HMRC Letters To High Earners: What You Need To Know

Table of Contents

Common Reasons for HMRC Letters to High Earners

HMRC targets high earners for various reasons, often stemming from discrepancies or suspected non-compliance. A tax enquiry or compliance check isn't necessarily indicative of wrongdoing, but it requires prompt and accurate attention. Here are some common triggers for HMRC letters to high earners:

- Discrepancies in declared income: HMRC cross-references your tax return with information from third parties like banks, employers, and overseas tax authorities. Any inconsistencies, however minor, can lead to further investigation. This includes undeclared rental income, dividends, or capital gains.

- Suspected tax avoidance or evasion: Complex financial arrangements or transactions that appear designed to minimise tax liability can trigger a tax investigation. HMRC employs sophisticated methods to detect these schemes.

- Failure to file tax returns: Late or incomplete self-assessment tax returns are a significant red flag. Penalties for late filing can be substantial, accumulating daily.

- Undeclared offshore income: Income generated from overseas investments or businesses must be declared to HMRC. Failure to do so carries severe penalties, including criminal prosecution.

- Unexplained wealth: If your lifestyle and assets significantly exceed your declared income, HMRC may launch an investigation into the source of your wealth. This is particularly relevant for high-net-worth individuals.

- Inaccurate PAYE or National Insurance contributions: Errors in your PAYE (Pay As You Earn) or National Insurance contributions can lead to HMRC contacting you to rectify the situation and potentially back-pay what is owed.

Types of HMRC Letters and Their Implications

HMRC uses different types of letters to communicate with taxpayers. Understanding the type of letter you've received is crucial in determining the appropriate response. These are some of the most common:

- Compliance Check: This is a routine review of your tax return, usually focusing on specific aspects or areas where potential discrepancies might exist. It's often less serious than a tax enquiry but still requires a thorough response.

- Tax Enquiry: A more in-depth investigation into specific areas of your tax return. This typically involves requests for further information and evidence to support your claims.

- Formal Investigation: This is a serious investigation that may involve penalties if HMRC finds evidence of tax evasion or deliberate non-compliance. It often involves a dedicated team of investigators.

- Penalty Letter: This letter informs you of penalties for late filing, inaccurate returns, or other breaches of tax regulations. Penalties can be significant, and it's important to understand the reasons for the penalty and explore potential avenues for appeal.

- Demand Letter: This letter demands payment of outstanding tax liabilities, often following a tax enquiry or formal investigation. Failure to comply can lead to further action.

Understanding the Language in HMRC Letters

HMRC letters often contain complex legal terminology and jargon. Don't hesitate to seek clarification if you don't understand something. The HMRC website provides guidance documents, but if you're unsure about the meaning of specific terms or the implications of the letter, it's crucial to seek professional advice from a qualified tax advisor. They can help you decipher the language, understand your rights, and formulate an appropriate response. Understanding your rights is key to responding appropriately to HMRC correspondence.

Responding to HMRC Letters: A Step-by-Step Guide

Responding effectively to an HMRC letter is critical. Here's a step-by-step guide:

- Acknowledge the letter promptly: Confirm receipt and indicate when you will provide a full response.

- Gather all relevant documentation: Collect all necessary paperwork, including bank statements, payslips, invoices, and any other evidence to support your claims.

- Meet deadlines: HMRC sets strict deadlines. Failing to meet them can lead to further penalties.

- Seek professional advice: Consult a tax advisor or accountant. They can guide you through the process and ensure your response is accurate and compliant.

- Keep detailed records: Maintain meticulous records of all communication with HMRC, including dates, details, and copies of all correspondence.

Preventing HMRC Letters: Best Practices for High Earners

Proactive tax planning can significantly reduce the risk of receiving an HMRC letter. Here's how:

- Meticulous record keeping: Maintain accurate and comprehensive records of all income and expenses. Use accounting software to streamline the process.

- Professional tax advice: Consult a tax advisor regularly to ensure your tax affairs are in order and to receive guidance on complex financial matters.

- Timely and accurate tax returns: File your self-assessment tax returns accurately and on time to avoid penalties.

- Understanding complex financial arrangements: Be aware of the tax implications of any complex financial arrangements before entering into them.

- Transparency and open communication: If you are unsure about anything, it's always best to contact HMRC and seek clarification.

Conclusion:

HMRC scrutiny of high earners is increasing, making it vital to understand your tax obligations and respond effectively to HMRC correspondence. While a compliance check might be routine, a formal tax investigation can be serious. Seeking professional advice is highly recommended, particularly with complex financial situations. Proactive tax planning, accurate record-keeping, and timely submissions are key to preventing future issues. If you're a high earner and are concerned about receiving an HMRC letter, or want to ensure your tax affairs are in order, seek professional advice today. Don't delay – contact a qualified tax advisor to discuss your specific situation and minimize the risk of HMRC correspondence. Proper tax planning and understanding of HMRC's requirements regarding high earners is essential for peace of mind and financial security.

Featured Posts

-

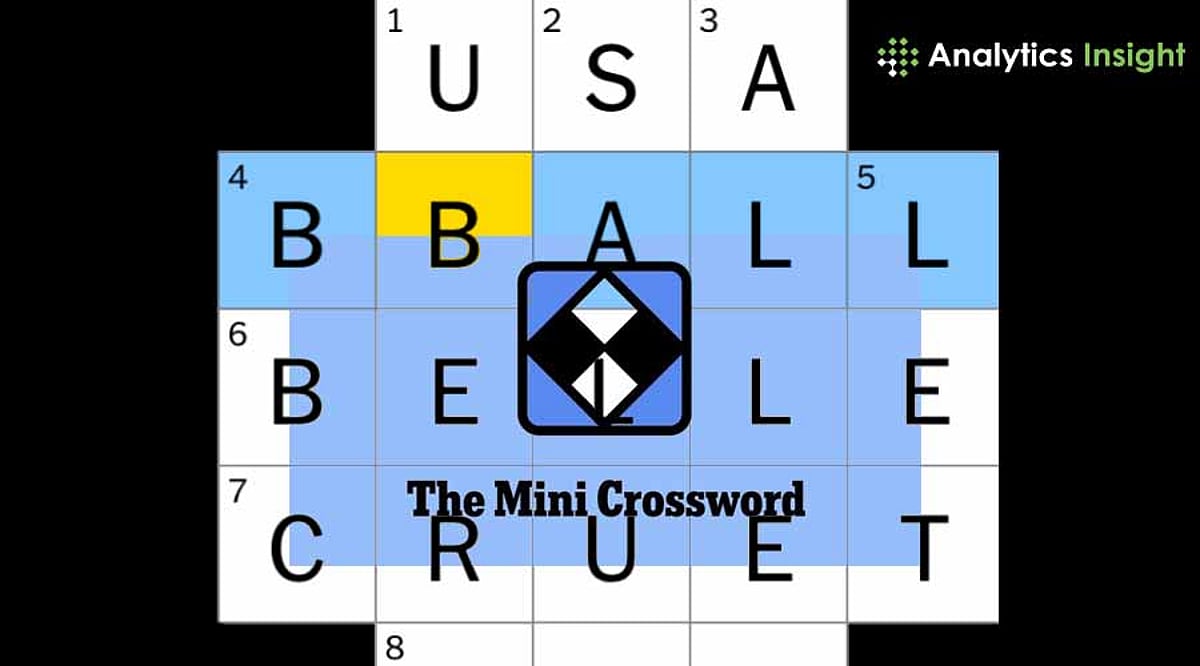

Nyt Mini Crossword Answers March 31

May 20, 2025

Nyt Mini Crossword Answers March 31

May 20, 2025 -

Todays Nyt Mini Crossword Answers March 27 Solutions

May 20, 2025

Todays Nyt Mini Crossword Answers March 27 Solutions

May 20, 2025 -

Forum International Des Technologies De L Information Et De La Communication Tic Abidjan 2025

May 20, 2025

Forum International Des Technologies De L Information Et De La Communication Tic Abidjan 2025

May 20, 2025 -

Mikhael Shumakher Radost Dedushki

May 20, 2025

Mikhael Shumakher Radost Dedushki

May 20, 2025 -

Astkhdam Aldhkae Alastnaey Lihyae Aemal Ajatha Krysty Thlyl Nqdy

May 20, 2025

Astkhdam Aldhkae Alastnaey Lihyae Aemal Ajatha Krysty Thlyl Nqdy

May 20, 2025

Latest Posts

-

Restrictions De Circulation Sur Le Boulevard Fhb Ex Vge Tout Savoir Sur La Mesure Concernant Les Deux Roues Et Trois Roues A Partir Du 15 Avril

May 20, 2025

Restrictions De Circulation Sur Le Boulevard Fhb Ex Vge Tout Savoir Sur La Mesure Concernant Les Deux Roues Et Trois Roues A Partir Du 15 Avril

May 20, 2025 -

Ivoire Tech Forum 2025 Accelerer La Transformation Digitale En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 Accelerer La Transformation Digitale En Cote D Ivoire

May 20, 2025 -

Us Armys Pacific Reinforcement Second Typhon Battery Deployment

May 20, 2025

Us Armys Pacific Reinforcement Second Typhon Battery Deployment

May 20, 2025 -

15 Avril Mise En Place De Restrictions De Circulation Pour Les 2 Et 3 Roues Sur Le Boulevard Fhb

May 20, 2025

15 Avril Mise En Place De Restrictions De Circulation Pour Les 2 Et 3 Roues Sur Le Boulevard Fhb

May 20, 2025 -

Abidjan 2025 Le Rendez Vous De La Transformation Numerique En Cote D Ivoire

May 20, 2025

Abidjan 2025 Le Rendez Vous De La Transformation Numerique En Cote D Ivoire

May 20, 2025