HMRC's New Tax Codes: Understanding Changes For Savers

Table of Contents

Key Changes in HMRC Tax Codes for 2024 and Beyond

HMRC periodically updates its tax codes to reflect changes in tax legislation and economic conditions. These changes can affect various aspects of your finances, including savings and investments. While specific details are subject to annual budget announcements, understanding the general trends is vital. Recent updates may include:

- Specific examples of new tax code structures: For example, a shift from simpler codes to those incorporating additional allowances or reflecting changes in personal tax thresholds. The precise structure will be communicated via your official tax code notification from HMRC.

- Changes affecting different types of savings accounts: The tax implications for ISAs (Individual Savings Accounts) and pensions might change, particularly concerning annual contribution limits and tax relief.

- Simplification or complication introduced by the new codes: Some changes might aim to simplify the system, while others might add layers of complexity. Understanding these nuances is key to navigating the new tax landscape.

- New thresholds or allowances impacting savers: Changes in the personal savings allowance, dividend allowance, or capital gains tax allowance will directly influence the tax payable on your savings.

For the most up-to-date information, always refer to the official .

Understanding Your Tax Code and its Impact on Savings

Your tax code is a crucial piece of information that dictates how much income tax is deducted from your earnings and savings interest. Knowing how to find and understand your tax code is the first step to managing your tax liability effectively.

- Checking your tax code online: You can easily access your tax code through the HMRC website using your Government Gateway account. This allows you to verify its accuracy and identify any potential discrepancies.

- Common tax code examples and their meanings: Understanding the structure of your tax code (e.g., 1257L, BR) is important for interpreting the tax deductions applied to your income. HMRC provides detailed explanations of different tax code components.

- Emergency tax codes vs. standard codes: An emergency tax code is temporarily applied when HMRC lacks sufficient information to calculate your correct code, resulting in higher tax deductions. Ensure you rectify this as soon as possible to avoid overpaying tax.

- Impact of different income streams: Your overall tax code can be influenced by multiple income sources (employment, self-employment, savings interest). Understanding the interplay between these streams is important for accurate tax calculations.

Tax Implications for Different Savings Vehicles

The new HMRC tax codes impact various savings plans differently. Here's a breakdown of key areas:

- Tax implications for ISAs: While ISAs generally offer tax-free growth and withdrawals, understanding how the new tax codes might indirectly affect your overall tax position is vital, especially if you have additional income streams.

- Impact on pensions and retirement savings: Changes in tax relief on pension contributions or the tax treatment of pension withdrawals can substantially affect your retirement planning.

- Tax efficiency of different savings products: The relative tax efficiency of various savings products (ISAs, savings accounts, bonds) can shift with changes in tax codes. Careful analysis is needed to optimize your savings strategy.

- Changes to tax relief on savings: Keep an eye out for adjustments to tax relief schemes impacting savings interest, as these can significantly impact your net returns.

Minimizing Your Tax Liability with Effective Savings Strategies

Proactive financial planning can significantly minimize your tax liability on savings. Here are some key strategies:

- Strategies to reduce your tax burden on savings interest: Understanding the personal savings allowance and optimizing your savings distribution across different accounts can help you lower your tax burden.

- Optimizing contributions to tax-advantaged accounts: Maximize contributions to ISAs and pensions to benefit from the tax advantages they offer.

- Importance of financial planning: Seeking professional financial advice can provide personalized guidance on optimizing your savings strategy within the new tax code framework.

- Using different savings accounts: Employing a combination of tax-efficient savings accounts can help you mitigate your overall tax liability.

Conclusion: Mastering HMRC's New Tax Codes for Maximum Savings

Understanding HMRC's new tax codes is essential for maximizing your savings and avoiding unnecessary tax burdens. By carefully reviewing your tax code, understanding its implications for different savings vehicles, and implementing effective savings strategies, you can significantly improve your financial position. Stay informed about HMRC's new tax codes and plan your savings effectively to maximize your returns! Review your tax code and savings strategy today to ensure you're making the most of your money.

Featured Posts

-

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025 -

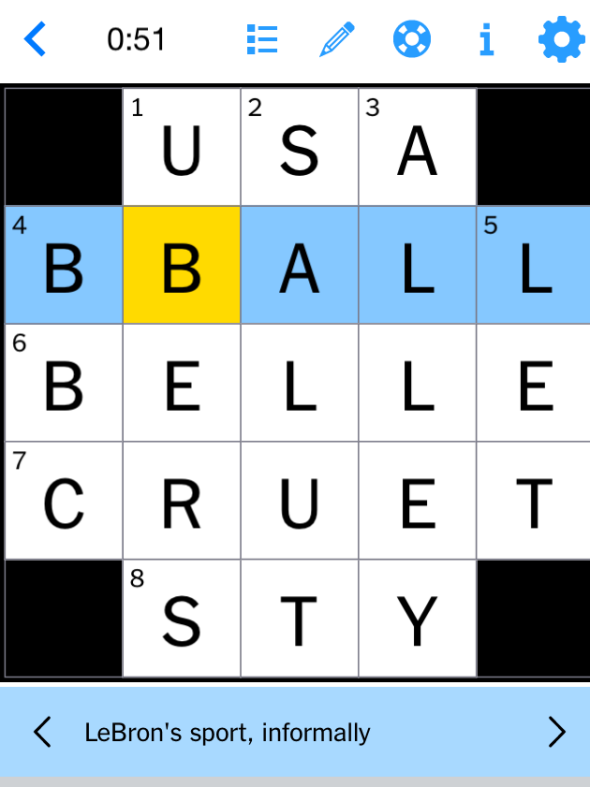

Complete Solutions Nyt Mini Crossword March 22

May 20, 2025

Complete Solutions Nyt Mini Crossword March 22

May 20, 2025 -

Manchester United Makes Contact 62 5m Transfer Pursuit Heats Up

May 20, 2025

Manchester United Makes Contact 62 5m Transfer Pursuit Heats Up

May 20, 2025 -

Pro D2 Calendrier Serre Valence Romans Et Su Agen Luttent Pour Le Maintien

May 20, 2025

Pro D2 Calendrier Serre Valence Romans Et Su Agen Luttent Pour Le Maintien

May 20, 2025 -

Biarritz Changement De Proprietaire Pour Le Bo Cafe

May 20, 2025

Biarritz Changement De Proprietaire Pour Le Bo Cafe

May 20, 2025

Latest Posts

-

Adressage Abidjan 14 279 Voies Identifiees A Ce Jour

May 20, 2025

Adressage Abidjan 14 279 Voies Identifiees A Ce Jour

May 20, 2025 -

Le Mass A Abidjan Un Evenement Majeur Pour Les Technologies Spatiales Africaines

May 20, 2025

Le Mass A Abidjan Un Evenement Majeur Pour Les Technologies Spatiales Africaines

May 20, 2025 -

Innovation Spatiale En Afrique Le Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025

Innovation Spatiale En Afrique Le Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025 -

Focus Sur Le Mass Le Marche Africain Des Solutions Spatiales A Abidjan

May 20, 2025

Focus Sur Le Mass Le Marche Africain Des Solutions Spatiales A Abidjan

May 20, 2025 -

Presidence Ghaneenne Visite Officielle De John Dramani Mahama A Abidjan Pour Renforcer La Diplomatie

May 20, 2025

Presidence Ghaneenne Visite Officielle De John Dramani Mahama A Abidjan Pour Renforcer La Diplomatie

May 20, 2025