchange rate are influenced by various factors, including news events, trading sentiment, and speculation.

-

Daily Exchange Rate Movements: Daily price movements can be significant, presenting opportunities for short-term trading strategies. However, these strategies require careful risk management.

-

Trading Opportunities: Short-term movements can create opportunities for traders proficient in technical analysis and short-term trading strategies.

-

Technical Analysis: Traders often use technical analysis tools such as moving averages, support and resistance levels, and other indicators to predict short-term price movements in the HKD/USD pair.

Long-Term Outlook for HKD/USD

Predicting the long-term trend of the HKD/USD exchange rate is inherently uncertain, but certain factors provide a context for a reasoned prediction.

-

Economic Factors: The relative economic performance of the US and Hong Kong will play a significant role. Stronger US growth might strengthen the USD against the HKD.

-

Geopolitical Risks: Global geopolitical events, including trade wars or other unforeseen crises, can significantly influence currency movements.

-

Currency Projections: While precise projections are challenging, most forecasts assume the HKD will remain relatively stable against the USD due to the linked exchange rate system. However, adjustments may occur due to economic or political developments.

Conclusion

The recent US interest rate drop has created ripples in the HKD/USD exchange rate, affecting short-term volatility and possibly influencing long-term trends. The US Federal Reserve's actions and the HKMA's response to maintain the currency peg are key determinants of the HKD/USD exchange rate dynamics. Short-term fluctuations present both opportunities and risks for traders, while long-term forecasting remains inherently uncertain. Businesses and investors need to carefully consider these factors and actively manage their exposure to this important currency pair. Stay informed about HKD/USD exchange rate fluctuations and their implications by continuously monitoring interest rate changes and economic indicators to make informed decisions. Learn more about effective strategies for navigating the HKD/USD exchange rate market and mitigating potential risks.

Featured Posts

-

400 Xrp Price Increase Is This Crypto A Smart Investment Now

May 08, 2025

400 Xrp Price Increase Is This Crypto A Smart Investment Now

May 08, 2025 -

Kontrakt Zhersona S Zenitom E500 000 Pravda Ili Slukh

May 08, 2025

Kontrakt Zhersona S Zenitom E500 000 Pravda Ili Slukh

May 08, 2025 -

Auto Analyst Claims Gm Uses Us Tariffs As Excuse To Cut Canadian Work

May 08, 2025

Auto Analyst Claims Gm Uses Us Tariffs As Excuse To Cut Canadian Work

May 08, 2025 -

Former Uber Ceo Kalanick Specific Decision Was A Wrong Turn

May 08, 2025

Former Uber Ceo Kalanick Specific Decision Was A Wrong Turn

May 08, 2025 -

The Future Of Xrp Analyzing The Potential Of Etfs And The Secs Influence

May 08, 2025

The Future Of Xrp Analyzing The Potential Of Etfs And The Secs Influence

May 08, 2025